(Post wrote on the weekend)

Last Friday did not give us the last higher high that I was hoping for, so today is the last chance to setup a big drop. Another higher high is needed as the turn date window was from the 22nd to 25th and if it pulls back and makes a low then I'll have to say it flipped and produced a bottom instead of a top (meaning it's skipped).

Ideally we hit and pierce through the FET of 5334 on the ES and 5296 on the SPX as well, but certainly not required as it could just be a point higher. Like I said previously the FET could fall shy or piece and we are close enough to it with the current high put in last week.

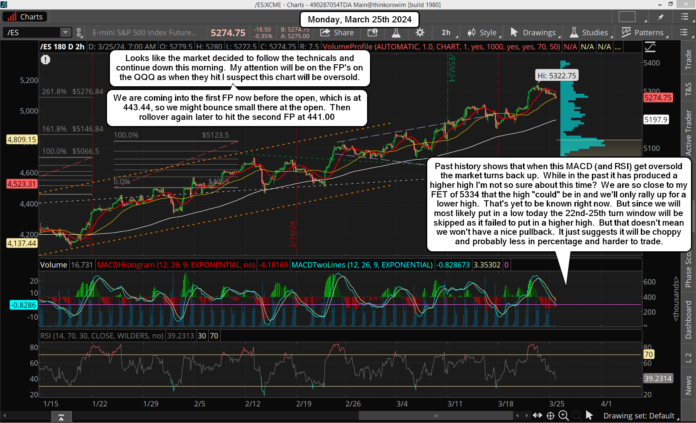

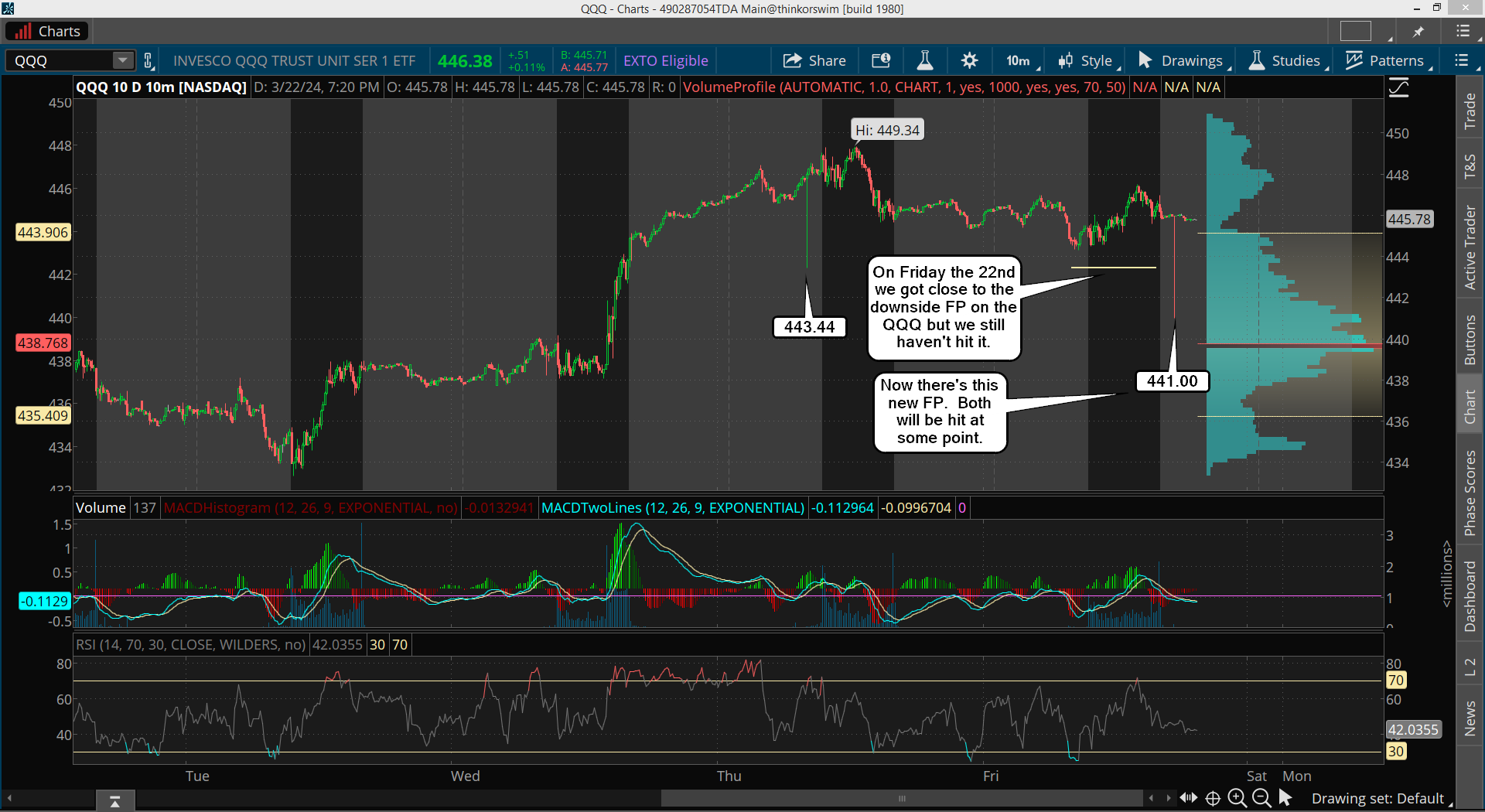

I exited my short at the close Friday at a breakeven as I just didn't like the way the market looked and felt. We pulled back small and got close to the FP on the QQQ but never hit it. I just didn't want the time decay over the weekend and decided that cash is a safe position when I don't know which direction it's going first on Monday. If we drop to the FP, (and we got another one after the close Friday that it lower), then I'll look for a long as the RSI and MACD's will likely be oversold on the 2hr chart for sure, but it could also be on the 6hr too. Here's that new FP...

So there's the 443.44 FP that failed to hit on Friday, and the new 441.00 FP after the close, which is probably around 5250-5260 on the ES I'd estimate. It's very frustrating to "not" get a setup for a nice correction, but you can't make the market do what you want it to do.

So I'm really rooting for a nice squeeze Monday to hit the FET and then reverse back down to start that correction. I would still be leary with those FP's there as typically they don't put out FP's like this if they plan on a short term correction and not just another dip to be bought. Most of the time the Fake Prints will be levels that they plan to pullback to and then turn back up, but I do find it odd that they put out a second downside FP before they even filled the first one.

