Thursday Update...

(to watch on youtube: http://www.youtube.com/watch?v=ZFndCEfZlL8 )

This video says that there is a Bilderberg meeting this weekend. The same gangsters that attend the Legatus events are also members of the Bilderberg Group. They set policies, laws, and more importantly... they control the direction of the stock market! What do they have planned next? Will we see another False Flag event on 06-11-11, causing the stock market to crash on Monday?

(to watch on youtube: http://www.youtube.com/watch?v=6vEiWw1FIX8)

Red

_____________________________________________________

Tuesday Update...

(to watch on youtube: http://www.youtube.com/watch?v=ggeDqS4yXNU)

Here's a video for Geccko and Richie...

(to watch on youtube: http://www.youtube.com/watch?v=2CP6DP-ZXOQ)

Red

_____________________________________________________

It certainly doesn't look good for the bulls... that's for sure!

While the bulls aren't officially dead, they need to make a stand this week or else they will lose the 1294 (spx) major support level. Once that goes, 1250 is going to act like a magnet. At this point, the high could be in for the rest of the year? While I'm still not sure if the 138.86 spy FP was real or not, I don't think it's going to be reached for several months at minimum. The charts tell me that a long term high might have been put already. I'm not sure yet, but we may have started Primary Wave 3 down.

(to watch on youtube: http://www.youtube.com/watch?v=0FGlp4hSHhU)

Some interesting news has come out to support this theory too. It seems that Tim Osman (Osama Bin Laden real name), who was indeed dead in 2001 from a kidney failure, managed to use the money that the Bush-Clinton Crime Family Syndicate (the Cabal) gave to him and turned it into Trillions of dollars. The money was used too train people to conduct terrorist acts that the Cabal wanted to happen.

Osman (Bin Laden) was a trained CIA operative himself, and trained others how to do these attacks. This people were known as the "CIA Database", which translated means "Al Qaeda". Put simply, Al Qaeda is CIA agents. So, Tim Osman (Bin Laden) did as he was told by George Herbert Walker Bush (Daddy Bush), but also used the money given to him to run Heroin and multiplied it many times.

Upon his death the money was frozen, and couldn't be released until 10 years later. That brings us up to 2011, in which the Cabal managed to steal this money funnel it to Goldman Saches and JP Morgan Sunday night at 4:19 PST May 1st, 2011. JP Morgan was about to be liqudiated if silver hit $50.00 and ounce, and they quickly used this stolen money to crash silver by establishing many new short positions in the COMEX silver futures before the open Monday.

This all happened 5 hours before Obama announced the death of Tim Osman (Osama Bin Laden). Silver dropped $5.00 in 40 seconds and is still currently new downtrend. This money will probably be used for QE3 at some point, but right now I think they plan on crashing the market over the next several weeks.

Then there is Dominque Strauss-Kahn, who was setup and arrested because he discovered that all the gold in Fort Knox is gone. His source from inside the CIA has firm evidence that the gold is gone and replaced with Fake Gold Bars. This all spells major trouble for the evil cabal (Bush-Clinton Crime Family Syndicate), they are clearly running out of money and quite desperate to save themselves before the crap hits the fan.

Since they don't have any real gold left to bargin with, and only this freshly stolen money from the now un-frozen Bin Laden account, you have too ask yourself a question... "if you were them, would you use the money to rally the stock up higher by buying long positions, or would you buy short positions and crash the stock market?" Which one makes them the most money?

The answer is simple... Crash the Stock Market!

That's what I'd do if I were in their shoes, as it would all you rob the sheep again on the way down, and then rob them again when you buy it back up later at heavily discounted prices. This tells me that the next few weeks are likely to blow through some serious technical support levels as the sheep don't see what's happening until it's over.

Let's not forget that this all happened right about the last Legatus meeting April 30th - May 1st... coincidence, or just great timing? You know the answer to that one don't you... yeah, I thought so. Since the next meeting is in October, and ends on the 23rd, I'd be willing to state that the current move down will be called Major Wave 1 (down) inside Primary Wave 3, and the rally going into October 23rd will be called Major Wave 2 (up) inside of Primary Wave 3 down.

