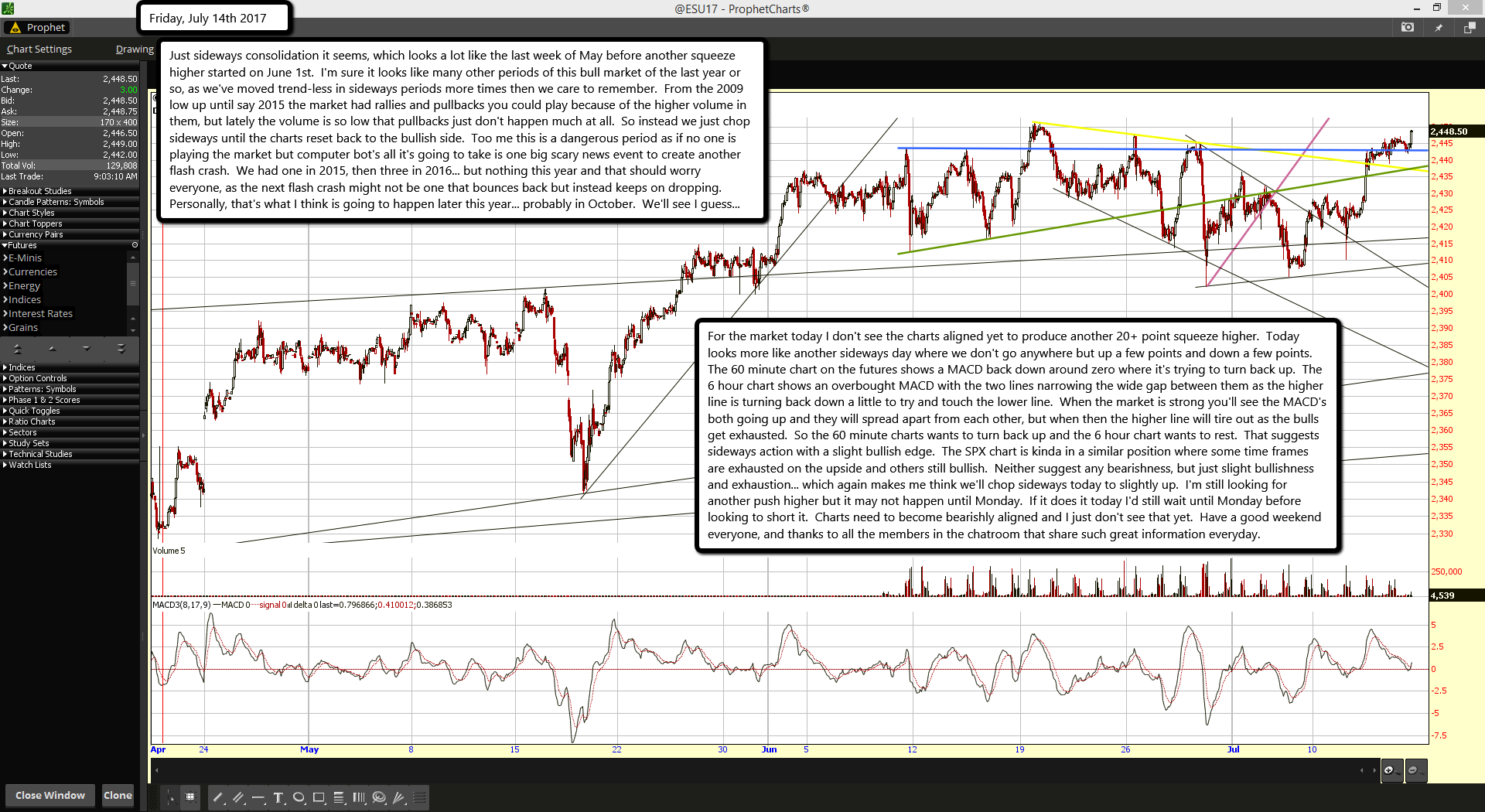

Just sideways consolidation it seems, which looks a lot like the last week of May before another squeeze higher started on June 1st. I'm sure it looks like many other periods of this bull market of the last year or so, as we've moved trend-less in sideways periods more times then we care to remember. From the 2009 low up until say 2015 the market had rallies and pullbacks you could play because of the higher volume in them, but lately the volume is so low that pullbacks just don't happen much at all. So instead we just chop sideways until the charts reset back to the bullish side. Too me this is a dangerous period as if no one is playing the market but computer bot's all it's going to take is one big scary news event to create another flash crash. We had one in 2015, then three in 2016... but nothing this year and that should worry everyone, as the next flash crash might not be one that bounces back but instead keeps on dropping. Personally, that's what I think is going to happen later this year... probably in October. We'll see I guess...

For the market today I don't see the charts aligned yet to produce another 20+ point squeeze higher. Today looks more like another sideways day where we don't go anywhere but up a few points and down a few points. The 60 minute chart on the futures shows a MACD back down around zero where it's trying to turn back up. The 6 hour chart shows an overbought MACD with the two lines narrowing the wide gap between them as the higher line is turning back down a little to try and touch the lower line. When the market is strong you'll see the MACD's both going up and they will spread apart from each other, but when then the higher line will tire out as the bulls get exhausted. So the 60 minute charts wants to turn back up and the 6 hour chart wants to rest. That suggests sideways action with a slight bullish edge. The SPX chart is kinda in a similar position where some time frames are exhausted on the upside and others still bullish. Neither suggest any bearishness, but just slight bullishness and exhaustion... which again makes me think we'll chop sideways today to slightly up. I'm still looking for another push higher but it may not happen until Monday. If it does it today I'd still wait until Monday before looking to short it. Charts need to become bearishly aligned and I just don't see that yet. Have a good weekend everyone, and thanks to all the members in the chatroom that share such great information everyday.