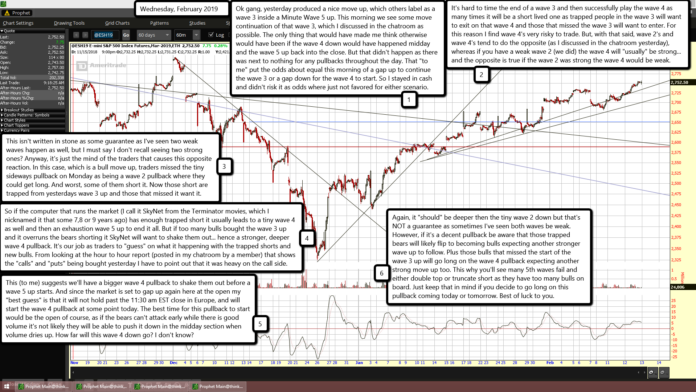

Ok gang, yesterday produced a nice move up, which others label as a wave 3 inside a Minute Wave 5 up. This morning we see some move continuation of that wave 3, which I discussed in the chatroom as possible. The only thing that would have made me think otherwise would have been if the wave 4 down would have happened midday and the wave 5 up back into the close. But that didn't happen as there was next to nothing for any pullbacks throughout the day. That "to me" put the odds about equal this morning of a gap up to continue the wave 3 or a gap down for the wave 4 to start. So I stayed in cash and didn't risk it as odds where just not favored for either scenario.

It's hard to time the end of a wave 3 and then successfully play the wave 4 as many times it will be a short lived one as trapped people in the wave 3 will want to exit on that wave 4 and those that missed the wave 3 will want to enter. For this reason I find wave 4's very risky to trade. But, with that said, wave 2's and wave 4's tend to do the opposite (as I discussed in the chatroom yesterday), whereas if you have a weak wave 2 (we did) the wave 4 will "usually" be strong... and the opposite is true if the wave 2 was strong the wave 4 would be weak.

This isn't written in stone as some guarantee as I've seen two weak waves happen as well, but I must say I don't recall seeing two strong ones? Anyway, it's just the mind of the traders that causes this opposite reaction. In this case, which is a bull move up, traders missed the tiny sideways pullback on Monday as being a wave 2 pullback where they could get long. And worst, some of them short it. Now those short are trapped from yesterdays wave 3 up and those that missed it want it.

So if the computer that runs the market (I call it SkyNet from the Terminator movies, which I nicknamed it that some 7,8 or 9 years ago) has enough trapped short it usually leads to a tiny wave 4 as well and then an exhaustion wave 5 up to end it all. But if too many bulls bought the wave 3 up and it overruns the bears shorting it SkyNet will want to shake them out... hence a stronger, deeper wave 4 pullback. It's our job as traders to "guess" on what it happening with the trapped shorts and new bulls. From looking at the hour to hour report (posted in my chatroom by a member) that shows the "calls" and "puts" being bought yesterday I have to point out that it was heavy on the call side.

This (to me) suggests we'll have a bigger wave 4 pullback to shake them out before a wave 5 up starts. And since the market is set to gap up again here at the open my "best guess" is that it will not hold past the 11:30 am EST close in Europe, and will start the wave 4 pullback at some point today. The best time for this pullback to start would be the open of course, as if the bears can't attack early while there is good volume it's not likely they will be able to push it down in the midday section when volume dries up. How far will this wave 4 down go? I don't know?

Again, it "should" be deeper then the tiny wave 2 down but that's NOT a guarantee as sometimes I've seen both waves be weak. However, if it's a decent pullback be aware that those trapped bears will likely flip to becoming bulls expecting another stronger wave up to follow. Plus those bulls that missed the start of the wave 3 up will go long on the wave 4 pullback expecting another strong move up too. This why you'll see many 5th waves fail and either double top or truncate short as they have too many bulls on board. Just keep that in mind if you decide to go long on this pullback coming today or tomorrow. Best of luck to you.