That leaves Major Wave 3 down inside of Primary Wave 3 down for the week beginning October 23rd. That one will make this current move look like a nuclear bomb went off compared to a grenade! I hope everyone survives the coming Great Depression Two, as it's going to be ugly!

Looking at the short term...

The charts support a positive close on Monday, unknown on Tuesday, but selling the rest of the week is likely. If we get a 50% retracement back up from last week, it would be another great shorting spot in my opinion. One of the stock I'd be looking to short would be Goldman Sachs and JP Morgan... why? Because of the new trouble they are currently in from the New State Attorny's office as well as the Justice Department and the Securities and Exchange Commission. I believe that the cabal plan to sacrificy one or both of these two companies.

Remember the FP here of Goldman? (http://reddragonleo.com/wp-content/uploads/fp-gs-61-05-on-03-21-2011.jpg) Then there is to other FP on them from awhile back (http://reddragonleo.com/wp-content/uploads/2010/08/gs-fake-print-13-10-on-08-09-2010-by-raised-by-wolves.png). How about this one on JP Morgan? (http://reddragonleo.com/wp-content/uploads/2010/09/jpm-fp-31-02-on-09016-2010.jpg). Revisiting other FP's is probably a wise idea now, as it seems that we are certainly heading down now, and the print will likely be bouncing levels. http://www.flickr.com/photos/reddragonleo

If this happens...

http://reddragonleo.com/wp-content/uploads/fp-usd-showing-82-50-area-on-02-02-2011.png

Then these should be hit...

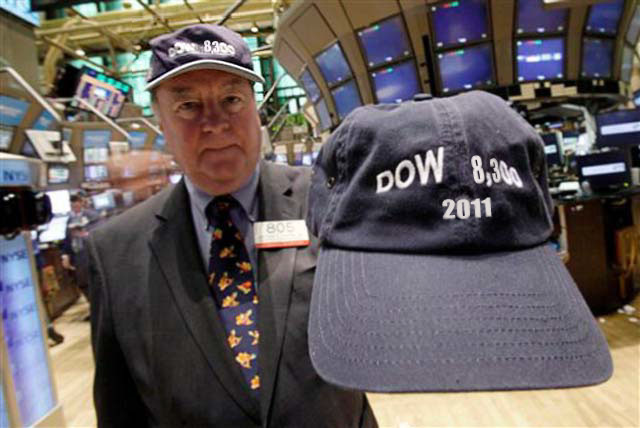

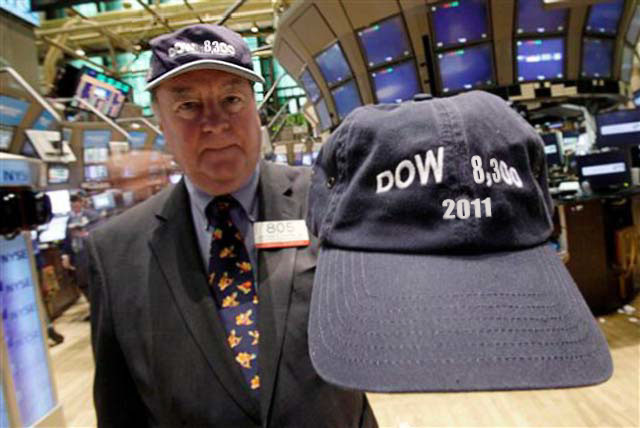

http://reddragonleo.com/wp-content/uploads/2010/07/dow-fake-print-8300-01-on-july-07-2010.jpg

http://reddragonleo.com/wp-content/uploads/2010/10/fake-print-885-spx-by-Jason70-on-10-01-2010.png

http://reddragonleo.com/wp-content/uploads/2010/10/gold-fp-of-939-on-10-14-2010.jpg

So, for everyone that is already short, this it what I believe you have too look forward to. These levels could be the end of Major Wave 1 down, and allow Major Wave 2 up to lead us into the week of October the 23rd. I don't know how high the bounce will be, but it doesn't matter as we know when it ends. If gold really does hit 939, it will be a huge buying opportunity, as the next run up should be the one that takes us to the 2500-3000 area that Lindsey Williams speaks of. We might not hit that level until after the next crash bottoms (the one scheduled to start October 23rd, 2011), but when it does, I'll be a buyer.

