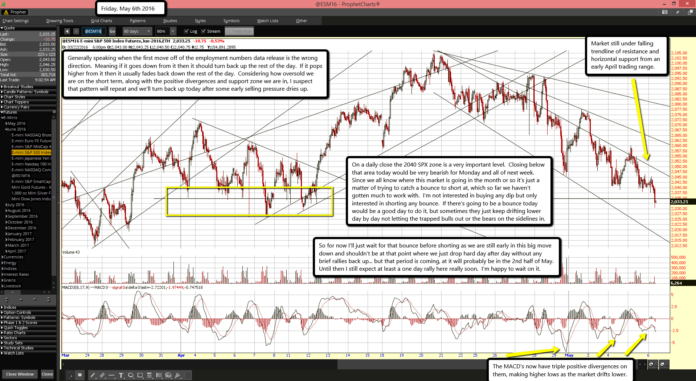

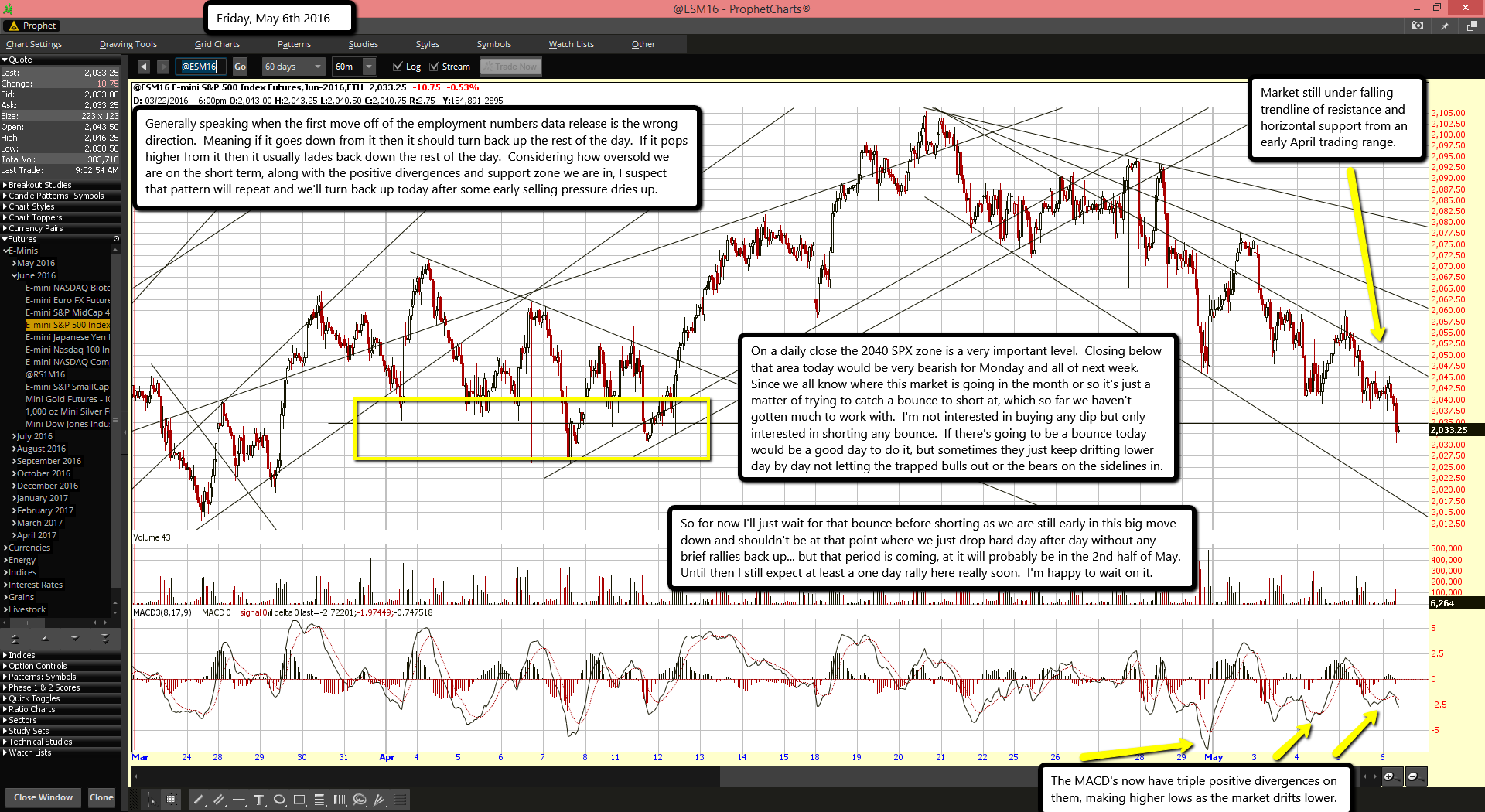

Market still under falling trendline of resistance and horizontal support from an early April trading range.

The MACD's now have triple positive divergences on them, making higher lows as the market drifts lower.

Generally speaking when the first move off of the employment numbers data release is the wrong direction. Meaning if it goes down from it then it should turn back up the rest of the day. If it pops higher from it then it usually fades back down the rest of the day. Considering how oversold we are on the short term, along with the positive divergences and support zone we are in, I suspect that pattern will repeat and we'll turn back up today after some early selling pressure dries up.

On a daily close the 2040 SPX zone is a very important level. Closing below that area today would be very bearish for Monday and all of next week. Since we all know where this market is going in the month or so it's just a matter of trying to catch a bounce to short at, which so far we haven't gotten much to work with. I'm not interested in buying any dip but only interested in shorting any bounce. If there's going to be a bounce today would be a good day to do it, but sometimes they just keep drifting lower day by day not letting the trapped bulls out or the bears on the sidelines in.

So for now I'll just wait for that bounce before shorting as we are still early in this big move down and shouldn't be at that point where we just drop hard day after day without any brief rallies back up... but that period is coming, at it will probably be in the 2nd half of May. Until then I still expect at least a one day rally here really soon. I'm happy to wait on it.