Wednesday Update...

(to watch on youtube: http://www.youtube.com/watch?v=UVt7jdVOQvc)

Red

One More High And Then A Serious SellOff!

(to watch on youtube: http://www.youtube.com/watch?v=r6CkWcNDLi4)

The selling pressure has about dried up I believe, as the about of traders bearish has reached extreme levels. This tells me that a bear squeeze is coming soon, as you know the gangsters won't let those bears on the train when it leaves the station for good.

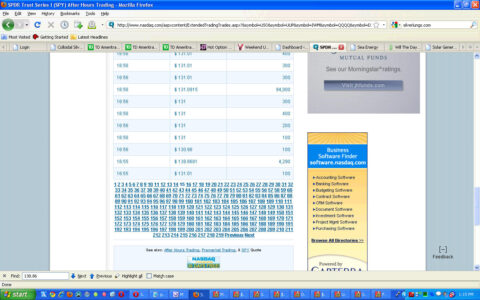

But before that happens, I do see a little more selling coming. The rally over the last 3 days was on light volume and is into a serious resistance zone right now. While I do see a bull flag on the 60 minute chart that should play out when the market opens on Tuesday, it will likely be an exhaustion move higher before a fall back down one more time. That 1340 spx area should hold the bulls back on this first attempt and allow the bears to push it back down toward the 1311 double bottom area.

Now the question is... will a "higher low" or "lower low" be put in?

Considering that the market is in a downward channel I favor the "lower low" scenario happening. The lower trendline of the channel should be around the 1300 spx area on Tuesday and that is my target for the low. It also is a "higher low" from the previous 1294 low on April 18th... which would still allow the bulls to make a final run up for my FP of 138.86 spy (about 1388 spx) that I see believe will be hit before this market really tanks for good.

(to watch on youtube: http://www.youtube.com/watch?v=O3O-vNTQnC4)

While I expect this week to end up with a positive close, the FP (fake print) isn't likely to be hit until the next week, or even the week of option expiration. It's common for the gangsters to put in a low 2-3 weeks before OPX, and then squeeze all the bears into that 3rd Friday... making all those "puts" they purchased expire worthless. Time and time again, I've seen them steal money from the retail traders this way. The game never changes, nor does the means... only the price points and day to day movement does. They have too do that... so you won't catch on to them.

Days to look out for this month... June 1st, 6th, and 11th!

June 1st is the day that the "White Dragon Foundation" is officially scheduled to start operations (according to the latest from Benjamin Fulford), and could be a day that the evil cabal stage another 9/11 type event (or 3/11 event... saving the 9/11 event for this October, as I fully expect the largest stock market crash in history to happen later this year). Of course they would do this because the WDF is being formed on that day (the White Dragon Society was formally the Black Dragon Society, but I guess they changed their name to look more positive? Afterall, the Lone Ranger was white and the bad guys usually dress in black... except Johnny Cash of course, as I believe he was a "good guy" who commonly liked to give the Illuminati the bird! LOL).

Personally, I don't think it will happen on June the 1st as even though the members in the WDF would know that the "staged event" was a message from the evil cabal (George H. Bush, George W. Bush, Henry Kissinger, Dick Cheney, Bill Clinton, Hillary Clinton, George Soro's, Warren Buffet, David Rockefeller, Jay Rockefeller, etc..., including their slave puppets like Tim Giethner, Ben Bernanke, Nancy Peloski, and to some degree Obama... even though he's trying to leave the gangster gang), I don't think the mass public would understand the importance of the date... therefore it's unlikely to happen.

Why you ask? Because the Illuminati gangsters like to do bad things to the public on ritual dates... and I don't see anything ritual about June the 1st. That leads us to the next date... June 6th. Why that date? It's not likely too happen either, as I'm no the only person that has failed to understand the meaning of the Simpson episode with the nuclear bomb going off, and the interpretation of the clock. However, it's still possible that the hand on the clock pointing to the eleven and the hand between the 5 and 6, indicate "5 minutes until 6 o'clock.

This can further indicate May (the 5th month) the 6th, (already passed now, therefore incorrect), or June (the 6th month) the 5th (referring to "5 minutes until 6 o'clock)... which is coming up this week. It also could still be November (the 11th month) the 6th, which came last year with nothing happening, but also comes again this year. Again, I personally think that is all wrong too. (Note: what I discovered while doing the video is that June 11th could also be the date of another false flag).