Back to this coming week...

The best I can see is a 50% retracement early on, like on Monday or Tuesday... then a lot more selling. The 60 minute chart needs to rally up and get overbought, and I suspect that will happen Monday, but could carry into Tuesday morning. After that, it bull season again, and the bears have the rifles.

Good luck everyone...

Red

The Bin Laden Psyop

http://seeker401.wordpress.com/2011/06/04/tom-heneghan-the-bin-laden-psyop-parts-1-2-the-strauss-kahn-honeytrap/ or http://www.myspace.com/tom_heneghan_intel/blog/542882169

Russia Says IMF Chief Jailed For Discovering All US Gold Is Gone

http://www.eutimes.net/2011/05/russia-says-imf-chief-jailed-for-discovering-all-us-gold-is-gone/

Prosecutors 'ask Goldman Sachs to explain behaviour'

http://www.bbc.co.uk/news/business-13637004

I agree with all your recent posts expect for the IMF one. He’s a Socialist hypocrite dirtbag who is married to a billionairess who enables his hypocracy……she’s an enabler! Russia will be a thorn in everyone’s side as long as Putin and his buddies have control. They are a wildcard actually. The next 2 years will be interesting indeed.

Anyway, it’s pretty interesting all that is happening with natural (artificial) disasters, bad weather, and all the other financial and political crap that’s going on. I’ve lived all over the place and this is the first time on the West Coast that I’ve experienced downpours of this magnitude in June in over 30 years. Over where you are, Red, thunderstorms occur between 4-6 pm every single day. But here, unheard of. I’ve never seen the general public so apathetic & brainwashed. I’ve never seen the crime rate go down during a really bad economy. I think this all leads to something really, really big.

As for Kahn, he’s a bad guy… that’s for sure. He seems too be trying to save his own hide, but I’m unsure what his plan is at the moment. Ben Fulford stated that he was trying to steal the Social Security money from America, so that’s another piece of the puzzle? Who’s got the right story? I don’t know, but I think the stock market is going to crash this week and next week… especially if they stage another false flag event on 06-11 (911?).

Good question……maybe the tornadoes in the midwest were “Plan B”, instead of earthquakes, because of all the publicity? This is all so amazing how a small handful of people have so much power. So much power over everything. I think at this point, odd stuff will be happening more and more frequently.

All I know is……sell the rallies!!!

Yes, they are using HAARP to manipulate the weather here in America. I definitely think that they are causing the problems around new madrid fault line in the Kentucky area too.

ES at golden ratio: http://niftychartsandpatterns.blogspot.com/2011/06/es-life-line-for-bulls.html

At worst we selloff till the VIX hits near 19. Red, i agree..we should get a relief rally over the next day or so to 1320-1324, then timberrrr. I posted on it as well a day or so ago. Overall, im very bearish until 11,500 which is 10 percent correction from top. Then a 50 percent retrracement (12,100) followed by C wave down on weekly charts…

http://sharkmarketanalysis.blogspot.com/2011/06/shrk-bites-06052011.html

Sounds about right Shark. Since we did indeed have one more low today, I expect a short couple of days rally from about here. I’m not sure how far, but the max I can see is the 1330-1335 spx level. I really don’t think it will get that high, but anything is possible. After that, I see more selling into the remainder of the week. (Nice post by the way).

thank u sir!

SPY Update: http://niftychartsandpatterns.blogspot.com/2011/06/spy-trend-update.html

Sweet Justice is served on the corrupt banks! I’m loving it!

http://www.digtriad.com/news/watercooler/article/178031/176/Florida-Homeowner-Forecloses-On-Bank-Of-America

Breadth is pretty negative so I would expect the market to close on the lows. McClellan Oscillator isn’t even oversold yet. I expect a pretty big down day within the next two days. All of the indices are below their lower Bollinger Bands except the Nasdaq. I am looking for a slight piercing of the March lows and then a large snapback rally. McClellan Summation index should breakout of the low end of its range for the past year and either it creates a one day bloodbath or it keeps racing to the “crash” zone.

