But the timing of the release of that information is when the dollar looks almost bottomed and ready for a technical bounce!

(to watch on youtube: http://www.youtube.com/watch?v=3NFzuJKh2T4)

I have noticed that the gangsters have been using Lindsey to move the stock market in the direction that they want it to go... which is always the opposite of what they tell us sheep. In this video recorded on February 3rd, 2012 Lindsey Williams states that it 100% certain that there will be a bank holiday on some Monday coming before this year ends. But the scare tactic manner that he gives his warning message some how feels like this dollar crash is coming this month of February or in March.

The dollar seems about bottomed to me and ready to rally up for awhile before crashing 40% overnight with a surprise bank holiday on some future Monday before this year ends. I've noticed that the same thing happened last year when Lindsey came out with the information from his gangsters friends that they plan to take oil up to $150.00 to $200.00 per barrel before 2012 is over with. Once again oil was rallying hard and it looked like (or felt like) they were going to make that happen within a few months, before the end of 2011 and way before the end of 2012.

The dollar message seems exactly like the oil message too me. It's a message they release to Lindsey when they want to use him to trick the sheep into a panic mode where they will "go long" on oil when they planned to sell it back down and now to "go short" on the dollar when they plan to rally it up. Once again... more misdirection from the Illuminati trash!

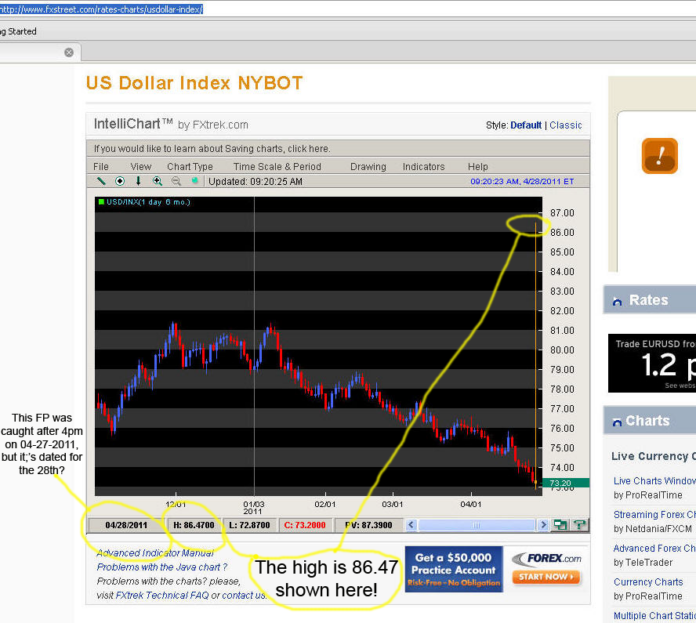

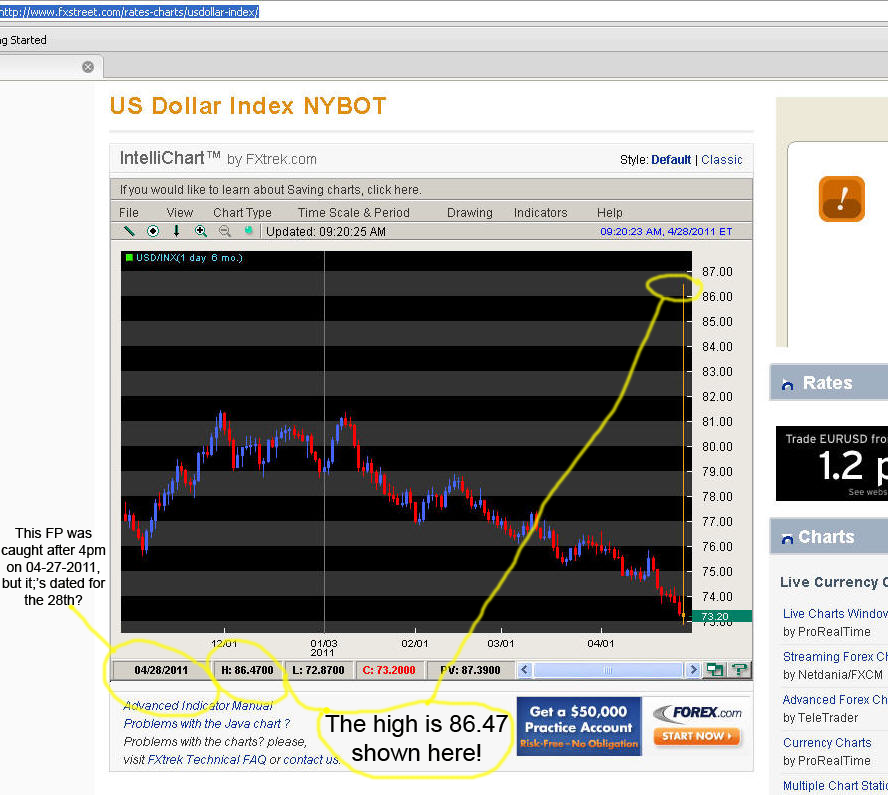

I think the dollar is going to rally hard very soon, as it looks to have almost hit a short term bottom. In fact, it could even rally up to new highs when the Euro crashes and then we could wake up some Monday with a 40% devaluation. Here's a FP on the dollar from April 28th, 2011...

Now look at this monthly chart and project out a couple of months from now. Notice how this nice trendline connecting the highs will like be moved down from where it's currently pointing at (around 87.69) to about the FP level of 86.47 on the dollar. Funny how that FP that showed up almost a year ago, is now pointing to what would basically be a 4th touch of a slightly downward sloping trendline from the first 11/1/2005 high connecting to the 3/1/2009 high for the 2nd hit, then 6/1/2010 for the 3rd... and finally a 4th hit at the forecasted FP level of 86.47 within a few months from now.

