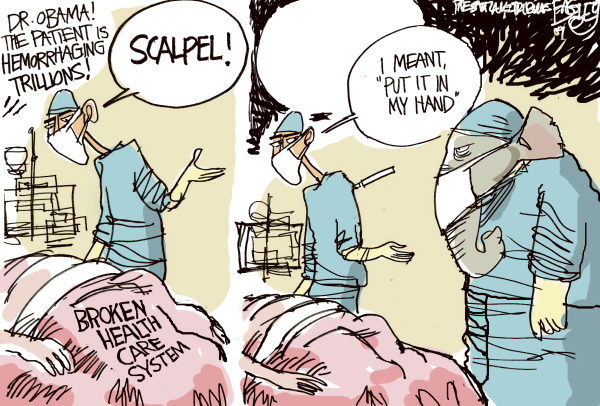

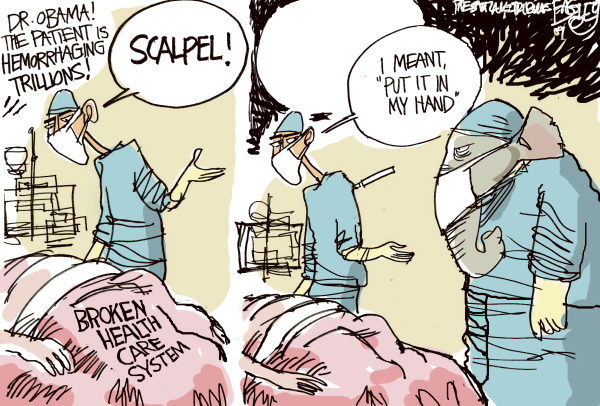

Looks like Obama will get the health care bill passed after all (even if the Republicans don't like it). Will it be good for the public or bad? I've heard nothing but bad, but I truly don't know until it's out and in the system. Let's hope it's a positive, as all American's need it.

I'm not going into a long post tonight as it's been a long day for me, and my brain isn't working too well. I will say that today appeared to be a simple "fake-out" move, as so many people expected the market to sell off on the health care bill, which of course means the market will do the opposite.

The big institutions knew that many traders went short on Friday, expecting the bill to pass, so they had to rally up and squeeze them out. Now that doesn't mean that the market is going to dump tomorrow. The institutions will first squeeze out the shorts, if they didn't do so today, and then a sell off should happen.

Besides the short squeeze, the market was also propped up for the passing of the bill. It wouldn't look good on Obama if the markets dumped on the very day that the bill passes. They don't want it to appear obvious do they? Of course not. But if the market dumps later this week, then they can blame it on the jobs report or something... but not the health care bill.

It's just a game of "slight of hand" that they play. Regardless, I still believe it will fall this week. I think the target for the coming fall is around the 107.38 spy level, as that where I caught a fake print back on March 6th, 2010. Sundancer caught one at 107.82, so somewhere in those areas is where the likely move down will end, or pause.

Of course this isn't going to happen overnight, as the 1150 spx level must be taken out first, then the 1115 spx will be the next major level. It's coming though... I'll really be interested to see if the month closes out above or below the 1115 level. That should tell us a lot about the future direction of the market.

Red

Intel – INTC monthly setup

max contain on monthly = 22.30

http://www.flickr.com/photos/47091634@N04/44572…

Microsoft – MSFT monthly setup

short with monthly close below teal(26.68) & purple(27.98)

http://www.flickr.com/photos/47091634@N04/44572…

US Steel – X Monthly setup

teal line = 62.78

http://www.flickr.com/photos/47091634@N04/44564…

Chesapeake Energy – CHK Monthly Setup

rejected @ max contain ($27)

purple line = 17

http://www.flickr.com/photos/47091634@N04/44572…

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1155 – 1170. I think a move to 1200 is underway. First upside target is 1175.

