August 20th update...

Technical Update

(to watch on youtube: www.youtube.com/watch?v=KrnOkyf-knA)

Red

_____________________________________________________

August 11th update...

No Stock Market Crash In August As Sheep Are Mislead Again

(to watch on youtube: http://www.youtube.com/watch?v=1bS2ZkQQhrs)

Red

_____________________________________________________

August 9th update...

Stock Market Crash Called Off!

These 2 articles (http://finance.yahoo.com/blogs/breakout/easy-money-policy-lead-world-greatest-credit-collapse-164806633.html) and (http://www.cnbc.com/id/100950234) are clearly put out to mislead the sheep into shorting this market heavily. This means the FED's are running out of money and don't have enough power left to get the market up past the current high. They need more money and that money has too come from the bears as there's obviously no retail traders left in the market buying at these levels.

So how do you get more money? You put out articles on the propaganda main stream media outlets that speaks of crashes coming. The sheep read this and start shorting. The way the game is likely going to play out is something similar to the big head and shoulders pattern back in 2010. Everyone seen it and waited for the top of that right shoulder to short at around 06/21/2010, at which point they tricked the bears by breaking down below the neckline of that pattern around 1050 SPX. They went down to 1010 on 07/01/2010 before reversing and going back up to make another right shoulder on 08/04/2010. Then they dropped again to lure in more shorts thinking we were going to crash really big. You have to remember how bearish the sentiment was back then as we had just had a flash crash on 05/06/2010... so traders were looking for a crash even bigger to follow.

Well, it never happened as they tricked the bears by rallying for many months afterward as they "gamed" the huge head and shoulders pattern followers. I remember back then how main stream media puppets were even talking about it on a chart on TV. Naturally they were paid to do so as it was very important to get the sheep extremely bearish and heavily short. That was the money they needed to squeeze the bears and rally it up to new highs later that year. I see something similar happening again.

Basically I see a move down next week to around prior support in the 1650 SPX area. But, this rally we are currently in could go up higher before we start to drop. I don't see it happening on Friday the 9th though as I expect it to be choppy with up's and down's inside the triangle the market is in now. Then Monday we could see some final move up to end the rally. Don't know how high but it shouldn't go above the current high. Maybe it comes a few points shy of it... don't know? It could happy Friday of course but odd's say it comes on Monday. Either way it's a good short down to the 1650 level of support. Then expect a rally and probably more selling afterwards. That's too far out to look right now but some how I think it's going to be a choppy 3 weeks before they final some bottom that they decide to launch their rally from.

The ideal spot would be the 1560-1580 area and then back up to the 1670 area to make the top of the right shoulder where the left shoulder was the May 22nd, 2013 high. The head is obviously the current high at 1709 on August 8th, 2013. The tricky part he is to watch the news closely to see if the paid actors start talking about the head and shoulders pattern that I think is going to form. If so then when you add the stories now out about a 1987 style crash (by more paid puppets) which that media exposure of this future pattern I'll give it a 99% chance of it failing and rallying to new highs into October of this year when I think we'll hit 17,000 DOW and then CRASH around Legatus again!

Red

_____________________________________________________

Don't be surprised if the crash date by W.D. Gann isn't changed as they don't want you to make money...

(to watch on youtube: http://www.youtube.com/watch?v=m7PfgC-KqAE)

We all know that the gangsters totally control the stock market 100% now and when it comes to the sheep (you and me) discovering the date in advance sometimes they are forced to make changes. Remember, if the sheep get short at the same time the wolves (the gangsters) get short then there's no one to steal the money from. They must have the sheep long when they are short as they need to have someone on the opposite side of the trade or else it wouldn't work. This is why the wolves will use their propaganda media outlets on TV (and on the internet) to lead the sheep in the wrong direction while they go in the opposite direction.

So when I see an article about a stock market crash that speaks of a well known forecaster named W.D. Gann that points to this August 16-23rd as the spot where the crash will start I have to wonder if it's not "planted" information to mislead the sheep again? It's different when it's on a small website run by one person as then it's likely put out to help fellow traders. But on a big site that a company runs you have to be leery as you don't know whether or not the gangsters control that site and therefore use it to steer the sheep in the wrong direction. I won't say for sure on it as Futures Mag isn't exactly as huge as CNBC, Yahoo Finance, or CBS MarketWatch... but it's still what I consider to be a "main stream media" site. Therefore we should be cautious now and be aware that the planned date could have been changed now?