Put call ratio has been enormous since Thursday and would have produced a 300pt upday by now during the golden days of this “bull market” but it looks like it was smart money buying the puts since I see very little bearish exuberance over at the data mining sites. In fact, I saw a lot of bottom calling.

I think we will see it start crashing this Friday Geccko, and Monday should be a blood bath… especially if they stage something on 06-11-11.

Next week is options expiration week so that gives me some pause whether a crash can occur during that week even though it contains the Armstrong date, the lunar eclipse date and the 111 date. But they pimped the Armstrong number heavily during the Heat/ Thrice game I watched against the Bulls and the Thrice number rearranged is the Armstrong number although they were using other numbers to form the combo.

The Champions league match between Barcelona and Manchester United flashed some interesting numbers as well including the 111 date number. (the first goal formed the number) and then they flashed 87 with the Villa(#7) goal that then turned into 58. I think the Messi goal formed the Armstrong number but I have to revisit the highlights but then it formed an 11 from the goalkeepers point of view.

Print Watch has registered a new print. In terms of the value, it is a major resistance level going back a few weeks, but also we have an IYR print much higher, so I suspect this could be a simple buy signal and tomorrow could trend higher.

Looks like a signal that tomorrow the market will rally some. I don’t think it’s going up very far though as I believe Geccko is right on his call that the insiders are likely the one’s buying the puts.

I am not looking for a huge rally yet but some kind of retracement at least to the IYR print! At that point I’d be looking to short.

Yes, I agree. I thought we might go up today toward about 1320, but I now believe that will never happen. The 1302 and 1309 area’s should stop any advance.

I wouldn’t doubt that over the course of the next two days, they fill the gap made on the job’s report. That might be the overall target by Wednesday’s open or so. I’d be looking for some kind of an exhaustion gap up.

The ultimate target for this sell off could be the 54.05 QQQ print we got awhile back that never filled.

What level are you referring to exactly?

The jobs report gap fill would go to 131.73 on SPY, or about 1315.

This print also came on the 15:11 bar….coincidence? lol. Actually, I don’t read into it. I’ve been keeping tracking the times of all the prints and I’m not noticing a clear pattern yet.

SKF signals are telling me possible bounce higher tuesday, maybe wed too, then back to the downturn business. i’m looking for spx to test rsi 30.2. i have a lot of stocks at rsi 25..once a stock is that low, it usually takes about 10 days, for it to get to rsi 35

look how low i put the buy signal on VZ, and this thing pays a 6% dividend. even it’s getting hammered.

—

Greeks get it!!!!!!

1250 in sight. Maybe China raises rates tonight??? Market definitly broken. Little Pomo tomorrow.. Bounce coming soon maybe Wednesday……

S&P 500 Analysis after closing bell: http://niftychartsandpatterns.blogspot.com/2011/06/s-500-analysis-after-closing-bell.html

Red, you probably heard about this, but chalk one up for the good guys……FORECLOSE ON THE BANKS!!!

http://news.yahoo.com/s/time/20110606/us_time/httpmoneylandtimecom20110606homeownerforeclosesonbankofamericayesyouheardthatrightxidrssfullnationyahoo

I did hear about earlier and posted a link to the video of the story, but I didn’t get all the details that yahoo has. Thanks for the repost… and here’s the video of it.

http://www.digtriad.com/news/w…

ROFLMAO!

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/06/es-chart-with-possible-reversal-setup.html

Well gang, it looks like I was a day off on my rally, as I expected it to start yesterday. Since it has now begun, I expect it to carry into tomorrow as well. But I think we’ll see a top to it then and another leg down to follow this Thursday and Friday.

yupyup! Hey Red, do you ever read any Martin Armstrong essays? Hes good with cycles and macro economics…

http://sharkmarketanalysis.blogspot.com/2011/06/is-end-near-martin-armstrong.html is the latest.

http://www.martinarmstrong.org/economic_projections.htm is the site for his essays

AAPL Chart: http://niftychartsandpatterns.blogspot.com/2011/06/apple-bearish-engulfing-in-week-and-day.html

AAPL Chart: http://niftychartsandpatterns.blogspot.com/2011/06/apple-bearish-engulfing-in-week-and-day.html

Mr. TopStep…

http://www.youtube.com/watch?v=VT-4HwEDIKw

ES Triangle pattern: http://niftychartsandpatterns.blogspot.com/2011/06/es-triangle-pattern.html

Trading idea: short GR.

