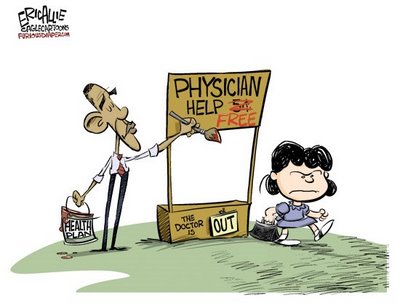

It's all about the Health Care plan now, as the market will likely react unfavorably to it passing. Obama is dead set on screwing the middle class with this piece of crap bill. It's going to cause premium rates go up for all customers as providers will be forced to cover everyone, including those with prexisting conditions. Common sense tells you that insurance providers will raise rates across the board to pay for those people.

It's not fair to the healthy people to be forced to pay higher rates, but Obama is dead set on passing it. Wall Street won't like it, and we bears are likely to see the correction that should have happened last month. Because of all this manipulation since last year's low, Obama and the gang will likely cause the Great Depression 2, with a stock market at 3,000-4,000 Dow within the next 2-3 years.

I hope I'm dead wrong on that, but all the charts point to that area as the finally low, before any real recovery can happen. If they would have stayed out the market, we might be recovering right now. This process of slowly pulling the band-aid off the wound is more painful, and will do more damage, then to just pull it off quickly. If will would have had Ron Paul as president, he stated that he wouldn't have bailed out the banks, and he would have most likely shut the Federal Reserve down.

That would have been the best thing to do, as the market would have probably put in a lower low then the March 6th, 2009 low, and then traded sideways for the last year building a solid bottom. By now we could actually have been just starting a healthy rally.

Shutting down, or bankrupting the 5-6 largest (and crookedest) banks, along with the Federal Reserve would have actually made every American the equivalent of $10,000,000 dollars richer as that how much debt would have been erased from the system. Basically, that's because the banks have stolen Billions of hard working American's money through the various bailout programs. I didn't see my bailout money... did you see yours?

We really didn't stand a chance in the rigged election either as McCain would have also bailed out the banksters. (So, I'd be all over him too if he had won). Trying to get a politician into office that's "Honest" and has "Integrity" is almost impossible. They usually don't have the funding to get noticed, and even if they do win some how, the crooked politicians won't work with them. Nothing will ever get done, until you get enough honest people to overpower the dis-honest ones.

So what about the market? I'd post some charts of the likely direction, but it's really worthless to do so until this bill gets passed... or not? If it doesn't get passed, then you can expect more of the same old slow grind sideways to higher, as the big institutions aren't allowed to sell their shares until Obama and gang give them the OK.

If the bill passed, as I expect it to do so, we should certainly see another 10% correction... at the minimum. Since it will be spring/summer soon, the market could then turn and go back up higher during those slow months. I think the real fireworks are going to happen this coming fall/winter, as I don't think they will be successful in holding it up during that period.

But, for next week... assume the bill passes, we should see some selling. Until that happens, I'm not wasting time posting charts. I will say that 1150 area needs broken first, then 1115 area, and finally the double bottom area around 1045. If will break that, then I don't see us going higher in the summer months.

So, I do believe that a correction is coming, but whether or not it's the start of the much anticipated "P3" or just another 10% correction is yet to be known. Just for clarification, when I say 10%, I mean a correction similar to the one's we've already had... which haven't actually made it all the way down to exactly 10%. Each one stopped just shy of a 10% correction. If we do go all the way to 10% this time... the bear market might be back?

If you're a beaten up bear like me, you start becoming more cautious of making correction predictions, as I've been wrong so many times. I know that every time I chart out a most likely path for any forecast correction, I get my foot stuck where the shine doesn't shine. I'm going to be a lot more nimble now.

Of course that's exactly how they plan it... keep whipping the dog until all you have to do is pick up the newspaper and the dog will obey. The government has succeeded in beating up every last bear to the point that they are either broke, just too scare to go short anymore, or have converted to being a bull. I must admit, I'm too scare to go short... until I see the big institutions participating. Without them selling, no down move will stick.

So, I'm expecting some selling next week... but I'm not shorting until I see how Wall Street reacts to the health care news. There are many reason for the market to fall. Not only is the market worried about the health care plan, but the Greece problem hasn't went away either. The dollar is looking bullish too. And I believe oil is also ready to fall.