Come the week of Aug. 16 - 23, the world’s largest Index, the S&P 500, will once again plummet. In an all too familiar fashion, it will drag down all other stock markets, superfunds and savings. No government or economic spin can ward off this descent, because nothing else but time governs the fluctuations of markets. Given that economic formulas and models are only pale reflections of the real world, as a forecasting tool, they can be utterly misleading. The way to gain insight into the forces driving the S&P 500 Index, and predict the Aug. 16 turnaround, is by consulting its graph and William Delbert Gann’s Square-of-9 (for why all Internet depictions of this Square are flawed refer to paragraph 7 below).

The graph’s coordinates X and Y, where X represents price and Y time, provide an untainted depiction of market behaviour. In addition to reflecting ‘price changes over time’, the plot of X and Y’s intersection points reflects also the perceptions, and thoughts, of those driving the ups and downs of price. Given that X is a function of Y, and Y is a function of X, and given that X is the volatile of the two, focusing on the forward procession of Y is far less challenging than the fluctuations of X (Figure 1).

Figure 1

There is reason to believe that when billionaire George Soros broke the bank of England by shorting the British pound on Sept. 16, 2002 and the AUD on May 08, 2013, the Y parameter and Gann’s Square-of-9 dictated his trades.

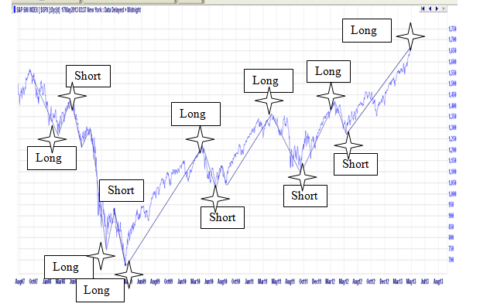

The first on the ‘to do list’ in analysing a graph is to determine the direction of the dominant trend. Figure 2 demonstrates that bearish trends manifest long down-swings with short upward corrections. And, as the market changes direction, its upward swings become longer in comparison to retreats.

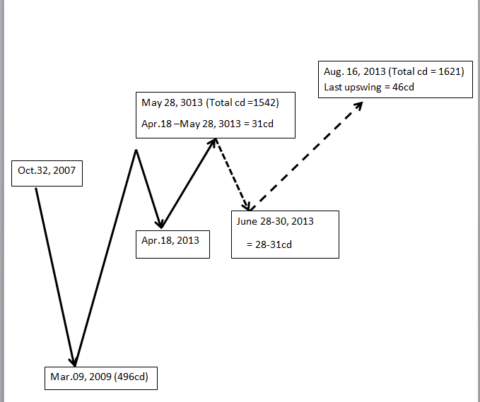

The schematic in Figure 3 captures the 496 calendar day (cd) GFC decline period (Oct. 31, 2007 — March 08, 2009), and the recovery phase (March 09, 2009 — May 28, 2013). It shows that the S&P 500 Index’s recovery, which at the peak of May 28, 2013 measured 1542cd, in addition to being in an uptrend, reached an all-time high.

On June 25, 2013, the decline from the May 28 peak measured 28cd. It was 3cd shorter than its preceding 31cd upswing (Apr. 18 – May 28, 2013). Given this Index’s bullish trend, the sketch indicates that the forthcoming advance, which cannot be shorter than 31cd, will measure 52cd on August 16, 2013 (Figure 3).

Figure 3

To validate these dates, we turn to W.D. Gann’s Square-of-9, however, before proceeding to the Square, a word about identifying markets’ major peaks and troughs.

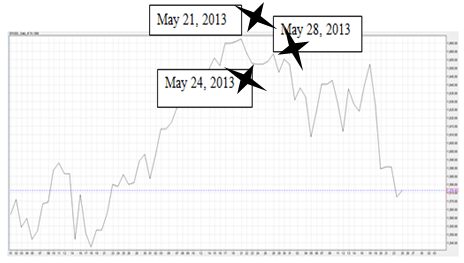

Even though pricewise the peak of May 21, 2013 was the highest point the S&P 500 reached on the chart, it was false (Figure 4). Given that it was followed by a 3cd decline and a 4cd advance, the longer swing, irrespective of price, is the one that determines the top.

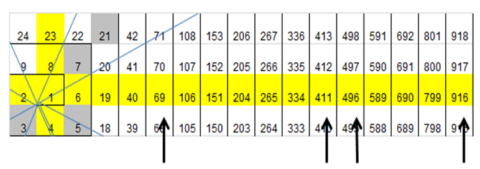

W.D. Gann (1878 -1956) was 13 when he famously declared that “the future is not unforseen.” From the age of 24, the Sqaure-of-9 — a sequence of orderly numbers spiralling outwards in an anti-clockwise manner from the number 1 at the centre (Figure 5) — generated him $50 million from trading stock and commodity markets.