Finally we have June the 11th, the day I expect something to happen...

Why you say? The 11th is a key number (and date) for the Illuminati, which is why they staged 9/11 on the eleventh of the month (and also because the emergency help number is 911). Of course most recently, they attacked Japan with the HAARP weapon (they being the gangster gang I listed above) on March the 11th. This date also has a lot of importance on the Astrology/Moon/Spiral Calendar (according to the most recent Spiral Date Chart of the month of June).

So, that leads me to believe that the next likely date for the gangsters to stage another false flag event is this June 11th, 2011 (notice the additional "11" in the year too... yeah, this year is very important to the evil thugs that rule this planet. Too bad their time of enslavement of the public is coming to an end next year... LOL). While I know that the 11th is on a weekend, and before option expiration, I wouldn't count on this opx being the usual bullish bear squeeze, making all the "puts" expire worthless. In fact, I'll be willing to go out on a limb and state that "if" we hit the 138.86 spy FP by Friday the 10th, then I fully expect a very bloody week starting on Monday, June 13th!

I'll be looking for massive "put" buying to show up in the "open interest" as the "Insiders" get short ahead of the coming stock market crash. While this one is likely to be quite large, the one coming this October should dwarf it in size. I fully expect the March 2009 low to be taken out before the end of 2012, as these gangsters causes all kinds of disasters (in the environment with their HAARP weapon, and in the stock market) too happen before they are finally removed from power... freeing all of humanity from the 8,000+ years of enslavement we've had!

On to the short term forecast...

I'm looking for the bull flag to play out Tuesday morning, taking us to the 1340 spx area. Then I expect the resistance to hold and the market to rollover the rest of the day. I'm not sure how low we go, but the 1300 area is my target. I believe the guys at Mr. TopStep were looking for 1296 on the ES, which is close to the 1300 SPX level. After that low is put in, I'm expecting a rally over the rest of the week and into the next week, taking us to the 138.86 spy FP level. I'm not sure if that's the final top, but it most certainly will be a target level that should be hit.

I'll be looking for a short position on Tuesday, and then I'll likely go long into June 11th. If the charts line up, and the FP is hit, then you're know what I'm doing next! This is all speculation of course, but that's what this blog is about... guessing! Don't fall in the trap of thinking that this market is going up forever and that this new high coming is the start of a new bull trend... it ain't happening! This is only one last attempt by the gangster thieves to get all the bears off the train before it leaves for "Dark Territory".

Rest assured, we are entering the beginnings of the first wave down of Primary Wave 3 (P3). While it's not here yet, it will be soon. This will be a taste of what is coming this Fall. While this Major Wave 1 down (inside of P3) should be very delicious to the bears, a feast awakes us when Major Wave 3 down (inside of P3 down) starts... which should resemble the 2008 crash, only worst!

If you are wondering why I keep stating "this October" (specifically, the week of October 23rd), it's not because that month is usually bearish, but simply because of the fact that the next Legatus meeting ends on the 23rd of this October. The last meeting ended this past May the 2nd... since then the market has dropped from 1370 spx to 1311 spx, and still hasn't bottomed yet. This group (made up of the evil Illuminati gangsters) controls policies and determines the direction of the stock market. The next turn date is October 23rd... and it will be the worst in history I believe.

As always... good luck to both bulls and bears!

Red

Is my site faster? http://reddragonleo.com/wp-content/uploads/website-speed-test-05-29-2011.jpg

Ben Fulford's latest... http://kauilapele.wordpress.com/2011/05/23/benjamin-fulford-may-23-2011-the-white-dragon-foundation-is-set-to-officially-start-operations-on-june-1st/

Comments by David Wilcock on Ben Fulford's latest... http://kauilapele.wordpress.com/2011/05/23/comment-by-david-wilcock-on-ben-fulfords-latest-5-23-article/

How to run your car or truck on water... http://www.project.nsearch.com/forum/topics/how-to-run-your-car-or-truck

(to watch on youtube: http://www.youtube.com/watch?v=VpZtX32sKVE )

ES Hour chart: http://niftychartsandpatterns.blogspot.com/2011/05/es-hour-chart-analysis_30.html

Nice…..Window dressing in full bloom with 1st of the month jumper coming up……:)

You haven’t said whether or not you think a new high is coming, or if the top is in? What say you?

