Does the stock market crash on August 5th, 2011?

(to watch on youtube: http://www.youtube.com/watch?v=J8zNd6AYP84

Red

__________________________________________________________

Here's the truth... the Flash Crash was planned by the Elite Illuminati Gangster Reptilians!

(to watch on youtube: http://www.youtube.com/watch?v=0gXf-vXhgbc

Not only was it planned well in advance of the actual event, it was told to their insider buddies at midnight the day before it happened. This fake print (FP) shows a trade was executed around midnight the day before the flash crash, with the exact price level they planned to take it to. Notice the 66.6667 level on the Full Stochastic, as it's a ritual number for the Illuminati trash.

The first screen shot also shows what happened on Thursday and Friday, and you can see that the FP is still showing up as well as the actual print low Thursday afternoon. If you had seen this print the day before (I didn't catch it, as this screen shot was emailed to me the day after it happened), you would have be able to exit your shorts at the bottom and go long for the ride back up... which allowed the insiders to make a killing, while the us sheep got robbed.

The stock market is setup to steal money from the innocent people (sheep) and give it to the elite gangsters (wolves... or Reptilians actually). It's been that way ever since it was created, but the manipulation that the thieves have been doing is at extreme levels now... and has been since about 2008 when they started all the quantitative easing (QE1, QE2, QE?...) programs.

These programs were just a way to inject stolen money (from you... the sheep, in the form of inflation) into the stock market to keep the ponzi scheme going up until now. The gangsters simply put the money into the crooked banks, and wrote themselves out record bonuses. They were all on the verge of bankruptcy, and were supposed too take that bailout money and give it out in loans to us sheep, but instead they used it to manipulate the stock market with... suckering in more sheep back into the market, and then stealing it all in one quick flash crash move down.

They are about to do it again... but this time the market will stay down!

Recently, an old FP showed back up... one that I seen back on 01-31-2011, showing the SPY at 34.65! Yeah, that's not a mistake... I said 34.65! On Friday the SPY was 129.33, which makes clearly makes the 34.65 print seem impossible to hit. But, what if it's another signal to the insiders as to where they plan to take the market? The print that I caught back in January of this year was caught again Friday by Anna (hotoptionbabe.com) on her 4 hours chart of the SPY. I didn't see it on my chart, but she uses Think Or Swim and I use Ameritrade... so possibly the systems are different and it never appeared on both?

There is a guy named Alan (howthestockmarketisprogrammed.com) that explains how they (the operators controlling the stock market) could seen out price levels for certain prints (high, low, open, and closing price) in color to the insiders, while us sheep see it in black and white. They have the technology to do that, so only certain people will see the color prints... which will allow them to know where they plan on taking the stock market to, the exact level, and the time it will hit it.

I think that is the case now, which explains why these FP's don't show up on every different charting platform. I've seen prints show up on Ameritrades' platform (Prophet Charts), but not on Think Or Swim... and vice verses. I think those are accidents, as the system they use to inform the insiders with colored numbers isn't perfect and sometimes us sheep see one show up.

However, knowing the exact date that it will be hit is still a mystery to us sheep, as we don't have the prints in color or the code to understand how to read them. So, we can only guess at the "when" part for the FP to be hit. But, since we are just 2 days away from the possibility that America could default on its' debt, I think the FP showing back up is a signal that they do plan to default. If so, then the time to hit that 34.65 FP on SPY is very near, as a stock market crash will definitely happen if America really does default.

Lindsey Williams said that America was going to default on its' debt...

As you remember from me previously posting the latest from Lindsey Williams, he cleared stated that America is going to default on the debt... and raising the debt ceiling or not doesn't matter one bit! Meaning, this Tuesdays' deadline isn't important as the elite gangsters have already made their decision... DEFAULT!