There's also talk of raising the capital gains tax, which will drive money out of the stock market and into tax exempt investments, like municipal bonds, etc... The longer this market stays up, the further it will fall. That's the really sad part for the average non-trading American, as all this manipulation is going to wipe out what little savings they have left.

You have 33 states with unemployment over 15%, and at least 5 states are ready to go bankrupt. There are so many reason for this market to tank, that I couldn't even list them all. The more the government intervenes, the worst it will be. If we had a truly free market, the bad apples would have already been removed from the basket, and some sort of real recovery could have already began.

But, we live in corrupt world where the rich get richer by stealing from the middle class to bribe the poor to vote them in office, or the candidate they support. If you're poor you'll be fine as the government will give you your monthly payoff. If you're rich you'll continue to sell your soul to stay that way. And if you still have a job, then you're somewhere in the middle... regardless of how much you actually make, consider yourself a "middle class" American. Meaning that your role in the Matrix is to work every day to serve others. Kinda sucks, doesn't it?

But, at least you have the illusion of freedom. You feel some what free... right? Of course, you know that you're really not free... for if you were, you could pick up and go anywhere, anytime, and stay as long as you want too. But, with a mortgage, wife, 2.5 kids, car payments, car insurance, health insurance (which will increase shortly), and who knows what other bills... you really aren't that free after all.

So we gamble in this casino game called the stock market, thinking that's it's not actually gambling because we can use some form of technical analysis to logically predict where the market is going... only to realize that the market doesn't operate on logic, but instead it operates with the sole purpose of taking your money. Kinda like Vegas... isn't it? Well, at least you could get free drinks in Vegas...

Red

great post red, a number of interesting points

for those not aware of the ritual taking place today with HealthCare(HC)

todays is SUN-day 3.21

3 = 111

it is currently the 111th meeting of congress

21 = 777

3.21 = 3.2.1.reset

___________________________________________

Let's look at some de-leverage ticks & gaps left by the operators

First here is a chart showing the de-leverage tick of 107.82 est. 2/16/2010

http://www.flickr.com/photos/47091634@N04/44500…

That de-leverage area presents some structural problems for the bull structure as the controlling TL that has held the SPX is currently above the de-leverage tick

We also have the SPX 1131.56 gap left on 3/5/2010

http://www.flickr.com/photos/47091634@N04/44203…

All long positions above SPY 107.82 will eventually become underwater, just like all the short positions below the 1127.38 gap left in January eventually became underwater.

As red has figured out, this game is designed to take your money and for most people it is no different than gambling @ a casino. You keep hearing me talk about the regulatory part of the market, due to that the market moves in two directions on all time frames which is the catalyst for parting people with their money.

Trade with the regulators, not against them.

How the heck do you come up with this stuff. Amazing stuff love to read A+++

Thanks, Great info. I also enjoy you post

I said since Sept 09 till Healthcare if passed we “will not see any significant sell off” (from Evil speculator blog post Sept) we shall see tomorrow if my thoughts are fullfilled.

Selling will come this week.

I do say yes to that.

Market knows better than anyone else.

I would sell off if it thinks Health bill is going to cause doom to economy. I think health bill is good for economy so market is shooting up.

I have no clue how this bill is good for economy ?

But looks like Mr. Market is saying so.

So I shall be humble and take Mr. Market's verdict.

BTW Red you wont pay more in taxes, you have to make over 250G!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

LOL.. What are you saying? Red has no chance of taking a shot at the American dream?

Yeah Red, I'll see you at my nightshift at McDick later. LOL

Red, Nice post. I feel less free everyday. We americans really need to find some good independent candidates to get in office.

Thanks GC,

Independent candidates would be better then the bought and paid for Democrats and Republicans that are in office now. The “2 Party” system needs to be eliminated anyway, and so should the “electoral voting system”. We should just count the peoples' votes.

Ah guys, probably anyone at the top is doing it mostly for ego and you know the outcome there can never be good. I truly believe that most presidents have the best intentions but with money and lobbying, nothing is ever truly honest. Anyway, at least for once we may have a red Monday. Sundancer, thank you so much for your insight, it gives me some peace of mind.