Hi Red,

Just letting you know that in fact June 1st is quite important there’s a partial solar eclipse occurring in Gemini which is quite important as it also coincides with a New Moon which will culminate with a Lunar eclipse on the 15th June. I think US time it should happen sometime late Wednesday afternoon. The date is also significant numerologically 1+6+2+11 = 9/11. Looking at the movement so far today I think this week could be pretty volatile plus NFP on Friday of course.

Thanks for the update… and yeah, this week could be volatile. Overall this week should close positive, but that doesn’t mean that it will go straight up. Thursdays are commonly bearish as of recently, so let’s see if we rollover again?

ES Hits channel resistance: http://niftychartsandpatterns.blogspot.com/2011/05/es-hour-hits-channel-resistance.html

The market is trying to work off the overbought conditions while still staying above the falling channel and resistance zone that it gapped up out of this morning. So far it’s holding support, which could mean that they will rally up hard sometime tomorrow after the 60 minute chart resets back up.

Of course if the support zone (currently around 1335 spx) fails, then a hard move down to probably retest the 1311 bottom should be expected. So far I don’t see that happening. The volume is too light, and this is a holiday shortened week. Not being a bull here, but I think they have control again.

I control your brain.

LOL… so you are a bull now! I refuse to be one, but instead just wait until I can be a bear again. By the way, silver could go as $40.00… especially if the overall market rallies.

I’m short many risk assets right now (gold, silver, S&P, oil) as I closed my IWM calls today. Just waiting for a pullback to buy, but the situation remains bullish. However, it is unclear whether the 6/10 turn will be a bottom or a top. I am guessing it’s a top above 1350-60

I think it will be a top as well. While we could see some selling this week to retest the 1311 spx low, (or to just put in a “higher low”?), I do see them pushing it up to the FP by the end of next week.

Yeah, expecting a higher low or double bottom. I suppose it’s possible the trade will get away from me here unless tomorrow begins turning lower (seasonality is positive tomorrow as well).

I see silver going down to test 34 again before it can rally higher, but again, if tomorrow is up big again then my whole thesis is incorrect.

Mr. TopStep…

http://www.youtube.com/watch?v=dKShqR1lOZ0

How bout that window dressing fellas…This pig is getting plenty of lipstick. 1st of the month jumper coming up. Selling into strength might not be a bad idea…:)

I would love to see another gap up tomorrow, as I fully believe it would be an “exhaustion gap” and quickly fall back down. How about that next level “double top” at 1351 spx… or if you really want to push it, 1359. However I doubt it can get there without a pullback first. I’m looking to short tomorrow, as I think we are going back down soon.

No video tonight gang. Maybe I’ll do one in the morning? Regardless, I’m looking an exhaustion move up tomorrow, followed by selling into the close and into Thursday. I’m looking to short again early tomorrow… good luck bears!

I’d love to see an exhaustion gap, and run higher.

why?

New Moon late tomorrow night. Darkest night of the month, trap the bulls come Thur morning.

http://www.life-cycles-destiny.com/dw/20112020.htm

and a symmetric confirmation of the dollar hitting some kind of lows around that date.

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/06/es-near-important-sar-level.html

Refresh page for Wednesday Update…

That’s what happens to silver bulls when they get that exuberance

Good call on silver. I only wish the market wasn’t so controlled and manipulated, as it would easily go down to 1300 this week if they simply let the charts dictate the market. Gangsters! I guess it’s harder to control the intraday moves in Silver, although the did do a great job of crashing it when it got close to the 50 level where JP Morgan would have gotten margin calls.

Silver is fine. There are two different prices for silver, the paper price and the physical price. Why else are people paying up to $8-$9 over spot price for the metal?

I think silver is going up to about $40 before taking another leg down.

Mr. TopStep…

http://www.youtube.com/watch?v=OAfhQkm5ky8

Looks like 1327 and then 1316 is the key level to look for a bounce at.

Buying some calls here at 1320. Not sure about the inverse head & shoulders bottom but to hedge against my silver and gold shorts I’d like to own some Aug SPY 138 and IWM 66 out of the money calls.