With that said, I also have this FP of the UUP showing 84.14 (http://reddragonleo.com/wp-content/uploads/fp-uup-84-14-on-06-30-2011.jpg) from 6/30/2011... but that would over 360 on the dollar if it was really an accurate FP on the UUP. But, I think it was put on the UUP but was actually meant for the dollar. So, we have an upside target of either 84.14 or 86.47 for the dollar... but which one? I don't know right now, but after the dollar has it's rally back up I'd then expect them to pull the bank holiday surprise on us sheep and devalue it 40% overnight.

Of course I expect Lindsey to be very quiet leading up to the final month before it happens. Then he can come out and say that he told us it was coming... which will be true, but the timing of the message is my issue. I don't think Lindsey is a stock market trader and therefore probably doesn't realize that he is being used to steal the sheeps' money by scaring them into "going long" oil just before it corrects, or "going short" the dollar just before it rallies.

Lindsey Williams will still likely be correct and both the dollar will crash, while oil and gold skyrocket up... but you basically have to do the opposite when he comes out with his message of fear.

With that said, this means that the stock market should sell off nicely over the next few months and probably bottom around the next Legatus meeting this coming May 2nd-4th, 2012 just when the dollar should hit one of the FP's (I personally think it will be the higher print of 86.47). This coming move down should be very nice for the bears, but nothing like the one I expect later this fall.

If this does happen like I think it's going to then every bear will be fully onboard the train and the media will be preaching the "Sell in May a Go Away" slogan like it's guaranteed to continue tanking. I think just the opposite will happen and the market will rally shortly after that meeting ends. They will likely put another stimulus package into the market (publicly or secretly is unknown) to rally it up for the 2012 election. This should be some type of larger wave 2 up, with wave 1 down starting here soon and ending in May.

This rally should continue until then next Legatus meeting October 10th-21st and then the largest wave 3 down ever should start!

