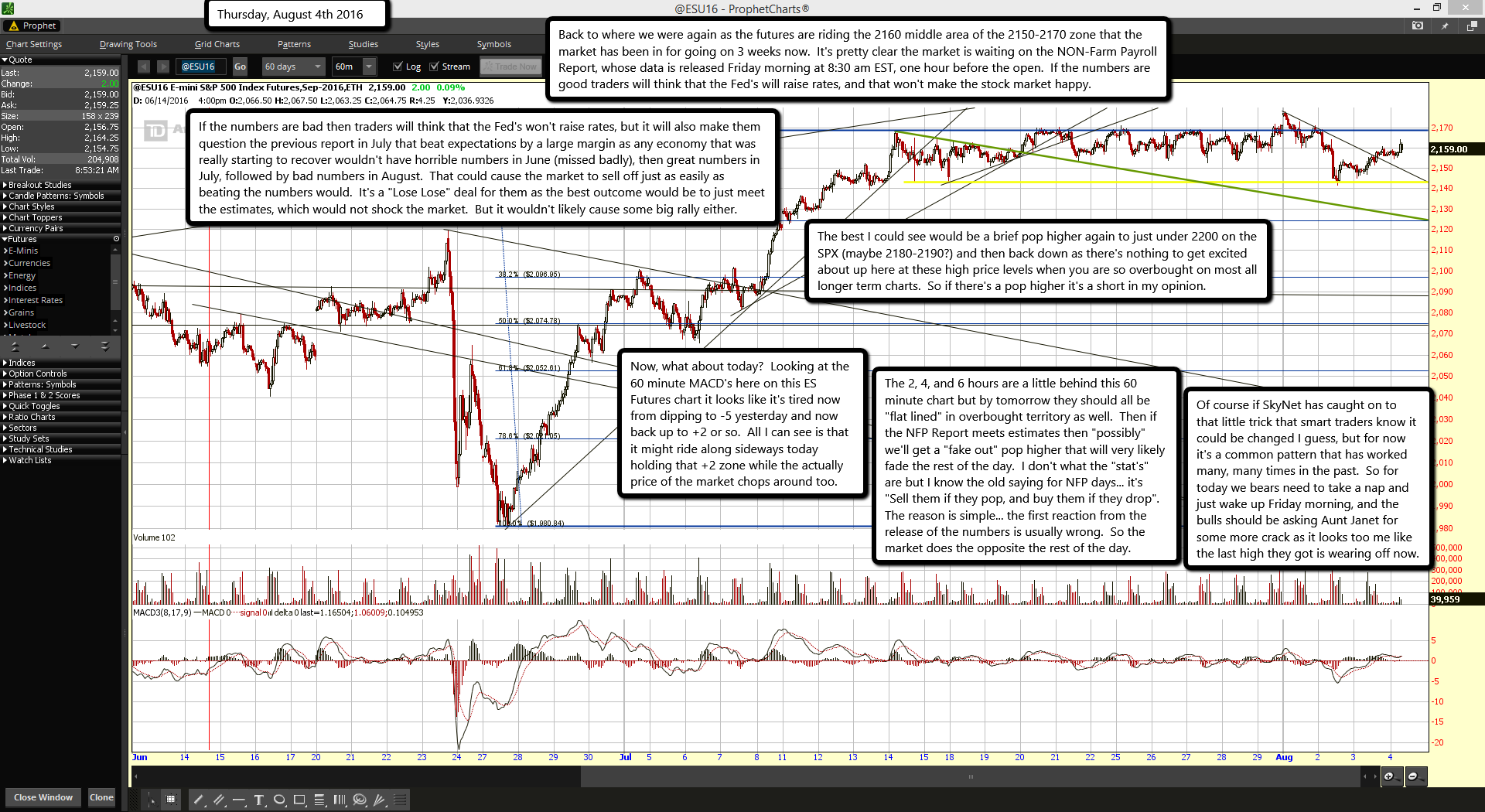

Back to where we were again as the futures are riding the 2160 middle area of the 2150-2170 zone that the market has been in for going on 3 weeks now. It's pretty clear the market is waiting on the NON-Farm Payroll Report, whose data is released Friday morning at 8:30 am EST, one hour before the open. If the numbers are good traders will think that the Fed's will raise rates, and that won't make the stock market happy.

If the numbers are bad then traders will think that the Fed's won't raise rates, but it will also make them question the previous report in July that beat expectations by a large margin as any economy that was really starting to recover wouldn't have horrible numbers in June (missed badly), then great numbers in July, followed by bad numbers in August. That could cause the market to sell off just as easily as beating the numbers would. It's a "Lose Lose" deal for them as the best outcome would be to just meet the estimates, which would not shock the market. But it wouldn't likely cause some big rally either.

The best I could see would be a brief pop higher again to just under 2200 on the SPX (maybe 2180-2190?) and then back down as there's nothing to get excited about up here at these high price levels when you are so overbought on most all longer term charts. So if there's a pop higher it's a short in my opinion.

Now, what about today? Looking at the 60 minute MACD's here on this ES Futures chart it looks like it's tired now from dipping to -5 yesterday and now back up to +2 or so. All I can see is that it might ride along sideways today holding that +2 zone while the actually price of the market chops around too.

The 2, 4, and 6 hours are a little behind this 60 minute chart but by tomorrow they should all be "flat lined" in overbought territory as well. Then if the NFP Report meets estimates then "possibly" we'll get a "fake out" pop higher that will very likely fade the rest of the day. I don't what the "stat's" are but I know the old saying for NFP days... it's "Sell them if they pop, and buy them if they drop". The reason is simple... the first reaction from the release of the numbers is usually wrong. So the market does the opposite the rest of the day.

Of course if SkyNet has caught on to that little trick that smart traders know it could be changed I guess, but for now it's a common pattern that has worked many, many times in the past. So for today we bears need to take a nap and just wake up Friday morning, and the bulls should be asking Aunt Janet for some more crack as it looks too me like the last high they got is wearing off now.