Opened at 86.71 on 6/7/11.

GR up against strong resistance, 86-87

Trading idea: short OSG.

Opened at 26.59 on 6/7/11.

negative cash flow. oil tankers full, nowhere to go.

wow, market didn’t even stay up at the end, i bought some puts, when it was still up

blow off top intra day whoohooo

i’m waiting for rsi 30 on one of the indexes, to tell me the bottom is close. all above 33 still

It’s close but not quite yet 🙂

I didn’t think that end of the day drop meant anything. Did you see IYR? It was up 1.2% on the day. One of the indexes was not telling the truth, and I believe the S&P was lying.

That end of the day dropoff was just awesome. It also brought breadth disparity down far enough so that the McClellan Summation Index will be hardly altered and can continue ticking downward to the moment of truth. It looks like it will break to a new low for the past year today and definitely will breach the low tomorrow unless there is a huge up day. Nasdaq Summation has already made a new low (actually several sessions ago).

So now it becomes a question of do we get the one day bloodbath and a short term low or do we have a date with destiny coming up rather fast. I think the markets bounce after they get to 30 daily RSI but that could be hit as soon as tomorrow. We can finally have a day where all the indices spend the entire day below the lower BB although $NDX still hasn’t dropped below its lower BB. Apple was down 5 all day so I wouldn’t have high hopes for a bounce in the Nasdaq.

60 minute RSIs are all still low though but a one day bloodbath should take them below the 30 level.

There was continued bottom calling on all the data mining sites yesterday although some traders I respect were calling for a short term bounce. Just scanned one site briefly so far and it looks like the bullishness is continuing. The high put call ratio won’t matter until we get the bloodbath day. We just broke through the support of two weeks ago and basically back tested it today. I can’t see a large bounce from here.

Dow Jones Analysis: http://niftychartsandpatterns.blogspot.com/2011/06/dow-jones-analysis-after-closing-bell_08.html

Looking for some more downside tomorrow. Futures selling a/h pump. We need China to raise rates tonight to have a descent move downward …:)

I think it will be down in the morning Robert, but rally into the afternoon. I see tomorrow closing positive, but Thursday and Friday could be ugly.

bermonkee is such a liar. he reports 3% inflation. wtf,

cheeze its went up 40% this week. add that in there you effing a hole bermonkee

Nice…and what about the article that said if we used the same methodology as in 1980, inflation would be at 9.6%……

http://www.cnbc.com/id/42551209/Inflation_Actually_Near_10_Using_Older_Measure

rsi 33 down to rsi 30, doesn’t sound like much, but sometimes it can be a pretty big percent

I didn’t realize the daily RSIs were that low but saw that there was a sizeable drop late last May when the RSIs were in a similar position.

They should go lower this time, as compared to March.

Refresh page for new video update….

More solar flares:

http://beta.news.yahoo.com/unusual-solar-storm-could-disrupt-earth-communications-194814480.html

The last time this happened in March, there was an earthquake and the market tanked:

http://www.foxnews.com/scitech/2011/03/10/major-solar-flare-erupts-make-auroras-visible-northern/

ES Hits 200 DMA: http://niftychartsandpatterns.blogspot.com/2011/06/es-at-200-day-moving-average.html

Crude Oil resistance level: http://niftychartsandpatterns.blogspot.com/2011/06/crude-oil-resistance-level.html

Well, I’m really disappointed in the bulls today. At this rate it will crash on Friday. I really didn’t think it would continue straight down some many days in a row without even a single positive closing day. The bears are really kicking the bulls butt right now. LOL

i think tomorrow will be an up day. or at least start out UP. LOL

Yeah, they’ve really put a hurting on the bulls this time (finally), but this is getting overdone on the downside right now. A rally is really needed… maybe some good job’s data? That would fool everyone!

a very good trader i follow, will be adding gold stock longs next week. this could push the indexes higher going into OPX

It would stand to reason that there should be at least one “UP” week on the weekly charts, so if this week closes down I would have too say that the odds of a positive close next week are strong.