The media will be all over the November 2nd election while the market crashes day after day. They will give little coverage to it, as the election will be there to distract the sheep. The bears probably won't believe it as they will have been chopped to death in the wave 2 up from May as I expect that to be some type of "zig-zag" pattern (horrible for swing trader, but a day traders dream) where it could look like the August to October period from 2011... but this time I don't expect another "Hail Mary" rally to start at the end of the wave in October.

This time it should really crash into the mother of all wave 3's down!

(to watch on youtube: http://www.youtube.com/watch?v=CP_drcJpxV8)

As for the 40% dollar devaluation Monday surprise... it could very well be the thing that causes the crash in the market! Yes, the dollar and the market trade opposite each other right now, but that's not written in stone. If the dollar is devalued 40% overnight I'd think every trader will panic and sell all stocks and buy gold and silver. You don't really expect that to be positive for American companies do you? If the price of goods and services cost them 40% more dollars to purchase from other countries... which they then have too mark up and try (keyword there... "TRY") to sell to you sheep, do you really think their forward looking earning reports are going to be good?

Of course not! People won't be able to afford basic food, utilities, and gas... let alone have extra money to buy stuff from retail companies. Traders will dump Apple just like they will dump Walmart... no stock will be left as who's going to risk that with massive inflation coming as gold rockets to the moon and beyond. Traders will panic and sell everything, and move into gold, silver... and oil probably too? Not sure on that one as demand with drop off a cliff when people can't afford to drive their cars from the devalued dollars.

But, they will still need oil. I just think more people will be catching the bus, riding a bike, or walking to work. Of course they may just stay home when they no longer have a job to go to anymore. All this spells lower demand for oil, which should mean lower prices. But, there is that planned WW3 with Iran scheduled to take place during the same time period, which would be done on purpose by the gangsters to shutdown the oil supplies from the middle east, therefore the price could still go up even with lower demand. All in all, I'd just skip trading oil and go long gold and silver, or short the dollar... should it hit the 86.47 FP by the week of or after the October 21st Legatus Pilgrimage ends.

Moving on to the short term...

