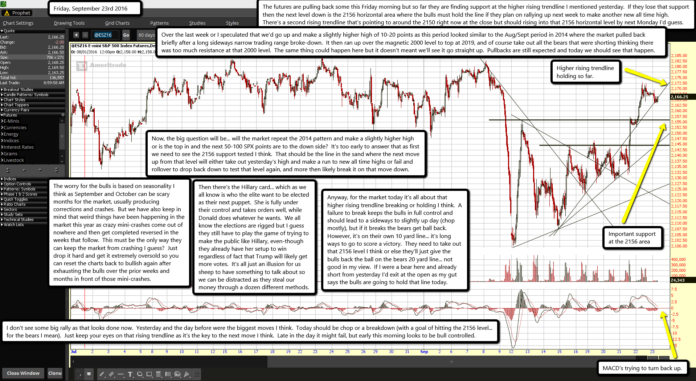

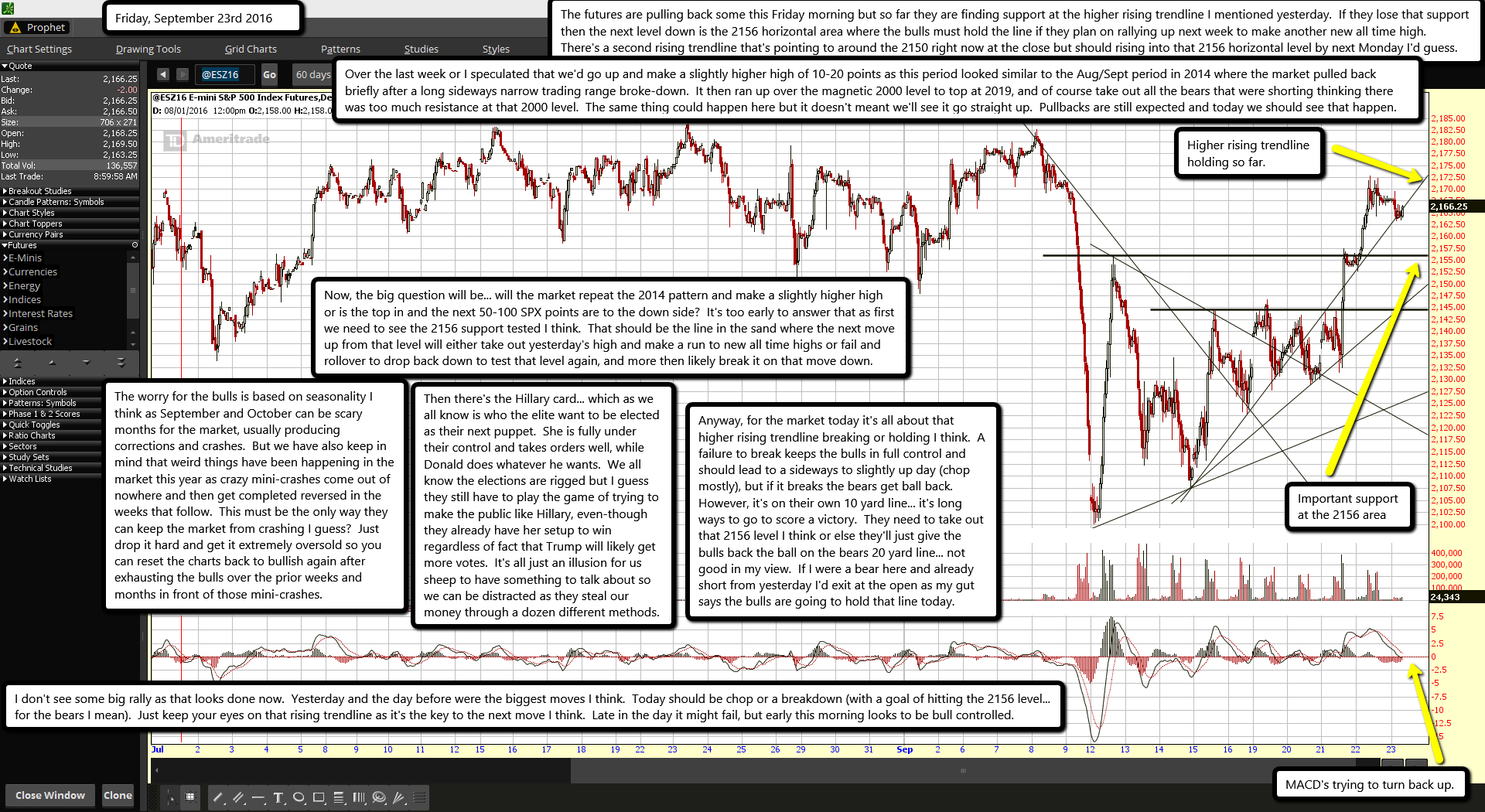

The futures are pulling back some this Friday morning but so far they are finding support at the higher rising trendline I mentioned yesterday. If they lose that support then the next level down is the 2156 horizontal area where the bulls must hold the line if they plan on rallying up next week to make another new all time high. There's a second rising trendline that's pointing to around the 2150 right now at the close but should rising into that 2156 horizontal level by next Monday I'd guess.

Over the last week or I speculated that we'd go up and make a slightly higher high of 10-20 points as this period looked similar to the Aug/Sept period in 2014 where the market pulled back briefly after a long sideways narrow trading range broke-down. It then ran up over the magnetic 2000 level to top at 2019, and of course take out all the bears that were shorting thinking there was too much resistance at that 2000 level. The same thing could happen here but it doesn't meant we'll see it go straight up. Pullbacks are still expected and today we should see that happen.

Now, the big question will be... will the market repeat the 2014 pattern and make a slightly higher high or is the top in and the next 50-100 SPX points are to the down side? It's too early to answer that as first we need to see the 2156 support tested I think. That should be the line in the sand where the next move up from that level will either take out yesterday's high and make a run to new all time highs or fail and rollover to drop back down to test that level again, and more then likely break it on that move down.

The worry for the bulls is based on seasonality I think as September and October can be scary months for the market, usually producing corrections and crashes. But we have also keep in mind that weird things have been happening in the market this year as crazy mini-crashes come out of nowhere and then get completed reversed in the weeks that follow. This must be the only way they can keep the market from crashing I guess? Just drop it hard and get it extremely oversold so you can reset the charts back to bullish again after exhausting the bulls over the prior weeks and months in front of those mini-crashes.

Then there's the Hillary card... which as we all know is who the elite want to be elected as their next puppet. She is fully under their control and takes orders well, while Donald does whatever he wants. We all know the elections are rigged but I guess they still have to play the game of trying to make the public like Hillary, even-though they already have her setup to win regardless of fact that Trump will likely get more votes. It's all just an illusion for us sheep to have something to talk about so we can be distracted as they steal our money through a dozen different methods.

Anyway, for the market today it's all about that higher rising trendline breaking or holding I think. A failure to break keeps the bulls in full control and should lead to a sideways to slightly up day (chop mostly), but if it breaks the bears get ball back. However, it's on their own 10 yard line... it's long ways to go to score a victory. They need to take out that 2156 level I think or else they'll just give the bulls back the ball on the bears 20 yard line... not good in my view. If I were a bear here and already short from yesterday I'd exit at the open as my gut says the bulls are going to hold that line today.

I don't see some big rally as that looks done now. Yesterday and the day before were the biggest moves I think. Today should be chop or a breakdown (with a goal of hitting the 2156 level... for the bears I mean). Just keep your eyes on that rising trendline as it's the key to the next move I think. Late in the day it might fail, but early this morning looks to be bull controlled.