Update for exciting Thursday...

Red

P.S. Please answer NEW POLL... Thanks

--------------------------------------------------------------------------------------

The correction is over now...

Yeah right... and I've got some ocean front property for sale in Kansas too! Once again, the run up into opx week has started off with a bang. Will it continue until Friday? Probably not much high, but not much lower either I'm afraid. This light volume period that we are in now, will allow them to easily gap up over resistance levels by running it up in the pre-market session first just like they did today.

So while there still might be a pullback, I think the 1040 level is off the table now. Maybe we dip to 1060 for the "B" wave down, but it may not happen until after opx is over. We could chop sideway until then, and sell off a little bit this week and a little bit more early next week.

However, the big concern is whether or not that week chart continues to roll back up, putting in higher lows on the histogram bars. That could mean that we aren't going to go down below the 1010 low for awhile.

If so, then we could just sell off next week, and rally the next few weeks after that (and maybe go for the DIA 118.16 print?). Now I don't know if that's going to happen or not, but the weekly is looking like it wants to roll back up. So, just keep your eye on that chart, for it would likely put a limit on the downside for now... at least until it turns back down again.

Moving on to tomorrow...

The daily chart is still moving up, but the ADX line is falling now. It's losing strength... finally! The negative and positive DI line are converging together now, which means it should be choppy in the market for the next few days. No major moves up or down should be expected during this criss-cross period.

The 60 minute chart is losing steam too, after putting in a much smaller histogram tower then the previous one. With the larger amount of open interest on the 107 spy put (289,000), I'd say that we will not go below 107 before this Friday. And, since the call side has 110,000 contracts at the 110 level, I'd also say we close below that level on Friday too.

Split the difference and you are looking at 108-109 spy level on Friday. Which really makes more sense if they plan on dropping back a little early next week to maybe 1060 spx... (1040 would be a gift to the bears, and could halt the up move?), before a move up to 112.41 next week. I'm not ruling out the possibility that we hit 112.41 spy by this Friday, but the odds are decreasing because the daily chart is losing steam.

So, my best guess for tomorrow is a slightly down day (not likely lower then 1080 area) or flat. But I don't expect too much more on the upside without a "pause" day or slight pullback at this point.

Good Luck to everyone...

Red

Guess who had shorts on BRCM, going into INTC earnings?

Hmmm… let me guess? YOU…

Not exactly one of my finer moments. I guess BRCM headed to 38 or 39. Triple top short, LOSER. 3% stop out a comin'.

And, it's a rounded bottom, with strength.

All the warning signs are there. Mental Lapse. It happens.

My overnight charts show the market went too high too fast, pullback for one day seems likely. JPM reports pre-market Thursday. That could be a down trigger, Or Wednesday the report on June retail sales, at 2 pm Eastern on Wednesday, could be bad. INTC earnings lift, may be short lived.

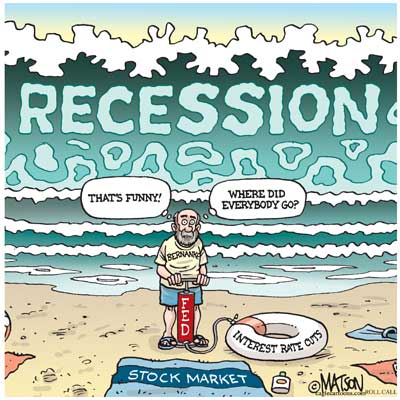

We can dub this the “Jobless and Homeless Recovery”.

Most of these bullish reports on earnings (after guidance was dropped back severely just recently like 33% on Alcoa one week ago) don't even list the earnings.

Go figure, INTC more because of gov contracts, so from DELL/HP expected blowouts

on Dell HP you are thinking they tank because of lack of gov contracts? just sayin' what are you sayin'

I meant they will report better sales, but u know its gov contracts not consumers

Some headlines are just too funny.

http://www.reuters.com/article/idUSTRE6622I4201…

Some more put call charts, on the daily. Esp for company with earnings coming up.

I don't see compelling information in here in particular, just made these charts. Feel free to comment.

Made these using my rarely used Etrade, but liking their trading platform upgrades.

http://oahutrading.blogspot.com/2010/07/earning…

Dow Jones futures before opening bell

http://niftychartsandpatterns.blogspot.com/2010…

Finally getting a little pullback I see… It's about time.

Retail, homebuying stink. INTC carried by gov't sales.

The whole economy stinks Jim, that's something we all agree on. But, the game is controlled and manipulated. So, the rally could likely continue, with only small pull backs along the way.

that's exactly what I said Stimulus upgraded their systems had to, so it's temporary!

Added typ at low so far. weakness is creating some oprtunity.

DRv has moved nicely this am.kendar@bresnan.net

Two more days left until opx is over with. I expect them to hold it around this level until then. But next week, I expect a move down for the “B” wave in this ABC move up to probably the 112.41 spy level.

You can now see in this 15 minute chart that it fell outside the rising wedge and is now backtesting the lower support line.

http://stockcharts.com/def/servlet/Favorites.CS…

However, I do think we could go down to that gap fill level of 108.03 before Friday. (Not shown on the chart, put it's the 1080 level).