While I still question why Lindsey Williams is being told all this information, I can't deny the fact that he has been extremely accurate up to now. My question is... "why are the Illuminati gangsters telling him the truth?". These thugs are master thieves and lyer's... why tell the truth to Lindsey when they know he will inform the sheep? I think they are telling Lindsey stuff that they want us to know about, because they want to upset us enough for us to start rioting in the streets and creating the violence they want too happen.

That way, they can declare Marshall Law and arrest us all, put us in FEMA prison camps, and finally burn us to death in train cars like the Nazi's did in Germany. Yes my dear reader, FEMA has nice pretty train cars ready will welded shakels to the floor to keep us locked up in while they burn us patriotic American for standing up for freedom and our rights to free speech... but of course they will tell the rest of the population we were terrorist.

I any case, I think Lindsey is telling the truth on America defaulting, and that will mean the FP on the SPY is the downside target. The "when" part is still unknown, but in this interesting radio interview with Dex at "The Vulcan Report" (http://pulsescan.blogspot.com), he thinks that it could all happen in just 2 weeks! He's analysis is based on what he sees in the computer algorithms, and they are telling him that programed selling will take place and it will simply free fall like a rock. He also states that he heard (word on the street) that the "Plunge Protection Team" will step aside and just let the market fall.

This will be the largest Stock Market Crash in the history of the Stock Market!

Can you imagine what is going to happen if this is all true and the stock market does fall to 34.65 on SPY (about 3,000 on the Dow)! There will be riots in the streets as people are suddenly broke overnight, as their lifesaving in the 401k plan is now worth 10 or 20 cents on the dollar! Mass unemployment will follow as companies are forced to shutdown because the value of their stock dropped to record lows, making it impossible for them to continue paying the liabilities owed to keep the company running.

Is this why all the government gangsters are fleeing the country and stocking up with 6 months of food and water... because they know what's coming? I really don't know if people will actually get paid on any short positions they take if the market really does drop to those levels. The gangsters will likely make all the trades invalid and not pay out on them (not their short positions of course... just the one's us sheep take).

Don't forget that these insiders have been selling their stock over the last several months at record paces. In fact the insiders selling is the highest level in the history of the stock market. Most of the selling was done last year, which should tell you that the gangsters have been planning this collapse for a very long time.

In the week ending last Friday, according to the latest issue of the Vickers report, this sell-to-buy ratio stood at 6.43 to 1. This is higher than 95% of other weeks' readings over the last decade.

The latest from Ben Fulford is that "The debts are finally being called in and those who thought they were Gods fall to earth!"...

In this latest report by Ben, he states that the world in basically "no longer accepting the US dollar for trade". The Chinese and Russia have agreed to trade oil with other curriences, which means that the Federal Reserve gangsters can print all the money they want, raise the debt ceiling, and it still won't matter... meaning the Fed Dollar will collapse!