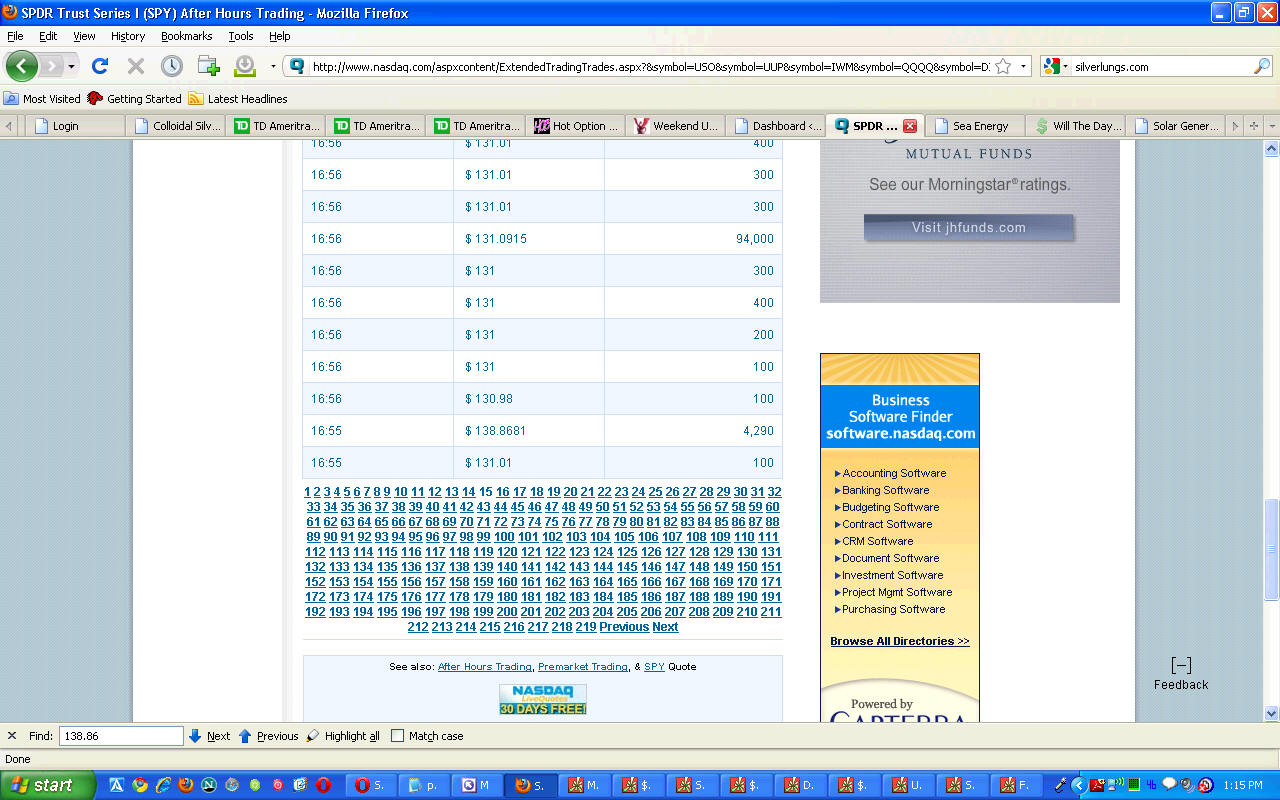

We have the recent FP on the SPY showing 137.00 from 2/2/2012 and the FP from March 11th, 2011 (the date Japan was attacked by the Rockefeller, Bush, Clinton, Kissenger, Soro's, Buffet Illuminati Reptilian Gangsters!). Here's a look at those FP's again. Notice the ritual numbers found in the prints. The 137.00 adds up nicely to 11 (1+3+7=11), and the date it showed up equals a "9" (2+2+2+0+1+2=9) or the number of "completion".

On the FP of 138.86 on the SPY from 3/11/11, you have of course the obvious date of "11" and the year of "11", and the Japan attack that happened. I don't see any other ritual numbers in the volume, time of the print, or the actually price level, but the 29 in the volume of 4,290 shares could mean the date of 2/9... or tomorrow, February the 9th, 2012? We'll know in less then 24 hours as I'm writing this post on Wednesday the 8th of February. While that's just a guess, even if it's a wrong one, I still expect this market to rally up to at least the newer FP of 137.00 spy (about 1370 spx) before rolling over and starting the first larger wave 1 down.

Once that FP is hit, I'll be looking for a short position on the market, and/or a long position on the dollar. Since the Dow has already put in a new high, you really would expect the SPX to at least put in a double top at the 137.00 FP before rolling over. I personally think they will have a one day squeeze up to the other FP of 138.86 to squeeze out any bears that are currently left in the market... and then close that day with a nice long topping tail. After that it should start down and continue down until early May I believe.

Well, that's my thoughts and plan of action for now. Of course that's subject to change, but I've presented my evidence to you so you use it for whatever it's worth. Too me I still hear the main stream media preaching the bear case. I want to them to preach the bull case... and they will if the spx takes out the previous high around 1370 and sucks in some bulls when it hits the 138.86 spy FP (about 1388 spx). Then I'd be a happy bear, as I'd be the first one on the train. 🙂

Red

Hi Red,

How exciting! I’ve never seen an FP before (in real time). Here’s today’s Bloomberg page, showing the DAX at 0 (100% loss).

I can’t seem to open the photo, but if that is true, man that’s just as scary as the 349 VIX FP. In my opinion, this can mean one of the following: a) That index goes away b) Those 30 companies all go bankrupt c) Stock trading no longer exists d) this FP is not real….