You should do a spread Cletus, as the VIX will kill your profit (as well as time decay). Try buying the 136 and selling the 138… better trade in my opinion.

I trade to lose

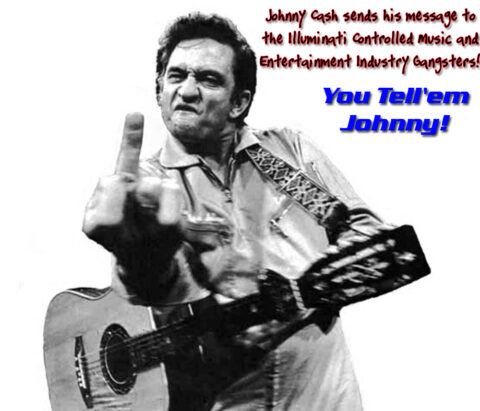

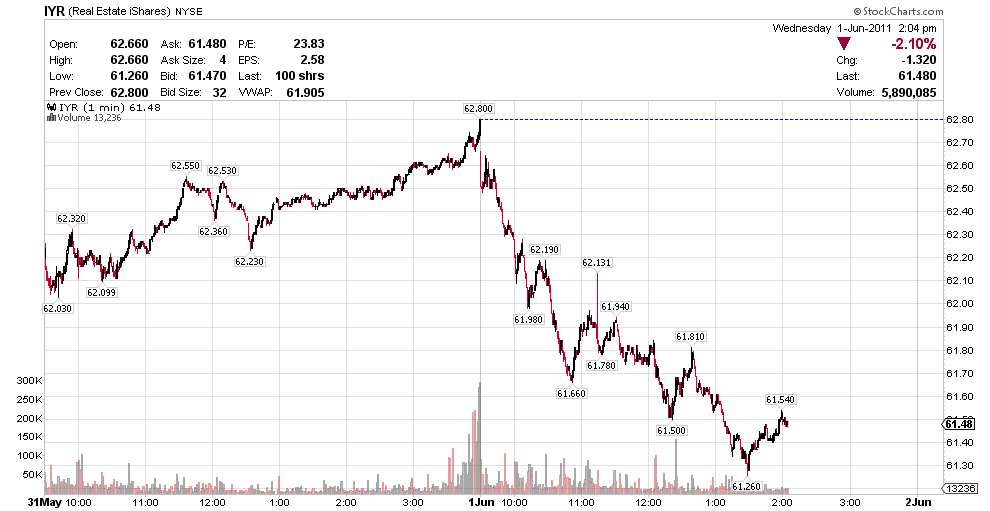

Print Watch, your official source for false prints, has issued a new print on IYR

Nice… thanks.

The Dow has already taken back all it gained from the low last week in one day. I was going to write that the rally was a classic hockey stick rally pattern seen right before a collapse but the market couldn’t even make it to June 1st. Not even a doji day. Reminds me of mid September 2008. And what’s surprising is the lower Bollinger Bands and 20 day averages are still dropping despite that rally.

The mofo’s stopped me out of a once profitable position yesterday but it looks like the secondary peak for commodities topped out right on schedule per one organization (actually

a day early just like silver did last month at its high before I could get a short position). Now I pray for a few days of sideways trading which probably won’t happen since it looks like crude oil is ready to drop to new lows.

Now I need to reconsider how the market moves into the lunar eclipse.

Don’t feel bad… I totally missed this move too! I thought we’d have some small selling, but not this big of a move down! They took a lot of bulls and bears by surprise on this move I believe.

I already have plenty of positions. I just wanted to add more. I was hoping for a flat day. I especially wanted to short emerging markets which had a nice bounce with commodities.

Negative 2000 on the breath… WOW!

GG chuckles.

Puetz. Do you want me to elaborate.

Silver finally fell off the cliff too… next is oil.

I closed my ZSL and SLV puts on that drop. Waiting for a backtest of the broken trendline up to 37 to re-enter on speculation it drops to 34.

Biggest concern is that it heads to 34 outright, but at that point I’d be looking to buy.

I’m sure we’ll get a bounce on it (and the whole market too), but I suspect it will go a little lower before bouncing back up to the broken trendline around 37. Regardless, smart to always take a profit.