The electoral system is to ensure that the politicians do not only cater to the few most populous states. It is there to ensure that politicians have to take into consideration the interest of less popular states. If you put in a pure popular vote system, then all the metropolitan states dominate all the agenda. No one would care what MN, WI, Ohio, IOWA, etc think.

What may be worth considering is the allocation of electoral votes. May be the electoral votes can be allocated based on % won by each candidates, instead of a winner takes all. But the Democrats will never allow that, as they would lose their strangled on the NY and CA electoral votes.

Btw, third party candidates are just vote splitters. A vote for your favourite third party candidate is basically a vote for your LEAST preferred candidate. Just ask those Dems who voted for Nader and those GOPs who voted for Perot.

The GOP has 40% of the votes. The Dem has 40% of the votes. Independents has 20% of the votes. Elections are not won by trying to win over the other party's diehard. GOP candidate catering to DEM diehard = mega fail. Dem candidate catering to GOP diehard = mega fail. They just alienate their own base and fail to win over the diehard.

Elections are won by consolidating your base and winning over just half of the independents. Screw the other party's diehard as they will never vote for you in most cases.

Third party candidate just wouldnt cut it. They will not get any diehard from either party as everyone remembers what Perot and Nader did, ie siphoning away votes to let in the other party's candidate. So the diehard will not vote third party. And there isnt enough independent. So third party candidate is just a pipe dream.

Voting for a third party is not just a wasted vote, but essentially, a vote FOR your least preferred candidate. All you manage to accomplish, is to deny the lesser of the two evils your vote, allowing the bigger of the two evils to prevail. Cutting your nose off to spite your face.

Look at the silver lining. Things are going to hell anyway. Now that the Dems have managed to stuff something the American people do not want, down their throats. Guess who get the blame when things blow up? The Democrats are in charge of putting out the fire and they just keep pouring more gasoline on it. Before the dawn of the internet, and lets thank Al Gore for inventing it, the democrats would just lie about everything through the liberals controlled media. Those days are gone now, thanks to Al Gore for inventing the internet.

If you are a concerned citizen, the chance will come in the second half of the decade to serve the republic, as a GOP candidate. The nation will look to you for leadership.

No point in cursing the darkness. Light a candle. Public service is an honored duty.

I'll certainly be voting for the good guys come this next election… if I can figure out who that is?

You only need to figure out which is the worst one and to know that failure to vote for his/her oponent, will allow that worst candidate to get in. 🙂

For a better view on what the political landscape looks like:

http://www.rasmussenreports.com/public_content/…

for those with access to data streams:

What are you showing was the high for the SPY on Friday?

I'm showing 117.293 & 117.773 on another.

I show 117.293 at 10:30 am on the 10 minute chart in Ameritrade (which is also Think or Swim)

Strange though if you look at the chart on Ameritrade it looks like the high was right after the open at 116.94. Yahoo finance lists the high as 117.48.

$SPX Intra-day gap checklist

3 min

1152.14

1149.63

1148.54

1145.1

1143.52

10 min

1131.56

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is again 1145 – 1157. Overnight the e-minis dropped as low as 1146.75, just into the target zone of 1141-47 for the reaction from 1165. I expect the market to begin a move to 1200 this week.

1150.25 -1165 actual Friday (14.75 points)

1146.75 (last night's low)

1145-1157 estimate for today (12 points)

1148.50 currently, so estimate is -3.50 to +8.50 from here (bullish)

Carl, you always cheer me up (NOT)!

Carl is Long one unit at 1149.00

And what are you doing?

TZA (daily) is a buy from Friday.

TZA weekly is a buy above the opening price ($7.55)

I'm all cash, still groggy and wanting to know how this market is going to react to the passing of Obamacide.

K – thanks. We have already reached Carl's upper target, no?

We already dropped to the top of Carl's range for how fall we should fall. Looks like a bounce here.

I dunno. Maybe we just trade in his range for the day.

I'm in TZA at 7.07 from last week.

That's what I should have done.

Still thinking that maybe TZA falls back to that area again, as part of TZA's typical non-V shaped bottoming process.

I think it will also. MY gut said sell at open and I didn't.