“I soon began to note the periodical reoccurrence of the rise and fall of stocks and commodities. This led me to conclude that natural law was the basis of market movements. I then decided to devote 10 years of my life to the study of natural law as applicable to the speculative markets and to devote my best energies toward making speculation a profitable profession.”

The numerals 1-9 forming the Square’s first ring inspired him to coin the device ‘The Square-of-9’, and its geometrical divisions, cardinals and diagonals.

The Australian mathematician, physicist and meteorologist, Trevor Casey — the first known man to unravel the Square’s mathematical structure since Gann — points out that all the Square’s Internet versions are mathematically wrong. In The Square Spiral— the Mathematics of Markets (BookPal 2010) he explains that this Square is a spiral mimicking the Milky Way. As such, it unfolds from left to right, in the same direction as the galaxy, and each of its rings expands twice during one 3600 revolution. The first expansion takes place upon the Square’s north-western diagonal and second upon its south-eastern arm. Therefore, in contrast to the Internet versions, the north-western diagonal runs along the numerals 1, 2, 10, 26, 50…∞, and the south-eastern along 1, 5, 17, 37, 65….…∞. (Figure 5)

The other point he emphasises is that the Square is a calculator designed to measure time and should not be used in forecasting price levels. The 0.618 and 0.382 Golden mean proportions, known as Fibonacci ratios, are best for determining the support and resistance levels of price.

Figure 5 – The Square-of-9 constitutes a spiral of consecutive numbers unfolding outwards from the number 1 at the centre. Its numerals follow the anti-clockwise (left to right) direction of the Milky Way’s spiral.

Gann’s breakthrough came about when he observed that time-intervals typically adhere to the Square’s axes in that they commence and terminate upon them. A mature interval bounces off and culminates upon the Square’s same axis by completing a 3600 rotation from and back to the point at which the preceding interval ended. In cases when a swing terminates upon the Square’s opposite axis, at 1800 angle, it remains unfinished until such time it completes a 3600 rotation to the axis it had bounced off. Given that the present recovery wave took off the Square’s eastern cardinal, and must terminate upon it, the Square-of-9 makes is possible to forecast its maturity date.

Figure 5 – The Square-of-9 constitutes a spiral of consecutive numbers unfolding outwards from the number 1 at the centre. Its numerals follow the anti-clockwise (left to right) direction of the Milky Way’s spiral.

Gann’s breakthrough came about when he observed that time-intervals typically adhere to the Square’s axes in that they commence and terminate upon them. A mature interval bounces off and culminates upon the Square’s same axis by completing a 3600 rotation from and back to the point at which the preceding interval ended. In cases when a swing terminates upon the Square’s opposite axis, at 1800 angle, it remains unfinished until such time it completes a 3600 rotation to the axis it had bounced off. Given that the present recovery wave took off the Square’s eastern cardinal, and must terminate upon it, the Square-of-9 makes is possible to forecast its maturity date.

Click to enlarge.

Figure 6

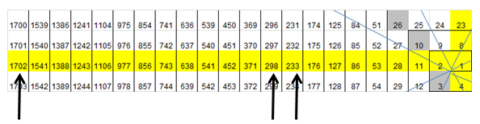

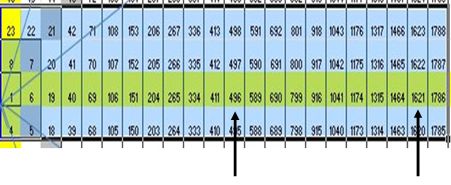

- Sep. 01, 2000 — Apr. 12, 2003 = 922cd

[The nearest value is 916, eastern cardinal - Figure 7]

- Apr. 12, 2003 — Oct. 31, 2007 = 1694cd

[The nearest value is 1702, western cardinal – Figure 8]

- Oct. 31, 2007 — Mar. 09, 2009 = 496cd eastern cardinal - Figure 7]

- Mar. 09, 2009 — Apr 23, 2010 = 411cd eastern cardinal- Figure 7]

- Apr 23, 2010 — Jul. 02, 2010 = 69cd eastern cardinal- Figure 7]

- Jul. 02, 2010 — Apr. 29, 2011 = 301cd

[298 western cardinal – Figure 8]

- Apr. 29, 2011 — Dec. 19, 2011 = 234cd

- [233 western cardinal– Figure 8]

Figure 7 – Eastern Cardinal

Figure 8 – Western cardinal

Allowing that the March 09, 2009 trough terminated upon the Square’s eastern cardinal, on day 496 of the run, the subsequent 2009 – 2013 recovery wave must also terminate there. On August 16, 2013, when it measures 1621cd, it and the 496cd downswing will form a 3600 angle upon the Square’s eastern cardinal (Figure 9).