Dow is at a new low now off the May high and hit its lower BB. Hopefully, this produces some sideways action. Of course, it just bounced off its lower BB last week so it’s doubtful we can hope for a repeat ie a multiday rebound.

Huge volume came in on IYR at the close. I think it’s near a bottom and IYR or DRN are good buys in this area.

We will probably make some new lows on the S&P and get a positive divergence on NYMO, but bottom line is that the market is set up for a big rally. I just can’t be on the bear side that long with sentiment this buried.

Around the time of the Osama Bin Laden high, sentiment was not particularly bullish according to several sentiment indicators I use. I find it extremely hard to believe the market topped that day.

If we bounce in the morning, then we’re going down again tomorrow. If we gap down in the morning, then a short term bottom should be put it. Either way, until we break the 1250 level the market can go back up over the coming weeks.

I think the first warning that today was a shakeout was all the posturing over the jobs report. I doubt Friday will be as bad as they think, and if it is, the market may put in a bottom that day. Could it be that June 10th is a low? Yep. So I’ll stay nimble here, and although I’m broadly bullish, I’ll look to be hedging into that date if the selling continues.

Look at a candle chart a year back and see how many times a big red bar has stopped the IYR advance for at least a couple of weeks. A big red bar has always been extremely bad.

Volume tells more than a candlestick pattern.

I guess the question you should ask yourself is: Do you think you can out-trade the person who placed massive buy orders on IYR at the close? A person who trades huge blocks?

No, I can’t out-trade the Fed, er……someone with deep pockets……

I’m actually looking for a higher high in IYR. But looking at the pattern, it shouldn’t rally back up. If it does, it’s a huge break from the norm and that means something is up. I wouldn’t be surprised to see some odd things happen this month.

An important thing to remember about silver is that it trades much more solidly throughout the day and into the overnight session than index futures, so silver could gap up huge tomorrow morning because it’s cycling through its normal re-test of the breakdown.

Unless you trade the futures contracts, you MUST take that into account with things like ZSL and SLV. That’s why I personally got out of my shorts on that crash.

To demonstrate this, look at how silver bottomed a few days ago and the US regular hours traders didn’t see a dime of that move.

Makes good sense… as I said, always take a nice profit. I just think it might touch the downward sloping trendline that intersects around 35.40 tomorrow morning, and then bounce. Hard too say, but a bounce will certainly come soon on it.

it was a surprise drop, eh Red?

Well, new moon tonight.

DOW -279 points

FYI – we’re inside the march 1st SPX candle. nothing much has changed in 3 whole months.

what could be better?

the market is a sham full of easy money. (with no easy way to drink of it)

live well, don’t let it eat your soul.

-GG

ES daily chart with support levels: http://niftychartsandpatterns.blogspot.com/2011/06/es-daily-chart-with-support-levels.html

Silver bouncing pretty hard. Could see a C wave extend into the 38 zone. A breakdown of 36.40 is bad but that’s a ways to go because volatility on silver has already moved higher, meaning the bears are weak right here.

I am expecting a lower low today, but I think we’ll close positive before the day is over. Probably just a “pause” day.

Look at IYR surging. DRN up 3%.

And people want to challenge me on it.

More importantly, they want to challenge the $50 million buyer yesterday at the close. Not smart.

I think we will close higher today, but not before a lower low is put in. You don’t know the time frame that big buyer is working with? He could be planning on hold for several months or more, which is fine for him as he can ride out the whipsaws… not something us short term traders can always do. I’m still short from taking a late day short yesterday. I’ll exit today though, as I do expect a short term bottom to be put in today.

Silver did bounce Cletus, as you thought it would. But now it looks to be headed down to major support at 33. I’m surprised it broke through the support at about 35.10 today, but it looks like it wants the 2 gaps filled below. The first one at 34 and then 33, which I would be a buyer with both hands at that level. It should have a multiday rally off of it I believe.

Here’s a quick video update gang…

http://screencast.com/t/FEvQWDtbZT

The Jobs report just confirms a debt ceiling raise and QE lite program to be instituted. Think stocks will rally after another round of easing? They aren’t cashing out of this ATM just yet. We are too far from elections, IMO.