I hope for D and worst case A. If B or C were to happen, I’d have wipe the skid mark out of my pants!

ES Ascending triangle:

http://niftychartsandpatterns.blogspot.in/2012/02/es-ascending-triangle.html

Copper support and Resistance:

http://niftychartsandpatterns.blogspot.in/2012/02/copper-support-and-resistance-levels.html

I saw the Dow was up 6.66 several minutes after the close over at stockcharts and now it’s 6.51 (6.6). Dow got up to 12924.74 at its high, a nice 292 reading while of course on 2-9-12.

Today should be the top if my theories and calculations are right. (The calculations should be correct but they are based on the theories).

AAII hit 52% bulls yesterday with 32 % spread between bulls and bears.

Dojis everywhere today with some of the leading indices red today like XLF, RUT.

The corporate event has taken place but it was in London not Switzerland. A lot of papershuffling among the same players. Now off to Switzerland possibly for the final consummation. The Legatians can head off there, engage in some winter sporting, and wash some money on the side.

Arena Global Trading in a self takeover.

It looks like Mr. NFL 666 might be part of the ritual afterall. His roster bonus is due on a peculiar date if my theories are correct, definitely a numerologically apropriate date. And the football media continues to make it an important event with constant updates on the melodrama.

Florio, nice post on Kurt Warner the other day. I realized Kurt Warner did most of the occultspeak but thanks for bringing it to our attention. A nice little collection of 58combos.

Are you saying we’re going to get a crash like Ahmad plunging into the endzone the other day?

Oh yeah! A belated Happy Facebook Day!!!!!! The big 8er from 2-4,24 (888888).

Things started to go haywire on Valentine’s Day in Social Network. We’re also entering the Warlock’s timeline.

Warlock’s firing and NFLer 666’s decision date are one day apart. I’ll need to review the Warlock’s twitter account more routinely now.

LMFAO was the only guest artist to appear at Madonna’s half-time show(and sing their material). Wonder why they were included? Nicky M. and MIA sing in Madonna’s new single.

Our hero #87 got mixed up with LMFAO later but that is a subject for a separate post.

Last time AAPL’s RSI was this high was a few days before the flash crash.

We have one more up wave to get all the BULLS in the Pen Ghecko. Then the Matador…………….. And what is this about Kurt Warner Occultspeak? Didnt see the original post.

The post wasn’t made here. It was made over at profootballtalk in a post title Kurt Warner says Eli isn’t a hall of famer. It is the 2nd most commented post over there and can be found on the right hand side of the page if one scrolls down. A collection of 5s and 8s thrown into Warner’s commentary with the author adding a few of his own numbers.

Silver range update:

http://niftychartsandpatterns.blogspot.in/2012/02/silver-range-update.html

ES Support levels: http://niftychartsandpatterns.blogspot.in/2012/02/es-support-levels.html

Barely any volume at all right now. Still less then 100 millions shares traded on the spy and there’s only 2 hours to go now. Very weak effort for the bears I’d say. If that’s all they got then the bulls will probably be back next week to put a hurtin’ on this poor brave bears.

Well we know there is one more good run left before we should be diggin holes and sharpening sticks. Arthur is scaring me too.

What is Arthur saying? … been early before in the past if I recall.

WB…you can’t make a statement like “Arthur is scaring me too” and leave us hanging…give us the scoop!

Arthur is calling bad bear news. Soon.

Be more clear on that statement please… “bad bears news”. It could be implying “good bull news”, or “bad news” which implies “good news” for the bears.

Does that make us the bad news bears?

Yeah… I think it does! LOL

SPX Analysis after closing bell: http://niftychartsandpatterns.blogspot.com/2012/02/s-500-analysis-after-closing-bell.html

Screenshot of SPY on stockcharts for last year. What’s wrong with this picture?

This is the first time I’ve ever seen an entire year of SPY values manipulated.

