Yesterday I said there was an FOMC meeting and a CPI release, but I was wrong. It was only Jay Powell speaking and the CPI is this morning. I got my days off it seems... sorry about that. The market did what felt like a blow off squeeze the last part of yesterday, and with the CPI this morning that could be the case?

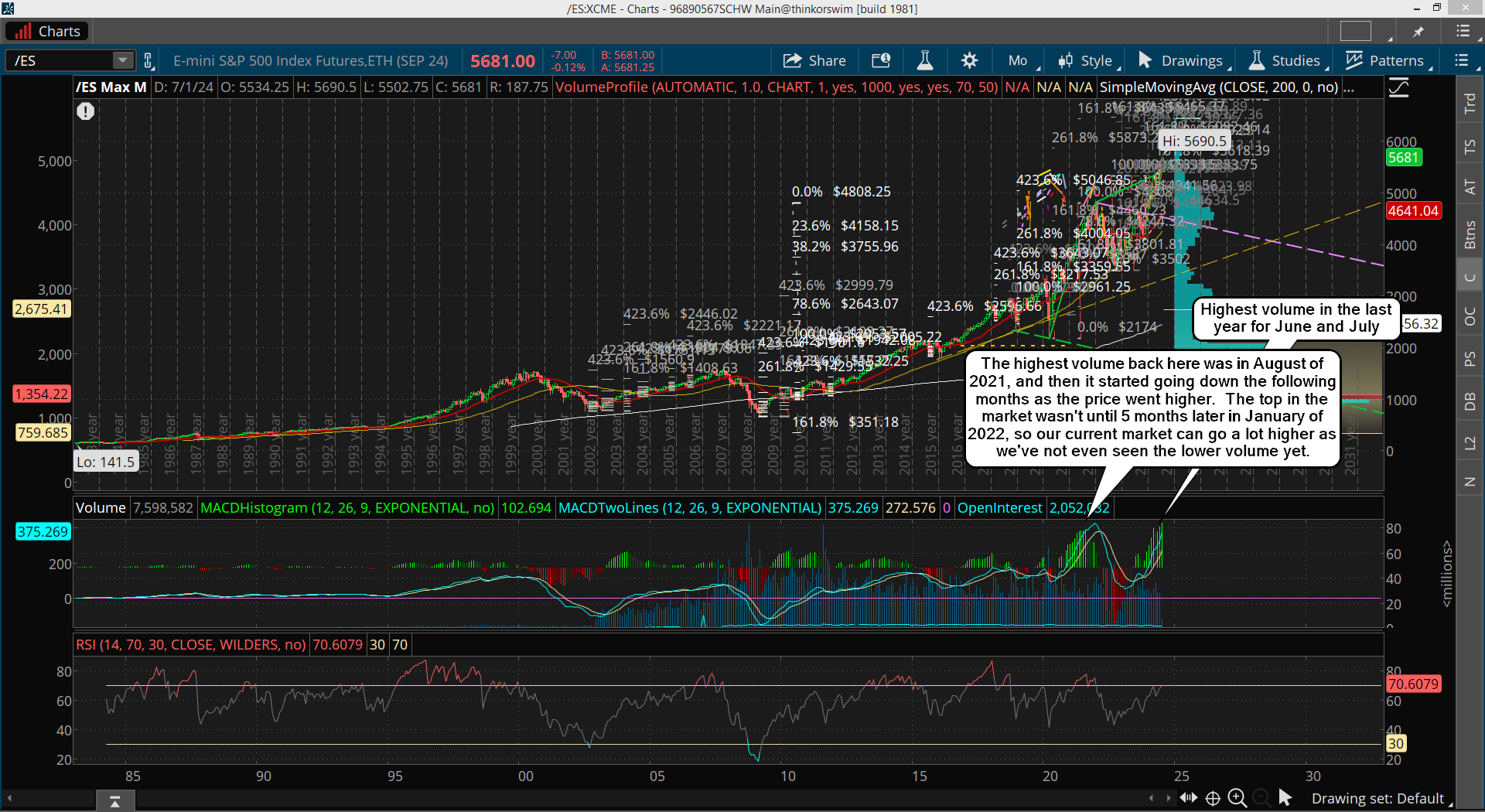

It's very overbought on most all time frames, so while the pullback might not be much in price (several hundred points), or percentage (4-6% ?), I do think it's going to require more "time" to play out. Meaning it should not be a 2-3 day event but instead it should drag out for 2-3 week I think. That's because the technicals will need that much time to cool off and reset before making another strong push higher. But everything points to that happening into late this year with 6000+ very possible.

The monthly chart is still very bullish, and the June closing candle actually put in a higher volume then the prior months. That means too me that as long as there is higher volume the market will go up more. It's only when you see a divergence between the volume and price that you know a top is near.

Currently that's not the case as volume continues to be strong. Where is that money coming from you ask? I don't know but possibly from foreign investors as they think our US Market is safer then theirs. And of course we don't know for sure but it's likely the Fed is pumping money into it to try and prop up the economy for "weekend at Bidens".

Regardless of who is doing it the facts are the facts, last months volume was the highest in the last year plus, any pullback we get in the coming weeks will be bought and another higher high in the following months will follow.

Have a blessed day.