Figure 9 – Eastern Cardinal

Harking back to Figure 3, we see that the recovery wave’s top, on May 28, took place on day 1542 of the run and culminated upon the Square’s western cardinal (Figure 8). However, given that it bounced off the eastern cardinal (on March 09, 2009), its rotation has so far achieved 1800 — an indication of an incomplete move. Note that the peak of May 28, followed by a 28cd decline, touched upon the western cardinal on June 25 at a 3600 (1542 and 28, Figure 8). The final 52cd advance of the recovery wave will reach the Square’s western arm on August 16, 2013, where it will once again form a 3600 angle. However, its total span of 1621cd will fall upon the eastern cardinal at a 3600 angle with the preceding 496cd of the GFC crash.

For three millennia the pharaohs of Egypt relied upon large rocks carved with horizontal lines to record the height the Nile’s waters had reached during each day of the seasonal inundation. Indeed, Nileometer records collected from rocks scattered along the Nile are the longest data series we have. And although large chunks from the BCE data are missing, the records we have go back to 624AD, to the day Cairo’s Rhoda Island Nileometer became functional. The sheer length of this collection speaks volumes to their importance to the then pharaohs and scientists today. Ravaging floods and droughts turned the Nile settlers into brilliant problem solvers obsessed with patterns, symmetry and time sequences. Their effort yielded the Square-of-9 — Egypt’s most guarded secret, which tracked the changes in the Nile’s ups and downs over three thousand years. Subsequently, the pharaohs enshrined it in the Great Pyramid’s tiers where the block arrangement of each mimics the spiral of the Milky Way. When pulled from the number 1 at the centre, this Square morphs into a pyramid (Figure 10). With no data-processing technology, the Square and graphs sustained the pharaohs until Egypt‘s fall to the Romans in 48 BCE. One can only speculate how much richer the pharaohs would have been had they also invented the stock market.

Figure 10 – The Square-of-9 constitutes an image of one pyramidal tier.

When asked “What is the cause behind the time factor?” Gann smiled and said: “It has taken me years of exhaustive study to learn the cause that produces the effects according to time. That is my secret and too valuable to be spread broadcast…” He died of heart failure in June 1956 and was laid to rest in New York’s Brooklyn Cemetery in a grave facing his beloved Wall Street. Just as the pharaohs departed leaving no clue to the secret they buried in the Great Pyramid’s tiers, Gann left us an image of one of its tiers, yet, withheld its layout and instructions of use.

References:

http://www.incrediblecharts.com/ - Free Stock Market Charting Software ($spx_us & $xao_ax)

http://www.timeanddate.com/date/duration.html - Calculate duration between two dates.

Original Post:

http://www.futuresmag.com/2013/07/10/unlocking-the-secrets-of-gann-will-the-market-cras

So what do you get out of that post? Is Futures Mag planting a seed to the sheep to go short during that period so they can make money, or is it to mislead the sheep so the gangsters can make money as those short get squeeze and the market goes up to even higher levels then we think possible? If you got a lot of sheep short from them reading that post and the wolves are short too... then will the crash still happen? I just don't know to tell you the truth? Maybe the article wasn't put up on purpose to distract the sheep and just done by some honest writer trying to help? I will say that "if" it shows up again on some other "even more well known" website here soon then we will know for sure that there won't be any crash!

If I were a gangster and knew about this time period, which a whole lot of sheep also know about it, I'd change the plan up a little and start the move down either before that time zone or after that time zone. That way the sheep won't be able to make any money. If it starts early then the sheep will chase the move down looking for the bounce that never comes (until the bottom of course), and if you go past that date then we'll see a huge squeeze during that time zone to put the SPX up near 1780 area... and all the sheep short will lose their money and miss the crash move that will follow. Sucks either way in my opinion... but the gangsters aren't called that just for no reason! Their sole purpose in this matrix is to steal, lie, cheat, rape, murder, and smile while doing it (kinda like politicians do on TV).

Now I've probably talked too much about the number "eleven" and it's possible they change the plan due to the sheep figuring that out. Meaning that the market tends to have important turns (tops or bottoms) on "eleven" dates. The next 11 date is this coming Thursday, August the 8th as it adds up to 22, which is an eleven. After that we have the 17th but that's a Saturday so it's out. Then there's the 26th which is after Gann's time zone of August 16th-23rd. So you have to wonder at this point whether or not "they" will changed up the date and start early (like this week... possibly the 8th?) or start later (possibly the 26th?)?

