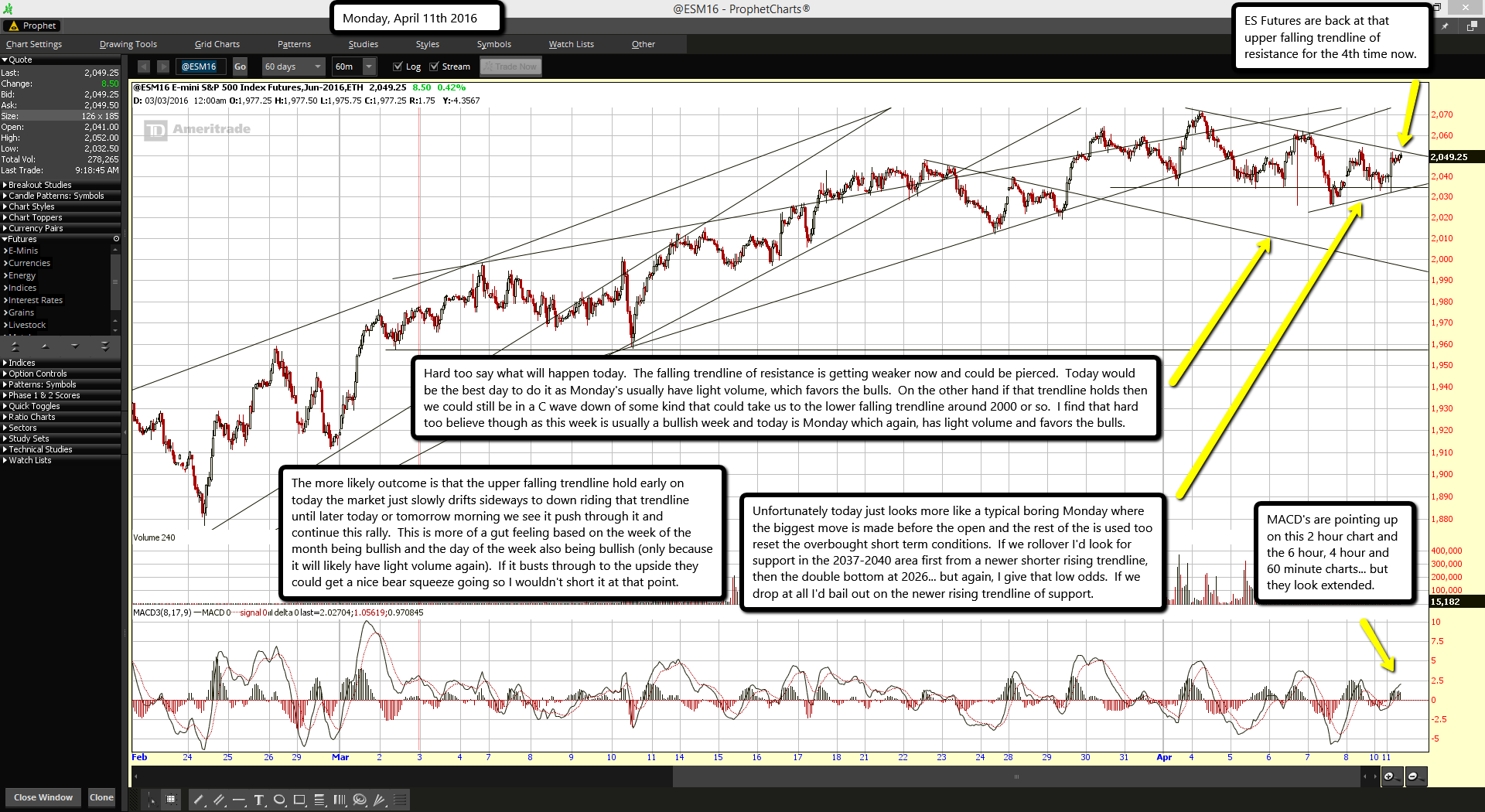

ES Futures are back at that upper falling trendline of resistance for the 4th time now.

MACD's are pointing up on this 2 hour chart and the 6 hour, 4 hour and 60 minute charts... but they look extended.

Hard too say what will happen today. The falling trendline of resistance is getting weaker now and could be pierced. Today would be the best day to do it as Monday's usually have light volume, which favors the bulls. On the other hand if that trendline holds then we could still be in a C wave down of some kind that could take us to the lower falling trendline around 2000 or so. I find that hard too believe though as this week is usually a bullish week and today is Monday which again, has light volume and favors the bulls.

The more likely outcome is that the upper falling trendline hold early on today the market just slowly drifts sideways to down riding that trendline until later today or tomorrow morning we see it push through it and continue this rally. This is more of a gut feeling based on the week of the month being bullish and the day of the week also being bullish (only because it will likely have light volume again). If it busts through to the upside they could get a nice bear squeeze going so I wouldn't short it at that point.

Unfortunately today just looks more like a typical boring Monday where the biggest move is made before the open and the rest of the is used too reset the overbought short term conditions. If we rollover I'd look for support in the 2037-2040 area first from a newer shorter rising trendline, then the double bottom at 2026... but again, I give that low odds. If we drop at all I'd bail out on the newer rising trendline of support.