NEM at 50-51 looks like the time to buy.

i have very good overnight go long signals on FSLR

We should get the bloodbath day tomorrow. Breadth was negative enought to get the McClellan Oscillator below -200 where big down days happen. All of the indices continue to hug their lower BBs and $NDX outperformed to the downside since it still hasn’t breached its lower BB. Oil was up big at one point and the markets still struggled. But emerging markets still headed downwards. It looks like things should accelerate to the downside. Yesterday was the failed rally attempt and today looks like the downside continuation day leading to the bloodbath day.

60 min RSIs are still low but they did not drop below 30 it appears on most indices. Some stayed elevated even with the decline.

There was bottom calling en masse yesterday on the various sites. I haven’t checked them yet today but I expect a continuation of the bottom calling.

Ideally, we get the wipeout day tomorrow with a final washout on Friday and then a big pop to start next week. If that doesn’t happen, then it could be a bloodbath week next week as the McClellan Summation Index has entered no-man’s land moving at a rapid velocity downward towards the “crash” zone.

O.K sold all my shorts today. No sense getting greedy..Think theres a good chance for a bounce sometime tomorrow.

Doesn’t seem like there is anything that could cause a substantial snapback. Still not really oversold, hell, still way overbought on the long term charts.

This would be the perfect setup for a false flag over the weekend and crash on Monday. Ah, wishful thinking………

We need a 2 day rally first… to squeeze out the current bears. You know they won’t let them make money on it. Plus, they need to trap some new bulls.

Actually, I think it’s the reverse now. The bulls are trapped and the market is not allowing the bears a good entry. I am beginning to wonder even if there will be a bounce. A one day affair if there is.

A decisive break below the March lows and the 200 day average would full bear alert. But I am expecting a bounce next week if the market drops into Friday based on a certain fractal.

You could be right? At this point I’m not sure when we will get a bounce? It’s still bearish, and the bulls just aren’t stepping up to the plate right now.

The big boys sold in March, when big banks and others sold their big s&ps, just a little sloshy trading since then……

Maybe. But if you look how jacked up the margin-indebted are, any bounce will be a fantastic, easy selling opportunity. That is, unless QE3 is leaked or some other “cheat code” pumps the market.

http://dshort.com/articles/2011/NYSE-margin-debt-and-the-market.html

Yes, the first attempt at a decent bounce will certainly fail as trapped bulls sell on it, trying to get out.

There you go: http://www.cbssports.com It’s the 111, Derek Rose 89 commercial, IKEA special number. The first goal of the Champions League final formed this number. They were flashing this number all over the place during Game 1 of the Stanley Cup final.

Dang, they have the Armstrong number hidden in between also. (The Thrice number rearranged)

Tomorrow is 6-9, which seems to be the insiders favored number for the year. How 2011 has a connection to 69, I don’t know although it is 115 years ago to 1896, the birth year for the Dow Jones Industrial Average.

That image probably won’t make it to the morning and they make sure you can’t click on it to get a link or an address.

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/06/es-cloud-continue-to-favor-bears.html

Hi Red, Are we resetting yet? Whats your thoughts on Friday and monday back down? Looks like 1294 on SPX has become resistance. do you think it will hold?

Considering that the move down was so strong, and the light volume today, I think we are going to have an ABC move up… which would carry us higher into Friday. Lot’s of bears now trapped, and I don’t think they are abandoning their positions just yet. Lot’s of bulls still buying the dip. Let’s see how high they take it? I don’t see them getting past 1320… if they make it that high?

SPY Chart: http://niftychartsandpatterns.blogspot.com/2011/06/spy-resistance-level.html

i’d be surprised if the spy gets over these levels next couple of days

Very confounding. Today’s rally very weak. It should have been stronger. In an ideal world, it would continue to rally tomorrow and then everything would make sense. But maybe it’s a one day affair and we continue our march to the March lows. Breadth weakened at the end enough so that it won’t damage the McClellan Oscillator too much. I’ll need to see where it stands later in the day.

I can’t really see the trapped longs getting bailed out right now and the Dow got to an important resistance area and up to the 60 rsi level on the 60min chart. The dollar was up with commodities although it appears crude oil pulled back as the day went along.

