Thursday Update...

(to watch on youtube: http://www.youtube.com/watch?v=iluvs1DhCN0)

I'm looking for a gap up and crap... plain and simple. I don't think the selling is done until the FP on the SPY of 123.03 and the QQQQ of 52.27 is hit. If tomorrow closes up big, then it's possible we could continue to the major resistance area of 1300 spx on Monday and Tuesday, but I really think we will fool the bulls and reverse back down tomorrow... probably the second half of the day.

Red

_____________________________________________________

Wednesday Update... Possible Flash Crash!

(to watch on youtube: http://www.youtube.com/watch?v=0a_NXi0Eub8)

We have a chance of a Flash Crash tomorrow, but I'm really only looking for the SPY 123.03 and QQQQ 52.27 FP's too be hit, and then a rally the rest of the day and into Friday. After that... who knows? This video below confirms what the woman in the next video down say about the 22nd and 23rd. There is a chance of a earthquake happening off the west coast until about the 26th or so, with the 19th being an important date to watch out for.

I'm looking to exit my short once the 2 FP's are hit... unless it blows past them on some more bad news from Japan. If so, then the Flash Crash should take us to the 1180 spx area, which is the 200dma. I don't think that will happen tomorrow, but it's possible... so keep your ears and eyes glued to the news, and post it if you see something! Good luck everyone...

Red

_____________________________________________________

Will the market explode tomorrow? I think so...

(to watch on youtube: http://www.youtube.com/watch?v=aeA6dzQRyp0)

Once the 60 minute chart peaks out and rolls over, the real panic should happen. It could be some wave 3 of 3 of 3 or something (I'm not an Elliottwave Expert), but whatever it is... it should beat Monday's move down! I think we are now in some sort of wave B (or 2?) up right now, with 1261 being the end of the first wave 1 down.

I suspect we will attempt to get back up to around the 1300 spx level and then start selling back down again. It could happen anytime tomorrow, as it depends on how long it takes for the 60 minute chart to top out and roll over. I suspect it will be within the first half of the day.

I'm still thinking that we will go down to the 123.03 spy FP level, before have a multiple day bounce back up. I can see us hitting that level by this Friday, or sooner. Next Monday and Tuesday we could have another earthquake if the woman in the video that I put up on the weekend post is correct again? (Here is the video one more time)

Notice that she did the video on March 8th, and called for earthquakes to happen between March 11th to the 14th. Then she stated (around 12:30 minutes into the video) that she was given a vision by Jesus and told the numbers 22 and 23. That's this coming Tuesday and Wednesday!

Now, whether or not you believe in Jesus or not isn't important... what is important is the fact that she has science behind her Planet X (also called Planet Nibiru) data, as seen in the computer model and forecasted path of this planetary body that the Main Stream Media (and NASA) says is a comet called Elenin. Lies... it's a planetary body! (Whether it is Planet X or not isn't know, but it's not a comet!)

Watch her video several times if you must, and let it all sink it. What is foretold in the bible is coming true. Notice the new movie out last Friday (3-11-11) called Battle LA has meteors (that are really aliens ships) falling from the sky. The Illuminati are clearly telling us what's coming.

Then there is the 2 Sun's showing up in the sky in the middle east in this video below... what's that all about? Is that what the people in Egypt are really rioting about? We are clearly in the end times, and this market is very fragile and ready to tank hard... as in crash for real this time!

I just don't know what to think right now, as all this information is overloading my head (and scaring me too!). So, I just have to focus on the charts and not think about these things too much, as I can't change any of them. Anyway, as far I as can see in the charts, we should go up in the morning to the 1290-1300 spx area and then roll over into the close.

I think we will be down again on Thursday and possibly Friday too. My target is again the 123.03 spy FP, and I think it will be hit this week. If it's hit by Thursday, then I can see us bouncing up on Friday and Monday too. Then Tuesday will be the 22nd, the date in that woman's vision, so it could be another turning point for more selling? That would be another wave 3 I believe, and a larger one then the one I'm expecting to start tomorrow.

