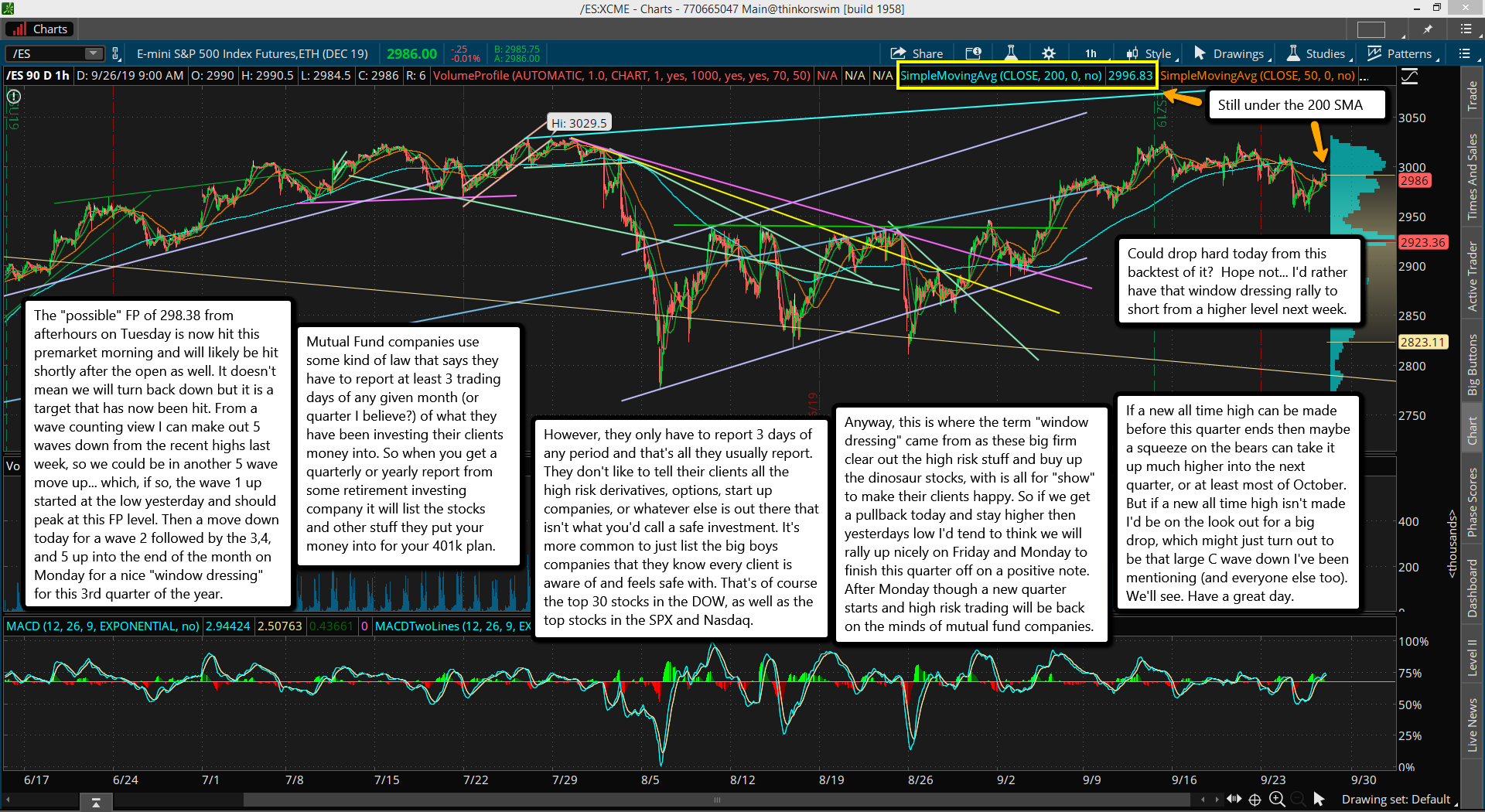

The "possible" FP of 298.38 from afterhours on Tuesday is now hit this premarket morning and will likely be hit shortly after the open as well. It doesn't mean we will turn back down but it is a target that has now been hit. From a wave counting view I can make out 5 waves down from the recent highs last week, so we could be in another 5 wave move up... which, if so, the wave 1 up started at the low yesterday and should peak at this FP level. Then a move down today for a wave 2 followed by the 3,4, and 5 up into the end of the month on Monday for a nice "window dressing" for this 3rd quarter of the year.

Mutual Fund companies use some kind of law that says they have to report at least 3 trading days of any given month (or quarter I believe?) of what they have been investing their clients money into. So when you get a quarterly or yearly report from some retirement investing company it will list the stocks and other stuff they put your money into for your 401k plan.

However, they only have to report 3 days of any period and that's all they usually report. They don't like to tell their clients all the high risk derivatives, options, start up companies, or whatever else is out there that isn't what you'd call a safe investment. It's more common to just list the big boys companies that they know every client is aware of and feels safe with. That's of course the top 30 stocks in the DOW, as well as the top stocks in the SPX and Nasdaq.

Anyway, this is where the term "window dressing" came from as these big firm clear out the high risk stuff and buy up the dinosaur stocks, with is all for "show" to make their clients happy. So if we get a pullback today and stay higher then yesterdays low I'd tend to think we will rally up nicely on Friday and Monday to finish this quarter off on a positive note. After Monday though a new quarter starts and high risk trading will be back on the minds of mutual fund companies.

If a new all time high can be made before this quarter ends then maybe a squeeze on the bears can take it up much higher into the next quarter, or at least most of October. But if a new all time high isn't made I'd be on the look out for a big drop, which might just turn out to be that large C wave down I've been mentioning (and everyone else too). We'll see. Have a great day.