There are 2 important levels of resistance overhead for the SPX, with the first one being the 1717-1720 area. Then there is the 1770-1780 zone, which should be the target should they go out past the Gann window. If they start early then I'd expect the first zone to be hit this week and then start the sell off before Gann's target dates. So for now I'm just going to be looking for the first zone to be hit and keep my ear to the ground for possible news that could scare the market. Like some planned false flag event or surprise whisper by Ben Bernanake about raising interest rates and/or stopping the QE. Anything that can shock the market like that probably won't be something we'll see ahead of time.

But we all have to do our part to watch as clues could come out before they actually pull the trigger and let her crash. Keep your eye's open on all the major sites for new FP's... especially huge ones! Remember that back when they had the flash crash they put out a FP the night before (around midnight) showing the downside target of 1065 (nice huh? 10[5+6=11] or 111... LOL). Clues are usually given but I'm only one person and can't catch it all. I depend on YOU to help me out so I can help all the other readers out too. Look for FP's and look for possible news events that could be the trigger. I think we are really close now so let's all keep our fingers on the trigger (meaning get ready and prepared to get short).

Red.

____________________________________________________________________

The major top due in August...

In my prevoius posts, I spent a good deal of time talking about certain turning points due in late May and the one coming up soon in August. Actually I described how the Venus cycle and Mayan calender work, explaining how the market was going to be weaker and weaker. I suggested that you folks not expect a big decline at first but give it some time and space until it gets weaker and weaker and now the real time of weakness has just begun! All you folks need to do is not to let those short-lived bounces and rallies fool you.

The truth of the matter is that this is exactly what the “movers and shakers” want from you. Actually, they all want you on the bull side now as it would not be so profitable if we (retail traders) knew exactly when to jump on board. As you all remember I also touched on Armstrong’s cycle work. You see, most financial markets analysts out there are already aware of the dates given by Armstrong’s pi-cycle work. Now with this being said do you really think that the market will turn based on his dates? Of course not!

With too many traders and analyst already being aware of such dates the stock market would never care to turn then. In fact, the pi-cycles exist... in the other words they have always existed, but the secret is that the harmonics change. It will not have to be the same thing for good. As time goes forward the things change... meaning more and more traders and investors get informed, therefore the harmonics become more complex.

But August is the month you need to watch closely...

Now the current move-down on the S&P is actually a correction to the sharp decline from June 19th to June 24th 2013. Meaning more short-lived rallies or sideways chops are in the cards. As soon as the prices resume rallying back up you folks need to realize that the market will not go to the moon. I suppose the next up-move will be relatively smaller or probably a failure, then it is going to be a time when a major top is put in. All you might want to do keep an eye out for set-up bars on weekly charts around August 16th And the full moon on August 20th.

Few days ago, I was talking with Red on Skype... talking about a potential short-term decline around August 7th and the market went down on 6th. Anyway, the top of the current long-term rally is going to be the beginning of a 3-year depression. And you folks would want to jump in as soon as you see the set-up bar.

May you profit handsomely,

Ali

afiroozi (at) rocketmail (dot) com

Looks like they decided to take it down first and then rally. Seems they always change the plan just when you think you got it figured out… LOL! So, I’m now expecting a bounce today for some smaller wave 2 up with the current move down being the wave 1 down.

That sets up a wave 3 down into tomorrow for a short term bottom. Then back up Thursday until Monday of next week. Then down again. But we still have a move down coming toward the 1650 SPX area. The timing of it is tough to figure out right now though.

Whatever move up into the close we have today David I think it will end the short term rally and allow a wave 3 down tomorrow. I’ll be looking to get a small short before the close.

New FP on the SPY of 170.74… http://screencast.com/t/lJBh2xCT

Gang, Ali hasn’t had time to do another update by after speaking with him a few days ago he stated very clearly that August 7th the market should be down. Something he see’s in the harmonics. Since we appear to be in some type of wave 2 up right now the charts support a wave 3 down tomorrow… which aid’s in what Ali see’s happening on the 7th.

ES Support levels: http://niftychartsandpatterns.blogspot.in/2013/08/es-chart-analysis_6.html

SPX trendline supports the “possible” FP’s on the SPY…

http://screencast.com/t/NHU1dmMfeoEm

Update opinion on FP on the SPY… http://screencast.com/t/O88M1924F

Market looks like it’s trying to rally here but appears too weak to do so. With such extremely light volume today you’d think they would have rallied by now? The short term oversold charts have worked off most of that condition and are move up steadily on their histogram bars but the market chops sideways.