What do you mean? I don’t see what you are talking about? The whole market has been manipulated heavily for many years now, but I don’ see anything unusual in that chart.

Compare today’s value to the value in May 2011. According to the graph, SPY just made a new high. Did it really???

Edit: Very subtle, eh?

http://www.upsidetrader.com/2012/02/11/dow-15000-omg/

Several different independent traders have picked the 1425 level as either a high for this rally or a yearly high, so there could be a pullback that leads to a higher high.

Dark cloud cover of citigroups :

http://niftychartsandpatterns.blogspot.in/2012/02/dark-cloud-cover-of-citigroups-inc.html

Dell Bearish candle and resistance line: http://niftychartsandpatterns.blogspot.com/2012/02/bearish-candle-at-resistance-line-of.html

Obama using the SEC as his personal election helper by looking into Private Equity:

http://www.bloomberg.com/news/2012-02-11/sec-looking-into-private-equity-firms-valuation-of-assets.html

Which, of course, is a precursor to Obama’s minions in the media attacking Romney.

Caterpillar looking weak at weekly resistance levels:

http://niftychartsandpatterns.blogspot.in/2012/02/caterpillar-looking-weak-at-resistance.html

Damn Hackers again! They hit every site I have hosted with Hostgator, and this was one of them. The StockMarketBloggers stie is on a different host and it was attacked by hackers last week, along with other sites I have hosted with that host (not related to the stock market).

This market is worst then Freddie Kruger and Jason combined… it just won’t die!

I think last Thurs was top.

Also, SPY up .999 today.

LOL… nice catch on the SPY! But, it’s supposed to happen over a weekend… which means it shouldn’t start tomorrow. Besides, we still haven’t hit the 137.00 FP yet.

What particular date would be appropriate for the crash starting date?

The date of the “crash” should be an “eleven” date, but the selling can start before that. However, if we are to have a 40% overnight/weekend devaluation of the dollar, then there might not be any downward selling first to lead up to a crash.

Crude Oil channel resistance :

http://niftychartsandpatterns.blogspot.in/2012/02/crude-oil-at-channel-resistance.html

Silver Descending triangle and range:

http://niftychartsandpatterns.blogspot.in/2012/02/silver-descending-triangle-and-range.html

Copper near support line:

http://niftychartsandpatterns.blogspot.in/2012/02/copper-four-hour-chart-analysis.html

For old time’s sake.

Nice catch… thanks. You didn’t catch the volume, high/low, open/close, and exact time by chance did you?

135.36+0.999 it closed at 9 plus 9. The end?

S&P 500 – Rising wedge pattern: http://niftychartsandpatterns.blogspot.in/2012/02/rising-wedge-of-s-500.html

Note that the 10.22 low on the RSP is a multiple of “eleven” as 22=11, which means 10.22 = 111. That and the .999 spy closing up points, and the fact that this new FP is pre-dated back to the May 6th, 2010 Flash Crash is a very big signal that another crash is coming very soon…

http://screencast.com/t/dsADtYPN

Everyone must keep you eyes out for heavily and un-usual volume on the various etf’s…. especially the dollar and the UUP. Look for some big buyer to show up right before the crash and short the dollar huge… probably on a Friday.

Keep watch the video’s from “Option Monster” as those guys will report any strange positions made. Bookmark this rss feed from them and watch the video’s daily to see when that “insider” comes in and makes his “dollar short” bet.

http://blip.tv/optionmonster/rss

Remember, we are being warned right not… from Lindsey Williams, to the most recent FP’s. A crash in the dollar is coming, and it should also be a “panicked” flash crash in the market too. In case you forgot, the May 5th 2010 Flash Crash was told to the insiders at midnight the night before. Here’s the FP’s to prove it…

Notice that 5+6=11, so 1056 = 111…

Also notice the 66.6667 in the “StochasticFull” in green in the 2nd print. Yeah, I’d say we have a confirmed crash coming. The “when” part is unknown right now, so I’m counting on all of you to keep watching…

Also, the volume of 4,954,338 added up 4+9+5+4+3+3+8=36 or 6*6… which is 666!