I followed Carl this morning, in and out of TNA (over my own objections) as Carl bought and sold. Worked out well this time.

Glad to know that all of my TZA charts are making a lasting impression. If TZA stops around here (7.06), and goes up, I'd say that that pattern has held.

TZA has less room to run up to the 20 day MA than many of the other 3x ETFs, so it isn't my preferred play at the moment.

Dreadwin,

I am a fan of your charts 🙂

Not a fan of TZA today though.

the reaction off the opening came from max contain on the 60 min. this is hit #2 of max contain since the uptrend began

http://www.flickr.com/photos/47091634@N04/44536…

Sundancer, last time we hit that containment level, we just burst higher. Why should this time be any different?

My own answer – dollar getting stronger, Euro and commodities getting weaker. Every indicator shows oversold (McClellan about to turn down, bullish sentiment high, CPCE at a low). Let's just hope these work.

Overbought I meant:) Need some coffee.

That is the nature of the beast with support and resistance. Reaching that point is onething. What happens there is another. Bouncing off a S/R or containment point is a reversal. Shooting through it, is a continuation of the existing trend. Just arriving at the S/R point, is only half the story.

Yes, very true.

Carl just sold one unit at 1155.00 (gain of 6 points)

$SPX 1163.29 gap filled from friday

1167.04 is the other 3 min gap from friday

OUt of TZA at 7.29

Still have all of positions. I will let you know if/when I ever sell them!

Nice call getting out of TZA.

Nice place to get out also — right under the pivot.

Everyone must be shocked at the market's action today.

The daily indicators are showing a topping action. I am looking to enter short position very soon. Half way to a confirmed sell signal. Waiting for the remaining ones to catch up. Expecting that to complete within this week.

Your timing is great. I don't think we have much more upside today and I don't think we close above last week's S&P high (3/17) as mentioned by Sundancer.

Will have to see. Too soon to tell yet. The potential is there.

I am not surprised. I said something to you about that on Friday. Nothing in this market surprises me any more.

Back in TZA at 7.11

long DRV at 8.70

The sky must be falling Dread back in the game. Good Luck!

for those with eagle eye's will notice, GS is magically down today

you also noticed the operator ran GS within .54 of it's 1/7/10 high (previous lower high) on Friday

for those with eagle eye's will also notice while the $NDX made new highs again today, AAPL couldn't even take out last weeks high

Look for a HC (above 1166.21) on the $SPX

I have an eagle's eye and have been following AAPL and GS closely but so far I am in a world of pain.

🙂 That pain better end tomorrow! ARGHHHHHHHHHHHHHHH!

what level does the $SPX need to get to for you to break even?

Well, it looks like they couldn't make a higher high. I live to fight another day then. Feel like I am being slowly roasted over hot coals. Good afternoon all and good job Dread!

Obviously, I think we head down from here. Thus far, all I've done is avoided losing by getting short too early(… this time…). The market can prove me wrong at any time.

Well it's all about timing and you seem to really get it right. We shall see but I have faith in you.

$DJI & $NDX HC, but no $SPX, that's odd

Is anybody else showing a SPY 117.773 high for Friday?

I am showing a high for Friday of 117.13. Strange. Sadly Sundancer, I think I would have to get back to around your 107.82 to break even. Isn't that where Red saw the fake print a while back?

i think it was around the crash gap of 107.34

the good news is that the operators have told you the SPY is going to print 107.82, the bad news is the time element could continue to wear on you mentally

ah – that's right. Yes, if we go higher from here, I'm out. If we make a slow up and down descent down, I can handle it. As long as we don't make new highs.

Carl at day’s end:

1145-1157 estimate today for /ES (12 points)

1147.75 -1163.25 actual today (15.50 points)

Spent most of the day above Carl’s high.

Trades:

In /ES at 1149.00, out at 1155.00 (gain of 6.00)

Grade B (one nice trade, but missed a big move)

TZA opened up 2.1%. Gap was filled. TZA was up 2.8% at the high, and closed down 4.1%.

We are in a New Moon Trade, which favors TZA. After five days, this trade is down 4.6%, and owning TZA over night.

Volume for TZA was the highest of the last 28 days.

$RVX (VIX for $RUT) closed down 2.1% with TZA down 4.1%. No divergence.