Yes, I see a temporary bottom being put in today Kevin. We should rally next Monday I believe. The 1294 level is big support, and as long as it holds today next week should be up (at least for several days of it).

Monday-Tuesday up,..Wednesday up AM ~ down PM heading into Initial Claims on Thursday… I see a patterrrrrn. LOL!

that follows the black top trading rule on FAZ..down 2 days then up on the 3rd day.

ES Near a trend line: http://niftychartsandpatterns.blogspot.com/2011/06/es-near-trend-line-in-daily-chart.html

Wow…just wow…

The last month of QE2 and both the market and jobs start to drop. How convenient for Mr. Helicopter. Now he has his justification for QE3 (to be called something else). My guess is it will take a bit more pain for them to truly justify it though.

We’ll see how far this drop actually goes. My guess is it’s an attempt to get bears on board for a huge squeeze once QE3 is announced. Why do I think that? This morning on the Today Show they were talking about the economy turning for the worse. Got to get the Sheeple thinking they need more help, right? Guess I woke up a bit cynical this morning…

You woke up a “realist”… LOL

Haha,…a “realist” in this “let’s pretend economy”. How does that work? 🙂

It makes you one of the minority (like all the “red pill takers”… LOL).

“What a mindjob,…I knew I should’ve taken the blue pill.” LOL!

ES Fibonacci levels: http://niftychartsandpatterns.blogspot.com/2011/06/es-fibonacci-levels.html

You can be sure the pundits & the Fed will be saying the problem was “not enough” QE. As to when they will implement, that’s the real question. Ask your local Congressman. They know all of this, and act on it, before us peasants & serfs.

You can bet that we will have QE3, but ‘when’? I suspect it will come at a much lower price, and in another name of course.

i think they will call it debt ceiling…lol

…which reminds me of a question that was asked during the S&P conference call regarding US debt a month and a half ago…”With the Fed monetizing debt, why should the US even bother to collect taxes?”

http://www.businessinsider.com/follow-where-you-tax-dollars-are-being-spent-2011-4

Super trading day fellas. Sold into strength then waited for Pomo to start buy programs…think pomo shot its wad and should see some more selling into the close……:) Enjoy your weekend Red

Enjoy yours too Robert, as who knows what next week will bring?

Trading idea: buy DIA.

Opened at 121.24 on 6/3/11.

good long signals on the overnight charts

Yes, we certainly should have a bounce next week… but what happens at the end of it is another story?

I’m trying to figure out if a qe3 program is in the works. Not much out there on the search engines, so far.

zstock, try http://www.zerohedge.com ..i can almost guarantee you that tyler will be one of the first to know or post about it…

I like DE at its 200 day..

http://zstock7.com/?p=4832

Dow Jones chart: http://niftychartsandpatterns.blogspot.com/2011/06/dow-jones-analysis-after-closing-bell.html