1147.75 -1163.25 actual yesterday (15.50 points)

1164.75 (last night's high)

1155-1170 estimate for today (15 points)

1163.50 currently, so estimate is -8.50 to +6.50 from here (neutral)

$DJI monthly setup

max contain = 10,844.42

http://www.flickr.com/photos/47091634@N04/44565…

Thank you – I follow the $NYMO. We are at similar levels on the $NYMO as we were on at the beginning of Jan. before the fall but it looks like we could still bounce around before plunging through the 0 line. Coincides with Dread's charts – might take a week or so to pull out of this. Just hope we don't close higher on the SPX. If/when we get to an oversold reading on the $NYMO, I will have to cover.

http://stockcharts.com/h-sc/ui?s=$nymo

This is so very strange. The DJIA has to get it up but the other indexes have to stay cool so the divergence is growing between them. Very odd that one can move up while the others are stagnant.

the $DJI is the only index that hasn't tested the high of it's 10/08' candle yet, which is coincidentally @ 10,882.52

the SPY 117.773 tick from friday may come into play

OK, hope not but thanks for the heads up.

AAPL still not making new highs. Unbelievable.

AAPL's regulatory limit = 229.34

New limit? Oye veh.

limit hasn't changed, remember AAPL high = Pi (22/7)

AAPLPi ritual is coming up in a week and a half on April fools day this year since East-star is on the 4th.

Yes, I remember everything you say. Interesting. Just hope the joke isn't on me! Wish they would get this up move overwith.

X going straight up. really unbelievable.

My inter day system is approaching a sell signal, but no confirmation yet. There is no guaranty as we may have a 200 dow pt plunge and then the Sell is over.

Intra day system is showing some minor distribution. Nothing material yet.

Another Maalox and rosary day for the over leveraged bulls and bears.

maalox for me, thank you very much!

If you don't mine my asking, what % of your portfolio is in 3x inverse?

100%. Am I crazy and stupid? Yes, I know that now.

Neither one. Just being on the learning curve. 🙂 Being there done that.

If you like, I can lend you the signals from my systems to help you recoup the drawdown.

Thanks SC for comforting me! Yes, as soon as I cover, I need to figure out a better way to do this and any help I can get would be much appreciated. All of you have been really helpful and I can't thank you enough.

Did you create your own systems?

Yes. The book I mentioned to you before, is a good place to start. I wish it was available when I first got started. 🙂

There is no secret out there, Monica. Everything is just a different rendition of what is available publicly. But everyone is keeping his/her own recipe secret. The thing is, once you know how to cook, you can create your own secret recipe. That book will show you what you need to know and how to learn what you need to learn.

I have also invested (a better term than SPENT) a ton of money in books, subscriptions, databases over the years. From all those, I managed to learn the principles behind the methodologies.

Now, you can go through all that or you can get a jump start by reading Part III (first edition) of that book I mentioned. 🙂

I blew a 6 figure portfolio once. 🙂 There is no glory, honor, profit nor special enlightenment in doing that. 🙂 I count my blessing that I was young and didn't have someone who would have kicked me out back then. LOL Blowing 6 figures was so easy. It was just numbers on paper. Didn't mean anything. lol If you want to know how I blew it, I did it by fighting a run away market.

SC, what book are you referring to.

Hi guys, Corey Rosenbloom is an analyst I respect and isn't biased like me. Interesting article he posted.

http://blog.afraidtotrade.com/strange-similarit…

Nevermind. Misread.

Carl is Long one unit at 1162.75

Earl, YOu in anything today.

I'm in TNA at the moment.

Trade Your Way To Financial Freedom, by Van Tharp. First edition. Part III is most important. Don't get discouraged if you can't get all the maths, as the equity market is less volatile in terms of random spikes than commodities, and thus you don't have to be over worried about covering your ass… I mean portfolio. The principles are the keys.

I don't know about the second edition.

Thanks, I will try and find first edition.

Thank you SC – I better go get the book!

$DJI Daily containment pts.

http://www.flickr.com/photos/47091634@N04/44579…

as you see every containment pt. gets re-tested from the opposite side it broke, yellow line is next to get re-tested

red line = 10,849.35

operators closed the $DJI @ 10,888

tomorrow is 3.24

24/3 = 888

And the 10th anniversary of the dot com bust! Unfortunately though, I don't think the operators are as smart as you!

I know where that SPY 117.773 tick came through on Friday

$SPX next containment pt. is @ 1178.73

http://www.flickr.com/photos/47091634@N04/44572…

Just got back to see that X and DJIA got to containment. Sundancer, how do we know that they just won't keep setting higher containment points? If this is true on the SPY then 3/17 is no longer significant, no? And how can the down go back to retest if the SPX needs to get up to 1178.73? I think I need to cover.