TZA has now been down 3 of the last 7 days — a lot of chop.

The low for TZA today was $7.03. The low three days ago was $6.93 which is the lowest TZA price ever.

Ultimate Oscillator for TZA bottomed at 20 twenty one trading days ago and has generally risen since then but has remained below 50 and is currently 38. Indicating continued weakness for TZA. Yesterday was highest of the last 21 days, but a 4 point drop today broke the definite up trend. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s long black candle touched the top Bollinger Band at the open (not touched for 6 weeks or so) and fell back into the congestion area and below the Bollinger mid-line (20 day MA). MACD has crossed from below and may be rising. Looks like $RVX will be falling. Bad for TZA.

Bollinger Bands for $RUT: The large white candle for $RUT retraced the body of the long black candle last Friday. Looks like a topping process for $RUT is well underway. Good for TZA if really topping out here. MACD is getting ready to cross.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s white candle rose to sit in the congestion area again. The upper Bollinger Band seems to be falling. Looks like a topping process is well under way, which is good for TZA.

TZA had a higher high, lower low and much lower close – bad for TZA.

Money flow for the Total Stock Market was $657 million flowing out of the market on an up day. Seems backwards, but has now for 3 days.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks like TZA is in a bottoming process, rising and falling somewhat randomly. The next random move might be up.

Are you in TZA now? Nice Post I really do appreciate this daily update.

I am all cash again. Nice price right now for TZA.

TZA has a lot going for it right now.

http://www.screencast.com/users/dreadwin/folder…

I went in to DRV because of the more attractive volume action.

The Daily view from Americanbulls

TNA has a BUY-IF (buy tomorrow if conditions are right) signal today. The candlestick today was a Long White Candlestick (strong buying pressure). The last two candlesticks formed a Bullish Piercing Line Pattern – a highly reliable bullish reversal pattern.

AmericanBulls has TNA up 0.04% since the sell yesterday.

TZA has a SELL-IF (sell tomorrow if conditions are right) signal today. The candlestick today was a Long Black Candlestick (strong selling pressure). The last two candlesticks formed a Bearish Dark Cloud Cover Pattern – a highly reliable bearish reversal pattern.

AmericanBulls has TZA down 0.28% since the buy yesterday.

Summary of $RUT based ETFs:

BUY-IF: IWM (1x), UWM (2x), TNA (3x)

SELL-IF: RWM (-1x), TWM (-2x), TZA (-3x)

Action for tomorrow: Possible buy of TNA, possible sell of TZA

The Daily view from Americanbulls

TNA has a BUY-IF (buy tomorrow if conditions are right) signal today. The candlestick today was a Long White Candlestick (strong buying pressure). The last two candlesticks formed a Bullish Piercing Line Pattern – a highly reliable bullish reversal pattern.

AmericanBulls has TNA up 0.04% since the sell yesterday.

TZA has a SELL-IF (sell tomorrow if conditions are right) signal today. The candlestick today was a Long Black Candlestick (strong selling pressure). The last two candlesticks formed a Bearish Dark Cloud Cover Pattern – a highly reliable bearish reversal pattern.

AmericanBulls has TZA down 0.28% since the buy yesterday.

Summary of $RUT based ETFs:

BUY-IF: IWM (1x), UWM (2x), TNA (3x)

SELL-IF: RWM (-1x), TWM (-2x), TZA (-3x)

Action for tomorrow: Possible buy of TNA, possible sell of TZA

TZA opened up 2.1%. Gap was filled. TZA was up 2.8% at the high, and closed down 4.1%.

We are in a New Moon Trade, which favors TZA. After five days, this trade is down 4.6%, and owning TZA over night.

Volume for TZA was the highest of the last 28 days.

$RVX (VIX for $RUT) closed down 2.1% with TZA down 4.1%. No divergence.

TZA has now been down 3 of the last 7 days — a lot of chop.

The low for TZA today was $7.03. The low three days ago was $6.93 which is the lowest TZA price ever.

