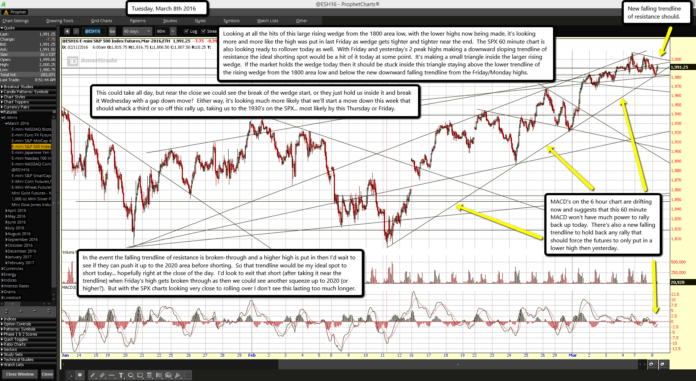

New falling trendline of resistance should.

New falling trendline of resistance should.

MACD's on the 6 hour chart are drifting now and suggests that this 60 minute MACD won't have much power to rally back up today. There's also a new falling trendline to hold back any rally that should force the futures to only put in a lower high then yesterday.

Looking at all the hits of this large rising wedge from the 1800 area low, with the lower highs now being made, it's looking more and more like the high was put in last Friday as wedge gets tighter and tighter near the end. The SPX 60 minute chart is also looking ready to rollover today as well. With Friday and yesterday's 2 peak highs making a downward sloping trendline of resistance the ideal shorting spot would be a hit of it today at some point. It's making a small triangle inside the larger rising wedge. If the market holds the wedge today then it should be stuck inside this triangle staying above the lower trendline of the rising wedge from the 1800 area low and below the new downward falling trendline from the Friday/Monday highs.

This could take all day, but near the close we could see the break of the wedge start, or they just hold us inside it and break it Wednesday with a gap down move? Either way, it's looking much more likely that we'll start a move down this week that should whack a third or so off this rally up, taking us to the 1930's on the SPX... most likely by this Thursday or Friday.

In the event the falling trendline of resistance is broken-through and a higher high is put in then I'd wait to see if they can push it up to the 2020 area before shorting. So that trendline would be my ideal spot to short today... hopefully right at the close of the day. I'd look to exit that short (after taking it near the trendline) when Friday's high gets broken through as then we could see another squeeze up to 2020 (or higher?). But with the SPX charts looking very close to rolling over I don't see this lasting too much longer.