BRIGHTON — Colorado wind power is rising with 1,880 huge turbines erected across the prairie, twisting white blades as long as soccer fields, a cleaner source of energy replacing fossil fuels.

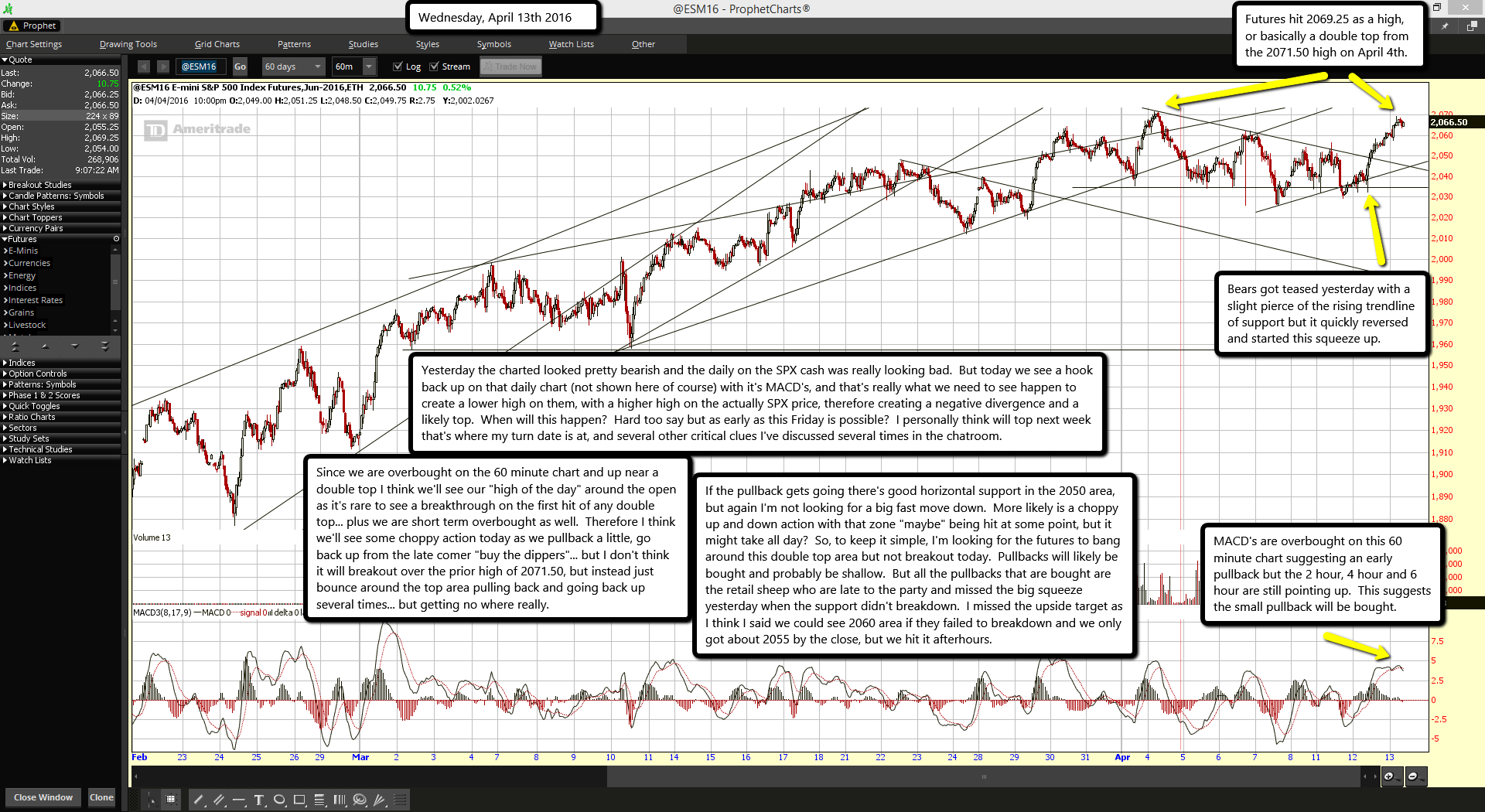

It has reached the point where the wind turbines generated 67 percent of Xcel Energy's Colorado-made electricity for one early morning hour in November, and 54 percent for two 24-hour periods in October

— feats unmatched around the nation, industry officials said Tuesday.