Wow, if they got the warning the night before, how could they have avoided the crash? And how come you never posted this before,that is wild.

I did post those screen shots several times before, but I actually never received them “before the flash crash”, so I didn’t benefit from being short on that day. It was too quick, and a reader of this blog sent them to me a day or so after the crash happened.

SMH anybody else think it’s a good short at 2-3 days ago high 34.9?

shorting at 34.9 is a very high probability trade that will most likely succeed, imo. the exit is tough. do i get 2% lower, or 3% lower. tough to call. etf’s keep going back up, after they fall a little.

it’s beginning to come to light, that QE1 wasn’t needed after all.

http://www.youtube.com/watch?v=GHLjoAI2-iQ

Ratigan is da man! I remember his rants on Fast Money during the crash in 2008. Like a mirror image of me when I get all worked up!!

Notice the strange things on Dylan’s face starting at about 45 seconds in? Is he a reptilian too?

At the very end of the video, he says all that money only ended up helping the banking cabal…

I like that guy… he’s telling it like it is!

found the video at another site. they really hate bernanke at this other site!!!

more so, than here, but maybe not.

Copper at channel support line:

http://niftychartsandpatterns.blogspot.in/2012/02/copper-at-channel-support-line.html

this up and down motion,if you didn’t have the FP’s would probably get a lot of bears in early.

Yes, pretty much I’d say it wouldn’t be wise to go heavily short until the 137.00 spy upside FP is reached. That about 1370 spx, and of course there is the 138.86 spy FP from last year that could also be the upside target. Hard too say, but I wouldn’t short until at least the first FP is hit, if not the higher one.

I came up with the all time high DAY. And you know what? It should be obvious to everyone here. Hint? All 11’s. This month.

Hmmm…. well, 02-22-2012 all adds up to “11”, is that the day you are thinking of?

Totally.

The 29th is also an “eleven” day too.

There is no 29th though.

Look at your calendar again, as the one on my computer says there is a 29th this month. Must be leap year?

Thinking out loud here on the FP’s:

What if the volume/price/date code on the FP’s are not signaling a date they will be hit at all? Thinking about what Lindsey said about Libya and Gadhafi and the TPTB are 4 months behind. My assumption is those plans in the middle east and the market are all tied together. So in theory they need to back off on the crash by 4 month too, right? What if the code on there was referring to an order or sequence in which the FP’s will happen?

This makes sense to me. If they are 4 months behind and need to slow down the crash, they want to make the top extend out also, right? So they just take their time in hitting particular FP’s, so their buddies know the next one won’t happen until the first one in the sequence is hit?

Not sure, just trying to think outside the box here to see if there really is a method to their madness….

You are correct Johnny, as I seen them hit older FP’s first (which were in the opposite direction of the most recent print) and then later hit the newest FP. This means they must hit at least the 137.00 spy FP and possibly the year old 138.86 spy FP first, and then they can head south.

Personally, I don’t see a crash until later this year when it’s close to election time. Speculating here now, but it’s looking like we could chop around until the next Legatus meeting May 2nd-4th, and then head down for the first wave 1 down. Then back up for wave 2 a month or so prior to the October 10th-21st Legatus meeting. Then of course a massive wave 3 down should follow…

Trade: buy NTRI.

Opened at 11.21 on 2/14/12.

have you seen WTW …i have, woot

ACI joining, imo— PCX eps cut last month, and made new sorts of lows,

—ACI is going to new 5 month low. the market cut it’s eps pretty bad 7

days ago.