Obviously that’s called a bear flag. So unless there’s some huge rally in the last half hour to close the market green I’m going to think that SkyNet wants to keep the market down here as it’s planning on moving lower again tomorrow.

At least that low David as wave 3’s or C’s are longer then wave 1’s or A’s. So if wave 1 was from 1709 to 1693 on the SPX then that’s 16 points. If you multiple 16 times 1.786 you get 28 points. So we should drop 28 points from 1699 or around 1671 spx.

bankers waiting to screw dip buyers with a sell into any rally but dip buyers didnt show up today

Yes, they have something up their sleeve and it’s not good for the sheep I bet. We should have rallied more today with the light volume so they are about to trick us I think. Look at this chart and tell what will happen when the blue rising trendline breaks (inside the 2 black trendlines that make up the channel)?

http://stockcharts.com/public/1092905/chartbook/254097560;

S&P 500 Analysis After Closing bell: http://niftychartsandpatterns.blogspot.in/2013/08/s-500-analysis-after-closing-bell_7.html

In your most recent post at 7:03 you say there is going to be an initial drop to “right here” but I have checked and can’t see the pointer or any line drawn. Where do you expect that initial drop, after the peak (possibly Aug 8,9) to go down to please?

I’m looking for around 167 on the SPY today if all goes as planned. Then a rally Thursday and Friday, followed by another even bigger drop all next week.

Here’s what I see http://screencast.com/t/rggYWQS7lEe0

tomorrow is an 11 day. I assume you’re looking for 1640/50?

Yeah, the bottom could go into tomorrow morning I guess Peter (especially since it’s an “eleven” day) but the target isn’t likely going to be 1640/1650 but around 1670 as in this chart. Here’s what I see http://screencast.com/t/rggYWQS7lEe0

The gap down this morning likely started a wave C (or 3), and inside that wave C there will likely be 5 waves. The first wave of that ended this morning at the low and we appear to be in the wave 2 up inside that wave C. The next move down in the close today and likely into tomorrow morning should be the wave 3 inside that C wave.

GOLD Trend update: http://niftychartsandpatterns.blogspot.in/2013/08/gold-trend-update.html

SPX update… http://screencast.com/t/9384oFebd

Last chance to get short and catch a wave 3 down inside a larger C wave is right now I believe.

GOOGLE Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/08/google-chart-analysis.html

Gap down tomorrow very likely!

APPLE Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/08/apple-chart-analysis.html

Very bearish looking today. A gap up to take out stops and then a reverse back down isn’t good for the bulls. We’ll likely continue down all day today.

They are doing everything they can to hold this market up guys. Even if they succeed in holding it here until Friday it’s going to be really ugly next week. This market is set to crash hard!

When the FED pulls the money out of the market what do you think will happen? http://www.themeshreport.com/2013/08/world-stocks-down-fed-official-flags-stimulus-end

New possible wave count… http://screencast.com/t/mwsc6bcQ08G

Crude Oil Support Levels: http://niftychartsandpatterns.blogspot.in/2013/08/crude-oil-support-levels.html

I still think we’ll make one more new high. We’ll see. The 22nd is today, friday is the 9th, and next tuesday is a 9 day. should be interesting

They are trying very, very hard to hold this market up this week but next week we are going to crash. They can’t stop it. It’s going to happen whether they want it to or not. How do I know for sure you ask? A higher power told me, and that’s all I can say.

fair enough. Haven’t seen you try and moslead anyone since I found the blog

With the huge market down move expected next week anyone still in the penny stock I mention exit today. I don’t think it’s going to do as well as it was forecasted… especially with the negative energy in the market right now and all next week.

Refresh page for update from Ali…

Silver resistance levels: http://niftychartsandpatterns.blogspot.in/2013/08/silver-resistance-levels.html

within a week silver will put in an intermediate bottom

He’s saying the 16th to 20th tho…

In my Skype chat Ali said he thinks that period will be a bottom. He told me months ago that the 10th-12th is a very important period. I’m getting conformation from someone else too and it’s looking like 140-145 area or 156 area by next Thursday. Don’t know which but there’s a lot of tense going on with “them” right now.

That’s quite a bold call. wow. Well, I’d def donate if you happen to be right

I hesitated to put it out there Peter but something wicked is coming next week and while I don’t want you to hold me to those exact levels I do want you to be aware that the odds of a huge move down are 90% from the information I’m putting together.

nedia was VERY bullish today too. so, could be

Seems everyone is bullish Peter… which makes me feel even stronger that this call will be right. I’m still looking for 167 area on the SPY and it “should” happen tomorrow but with the manipulation it could happen Monday.