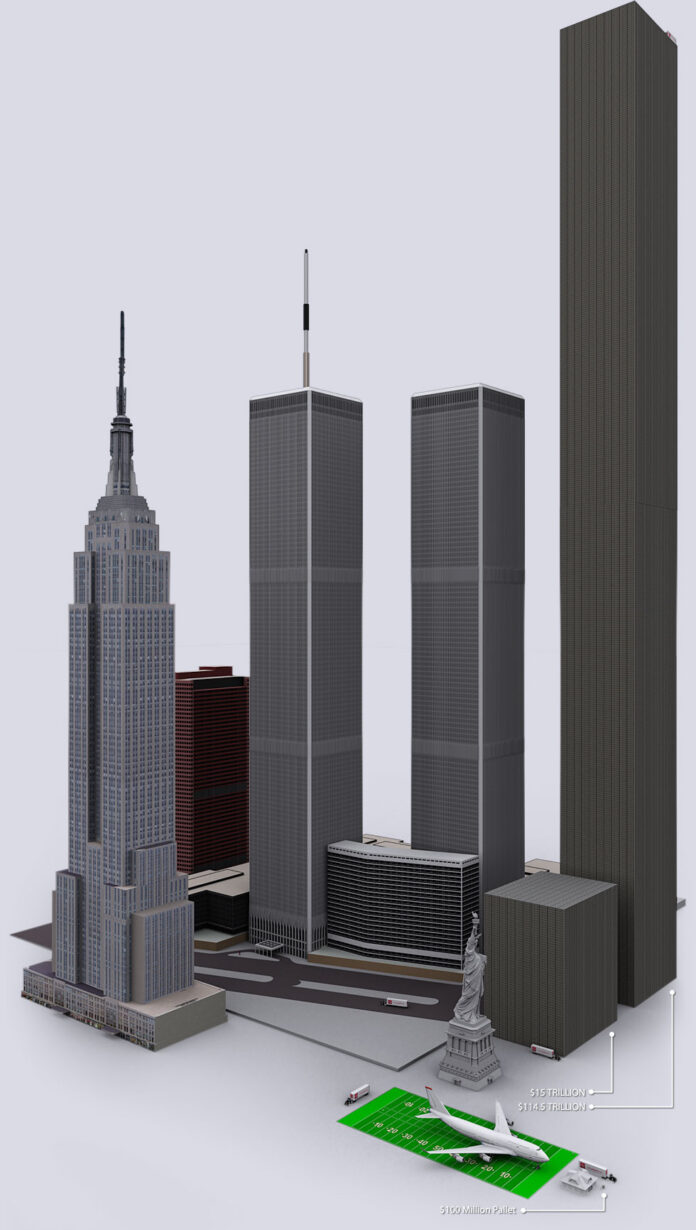

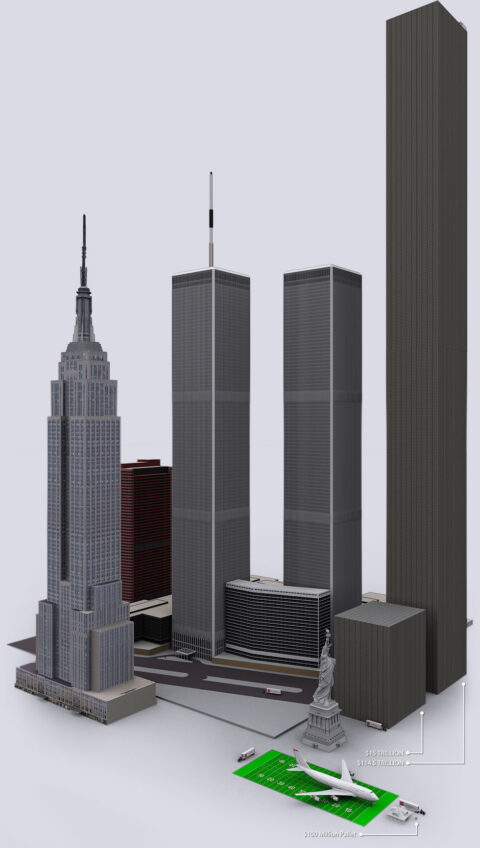

That of course reminds me of what Lindsey Williams said about the dollar... that it will collapse! No matter how you spin it, the about of debt the gangsters created (and push off onto us sheep to pay)... it's impossible to pay back. Take a look at this explanation of what are debt looks like in 100 dollar bills stacked up (http://usdebt.kleptocracy.us)...

The taller tower on the right is our debt... and it's almost twice as tall as the twin towers! It's impossible to pay back! That's why America has no choice but to default, and why we are likely to see the FP level of 34.65 on SPY actually hit! Scary huh? To think that this is all done on purpose to steal the last dime from us sheep, and make us so broke we can't afford to protest, just makes my blood boil!

Ok, so lets add up what we and know and come to our own conclusion...

- The old FP from back in January showed up again on Friday, just days before the debt ceiling deadline on August 2nd, 2011.

- Lindsey Williams, who has an outstanding accurate track record so far, stated the America will default on it's Debt

- Dex's computer algorithms are showing that the market could collapse in the only 2 weeks, and "the word on the street" is that the Plunge Protection Team will stand aside.