Ultimate Oscillator for TZA bottomed at 20 twenty one trading days ago and has generally risen since then but has remained below 50 and is currently 38. Indicating continued weakness for TZA. Yesterday was highest of the last 21 days, but a 4 point drop today broke the definite up trend. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s long black candle touched the top Bollinger Band at the open (not touched for 6 weeks or so) and fell back into the congestion area and below the Bollinger mid-line (20 day MA). MACD has crossed from below and may be rising. Looks like $RVX will be falling. Bad for TZA.

Bollinger Bands for $RUT: The large white candle for $RUT retraced the body of the long black candle last Friday. Looks like a topping process for $RUT is well underway. Good for TZA if really topping out here. MACD is getting ready to cross.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s white candle rose to sit in the congestion area again. The upper Bollinger Band seems to be falling. Looks like a topping process is well under way, which is good for TZA.

TZA had a higher high, lower low and much lower close – bad for TZA.

Money flow for the Total Stock Market was $657 million flowing out of the market on an up day. Seems backwards, but has now for 3 days.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks like TZA is in a bottoming process, rising and falling somewhat randomly. The next random move might be up.

Are you in TZA now? Nice Post I really do appreciate this daily update.

I am all cash again. Nice price right now for TZA.

TZA has a lot going for it right now.

http://www.screencast.com/users/dreadwin/folder…

I went in to DRV because of the more attractive volume action.

Carl at day’s end:

1145-1157 estimate today for /ES (12 points)

1147.75 -1163.25 actual today (15.50 points)

Spent most of the day above Carl’s high.

Trades:

In /ES at 1149.00, out at 1155.00 (gain of 6.00)

Grade B (one nice trade, but missed a big move)

for those with eagle eye's will notice, GS is magically down today

you also noticed the operator ran GS within .54 of it's 1/7/10 high (previous lower high) on Friday

for those with eagle eye's will also notice while the $NDX made new highs again today, AAPL couldn't even take out last weeks high

Look for a HC (above 1166.21) on the $SPX

$DJI & $NDX HC, but no $SPX, that's odd

Is anybody else showing a SPY 117.773 high for Friday?

I am showing a high for Friday of 117.13. Strange. Sadly Sundancer, I think I would have to get back to around your 107.82 to break even. Isn't that where Red saw the fake print a while back?

i think it was around the crash gap of 107.34

the good news is that the operators have told you the SPY is going to print 107.82, the bad news is the time element could continue to wear on you mentally

ah – that's right. Yes, if we go higher from here, I'm out. If we make a slow up and down descent down, I can handle it. As long as we don't make new highs.

Well, it looks like they couldn't make a higher high. I live to fight another day then. Feel like I am being slowly roasted over hot coals. Good afternoon all and good job Dread!

Obviously, I think we head down from here. Thus far, all I've done is avoided losing by getting short too early(… this time…). The market can prove me wrong at any time.

Well it's all about timing and you seem to really get it right. We shall see but I have faith in you.

I have an eagle's eye and have been following AAPL and GS closely but so far I am in a world of pain.

🙂 That pain better end tomorrow! ARGHHHHHHHHHHHHHHH!

what level does the $SPX need to get to for you to break even?

long DRV at 8.70

The sky must be falling Dread back in the game. Good Luck!

Back in TZA at 7.11

Everyone must be shocked at the market's action today.

The daily indicators are showing a topping action. I am looking to enter short position very soon. Half way to a confirmed sell signal. Waiting for the remaining ones to catch up. Expecting that to complete within this week.

Everything is subjected to revision pending new development. One data point at a time.

I am not surprised. I said something to you about that on Friday. Nothing in this market surprises me any more.

Your timing is great. I don't think we have much more upside today and I don't think we close above last week's S&P high (3/17) as mentioned by Sundancer.

Will have to see. Too soon to tell yet. The potential is there.

That is the nature of the beast with support and resistance. Reaching that point is onething. What happens there is another. Bouncing off a S/R or containment point is a reversal. Shooting through it, is a continuation of the existing trend. Just arriving at the S/R point, is only half the story.

Yes, very true.

Glad to know that all of my TZA charts are making a lasting impression. If TZA stops around here (7.06), and goes up, I'd say that that pattern has held.

TZA has less room to run up to the 20 day MA than many of the other 3x ETFs, so it isn't my preferred play at the moment.

Dreadwin,

I am a fan of your charts 🙂

Not a fan of TZA today though.