I wouldn’t doubt today’s rally even after the weak close.

Why?

Because retail traders doubted it and bought lots of puts. As a bull, you like to see pessimism on a bounce.

Tomorrow could theoretically dive to a new low. We still haven’t hit the QQQ 54.05 print, but it might take another week or two to get there once the bulls stage a little comeback here.

IYR is confounding me. I see huge volume coming in day after day, yet price is stable. I assume these are buyers but it could be big players liquidating for a deeper dive. We have an IYR print higher up, so I’m more in the bullish interpretation camp.

XOM

I am bearish on XOM. target: approx: 68

no problem deej. XOM 68 seems too low to me, considering its target price is over 100

68 is a LT target. I think now, it should rally to atleast 88-90 area

Enjoyed the bounce today….sold into strength of course…leaning towards downside tomorrow maybe significant..:)

Refresh page for new update…

Red, I enjoy your videos but the Elliot Wave stuff doesn’t work for me. lol. It seems like too much speculation. How do you know we’re not in a C wave right now instead of a wave 3? It seems like people waste too much time on it. In a few weeks you’ll know what form it took, but right now we are just looking at past data and of course it will seem obvious in retrospect.

I think Elliot Wave is useless for bigger scale projections. It is ONLY useful when you see clearly formed patterns like a 5 wave pattern with proper fibonacci relationships, etc. Even then it is hardly useful.

There might be a few EW “geniuses” out there, but frankly they are few and far between. Even the people from Elliot Wave International, who SHOULD be the geniuses, are regularly wrong.

Here are the things that work in trading, in my opinion. At the end of the day, every trade is about probability. You want an entry and exit with the highest probability of working.

1. Does volume support the trade? Are you exiting a long/shorting into light volume or profit taking patterns? Are you buying/covering into heavy volume near a low?

2. Is there a momentum divergence? Is momentum increasing or decreasing?

3. Are you entering at a support or resistance level? Pretty much no trade will work unless it is taken when a support or resistance level is hit, broken or provides a probably turning point.

4. Are you measuring time to figure out if the instrument is at a cyclical turning point?

All these things give you clear exits and entries, and give you the highest ODDS of winning at some point during the trade, whether you want to scalp or buy and hold. Elliot Wave is completely unnecessary.

I’m not saying I have the holy grail. I just think this is the only common sense approach that works in the long run. Each trade should have a checklist like the one above.

Yes, EW is only speculation… I must agree with you on that. I don’t trade off of it either as there are too many different possibilities. But I try to guess at the most probable scenario by looking at all the other technicals. So, in this case, I think we could bounce back up to about 1310-1320 before falling back down again.

Will it happen tomorrow, or take next Monday or Tuesday to occur? I don’t know, but once I see the short term charts showing weakness and looking topped, I’ll be looking to short again. Unfortunately, there is NO magic system, so educated guesses will have too do.

Exactly! Wave 3 down has been expected for 2 years already. Elliott Wave patterns seem wayyy too backward looking for me. That doesn’t mean I ignore it completely, I just don’t put much weight into them. I think we are close to a bottom in the market before another runup headfake. I am not so sure the 1388 FP is real now. The bears have the momentum, but 1250-1260 SPX is where the bulls will make a huge stand. European bailout news may spark a short lived rebound to get all the retail buyers back in.

The Thrice lost tonight and blew my little scenario for a high tomorrow with a tank job following the Thrice championship on Sunday on 6-13. The Thrice cannot win the title on Sunday; they can only lose it.

I don’t think it matters anyway since afterhours activity isn’t looking so hot for all of the markets.

But it would be nice to see a high for tomorrow anyways.

ES fib levels: http://niftychartsandpatterns.blogspot.com/2011/06/es-retracing-yesterdays-up-move.html

Hi Red, I guess that 1294 spx was the kiss goodbye, as we discussed yesterday.

Looks that way now. I thought they might go a little higher first and then roll over, but it’s still too weak I guess.

Dow Jones Broadening pattern: http://niftychartsandpatterns.blogspot.com/2011/06/dow-jones-broadening-pattern.html

Bear flag almost done on the 15min SPY chart… this sucker should break to the /ES 1258 area today…