- Insider selling is at 6.43 to 1 as of last Friday, higher then 95% of other week's dating back for the last decade.

- Insiders in the government have been told to stock pile 6 months of food and water, and leave the country if possible.

The amount of debt owed is mathematically impossible to pay back.

At this point, it is my conclusion that the largest stock market crash in history is just days away from starting. And I'm going to further conclude that the coming Legatus pilgrimage that ends October 23rd, will be the bottom and a turning point for the market to start back up. This all assumes that we don't crash to the FP level in just 2 weeks, and then I really wouldn't know what to expect? If so, then I would assume the market would basically trade in a wild and choppy range until October, at which point another round of money will be put into the market... starting the real rally.

I haven't touched on what the charts say in this post yet, as it won't matter if this crash happens. But if not, then let me go over that briefly too, as that's important to know as well (just in case I'm wrong on "The Great Depression Two" happening).

Ok, the market had every chance to rally on Friday but failed. The 60 minute charts are pointing up, but with the daily and weekly pointing down, I don't think is can go up very much further. I'd expect it to rollover quickly and head back down lower... breaking the 200dma. I know some people are expecting a wave 2 up, but the daily charts (and the weekly) just don't support a move up starting on Monday.

The short term charts need to get oversold again before I could see a rally starting... and that's not the case going into Monday. Plus, I didn't see any fear or capitulation move in the market Friday... which usually marks a short term bottom. Any way you look at it, I just don't see a rally starting on Monday. The daily MACD's are still pointing straight down with no sign of turning back up yet.

Possibly Tuesday we could see them turn up and start the wave 2 rally (again... assuming we don't crash and they pass a bill to raise the debt ceiling). However, a move back up would quickly fail, and I doubt that it would last more then 2 days. It would also set up a perfect "MA" pattern with the "M" already being formed and the left side of the "A" being the rally up. The following right side of the "A" would be take out the current low from June of 1258 SPX. It would also be called a "Wave 3" in Elliottwave terms... and I believe it will be several wave 3's, not just one. That means it will be a powerful move down, multiple wave 3's are scary moves that take a lot of people by surprise.

What seems likely to happen is another move down on Monday to get all the short term charts oversold (and letting the daily find a bottom it can bounce from), followed by a rally for wave 2 up on Tuesday will some type of positive news on the debt ceiling bill being resolved. Remember, whether it passes or not isn't important... America is still going to default on its' debt. This debt ceiling issue is just a distraction, which should give the market the wave 2 up people are looking for... but after that quick fix shot of crack wears off, the market will roll back down and start the multiple wave 3's!

On the another hand, what if the debt ceiling isn't raised?

In that case, I wouldn't be expecting any wave 2 up to start, but instead the 2 week crash that Dex stated his algorithms are pointing at as possible to happen. So which will it be... I don't know? But the writing in on the wall now, I just can't decide if I want to believe it or not? We have a turn date on July 30th from the New Moon, which should mean a rally as we have been selling off for awhile now... but will it? Afterall, they don't always work... and certainly this time really is different!

(to watch on youtube: http://www.youtube.com/watch?v=8pdWiQU397A

I haven't even talked about Elenin (Planet X or Nibiru), as between August and the end of the year it is supposed too be passing at its' closest point to Earth... which is what many think will rotate the poles and kill 90% of the population (while the elite gangster reptilians hide in their underground cities). Of course if this happens, then I'll be dead like the rest of you wonderful readers... as the sheep always get slaughtered by the wolves it seems.

So what's the point in even writing this blog post if I believe all of that is going to happen? Because I don't think it will... that's why! Sure, the stock market is going to collapse, but I don't think we will be harmed from Elenin (assuming it's real and not a hologram made up with the gangsters secret technology they got from the aliens they have been working with).

