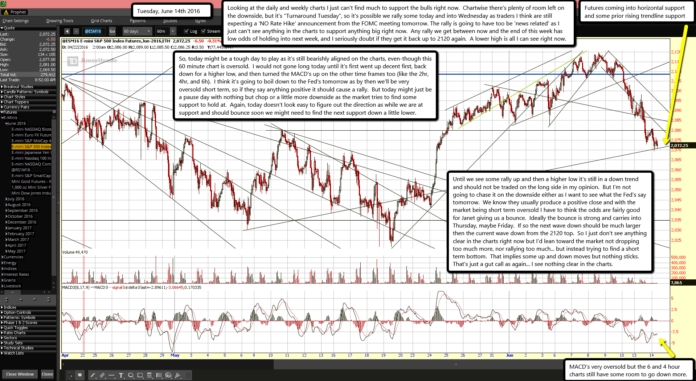

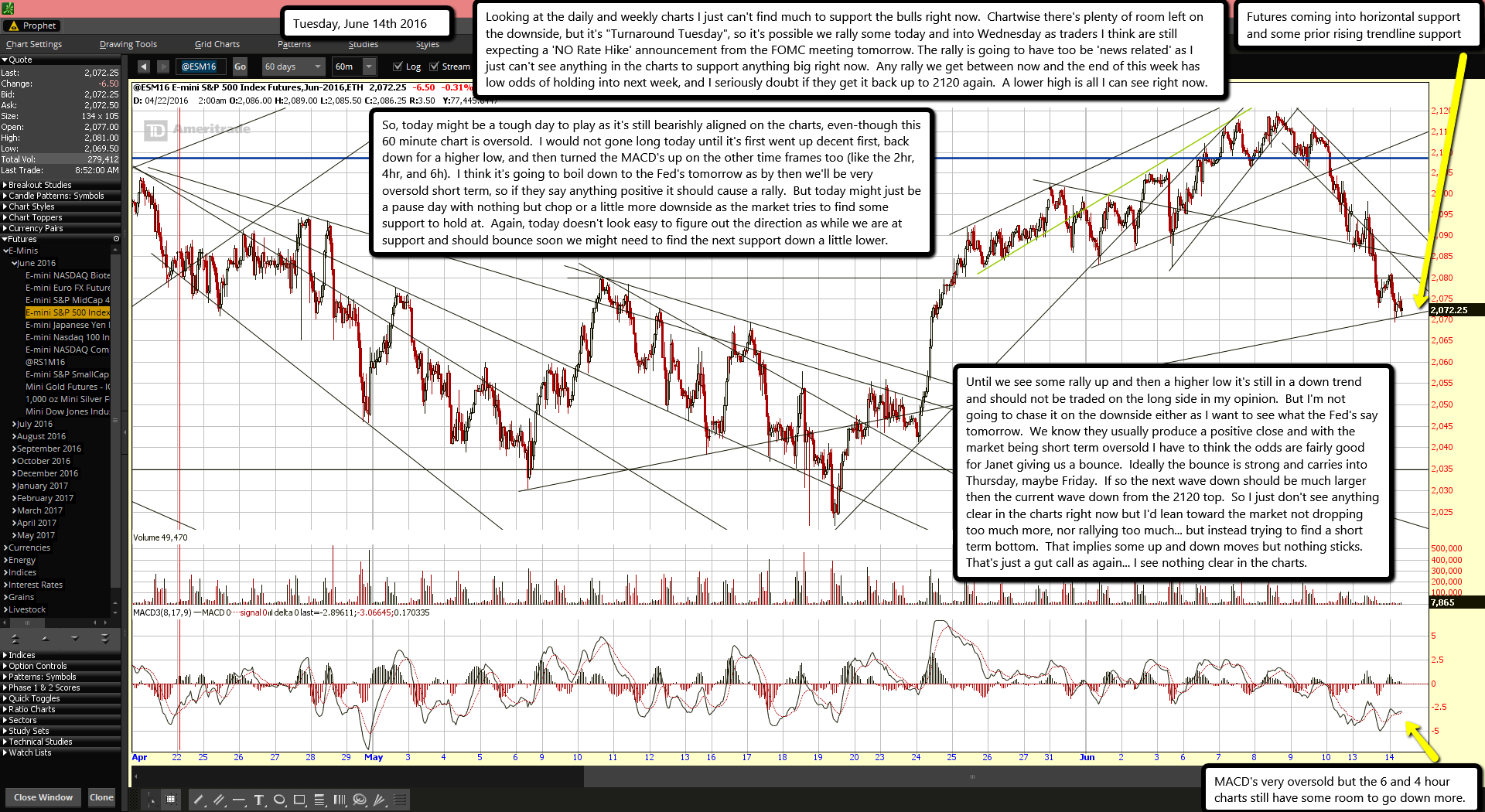

Futures coming into horizontal support and some prior rising trendline support

MACD's very oversold but the 6 and 4 hour charts still have some room to go down more.

Looking at the daily and weekly charts I just can't find much to support the bulls right now. Chartwise there's plenty of room left on the downside, but it's "Turnaround Tuesday", so it's possible we rally some today and into Wednesday as traders I think are still expecting a 'NO Rate Hike' announcement from the FOMC meeting tomorrow. The rally is going to have too be 'news related' as I just can't see anything in the charts to support anything big right now. Any rally we get between now and the end of this week has low odds of holding into next week, and I seriously doubt if they get it back up to 2120 again. A lower high is all I can see right now.

So, today might be a tough day to play as it's still bearishly aligned on the charts, even-though this 60 minute chart is oversold. I would not gone long today until it's first went up decent first, back down for a higher low, and then turned the MACD's up on the other time frames too (like the 2hr, 4hr, and 6h). I think it's going to boil down to the Fed's tomorrow as by then we'll be very oversold short term, so if they say anything positive it should cause a rally. But today might just be a pause day with nothing but chop or a little more downside as the market tries to find some support to hold at. Again, today doesn't look easy to figure out the direction as while we are at support and should bounce soon we might need to find the next support down a little lower.

Until we see some rally up and then a higher low it's still in a down trend and should not be traded on the long side in my opinion. But I'm not going to chase it on the downside either as I want to see what the Fed's say tomorrow. We know they usually produce a positive close and with the market being short term oversold I have to think the odds are fairly good for Janet giving us a bounce. Ideally the bounce is strong and carries into Thursday, maybe Friday. If so the next wave down should be much larger then the current wave down from the 2120 top. So I just don't see anything clear in the charts right now but I'd lean toward the market not dropping too much more, nor rallying too much... but instead trying to find a short term bottom. That implies some up and down moves but nothing sticks. That's just a gut call as again... I see nothing clear in the charts.