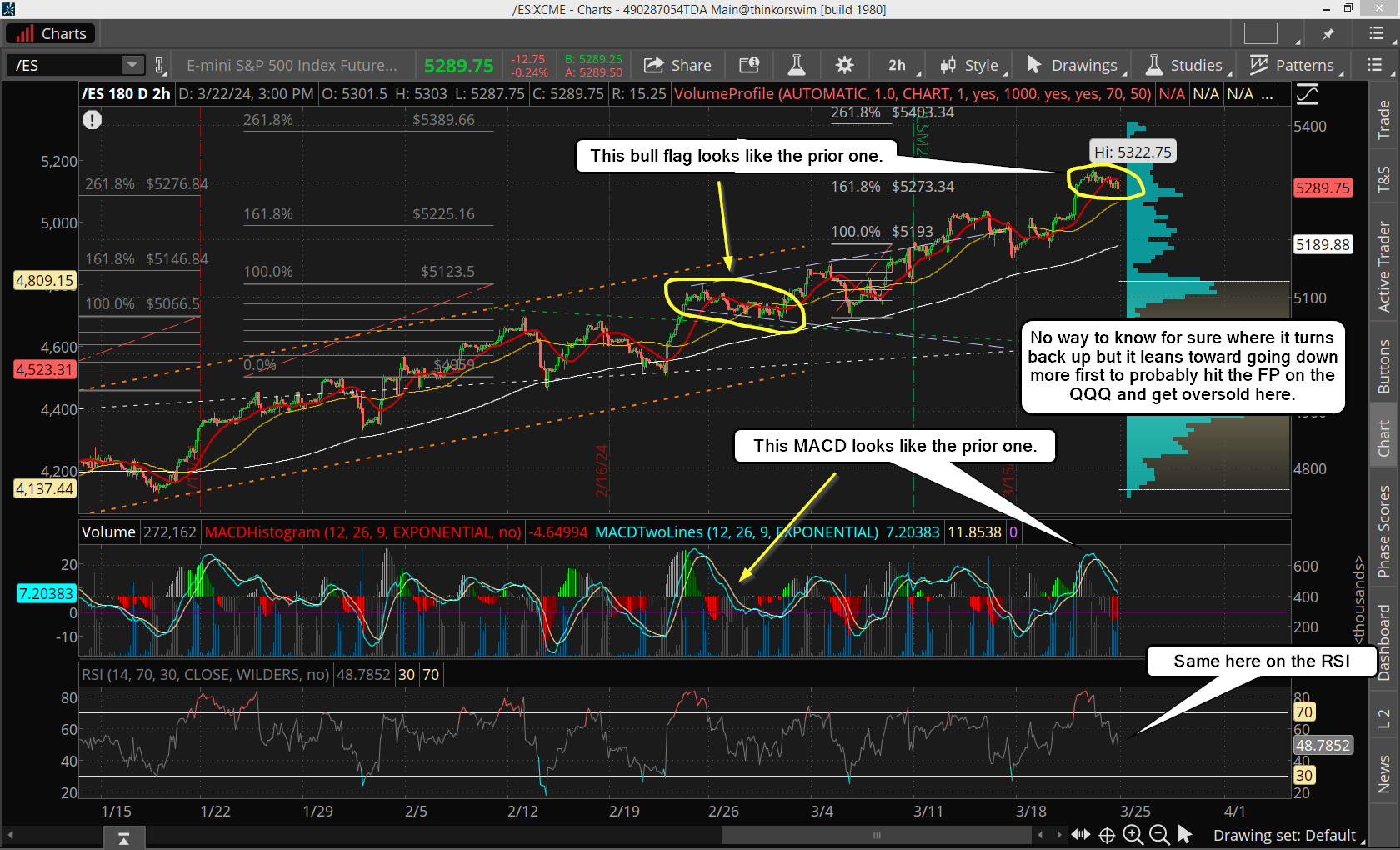

As for the technicals the MACD and RSI on the 2hr chart turned down sharply from Thursday into Friday but the price didn't drop much. It looks a lot like the bull flag that was made from 2/23 to 2/29, and while it looks like it's got lower to go on this screenshot from Friday it could turn back up anytime.

I normally would think that this pattern would play out by going lower to get fully oversold first on Monday, and there's the FP's on the QQQ to support that line of thinking... but since we are still in the "turn window" I can't rule out that it turns back up from where it ended Friday and makes that last rally back up instead.

Then we rollover and drop to hit the FP's and ideally keep going to start the much needed correction that everyone is wanting. We have several things that support this, which of course the first one is the turn window. Then there's the fact that Monday is a Full Moon and we also a Lunar Eclipse is the 24th-25th. Plus we are close to a Solar Eclipse on April 8th. Lastly we have my Fibonacci Extension Target that is super close too. Many reason that we could get a nice correction, but we MUST rally to a higher high first.

My thoughts on this are that the turn window will be skipped so that the market doesn't put in a major top, as if it does then a larger drop would be needed, and it would have to bottom into another turn date. I just don't think they will do it. Instead I think they bypass it and put in a low Monday.

Then Tuesday or Wednesday we rally back up into the end of the week, which is Thursday because we are closed on "Good Friday" for the holiday. Usually light trading happens during holiday weeks, which supports the bulls of course.

The FP's on the QQQ tell me that's where the bottom is likely going to be at before the turn back up. As for which one? Well, I have to go with the deepest one at 441.00 for the target. I think that would put the ES in the 5250 zone most likely. It's just a rough guess as they don't track each other as close as the SPY would to the SPX and the ES, but that's my best guess.

So, unless we start off Monday with a strong rally up odds favor this scenario. It would suggest a small bounce early in the day that hits overhead resistance and can't get through it. Then it rolls over to head to the FP's into the the close or Tuesday morning. Resistance is around the 5300 zone now as you can see in the chart above.

Now the bounce back up will the the "tell-tale" sign I think as it might not clear that same resistance on the way back up? I just don't know? While I would love to see that last squeeze higher to hit 5334+ it might fail.