All in all though, I'm happy today and hope all of you are too! If the poles do shift and 90% of us die, I'm still gratful for the time I've been alive on this beautiful planet... and hope to return in my next life as one of my cats, because they've really got it easy and don't worry about anything! LOL 🙂

Best wishes to everyone, and try to stay safe if the crap really does hit the fan...

Red

P.S. After writing this post they reached some type of debt deal and the market is rallying this Sunday night. At this point it looks like we will have our wave 2 move up afterall. But once it's done, I still expect the market to tank. There is the possibility of some type of false flag event staged by these gangsters to blame the crash on... so keep that in mind too.

Thanks Red for the new post. Wondering if you heard of a recent trade against the US, betting one Billion on a downgrade from AAA to AA.

Bill

Thanks Red for the new post. Wondering if you heard of a recent trade against the US, betting one Billion on a downgrade from AAA to AA.

Link is: http://sgtreport.com/2011/07/the-1-billion-armageddon-trade-placed-against-the-united-states/

Bill

I wouldn’t be surprised if some gangster banksters like Goldman Sachs made a bet a like that… as they always know what is going to happen before it happens.

Looks like the link didn’t go through. Here is another link to the same story.

http://etfdailynews.com/2011/07/25/investors-the-1-billion-armageddon-trade-placed-against-the-united-states/

Bill

Thanks… I fixed it for you .

Goldman Sachs bond traders are leaving because they can’t make money in the bond markets anymore. It has to do with QE ending, and it also shows these guys aren’t invincible. I don’t think Goldman is the one running the show.

http://samedaydumpsters.net/1965/dumpsters/goldman-sachs-rates-desk-hemorrhages-traders/

LOL… the gangsters can’t make any money but their “free money spigot” is turned off! That’s just too funny! I hope that company goes bankrupt in the coming crash!

http://money.cnn.com/2011/08/01/news/economy/debt_ceiling_deal_cbo/index.htm?iid=Lead

Wall Street loves this deal. We rally BIG this week…..

We’ll see Robert… I’m not so sure about it. While there is still the possibility that we will go up to the 138.86 SPY FP, I’m not counting on it. The evidence points to a default, and the largest stock market crash ever. Of course it doesn’t mean a rally can’t happen first… they need to surprise the sheep as usual.

ES possible IHS: http://niftychartsandpatterns.blogspot.com/2011/08/es-with-inverted-head-and-shoulders.html

Good Morning everyone… all is now well in the land of OZ!

Strong opening is fading.

http://rocsinvestmentaccount.webs.com/

Gotta love this gang… so funny! Pop and drop big time!

http://stockoneradar.blogspot.com/

Sink or Swim Time in the Swamp for the market!

I think the options are “sink or drown”, as swim doesn’t even seem to be available right now.

You are right Leo. It seems swimming is not an option.

The market is resting a support right now, but if it trades sideways all day and forms a bear flag, it’s not likely to bounce from it tomorrow. There is also the possibility of a downgrade of America (which could happen overnight?), and cause a crash to start.

Also, as silverbullet pointed out with this story (http://etfdailynews.com/2011/07/25/investors-the-1-billion-armageddon-trade-placed-against-the-united-states), the odd’s of a downgrade are strong. People don’t make Billion Dollar bets unless they are one of the insiders and know what’s going to happen before it does.

Support is now broken on the qqq’s and others look soon to follow. I didn’t see it, but some traders on twitter seen a print by cnn showing the Dow down 400 points. It not there now, but something to keep in mind.

The market seems to be waiting to hear what the GOP say at 1:30 pm today. No matter what they say, the market is still doomed. “If” it bounces, it’s just another shorting opportunity…

http://www.marketoracle.co.uk/Article29471.html. I think we will go as low as 11950 and then that’s it, all aboard the train.

I can certainly see that the charts could support a rally to new highs as shown in that chart of the Dow… but my question is, “Where is the money going to come from?”. They aren’t doing QE3 yet, and without that heroin for the market, it can not rally to new highs. Charts say it’s possible, but the lack of money say it’s impossible. I still think we are going to crash, and the high is in for the year (and many years to come).