Update for Friday… http://screencast.com/t/GzHYp3KaQA8

I got lucky on 1680 pullback call (better be lucky than good), will reopen leveraged short position tomorrow

(my core portfolios are all 100% net short – not counting long natural gas which I went long yesterday at 3.381 /NGX3 – glad I did not have stops today – that was a mother of all shakeoffs )

Trade well

take a look at silver /SI long within a week

Should have one more lower high on the SPX David. Probably Monday as it looks like we are stuck in these triangle for today. The lower high could even go up and fill the gap around 1707 SPX but I’m just guessing at that level.

Yesterday’s cnbc.com home page Time to get bearish on

stocks: Strategist

Today’s cnbc.com home page Marc Faber: Look out! A

1987-style crash is coming

Hard to see a crash when cnbc is telegraphing things so blatantly.

Oh crap! That sucks! They always do the opposite to trick the sheep. Man I hate seeing that as that means they “could” change the plan next week? Don’t know yet as possibly they still take it down hard and do a mini-crash, at which point everyone on the planet will become super bearish… and then they rip it back up to new all time highs (which I believe is already planned?). I see 17,000 Dow in October after a big sell off next week and possibly the following week. That would fool the most sheep I think.

ah. Not a good sign for the bear case sadly. Out of curiosity though red, have your sources given you other dates that have worked out before?

Those 2 articles out mean the odds of a crash just went down to 5%… meaning there’s NOT going to be a crash next week. Yes, we will sell off some but no crash. Bummer 🙁

Agree, Maybe 1670/80, then new highs… Bears just have no chance lol

Sheesh, more bad news for the bears.

CRASH CALLED OFF, but selling still coming. Refresh page for quick Friday and next week update.

Falling Wedge of INTEL: http://niftychartsandpatterns.blogspot.in/2013/08/falling-wedge-of-intel.html

bears this year, for entertainment http://www.youtube.com/watch?v=lTMwrAefIVQ

LOL… now that’s funny!

SPX update: http://screencast.com/t/WKIUOhunH

Gold Chart analysis: http://niftychartsandpatterns.blogspot.in/2013/08/gold-chart-update_9.html

If you ever wondered if the gangsters do things to the sheep without telling you… your are wrong! They show you through the movies they put out. In fact if you want to know how evil they are and what they have planned for you, just watch the movie called “Assault On WallStreet 2013” as it’s very detailed into what they have done and plan to continue doing. I personally think the guy in the movie is hero and should really go take out his anger on Lloyd Blankfein and Jamie Dimon for starters (but the list of bankster pigs is too long to type here)

You can blame the heads of these companies all you like.

Yet..what about the people/companies that give GS, JPM, their funds?

THEY are the issue…not the CEOs.

—

Yes, I agree that there are many more gangsters above them and they deserve the same or worst done to them.

No.. that is not what I was implying.

Quite the contrary. You are blaming a very few individuals at the top.

It is the SHEEP – as you like to call them, who are to blame.

—

You are holding the same philosophical viewpoint as those who wish to blame Hitler for WW2, rather than the German populace. It wasn’t one man who invaded dozens of nations..it was a collective of millions..who ALL actively supported their elected leader.

Don’t go pinning the blame for anything on Dimon or Blankfein, when it is the VERY sheep who are sending them THEIR money, allowing it to be leveraged up..and then expecting ‘good returns’.

Red, you..and the majority have been bitching and whining about the ‘bankster’ CEOs for over 5 years now, and yet…the real problem is the one facing you in the mirror each morning.

Regardless..have a good weekend.

Permabear, it’s true that the sheep do send their money to these people to invest it for them but most sheep are clueless as to who they are dealing with. Is the the sheeps’ fault for “not knowing” or is the banksters fault for deceiving them?

The sheep are like children that simply haven’t learned yet. The parents are like the banksters, only these parents lie to the children. I’m sorry but I can’t blame the sheep for not understanding who they are doing business with. The banksters are the criminals here in my opinion, but you are welcome to disagree.

Sidenote: Interesting video…http://www.youtube.com/watch?v=3u81di6JmXw&feature=youtu.be

As for Hilter, I do blame him… just like I blame his relatives like George Bush. People in power can choose to do good things or bad. Hilter was a nobody and has zero money or power until the Rockefeller’s, Rothshilds, Vanderbuilts, and who knows how many others… gave him money and put him in power.

He was a puppet controlled by these satanists, but he could have said no and not done what he did. I personally would have said no and remained poor. Of course they would have picked someone else but it wouldn’t have been me.

People have the power to be good or evil and those people in power right now are evil. The only way they continue to make money is to lie, steal, cheat and deceive the sheep. You blame the sheep for investing with them but I blame the banksters for deceiving them.