Ok, that's all I got for now. I'll keep these daily posts short and leave the long one for the weekend.

Red

For some reason, I don’t think this is the one that tanks the market (kings-x), because stuff like this happens in 3’s…MidEast, Earthquake…what’s next?

Good video Red,

looks like Ben Fulford out with more info.Weekly geo news

That print from earlier in the day had 1929 encoded in it but the resolution wasn’t too clear and I couldn’t see some of the numbers particularly how much it dropped and the percentage and I didn’t understand the number to the left of those numbers. Was that the time???? Anyway, was it implying that it’s 1929 from here on???? 3.14 or Pi day was 322days from April 26 (s&B #) and 256days from July 1. 256×2===512 or 8x8x8 It was also an interesting number of days from 10-19-87.

Good Morning everyone. Should be an interesting day today. We’ll see how high they can push this puppy before it rolls back over.

There was an intraday print yesterday at 1:00pm for 127.22 spy, which could be the target for the suspected B wave down.

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/03/es-hour-chart-analysis_16.html

What patterns do you see emerging on the intraday charts??? Bearish wedge, ascending triangle, pennant or something out… looking at 5min and 15 minute charts….crap are we seeing a breakout now… dang

Dee, it looks like we may have put in our B wave down and we are now starting the C wave up… which should continue through most of the day. I’m still looking for that 1300 area as heavy resistance, which should have the 60 minute chart peaked out and ready to roll over by then.

I just got a call from a guy pitching me on an oil deal. He gave me an oil stock that went up 500% the last time. He asked me if I was interested in the next one. I said, not as much as the first one, as I am looking to just have fun for the next year and see where the world goes.

Told him a little about what we think, what could happen etc.. He thought I was off my rocker. The average dude is pretty oblivious to all this chicken little stuff, I tell ya.

Now that’s funny! Yes, the average person is clueless to what’s really going on in the world… and they will think you are crazy. I get that a lot… LOL.

EURUSD Chart: http://niftychartsandpatterns.blogspot.com/2011/03/ascending-triangle-of-eurusd.html

Dang what just happened????

I don’t know, but the market didn’t like it…

The EU energy chief made some comments, giving some people a chance for a quick trade. Probably told some of his buddies to sell short before his comments came out.

Probably screwed up the technicals because now there’s a double bottom (short-term).

LOL…

I’m watching CNBC on TV and they stated that the movie China Syndrome (which was about an nuclear accident happening) came out just weeks before Three Mile Island happened. I guess the Illuminati have been playing their games for a long time.

The charts are mixed right now and I’m out of my shorts. We have a double bottom now, with a lot of volume pushing that 5 minute candle up hard when it hit. Plus the 60 minute chart has yet to go positive and get over bought. So, I’m not sure what the market is going to do at this point? Cash is a safe position for now.

Said it before….and I’ll say it again. STAY SHORT

I agree… this is going exactly as I believed it would happen (but I thought it would be Euro debt driving it, which by the way is still there)…increase volatility so majority of participants will not have put protection going into April… tomorrow may be a big day, Friday as well, as they may force la la land put sellers to get long, smart ones covered yesterday… replay of 1987 into end of March…

Now the Fed is extending POMO today. Sounds like a concerted effort to give an excuse to pump more money into the market.

By the way gang, I found Ben Fulford’s latest post… and YES, their is evidence that the Japan Earthquake was created by HAARP, and done by the Criminal Cabal in Washington DC….

http://www.godlikeproductions.com/forum1/message1398227/pg1

My downside target for the week is /YM 11,390 and VIX 31. Relate that to spy, qqqqs…

Sounds like a mini-crash too me. Thanks for the update.

No problem. THe weekly DOW RSI has more room to go down, but is running out of time. Full moon this weekend and seasonal cycles turns bullish monday as well. Not to mention the monthly S and P chart still has a tad bit more to go up to reach sloping trendline, and POMOs (120 billion left in Q2 by en dof June). Right now we are in the 4th EW down on weekly /YM and should start 5th wave up next week until late may early June.

