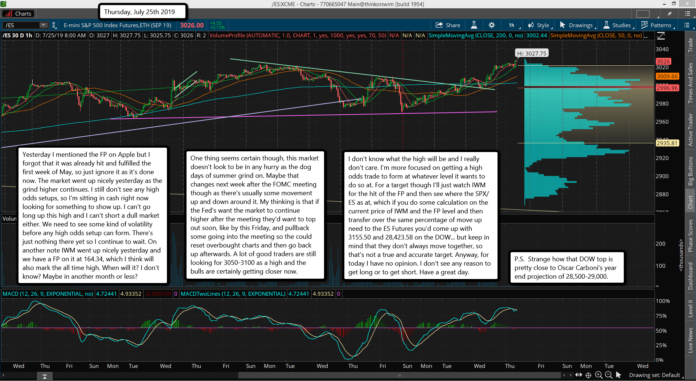

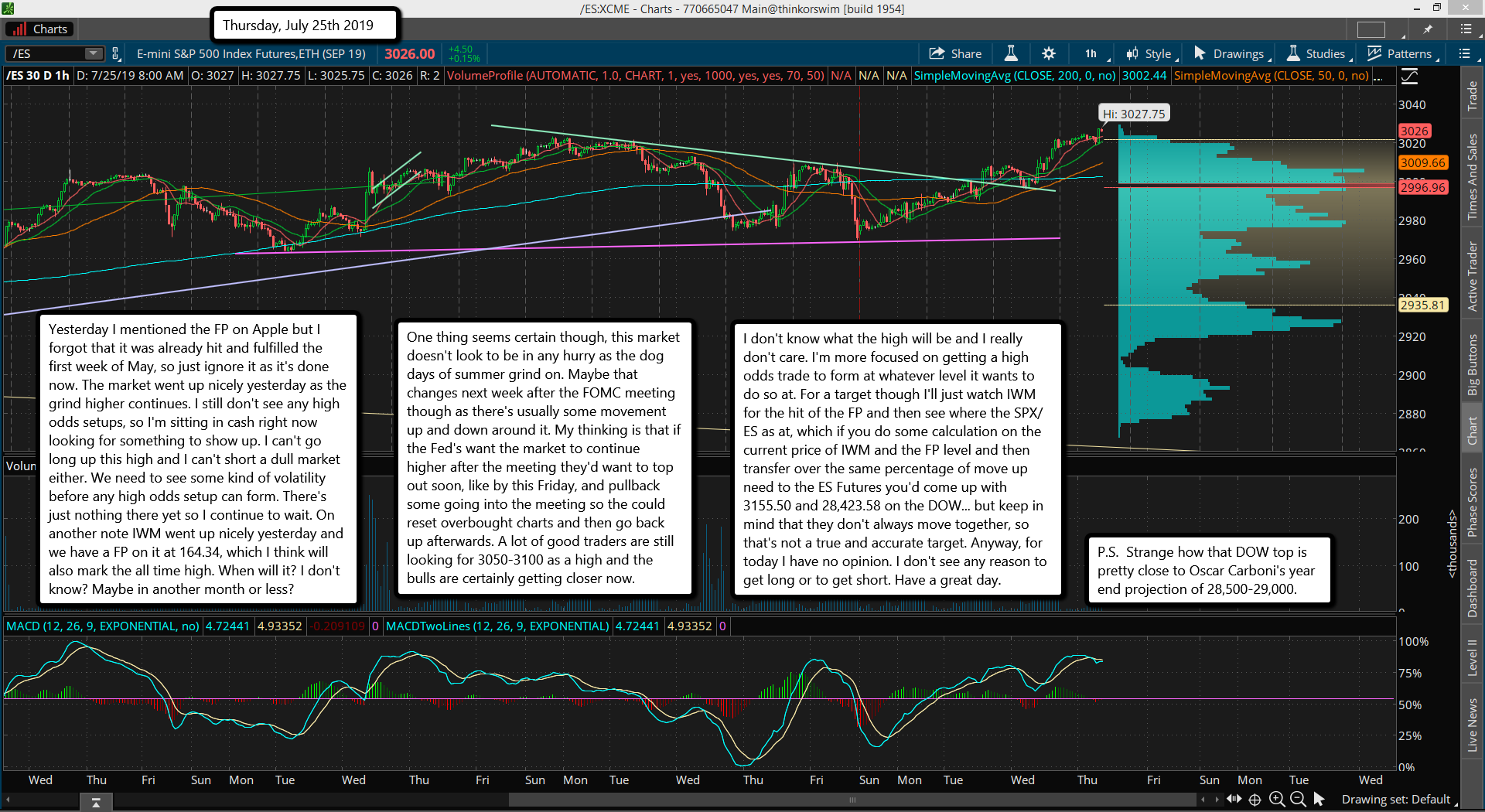

Yesterday I mentioned the FP on Apple but I forgot that it was already hit and fulfilled the first week of May, so just ignore it as it's done now. The market went up nicely yesterday as the grind higher continues. I still don't see any high odds setups, so I'm sitting in cash right now looking for something to show up. I can't go long up this high and I can't short a dull market either. We need to see some kind of volatility before any high odds setup can form. There's just nothing there yet so I continue to wait. On another note IWM went up nicely yesterday and we have a FP on it at 164.34, which I think will also mark the all time high. When will it? I don't know? Maybe in another month or less?

One thing seems certain though, this market doesn't look to be in any hurry as the dog days of summer grind on. Maybe that changes next week after the FOMC meeting though as there's usually some movement up and down around it. My thinking is that if the Fed's want the market to continue higher after the meeting they'd want to top out soon, like by this Friday, and pullback some going into the meeting so the could reset overbought charts and then go back up afterwards. A lot of good traders are still looking for 3050-3100 as a high and the bulls are certainly getting closer now.

I don't know what the high will be and I really don't care. I'm more focused on getting a high odds trade to form at whatever level it wants to do so at. For a target though I'll just watch IWM for the hit of the FP and then see where the SPX/ES as at, which if you do some calculation on the current price of IWM and the FP level and then transfer over the same percentage of move up need to the ES Futures you'd come up with 3155.50 and 28,423.58 on the DOW... but keep in mind that they don't always move together, so that's not a true and accurate target. Anyway, for today I have no opinion. I don't see any reason to get long or to get short. Have a great day.

P.S. Strange how that DOW top is pretty close to Oscar Carboni's year end projection of 28,500-29,000.