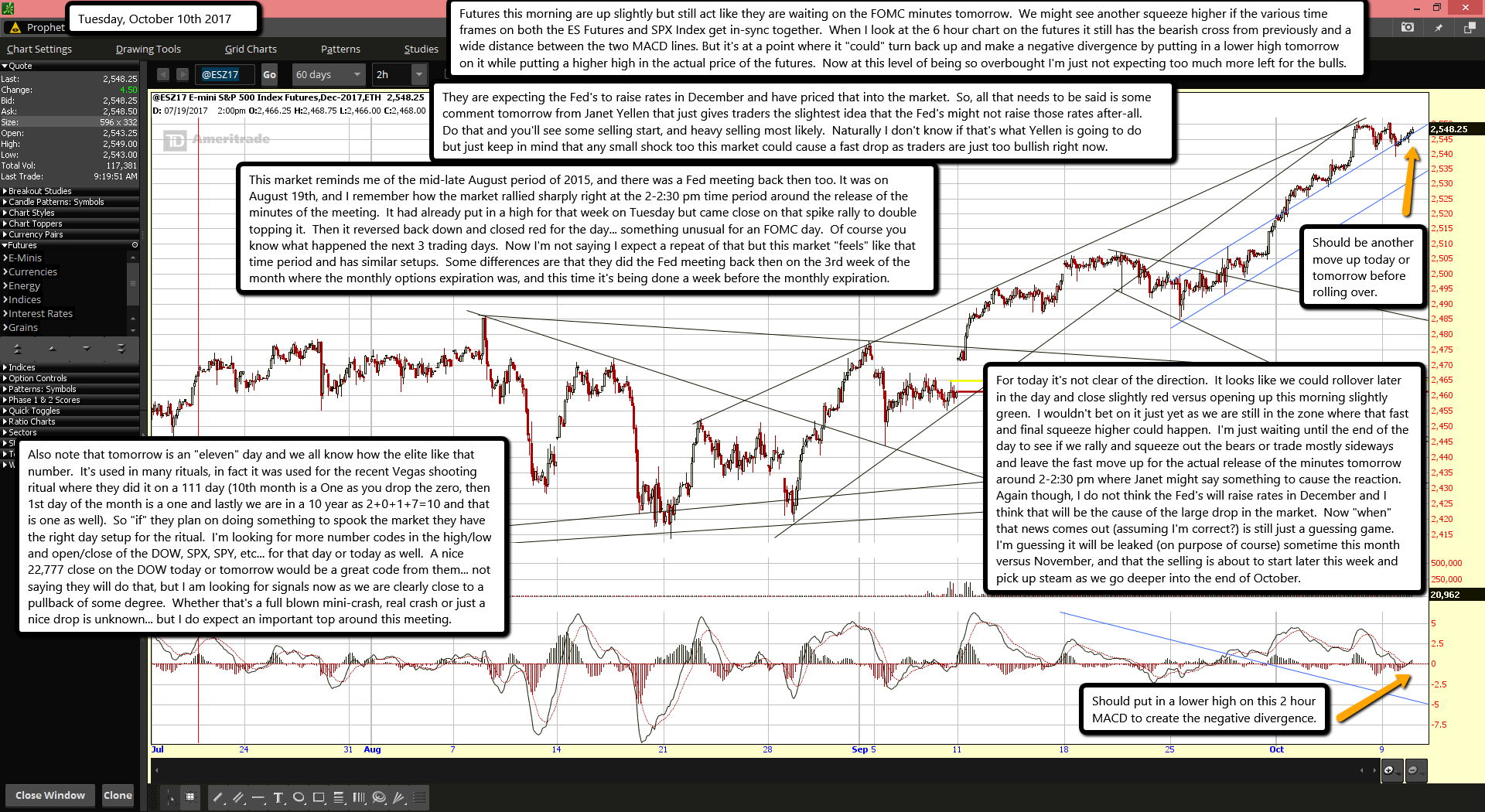

Futures this morning are up slightly but still act like they are waiting on the FOMC minutes tomorrow. We might see another squeeze higher if the various time frames on both the ES Futures and SPX Index get in-sync together. When I look at the 6 hour chart on the futures it still has the bearish cross from previously and a wide distance between the two MACD lines. But it's at a point where it "could" turn back up and make a negative divergence by putting in a lower high tomorrow on it while putting a higher high in the actual price of the futures. Now at this level of being so overbought I'm just not expecting too much more left for the bulls.

They are expecting the Fed's to raise rates in December and have priced that into the market. So, all that needs to be said is some comment tomorrow from Janet Yellen that just gives traders the slightest idea that the Fed's might not raise those rates after-all. Do that and you'll see some selling start, and heavy selling most likely. Naturally I don't know if that's what Yellen is going to do but just keep in mind that any small shock too this market could cause a fast drop as traders are just too bullish right now.

This market reminds me of the mid-late August period of 2015, and there was a Fed meeting back then too. It was on August 19th, and I remember how the market rallied sharply right at the 2-2:30 pm time period around the release of the minutes of the meeting. It had already put in a high for that week on Tuesday but came close on that spike rally to double topping it. Then it reversed back down and closed red for the day... something unusual for an FOMC day. Of course you know what happened the next 3 trading days. Now I'm not saying I expect a repeat of that but this market "feels" like that time period and has similar setups. Some differences are that they did the Fed meeting back then on the 3rd week of the month where the monthly options expiration was, and this time it's being done a week before the monthly expiration.

Also note that tomorrow is an "eleven" day and we all know how the elite like that number. It's used in many rituals, in fact it was used for the recent Vegas shooting ritual where they did it on a 111 day (10th month is a One as you drop the zero, then 1st day of the month is a one and lastly we are in a 10 year as 2+0+1+7=10 and that is one as well). So "if" they plan on doing something to spook the market they have the right day setup for the ritual. I'm looking for more number codes in the high/low and open/close of the DOW, SPX, SPY, etc... for that day or today as well. A nice 22,777 close on the DOW today or tomorrow would be a great code from them... not saying they will do that, but I am looking for signals now as we are clearly close to a pullback of some degree. Whether that's a full blown mini-crash, real crash or just a nice drop is unknown... but I do expect an important top around this meeting.

For today it's not clear of the direction. It looks like we could rollover later in the day and close slightly red versus opening up this morning slightly green. I wouldn't bet on it just yet as we are still in the zone where that fast and final squeeze higher could happen. I'm just waiting until the end of the day to see if we rally and squeeze out the bears or trade mostly sideways and leave the fast move up for the actual release of the minutes tomorrow around 2-2:30 pm where Janet might say something to cause the reaction. Again though, I do not think the Fed's will raise rates in December and I think that will be the cause of the large drop in the market. Now "when" that news comes out (assuming I'm correct?) is still just a guessing game. I'm guessing it will be leaked (on purpose of course) sometime this month versus November, and that the selling is about to start later this week and pick up steam as we go deeper into the end of October.