Why is that bull market moves are so boring that you just want to take a nap instead of watching the tape move? It's like watching turtles race. Bring back the hare! He's much faster and more fun…

Dow Jones trading below 50% fibonacci level

http://niftychartsandpatterns.blogspot.com/2010…

Breaking news = Biden/Romer : stimulus created 3 million jobs

I guess in India, China,etc. I wonder how many in USA

Red, you should apply to get your share of 3 mil jobs

http://www.youtube.com/watch?v=BiuGrpusI7A

Great message! Does this guy have a good following?

S&P 500 – BROADENING TOP FORMATION

http://niftychartsandpatterns.blogspot.com/2010…

anoopsan, Great call on KO short…You picked a great winner.

I thing the fall has just started. If end in negative territory today the stock will go down till 51.90 levels where the 50 day moving average is at present. A close below this average will trigger a larger correction

Extremely weak retail environment. That entire sector can't seem to pull muster.

Everything is rolling over here. Jaywiz we probably had a 4 and truncated 5th wave this morning. Cobra had another WOW moment with Nasdaq 100 intraday cumulative tick hitting extreme levels which undoubtedbly carried over this morning. Intel has given up half its gains with a massive black bar.

FED DOWNGRADES THE U.S ECONOMY

Are you serious? We just created 3 million jobs somewhere

… or saved. Don't forget our national (jobs) savings!

They mentioned created not saved

Strange… I've always heard “created or saved” together and inseparable… kinda like “shock and awe” or “peanut butter and jelly” 🙂

absolutely

here you go

http://www.marketwatch.com/story/us-stocks-lose…

Hey Reza,

I need one of those 3 million jobs… where are they? LOL Just give me the 150k plus that they spent to create the job position instead.

well they forgot to mention in US. I guess they meant overseas

We could go down and fill the gap at the end of today or tomorrow. It's at 108.03 spy (about 1080 spx).

Quick technical question??

Do you all prefer the fast or slow stochastic???

http://www.marketwatch.com/story/us-stocks-lose…

Rvix is at 4.85% vix 2.25% positive. This is nothing to get too excited about yet but during the up move the vixes seldom saw those % in inverse.

Tells me nerves are getting itchy.

Besides the vix not supporting the sell off, the volume isn't either. Only 118 million shared traded on the SPY now at 2:30pm est. It won't even come close too 200 million by closing.

Low Volume = Small Sell Off.

http://www.cnbc.com/id/38245767

They will run the market on this because its not so bad.

they'll run this market because they are crooks

Thieves too…

same thing 🙂

Thought you might like this:

http://www.cnbc.com/id/38244083

Looks like we are going for gap fill today…

3 million jobs created, and no more recession declared by Red Dragon

Its adding up

LOL… Lies, Lies, and more Lies!

NFLX looks determined to reach it's last high. possibly 135, manipulating crooks.

Going Long CME, ahead of JPM pre-market earnings, Thursday…More crooks JPM.

These guys make President Nikon look like a Saint!

JPM, they'll go up on earnings… Based on my new method… crookology.

Nixon too. And I remember the whole deal although I was just a lad.

The thief you know is better than the one you don't!

History is and will be kind to him.

From what I read somewhere about the whole Watergate deal, Nixon was setup. Probably by the Illuminati gangsters, I'd guess. Maybe he was bucking the system and not listening to them anymore?

So, they set him up… and now he goes down in history as a corrupt President. Go figure… it's how the crooks operate I guess.

Any President that bucks the system is either framed, assassinated, or had an attempted assassination. So it's easy to find the good Presidents now… just look for the one's killed.

I don't know about that Red. History has been kind to Nixon and not JFK. When I went to school he was a hero. Now, not so much.

You need to read some of those links you post on the Iluminati. I do not think you would agree with the hate those sites propagate. Sometimes you have to get past the initial paragraph or two.

I'm not implying that all presidents are bad, only that the ones that got assisinated were most likely trying to “do the right thing” and not listen to their advisors that where telling them to do something else.

Of course most of their advisors were probably “bought and paid for”, by TPTB… Illuminati or some other group that secretly ran the world.

I'm sure that there good people inside those bad groups, that are simply trapped now. Obama might be one of them? Who knows? I know he's part of the Illuminati group, as they put him in office. Most all President were “put” in office, and not freely elected. But, maybe he'll turn into a good guy in the end? One can only hope he does.

Yep! When I was young they used to call it the Trilateral Commision? Remember that??

red YGM.

Got it… and yes, I agree with you… we are going up. (YGM)

YGM?? What is that?

“You Got Mail”

I do not text either. Guess i am still 20th century

LOL (Laughing out Loud)

Me neither

You guys are too funny… Hell, I just recently started texting, so don't feel too bad.

I know how to text, then recent call on ban on texting while driving, thats why not much into it

There are going to close all markets green to avoid the negative in opex week

INTC 21.35, looks like a long intraday, I hate to say it!

Red, your friends video

http://www.youtube.com/watch?v=BiuGrpusI7A

Well the second 1/2 of July is upon us.