I seriously doubt that the sheep would invest with these banksters if they knew the whole truth. Naturally I don’t invest with the banksters as I’m aware but most sheep are clueless, and I just can’t blame someone who doesn’t understand the system versus someone who deceived them into investing.

But that’s simply my opinion and thoughts and you of course can have a different opinion. I’m sure there are some honest bankers out there, but I just haven’t met one.

hmm.

Well, I can only say, we are all sheep at birth.

It is then a CHOICE, as to what we believe.

You chose to learn and understand..whilst your neighbours CHOSE not to.

Its a choice .Red…and that is something which I think is still largely overlooked by the doomer crowd. They want to blame a few at the top, rather than those around them who CHOSE to remain ignorant.

The US..and even my own nation have EXACTLY the govt. and leaders we deserve.

Scary philosophical point, huh?

APPLE Weekend update: http://niftychartsandpatterns.blogspot.in/2013/08/apple-weekend-update.html

Google triangle pattern: http://niftychartsandpatterns.blogspot.in/2013/08/google-triangle-pattern.html

A small pop. then drop. wuld be nice… but surprised you didn’t go short over the weekend red

The charts are very bearish and clearly point to a move down on Monday. There is a small head and shoulders patterned from last weeks’ moves and a larger head and shoulders pattern going back to late July. Then and even larger head and shoulders going back to May… so yes everything is extremely bearish.

But, every time in the past I see patterns like this they end up fooling me with a tricky move to the upside first. So I decided the safe move was to stay in cash to see what happens on Monday. From looking at the charts I’d say there is a 90% chance of opening down on Monday morning.

However, everyone else sees the same thing I do… meaning they could do the opposite and open up on Monday instead of down. Or they could open down and reverse really fast and rally all day? I don’t know what they have planned but I know it’s going to be tricky, so staying out of all positions seemed to be the wiser move in my opinion.

I see. Been short financials for awhile now, due to there continued weakness despite pushing higher, but I see what you mean. Plus, holding over a weekend is a pain. Both flat, or wrong direction, hurt you.Only thing I found odd, if they plan on crashing next week, was closing near the lows

SLV Weekend update: http://niftychartsandpatterns.blogspot.in/2013/08/slv-weekend-update.html

Yesterday was 9420 days from the lesser grand ritual double five years ago. 9420===3×3140 days or 3 Pi. This is a basic component of Martin Armstrong’s Pi Cycle. His ECM (5313) had a turn on August 7 but Martin Armstrong is now disavowing his Pi cycle saying the ultimate economic peak won’t come until October 2015. Lately his ECM/ Pi cycle hasn’t been working and most of his recent essays have been ridiculous numerology fests so much so that I was thinking his whole ECM model lately was a little numerology game.

Technically things are setting up. Most indices settling around their lower BBs as they await the flare opening to the downside.

A certain little indicator waiting to cross beneath its downsloping 50 day average while its component registered a minor change reading on Friday. It should drop below its 50 day on Monday unless there is a monster upday.

A new technical indicator I have been trying has most indices in no mans land between upper and lower boundaries at least as I interpret it. It seems to be a pretty good trend indicator with a few whipsaws but generally it points to a change in trend in a timely manner.

Refresh Page for new video update…

well said… Bernanke speaks at the end of october too though red. so keep that date i n mind. Damn t sucks for bears this year

Yeah Peter, it sucks being a bear. I just can’t wait until they announce that the world is saved in October and they are looking for 20,000 DOW! Then I’ll know for sure the crash is coming!

I think you;re right on a pullback either way, but I dobnt we crash just yet

ES Chart Analysis: http://niftychartsandpatterns.blogspot.in/2013/08/es-chart-analysis_12.html

The way I see what happened this morning is simple… they gaped down below the 1685 SPX support level to take out all the bulls’ stops. They as low as 1675 on ES futures to take out the bulls’ that were long there too. They also lured in some bears with the gap down. Right now the bears are trapped and expecting the overhead resistance to hold.

Now, as of today it’s possible that the line holds and we dip back down some to lure in some more bears.. but I honestly wouldn’t count on that happening. It would make more sense to just keep push up here and use the momentum from the trapped bears to gain more ground on the upside. Then tomorrow morning they can gap up over the next resistance level, but it’s looking more and more like they are getting ready to go after the bears’ stops this week.

GOLD Resistance Levels: http://niftychartsandpatterns.blogspot.in/2013/08/gold-support-and-resistance-levels.html

SPY update… http://screencast.com/t/5jdLjqtKNxY