Going to post some charts shortly…

after that, buying May or June 50SP calls on FCX this friday. Hopefully the stock price will be 45 or 46 by then, holding until the daily RSI gets overbought. I blogged on this trade last night.

http://sharkmarketanalysis.blogspot.com/

Thank you Red. This is the first time i have blogged here but i pay close attentionto your analysis as well as my own. Thank you.

What’s your downside target on the FCX?

FCX

FCX has some positive divergence forming but downside is still 47/48. any lower and consider it a gift from the heavens. Its the timing thats the most important, friday morning should be its low… daily chart shows 200MA at 46.

What are you thinking the low on the spx (or spy) will be? I’m still thinking we hit the 123.03 spy FP.

here are some charts from last night..u can still see the targets

http://sharkmarketanalysis.blogspot.com/2011/03/shrk-bites-03162011.html

SPY Target 120.50 (be careful, this can hit in premarket or after hours… so lets not get too greedy lol) Im selling my shorts by tomorrow’s close. Will free up cash for FCX calls on friday.

QQQQs target= 52

*** THESE TARGETS MUST BE HIT BY FRIDAY 11am or as pink floyd song goes “RUN LIKE HELL”. lol ***

Again, next week should start 5th wave up on weekly /YM until June 5th. So next week its “Bad News Bears”

Goodluck Red and the rest of your dragons! =)

The SHARK sees blood and is hungry!

Managed to eek out $1K profit on Q’s puts! Happy days 🙂

Congrats! Tough to trade this wild market. Any profit is a blessing…

Yes, now let’s see if I can make some money on my SPY puts… held on too long and still a bit upside down

If Shark is right I should make a nice profit on those too… they expire Friday so I may have to bail early… 🙁

What is up with RUT today … not playing

It’s not dropping as much as the Dow and S&P… that’s for sure.

http://www.stocktiming.com/Wednesday-DailyMarketUpdate.htm

I love that word “distribution”!!!!

Nice… thanks Dee. Looks like the direction is still down.

Red, can u take a look at the 15min SPY chart? Is that a 2nd wave up , about to start 3rd wave down?

The 15 minute chart is trying to go back up but the 30 minute chart is still pointing down and putting pressure on it. The 60 is undecided it seems, as it looks like it wants to go positive but can’t. We may go lower today, as this market is very weak now.

VIX has about 3 to 4 more dollars to go as well. 31 to 33 is target. Could be hit tomorrow or by end of today for all i know. Either way, more weakness to come in equities

Yes, if the 15 minute chart would ever make it above the zero line it, when it rolls back down the markets should take out the current low I believe. Could be at the end of the day or tomorrow morning on a gap down?

yup!

Looks like we are about ready to breakdown here…

Red, we covered our shorts too soon….

Yes, we did. I went short again. Hate to go short when we are so oversold, but I think she’s going down more.h

I’d say we are on our way to the spy and qqqq FP level.

We are now below the 100dma on the spx… big institutions watch that.

I am short till at least 1240 on the SPX. At least. I don’t know why you guys didn’t see the big shift in direction. Its not like you weren’t looking for it.

Because we get too caught up in the action… LOL.

What do you think of this major rebound?

No much. LOL.

Well, looks like we are finally going to bounce… figures, just as I got short. I’m staying short until the 2 FP’s are hit on the spy and qqqq.

That was fun! Well, shorts out. Don’t wanna worry about that last few points. Time to wait until it tops out again……

Wow… nice bottoming tail on the 60 minute chart. Everything looks ready to rally up tomorrow for a several day rally. I’m staying short. FP isn’t hit yet. Bulls just keep on buying this dip. I don’t think it’s finished yet.

red,

i see the 60 min chart – but we just subdivided AGAIN!!! 5 series of 1-2’s of varying degrees. …… the fat lady ain’t gonna sing – she is gonna FALL off the edge of the stage. That is what the waves look like to me.

stand back! this is gonna be BIG!