Trade: buy AEM.Opened at 33.81 on 2/14/12.might not get the 39 exit this time, but i’m pretty sure i will get the 37 exit!!! eventually

Talk about a ramp job into the close! Nothing but bear meat for dinner for these gangsters I see. LOL

Feb 22nd or 29th for their dinner. They want a black president to preside over the worst slaughter in US history apparently, according to my sources.

Any survivors will be picked off by the chinese mercs up in N. canada.

Chinese mercs will be dinner for local hunters in the mid-northern states.

You are sadly mistaken !

I’ll agree with you totally. The lay of the land and the knowledge of the long term residents will result in any foreign force (especially with no support) being mopped up.

You’re sources? You should have quite a few… and they should tell you what’s going to happen in advance. You should call some of those old contacts and poke around some… especially the “banker” friends.

Big banker as you know told me to sell US dollars, but I think he has fallen for the same disinfo as Lindsay. Its stock market fall, and US dollar rise imo.

You will be correct on that point. Dollar Stock Market. in the near future.

Both probably mean sell USD over medium/long term. Short term, past this week, probably looking for a bounce.

washboard, put me on your email list

heereza@yahoo.com

SPX Analysis after closing bell:

http://niftychartsandpatterns.blogspot.in/2012/02/s-500-analysis-after-closing-bell_15.html

Madman Bernanke pumping es overnight on more China bailout rumors. Here’s your peak coming soon, Red.

Yes, it looks like we’ll rally more tomorrow… crazy huh!

I wish I could call it crazy, just another day in the office for the Madman! This garbage is so overBOT, the trades will be fairly easy this week.

I haven’t seen so much symmetry around a certain date. It’s incredible. No wonder a certain forum/ website where I used to post went to cyberheaven.

Thus, the stock market really shouldn’t go to a new high.

All of the current after-hours commotion might be a headfake then and related to typical crude oil options expiration manipulation and should be over by the morning when options expire.

Forgot to mention that there were more signs of a top recently. Stuff some of you may have already seen. Nasdaq to NYSE volume ratio spike and Rydex ratios at one of the highest bull bear ratios in recent times (up to the levels in early May)

Still havent met anyone who shorted before a crash. Anyone got any theories on that one?

Maybe, you don’t hang out in the right circles?

Make it possibly two forums that have gone to cyberheaven.

ES Chart:

http://niftychartsandpatterns.blogspot.in/2012/02/es-hour-chart-analysis.html

EURUSD Weekly chart:

http://niftychartsandpatterns.blogspot.in/2012/02/eurusd-weekly-chart.html

Google resistance levels:

http://niftychartsandpatterns.blogspot.in/2012/02/goog-resistance-levels.html

My thoughts are that we will top in May or June of this year for the final top before selling starts. There will be insiders that go short heavily just before so we have to keep our eyes open for that. The bigger “crash wave” should come either after this coming October Legatus meeting, or when ever the next one is in 2013.

While this year should start the big wave of selling I believe 2013 will be much worst. This year should be like 2008 and next year should like March, 2009. I’ll be looking for the 666 spx low to be taken out in 2013.

New Lindsey….

http://jumbofiles.com/0abxxre42zlq

Nothing huge that is new. However, he does go into some detail/perspective that I haven’t heard in a while. Might be worth a listen…

Cool… I’ll listen to it now. What I believe is happening with Lindsey is that the gangsters are giving him information that also includes “buzz” words… which we sheep miss most of the time.

While Lindsey was focusing on the “dollar devaluation of 40% overnight”, we really should be listening to the keywords “massive debt”… which means a higher stock market over the next few months.

I think we are going to chop around some but continue up into May or June of this year. We should but in a new high to fool the sheep into believing the selling is over. So, we could (?) have sell off here for a few weeks but I still think we’ll top out in May/June of this year, as “Massive Debt” means “Rally” too me!

The “dollar devaluation” will still happen, but you won’t see it coming (at least most sheep won’t… I hope to be one of those sheep that does catch the date). Again, I think we need to focus on the words in between the speech when Lindsey speaks.