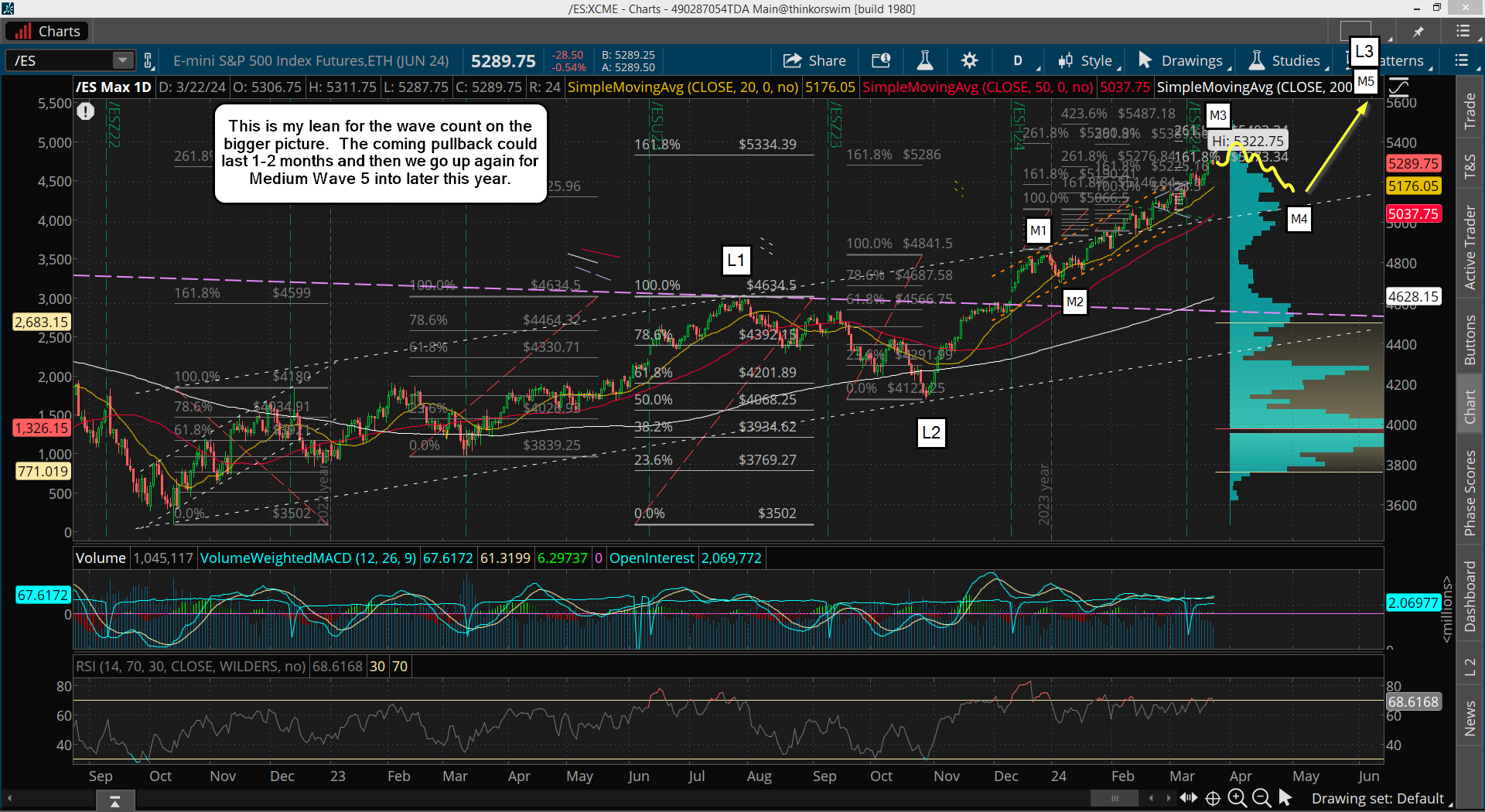

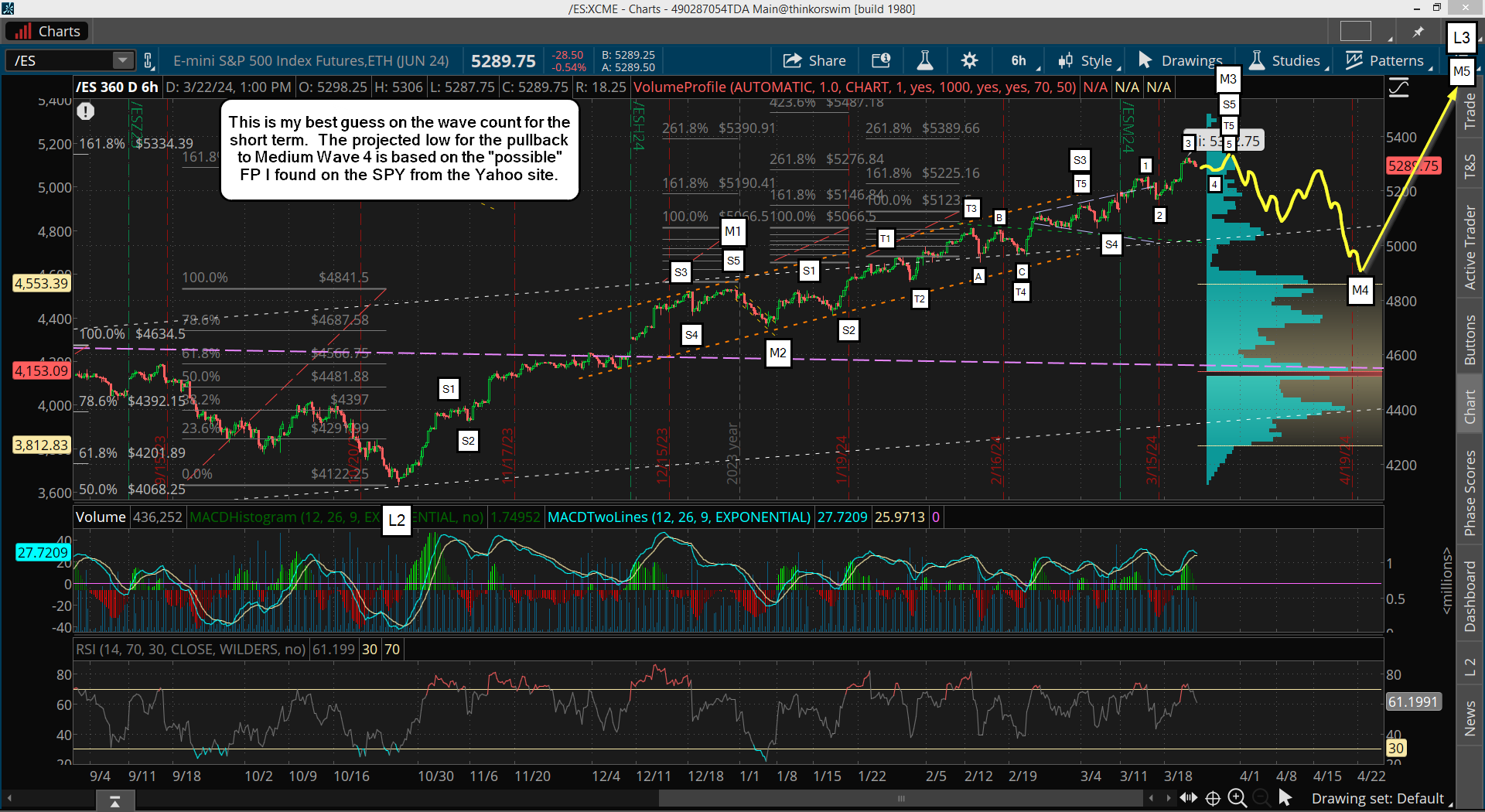

Next, let's go over the wave count. Below is the bigger picture chart...

I've moved around some of the waves a little based on where I think we are at now and what should follow. I don't think we have finished Medium Wave 4 down basically. I think that's the wave we will see into April for the coming correction.

Here's the short term..

On this chart you can see I did my best to label the Small Waves, Tiny Waves and even the Extra Tiny Waves. I think the pullback to the FP's on the QQQ will be Extra Tiny Wave 4 and then we'll get Extra Tiny Wave 5 up later this week to make another higher high. That's where we should reach the FET of 5334 and complete T5, S5 and M3... and then we start a correction for Medium Wave 4 down.

If this all plays out like I think then we could reach the "possible" FP on the SPY sometime into mid-April to end the correction. The Solar Eclipse is on April 8th so that could be the biggest and scariest part of the drop, (the Small Wave C?) but it might chop around the low for another week or so before putting in the final low. Hard to know for certain, but I would look for this to unfold in an ABC pattern with the C wave subdividing into 5 smaller waves, plus the A wave as well. The B up could be just one wave or subdivide into a 3 wave pattern. That's all I have for now.

Have a blessed day.