Dow Jones chart: http://niftychartsandpatterns.blogspot.com/2011/03/dow-jones-daily-chart-analysis.html

I saiid it twice and I’ll say it again…STAY SHORT!

All the market needs now is some more bad news. There is a bundle of it to come.

This trader is very good. He does swing trades both ways, for hours/days/weeks. You guys should check the site out

http://balancetrading.blogspot.com/http://balancetrading.blogspot.com/

says that it doesn’t exist … can you check your link please – thanks

http://balancetrading.blogspot.com/

thanks – odd that he is in cash… I guess I was getting that he day/swing trades… as of Tuesday he thought we were going up – I would think that with all the volatility he would jump in for a couple quick trades on a day like today… thanks for the post

http://www.facebook.com/profile.php?id=100001563450122&ref=ts

Red,

http://www.youtube.com/watch?v=muyu4aucZDM

Disregard if you’ve seen already. Very detailed video on HAARP.

Our own government is making the Nazi Doctors look like choir boys.

I thought our government was made up of a both of nazi? LOL

We made some nice coin today Red. This thing is coming unglued quickly. We just may see the 200dma. We could see a break from the selling soon but further downside looks to be the case.

Robert, I’m fairly certain we will hit the FP of 123.03 spy and 52.27 qqqq tomorrow morning, and I’ll probably exit my shorts there… unless it looks like a flash crash is coming. Hard too say, but yeah… we could hit the 200dma soon!

Refresh page for new update…

For those interested, I wrote an article that I think pretty much nailed the whole Nuclear Situation in Japan, and Zero Hedge picked up on it and published it. Lil’ ol’ Hawaii Trading getting published on Zero Hedge, that is cool.

Check it out here

http://www.zerohedge.com/article/guest-post-nuclear-japan-stock-market-holding-pictures-reactor-3-and-4#comment-1065186

And here is Hawaii Trading, maybe you have seen it before

http://oahutrading.blogspot.com/

Well, looks like all is good again and time to rally. So it now seems unlikely that we will hit the 2 FP’s today. Maybe tomorrow or next week after this relief bounce is over. I’ll just have to ride it out as long as I can… Bummer.

New shorting opportunity??? I just don’t trust today’s action

I thought they were going to rally it on up and squeeze out the bears here, but maybe it was a bull trap and we will go lower today? It too hard to figure out right now. The charts are mixed, but do support a big rally. I’m just sitting tight to see what happens…

I will only short again when the VIX 15min closes the gap from wednesday around 22 dollars…and when it gets close to the 200 day MA. Again, around 22. So there could be more upside to this rally until that gap gets closed. Othewrise, i would be short right nowor wouldnt initiate shorts yet.

If we do happen to selloff tomorrow, i like FCX and WYNN Calls.

Hey Shark, whats your email address ? I want to ask you a few questions , Thanks.

Hey Shark, whats your email address ? I want to ask you a few questions , Thanks.

Yes, I must agree with you Shark. It looks like we will go up for a few days.

looks like we may go down tomorrow one last time when the VIX hits 22 or 21… but i believe the weekly trend will be turning up by mid week next week. Again, till June 5th. wait for confirmation though! hehe

Well, you know I have a FP of 138.86 on the SPY… so that’s probably the final high for this P2 rally.

Do you think that it might be an inside day for the VIX??

I will only short again when the VIX 15min closes the gap from wednesday around 22 dollars…and when it gets close to the 200 day MA. Again, around 22. So there could be more upside to this rally until that gap gets closed. Othewrise, i would be short right nowor wouldnt initiate shorts yet.

If we do happen to selloff tomorrow, i like FCX and WYNN Calls.

That just means the plan was to play up all this news as an excuse to get a bunch of bears on board to short…remember, the MARKET MAKES THE NEWS, not the other way around. The news doesn’t make the market, but they try to make it look that way.