Get out your thinking caps and figure this one out gang…

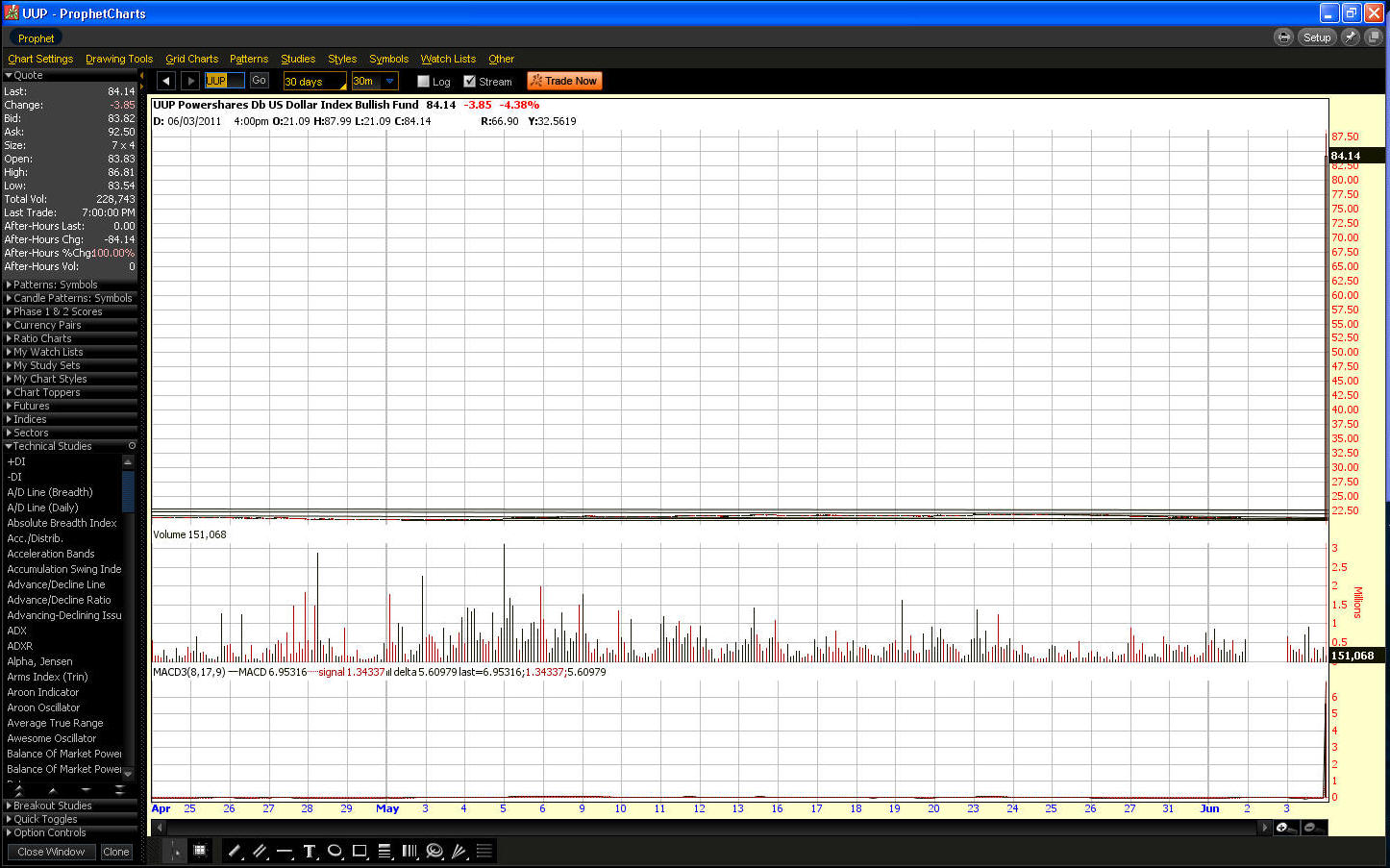

Look at the opening, closing, high and low price. Look at the date. Try to put the numbers together to come up with a future date and price level that the dollar is going to sky rocket up. If it lines up with June the 11th, then we could have our stock market crash next week?

By the way, trying to overlay this FP with the dollar would put it at about 284 (it’s currently around 73-74)… which would only happen if the euro collapsed as Lindsey Williams said it would. Then we would only have 2-3 weeks to get out of all paper… remember? While I don’t think the print means that the dollar will go up to that level, I do believe there is a hidden code telling the real future price level and date.

Have good weekend everyone (Richie, this puzzle is for you and Geccko to work on).

IWM Bearish engulfing: http://niftychartsandpatterns.blogspot.com/2011/06/bearish-engulfing-of-iwm.html

a move to 1.90, would be a possible monthly bottom.

http://slopeofhope.typepad.com/.a/6a00e009898222883301538eef0bff970b-popup

32% of spy500 above 50 day.

GE Stock chart: http://niftychartsandpatterns.blogspot.com/2011/06/general-electric-weekend-update.html

anybody have any qe3 links?

SLV Weekend update: http://niftychartsandpatterns.blogspot.com/2011/06/slv-weekend-update.html

The Founders Did Not Intend For America to Be Run By Big Banks and Wall Street

http://www.youtube.com/watch?v=n0gjVjyUlro

Nice…. worth reposting on the new post.

i’m having to switch from a 5 month chart to a 9 month chart, to see the nov-dec lows of many stocks.

when i have to enlarge the time frames, that usually means the qqq is about to retest rsi 30

my plan is to short any of my current longs, on any pop highers they might make, next few days

New post…

http://reddragonleo.com/2011/06/05/is-the-stock-going-to-crash-this-week/