Good point; everyone forgets printed money was driving the market, and ONLY printed money. Look at IBM. That garbage has been running on QE (dollar destruction). The revs just BARELY broke 2008 levels and the stock price is now 40% over 2008 levels. We all have to keep in mind that we are still in WTF-land.

Boehner Delays Press Conference Until 3:30PM: Trouble Getting A Majority?

http://www.zerohedge.com/news/boehner-delays-press-conference-until-330pm-trouble-getting-majority

This likely means he doesn’t have the votes… which means the market will tank. Maybe we’ll see that 400 point drop in the Dow after all?

TLT has gap ups if filled measure down to $96.31 and $94.50 area.TIP has gap ups if filled measure down to $112.87 and $110.50-$110.75 area.

Bond don’t indicate a crash.

http://rocsinvestmentaccount.webs.com/

Some how I don’t think we’ll be able to see the crash coming in the charts… only that the charts are bearish for the market right now. Remember, “if” this market does crash, it will be the largest in the history of the stock market and take most traders by surprise. The computer bot’s will take over and a non-stop drop will happen.

While I don’t know if it’s going to happen or not, I can’t overlook the signs that the possibility is there. I’m just taking it one day at a time and staying short. Even if it rallies back up some, I think it’s only a bounce to be shorted… not a new rally to new highs.

Yeah when the HFTs take over……can you say BANK HOLIDAY?!?

BWAHAHAHA!!!!!!!!!

SPY Trend update: http://niftychartsandpatterns.blogspot.com/2011/08/spy-trend-update.html

Hey Red, have a story and a half for you. Email me.

Email sent…

debt ceiling does have a negative effect on the education sector. the twin support at 116, might be the long.

�

what effect is that? student loans?

http://rocsinvestmentaccount.webs.com/

yep, i think there’s a 2 billion decrease. i forgot if that was for every year.

Today could be the day that the real bounce in the market starts? As in “that wave 2 up” that we never had yet.

However, lets not forget about the One Billion Dollar bet on the US being downgraded…. meaning the bounce we are looking for might not happen?

SPX Near weekly support line: http://niftychartsandpatterns.blogspot.com/2011/08/s-500-near-weekly-support-line.html

That is what I was just looking at. We haven’t been near this level since the fall.

http://rocsinvestmentaccount.webs.com/

If we double bottom around here and bounce for several days, then we will put in an “MA” pattern with the “M” already being formed and the left side of the “A” being the rally back up This is a very bearish pattern, as the right side of the “A” is usually twice the length of right side of the “M”. If we don’t bounce up to form the left side of the “A”… well let’s just say that picture isn’t pretty either.

FSLR chart

�

call me stupid, but i’m trying a long IWM here at the triple bottom.

Good luck Z… I’d rather short the rips and pass on going long for the counter trend.

Stupid! Yeah I went long too, only because this is a little overdone. The covering rally may be harsh. But then again, I might get stopped out tomorrow!

Edit: China is learning a hard lesson…don’t trust the EU when they ask you to buy Euros! Talk about squandering a fortune.

IYR,ICF very close to the bottom, less than 2% away from potential

bottom. IYR rsi 34, never seen it go to rsi 30, long long time

i like VNO,MAR,HOT,JLL in that sector…for big percentage gains.

Now things are getting dicey. We’re down near the June and March yearly lows on many indices now with the $rut at a new yearly low. $ndx finally dropped to its lower BB.

My favorite indicate will be extremely negative oversold at the close and it would have to hit an alltime negative reading tomorrow for it to get anymore negative which seems unlikely since cycles and other indicators don’t indicate that this is the time for a crash.

We should get a bounce but who knows. If things don’t reverse soon, it could morph into a crash but as I said we are already super oversold. When the SP tests its March lows, it could produce a reaction bounce.