Meant to write, how can the DOW go back and retest if SPY needs to climb higher?

look @ this chart everyday so emotions don't take over

http://www.flickr.com/photos/47091634@N04/44500…

the $SPX has to re-test it's containment pt. along with the $DJI

if we get a higher close than 3.17 than the two long term sequences break synergy

it's all about what your time frame is & if you have levered instruments, leverage will kill anybody's trading account, options, futures

with 3x etf's your concerned with exponential decay

OK – thank you. Yes, I have time decay going against me on the 3X ETFs but I think at this point I am stuck.

I hope you don't mind the questions but does breaking synergy (based on the higher close today) mean that a longer term top is no longer clear and that after we retest containment we could go even higher?

for those trading the IYR, it's currently coiling on back of a daily containment pt.

http://www.flickr.com/photos/47091634@N04/44572…

it's next containment is in the 53 range, where the crash gap is @

GS down today hummmm

please get there today g-d!

Not gonna happen. Still have more days of this I guess.

tomorrow is the 10 year anniversary of the S&P dot com high, were you involved in the capital markets back then

I was but to as an assistant to a head market maker. Put us out of business.

yeah dot com liquidated a lot people,

the market is a revolving door with people

we're getting close to liquidating the number of people we liquidated during the 08' crash, their handy dandy oscillators got stretched to the stratosphere and people don't have the capital capacity to stay in the game

Well, if we don't turn around in the next couple of days, I will be liquidated as well.

Carl at day’s end:

1155-1170 estimate today for /ES (15 points)

1159 -1170.50 actual today (11.50 points)

Nice call on the high.

Trades:

In /ES at 1162.75, did not sell, up 6.25 after hours.

Grade B

He saw that breakout coming. I did not. Still green on my DRV trade, still holding.

Carl seems to be holding over night. I have TNA and not sure whether to hold overnight or not.

$TRAN not confirming the new high. $DJUSRE not confirming the new high. TNA is up over 10% since Monday's open. Probably time for $RUT to take a breather and retrace. TZA never seems to put in a V shaped bottom, so you will likely have another chance to pick it up this low.

Me to Dread.

There will be some sort of new home sales number tomorrow morning. Might be important for DRV.

TZA opened up 0.4%. Gap was filled. TZA was up 1.0% at the high, and closed down 3.6%.

We are in a New Moon Trade, which favors TZA.

Following AmericanBulls guidelines, this trade sold TZA at the open at $7.05.

After six days, this trade is down 4.1%, and in cash.

Volume for TZA was nearly as high as yesterday, which was the highest of the last 29 days.

$RVX (VIX for $RUT) closed down 3.6% with TZA down 3.6%. No divergence.

TZA has now been down 4 of the last 8 days — chop.

The low for TZA today was $6.79, the lowest TZA price since the origin of the written word. Bad for TZA.

Ultimate Oscillator for TZA bottomed at 20 twenty one trading days ago and has generally risen since then but has remained below 50 and is currently 33. Indicating continued weakness for TZA. Two days ago was highest of the last 22 days, but a 9 point drop in these last two days crushed that definite up trend. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s black candle fell to the bottom of the congestion area and below the Bollinger mid-line (20 day MA). MACD has crossed from below and looks flat. Looks like $RVX will be falling. Bad for TZA.

Bollinger Bands for $RUT: The large white candle for $RUT pushed up towards the top Bollinger band. Looks like what I thought was a topping process for $RUT may have been a fake top, as today’s candle made a new (on the 3month chart) high, and looks like the beginning of another rally. MACD was getting ready to cross down, but now seems to be rising again. Bad for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s white candle rose above the congestion area. The upper Bollinger Band seems to be falling. Looks like what had looked like a topping process was more of a coiling. Bad for TZA.

TZA had a much lower high, lower low and lower close – bad for TZA.

Money flow for the Total Stock Market was $528 million flowing into the market on an up day.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks like TZA will fall tomorrow.

The Daily view from Americanbulls

TNA has a confirmed BUY signal today. The candlestick today was a White Candlestick (normal buying pressure).

AmericanBulls’ buy price was $55.69 (opening price).

TZA has a confirmed SELL signal today. The candlestick today was a Black Candlestick (normal selling pressure).

AmericanBulls sell price was $7.05 (opening price). While the most recent TZA buy was in place, TZA went from $7.12 to $7.05, down 1%.