Falling costs, a state mandate, a federal subsidy and sheer momentum are driving the shift to renewable energy.

The proliferation of turbines here — doubling the number in 2009 — reflects a takeoff of wind power nationally that has cut carbon dioxide emissions by 132 million tons, American Wind Energy Association research director Michael Groggin said.

Giant Vestas wind turbine blades loaded on a train awaiting delivery at the plant April 12, 2016. (

Andy Cross, The Denver Post)

"That's the equivalent of taking 28 million cars off the road, and this is going to help Colorado comply with the Clean Power Plan," Groggin said.

Shifting from coal and gas to wind power "will help bring the United States into compliance with international climate change commitments. It will show that the U.S. can be a leader," he said.

Politicians and investors are embracing the shift. Long a backer of oil and gas extraction along the Front Range, Gov. John Hickenlooper on Tuesday opened a national industry forum at a Vestas Americas turbine factory

in Brighton — one of four Vestas plants in the state that employ 3,700 workers.

"This is a state issue for us. We view it as one of our highest priorities," Hickenlooper said.

Colorado initially looked to natural gas as bridge away from coal-fired electricity, but "wind is going to take an increasingly large share of that as well," he said.

Today, "wind turbine technician" ranks as the fastest-growing occupation, according to the U.S. Bureau of Labor Statistics.

Utility giant Xcel Energy is playing a key role, purchasing electricity from 21 Colorado wind farms.

"We've cultivated wind as our most cost-effective renewable energy option because we recognize that this source of energy is not only a benefit to the environment but also a major economic driver for the state," Xcel's Colorado operations president David Eves said. "Our plan is to expand our wind offerings to provide hundreds of new jobs for Coloradans, make a billion dollars in new investments, keep energy costs low for our customers, and improve the environment."

On Tuesday, Eves and Vestas Americas chief Chris Brown announced a plan to build Colorado's largest wind farm. If the Public Utilities Commission approves, the eastern plains project would add 300 more wind turbines and produce 600 megawatts of electricity.

Congress has extended the federal government subsidy for the wind power industry until the end of this year, boosting incentives to build before a gradual phase-out.

Xcel supplies 65 percent of Colorado residents and currently generates 2,566 megawatts of electricity from wind, or about 25 percent of demand. In comparison, more than half Xcel's electricity comes from coal and 1 to 2 percent comes from solar sources.

Colorado lawmakers in 2004 initiated change, passing a renewable energy standard requiring public utilities to use wind and solar to produce some of their electricity. Lawmakers twice have increased that percentage. By 2020, 30 percent of electricity must come from renewable sources.

Xcel already averages in "the high 20s," a spokesman said. The surges where 67 percent and 54 percent of electricity came from wind occurred on windy days when overall electricity use by residents was relatively low.

Overall, Colorado utilities on average produce 14 percent of electricity from wind turbines, ranking the state among national leaders. Iowa leads at 31 percent.

One reason wind has advanced is forecasting. National Oceanic and Atmospheric Administration meteorologists analyze energy potential from wind and try to give utility grid operators several hours, and sometimes days, of notice when wind will be strong.

This allows operators to adjust the grid draw wind power, rather than from coal or other sources, when it is available.

Governor Hickenlooper hails rise of wind power at Vestas plant on April 12, 2016. (

Bruce Finley, The Denver Post)

Industry analysts said wind's role will continue to expand.

And Vestas CEO Brown said the massive fiberglass blades made in Brighton may expand, too.

While installation of more transmission lines will be essential, shifting to clean energy in the future will hinge on "capturing more wind" with blades, he said.

Even a 1-meter lengthening of blades that now stretch 100 meters from tip-to-tip could more than double the amount electricity produced, he said.

"We want to have taller towers and bigger blades," he said

Steven Mufson covers the White House. Since joining The Post, he has covered economics, China, foreign policy and energy.

Steven Mufson covers the White House. Since joining The Post, he has covered economics, China, foreign policy and energy.

Mike DeBonis covers Congress and national politics for The Washington Post. He previously covered D.C. politics and government from 2007 to 2015.

Mike DeBonis covers Congress and national politics for The Washington Post. He previously covered D.C. politics and government from 2007 to 2015.