“We should get a bounce but who knows.” …yeah, I’m thinking the same thing! But “where’s the money coming from”? No more POMO, or QE2 money… and it looks like the PPT are now unemployed too. Rally? I’m not counting on it anytime soon. Maybe we have a small one, or just some choppy sideways days… but I don’t see any big rally yet. Crash seems more likely too me!

hey red,

I NEVER NOTICED THIS BEFORE, but there is a like button in

disqus—nobody ever clicks on it, though. probably cause nobody

notices it—haha..

the like button i’m talking about, is in the top left hand corner, above

add new comment.

when anyone clicks it, their avatar shows up. how about

that!

AND—–you can click on it yourself, and send the posting link out on to twitter.

can i bet this— spx is up 12-14 points intraday wed –i have strong signals, say

this will happen, because my bands are stretched too far.

utilities are up in AH, must be interest rates are pulling back–

UPS,TGT,AMGN,GILD up +1 to +2%, yep, i think we get an up day, wed

BBY had an up day, falling knife is finished, i bot today

Hey Red, isn’t it about time for an artificial disaster to take the blame off the Fed???

LOL… yes, it is about time for that to happen. Hmmm… I wonder what it could be? Maybe a nuke going off in downtown Springfield?

DOH!

Looking at prints for SPY…

Just hit the lowest one in “recent history” 125.14, but there are unfilled ones all the way back to 11/15 at 116.71. The highest recent ones we haven’t hit are at 135.37, 134.59, 131 and 128.79 (today).

As for FP’s we still have the Dow 8300 and SPX 885 one’s… maybe that’s the first target down? LOL… that’s one helluva first wave down! (Not likely, but anything is possible)

I would say this is the “shot across the bow.” With over 100% retracement this quickly, damn! Any QE after this would probably just keep us in a range, if that.

I think a lot of people are expecting a bounce around this area, as it’s a double bottom from early June… but actually it’s a triple bottom from early March. You know what they say about triple bottoms? Answer: There isn’t any! Meaning they fail…. which is exactly what I expect to happen tomorrow. What the bulls panic when this keeps on dropping instead of rallying!

Exactly.

Which is why I’m scratching my head as to what is the best course of action. Maybe I should use my reptilian brain?? OK, tell me that wasn’t a good one!

Just a quick update, as a new video isn’t really necessary yet. I would like to say that we are going to bounce from here and put in a wave 2 up… but I can’t. While the market is very oversold right now, and should bounce, unless the government tells the PPT to stop the selling there’s just no money for any large rally.

We could get a small one tomorrow, if the economic news out isn’t bad and is actually good… but I’m not expecting that too happen. You have ADP Employment, Factory Orders, ISM Services, Crude Inventories, and 3, 10 and 30 year bonds announcements and reports out. Some how I think most of it will be bad, and more selling will happen.

It looks to me like the big institutions are selling right now, and not the retail bears. Without free money to hold up the market, I just don’t see how a big rally can happen. You can bet that every trapped bull will be selling on any bounce to get out of their trapped longs… which means the market isn’t likely to bounce very far. I don’t think the bears have too worry about a short squeeze anytime soon.

From a technical point, a rally should start asap… but reality (as in… “the lack of free POMO money”) tells me we will go down lower again tomorrow. Oversold can stay oversold for longer then anyone expects. Trying to catch the bottom and go long without the PPT’s POMO money to support you, is like flushing money down the toilet.

I’m sure a bounce will come soon, but the first one will likely fail and give the bears an exit out before the 2nd attempt. We also have the One Billion Dollar bet that the US gets downgraded… the “when” part is unknown, but I’d say it will be soon and surprise everyone when it happens. I wouldn’t want to be long when that news comes out.