Summary of $RUT based ETFs:

Confirmed BUY: IWM (1x), UWM (2x), TNA (3x)

Confirmed SELL: RWM (-1x), TWM (-2x), TZA (-3x)

Action for tomorrow: none

The Daily view from Americanbulls

TNA has a confirmed BUY signal today. The candlestick today was a White Candlestick (normal buying pressure).

AmericanBulls’ buy price was $55.69 (opening price).

TZA has a confirmed SELL signal today. The candlestick today was a Black Candlestick (normal selling pressure).

AmericanBulls sell price was $7.05 (opening price). While the most recent TZA buy was in place, TZA went from $7.12 to $7.05, down 1%.

Summary of $RUT based ETFs:

Confirmed BUY: IWM (1x), UWM (2x), TNA (3x)

Confirmed SELL: RWM (-1x), TWM (-2x), TZA (-3x)

Action for tomorrow: none

TZA opened up 0.4%. Gap was filled. TZA was up 1.0% at the high, and closed down 3.6%.

We are in a New Moon Trade, which favors TZA.

Following AmericanBulls guidelines, this trade sold TZA at the open at $7.05.

After six days, this trade is down 4.1%, and in cash.

Volume for TZA was nearly as high as yesterday, which was the highest of the last 29 days.

$RVX (VIX for $RUT) closed down 3.6% with TZA down 3.6%. No divergence.

TZA has now been down 4 of the last 8 days — chop.

The low for TZA today was $6.79, the lowest TZA price since the origin of the written word. Bad for TZA.

Ultimate Oscillator for TZA bottomed at 20 twenty one trading days ago and has generally risen since then but has remained below 50 and is currently 33. Indicating continued weakness for TZA. Two days ago was highest of the last 22 days, but a 9 point drop in these last two days crushed that definite up trend. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s black candle fell to the bottom of the congestion area and below the Bollinger mid-line (20 day MA). MACD has crossed from below and looks flat. Looks like $RVX will be falling. Bad for TZA.

Bollinger Bands for $RUT: The large white candle for $RUT pushed up towards the top Bollinger band. Looks like what I thought was a topping process for $RUT may have been a fake top, as today’s candle made a new (on the 3month chart) high, and looks like the beginning of another rally. MACD was getting ready to cross down, but now seems to be rising again. Bad for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s white candle rose above the congestion area. The upper Bollinger Band seems to be falling. Looks like what had looked like a topping process was more of a coiling. Bad for TZA.

TZA had a much lower high, lower low and lower close – bad for TZA.

Money flow for the Total Stock Market was $528 million flowing into the market on an up day.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks like TZA will fall tomorrow.

Carl at day’s end:

1155-1170 estimate today for /ES (15 points)

1159 -1170.50 actual today (11.50 points)

Nice call on the high.

Trades:

In /ES at 1162.75, did not sell, up 6.25 after hours.

Grade B

He saw that breakout coming. I did not. Still green on my DRV trade, still holding.

Me to Dread.

There will be some sort of new home sales number tomorrow morning. Might be important for DRV.

Carl seems to be holding over night. I have TNA and not sure whether to hold overnight or not.

$TRAN not confirming the new high. $DJUSRE not confirming the new high. TNA is up over 10% since Monday's open. Probably time for $RUT to take a breather and retrace. TZA never seems to put in a V shaped bottom, so you will likely have another chance to pick it up this low.

please get there today g-d!

Not gonna happen. Still have more days of this I guess.

tomorrow is the 10 year anniversary of the S&P dot com high, were you involved in the capital markets back then

I was but to as an assistant to a head market maker. Put us out of business.

yeah dot com liquidated a lot people,

the market is a revolving door with people

we're getting close to liquidating the number of people we liquidated during the 08' crash, their handy dandy oscillators got stretched to the stratosphere and people don't have the capital capacity to stay in the game

Well, if we don't turn around in the next couple of days, I will be liquidated as well.

GS down today hummmm

I hope you don't mind the questions but does breaking synergy (based on the higher close today) mean that a longer term top is no longer clear and that after we retest containment we could go even higher?

OK – thank you. Yes, I have time decay going against me on the 3X ETFs but I think at this point I am stuck.

operators closed the $DJI @ 10,888

tomorrow is 3.24

24/3 = 888

And the 10th anniversary of the dot com bust! Unfortunately though, I don't think the operators are as smart as you!

Thank you SC – I better go get the book!