ES Hour chart: http://niftychartsandpatterns.blogspot.com/2011/03/es-hour-chart-analysis_17.html

STAY SHORT

LOL… don’t worry about that. I’m stuck short! So, it either rallies up and my shorts get ate by the bull, or I eat the bull… I prefer the later.

Stuck and Smart….hmmmm…your version of stuck is about to make you look Smart. As I said before about a week and half ago trading too much will lose you money because you get caught in these unusual jumps.Hang in there Red, if feel like Deja vue with a call to the infamous “Richie Rant”. Patience

LOL kihei,

i am infamous!! who knew?? hahaaa i like to call it my “richie renaissance” moment – and yes kihei you called it correctly – was impatience. i am on board with you and your take on the direction of the market.

….and i am still short!!!…..

Hey you keep saying stay short… would you mind elaborating?

I need some good reading and convincing today LOL 🙂

(seriously)

Hey you keep saying stay short… would you mind elaborating?

I need some good reading and convincing today LOL 🙂

(seriously)

SPY 5 Minutes chart: http://niftychartsandpatterns.blogspot.com/2011/03/spy-5-minutes-chart.html

SPY just kinda drifting around today.

high radition hitting CALI RIGHT NOW. When this info goes public charts won’t matter! stay short

that’s quite a statement.

A) you are privy to private info

B) you are lying through you teeth

C) it TRUE! (run for the hillls!)

http://colonel6.com/2011/03/17/scientists-project-path-of-radiation-hitting-southern-california-late-friday/

oh, this is so funny.

[Red sitting at the table]

Hey GG… I thought you forgot about us. Good to see you still around.

I come round here when I forget to take my lithium.

LOL.

Hey GG… I thought you forgot about us. Good to see you still around.

Looks likr Red needs a manicure BAAADDD.:)

Looks likr Red needs a manicure BAAADDD.:)

that is mean – you know that bear is a Democrat!!!

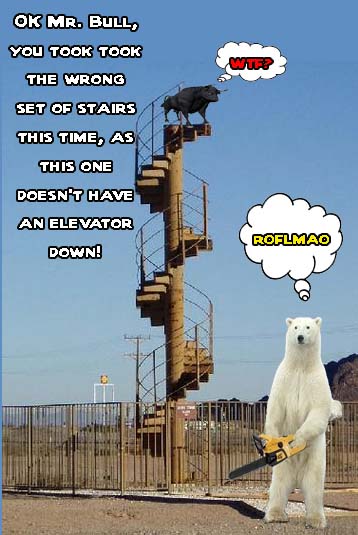

Ok gang… I’m not that patience. This is me and the bull…

AWESOME PIC! LOL

notice the steel pole supporting the stairs.

gonna need a cutting torch.

ROFL.

hehehe

Ok – just went to do dishes and came back and bam… what happened????

I’m not sure Dee… looks like the short term charts are just rolling over now. I didn’t hear any news, so it’s just the charts doing what they are supposed too.

Ok – I was referring to that 40 pt drop on DOW which is now recovering some.. we on same page? I thought that pretty dramatic!

Ok experts… what happens now – I am wondering if I cover my new shorts before end of day …. do we bounce again into OPX?

It’s looking too me like the charts have worked off some of the oversold conditions and should head lower into the close. Don’t know about tomorrow, but I can’t see it rallying back up until the short term charts reset back up… which I don’t think will happen tomorrow (at least in the morning)

Red – just sent you an intraday FP on Q’s 54.13 – not dramatic but something

was at 2:01

Volume spike too

That was near close yesterday… too late in day to be late fill right?

Yes Dee… that print is probably a late fill from yesterday’s close. But I still think the 52.27 qqqq print you caught will be filled… probably tomorrow morning. Same goes for the 123.03 spy FP.

Hope you are seriously right 🙂

oilbama giving a speech at 330..market normally sells off lol

He is just now getting around to “commenting” on Japan… too busy playing golf, doing NBA picks and planning So American trip…. I feel sooooo safe