Ok, that’s about it for Tuesday’s update. I remain short for now. Good luck everyone.

http://www.zerohedge.com/article/russell-napier-bear-market-bottom-will-be-sp-400

the market wants to ignore good earnings, and play economic reports. ok, fine by me, i can play that way too—-

they have the friday’s jobs reports number—the fix is in—it is set so

low, 50K, i think there will be a surprise to the upside. tomorrow, ADP

jobs reports, 100K estimate. if that gets 150K, look out bears,

i’m looking for an intraday bounce 1262 or 1272, on the spx for wed. if

above 1272, that could be enough buying, to reach my other signal at

1300-1305

BTW—i’d short 1305 if i see that—i’m suspecting the vix to trade sideways, next couple of weeks.

the above statement can quickly turn into hero to zero advice. use ant navigation:)

SPX hits previous support level: http://niftychartsandpatterns.blogspot.com/2011/08/s-500-near-previous-support-level.html

The bulls are running scared now!

Long to short. That was quick.

Stay out of the long ACP… that’s my advice! Too dangerous! P.S. Several of us are chatting in the chatroom right now. Come join us….

http://stockmarketbloggers.com/chat/

SPX Violates 1249: http://niftychartsandpatterns.blogspot.com/2011/08/spx-violates-previous-support-level.html

Bernanke Gets Hammered, Tells Truth About US Economy

http://www.theonion.com/articles/drunken-ben-bernanke-tells-everyone-at-neighborhoo,21059/

Crude oil chart: http://niftychartsandpatterns.blogspot.com/2011/08/crude-oil-staying-below-50-dma.html

QQQ 5 Minutes chart: http://niftychartsandpatterns.blogspot.com/2011/08/qqq-5-minutes-chart.html

I think we have bottomed for the short term. I found the trendline of support that we bounced from. It starts in 1995, so I’d say it’s a very important line of support.

Damn Red, you’re right. If you go back to 1990, there’s also support – if you estimate where this support & the S&P will hit – between 1050 & 1100 in the S&P.

Yes, I drew a trendline from 1995 to the present at the market hit it exactly today, and reversed… LOL!

These are historical times, indeed!

Yes indeed my friend… once in many lifetime events are happening. I didn’t get a chance to do a video update tonight, but I’m looking for a rally into the 9th or 10th of next week. Then more down. I’ll do one tomorrow (maybe in the morning).

So far Nasdaq is remaining above June lows on both an intra-day and closing basis. Looks like today’s up session was on decent volume and better than yesterday’s selloff.

http://rocsinvestmentaccount.webs.com/

So far Nasdaq is remaining above June lows on both an intra-day and closing basis. Looks like today’s up session was on decent volume and better than yesterday’s selloff.

http://rocsinvestmentaccount.webs.com/

The S&P should see 1160 end of this week or next. Then small bounce and slide to the end of August to 875.

I still have an old FP of 885 spx, so that could be the bottom of the first major wave down? Then up into October for major wave 2, and finally down again for major wave 3 starting the week of October 23rd. Sounds like a good plan too me… LOL

SPX Analysis after closing bell: http://niftychartsandpatterns.blogspot.com/2011/08/s-500-analysis-after-closing-bell_04.html

ES Unable to change the trend: http://niftychartsandpatterns.blogspot.com/2011/08/es-unable-to-change-trend.html

VXX keeps rising… not good. Something we don’t know maybe? How about the One Billion Dollar bet that the US defaults?

The high today so far in the VIX is right below 25.50 which was an area it recently closed a gap down it created in March – interesting.

http://rocsinvestmentaccount.webs.com/

On 06-16-2011, the VXX hit 26.88… maybe that’s the target before a bounce?

Just the the Qs print from AH yesterday. No other downward ones I can see in recent history.

I don’t have any close FP’s either… not new ones at least. There is that old one showing 106 on the SPY from last year, but that’s about it. (It’s on the “Photo’s” button on the red Wibiya toolbar below).

It’s beginning to look like that FP might be a good overall target, according to the trendline from after the ’87 crash.

Double bottom low on the Dow is 11,555 intraday, and 11,613 closing price on 03-16-2011

USO Head and Shoulders : http://niftychartsandpatterns.blogspot.com/2011/08/head-and-shoulders-of-united-states-oil.html