I put up a NEW POLL and Video, so please refresh you page (for those that didn't know I put it up).

Hi Red,

I did it! A Video Blog.

http://screenr.com/dQR

That cool Z…

I watched it, and it's a different way to forecast then I do. I like seeing a different look, whereas you use P/E's and earnings to forecast… as I used Technical Analysis. Good job.

Re JPM earnings.

When your cost of funds is 0 is it not easy to earn a lot???

LOL, yeah I agree with that 100%! Hell, if I had unlimited funds too, I'd never lose in the stock market as I'd could manipulate the price in whichever direction I needed it to go, so I could steal people money (errr… I mean profit from fair trading).

Here's that FP I talk about in the video from yesterday in the afterhours.

http://reddragonleo.com/wp-content/uploads/2010…

The FP is 110.67 spy, and I expect it to be hit today or tomorrow.

That also happens to correspond with the 78.6 fib retracement (110.62) from the last high to low. We popped above the 61.8% fib at 108.59, so I would expect SPY to make it to 110.62 give or take a few cents and sell-off. I dont like this price action. Seems as though we are just bouncing around and pulling back a little before heading to 110.62. I'm in some TZA, but keeping a tight stop.

Iam having a hard time reading this today. looks like a sell on news day which usually ends up reversing. But

the vixes are green so there is distribution, people selling, but not at a brisk pace at the moment. vixes below 6% positive.

something just come out?

The 15 and 60 minute charts are in negative territory on the histogram bars and probably won't start to roll back up until noon or later.

That means a run up into the close and possibly tomorrow morning too. After the 11am time period is gone, the PPT will push it up in the light volume period.

Gap fill on this move down is 108.03 spy, and it looks like we will get it today. Just don't be fooled into shorting yet gang, as that 110.67 spy FP will be filled.

It might be later today, or tomorrow, but we are know how this game is played now.

RUT Vix just hit 6%.

Selling is accelerating. Not sure what the fire is but its a slow burning this am

Looks like that's it…

We hit 108.17 as a low, and although the opening gap was 108.03, the actually closing on the previous day was 108.25… which could also be considered as “gap fill” on this move down.

Lots of times I've notice they go down close to gap fill, and bounce back up squeezing out the bears, and getting the retail bulls on thinking the gap is close enough for “gap fill”.

Then, they turn it back down one more time to finally fill the gap to get those retail bulls to bail on there position thinking the rally back failed. So, we still could see the actual gap fill level at 108.03 spy before the afternoon rally.

The time period is also key to watch, as it's not close enough to the 11am-11:30am period, where traders leave for lunch. That suggests there is still enough time to go down to 108.03 but the lunch rally.

DOW JONES- HIDDEN NEGATIVE DIVERGENCE UPDATED CHART

http://niftychartsandpatterns.blogspot.com/2010…

Since tomorrow is opx, and the largest open interest level on the call side is 110, and the put side 107, I'm still expecting a close somewhere in between those two levels.

We may never know, the open interest position can change very quickly

Link is broken. 🙁

Thanx Sir

I have edited it

BROADENING TOP OF S&P 500

http://niftychartsandpatterns.blogspot.com/2010…

At this rate, the 60 minute chart won't bottom and roll back up until closer to the close today. That could cause tomorrow to be an UP day, as it rises back into positive territory. This assume the daily chart doesn't turn down today… and so far, it doesn't look like it's going too.

BEAR FLAG – Dow jones 10 minutes chart

http://niftychartsandpatterns.blogspot.com/2010…

Yep… that's a mini bear flag and a minor bear flag. It will be interesting to see if there is enough selling pressure for them to play out today.

Wheeeee!!!! Are we having fun on the roller coaster?

LOL… so much that bear flag!

The 60 minute chart is rolling back up now, from being oversold all day. I suspect that the low is in for today.

JPM beat street by 66%. Crooks.

Z,

what do you think about Fed downgrading the US growth

That makes sense, considering the latest consumer confidence report dropped big time. ( crashed retail stocks, temporarily)

GDP numbers seem to be very fluid, month to month.

WMT earnings should be good, then the FED will raise the GDP again.

But look closely…. record profits… but reserve capital drastically DOWN. They're sitting pretty now… until the next downturn.

JPM also has all that WAMU debt. I was surprised when JPM reached 48.

What did you expect… it's our money they are trading with.

JPM had to use off world accounting. (Mars maybe)

I suspect they only beat by 16%… when one takes out their fantasy, lotto numbers.

“Mars Maybe”… LOL

I've not talked about conspiracy stuff in awhile, but just to let you know… our government has a secret space program like on Stargate SG1. We have humans on Mars in a city under a dried lake bed that has 670,000 living beings in it.

Humans, aliens, future humans, etc… all their together. Our government uses an ancient technology that allows them to “jump” to Mars similar to a transporter machine on Star Trek.

You step in some like a elevator and jump to Mars. They call it a “jump room”. We also have real Stargates on this planet and our government has been using them to communicate with aliens and future humans.

The Roswell crash in 1947 was future humans (52,000 years in the future) that came back to warn us about 2012… which we are now going to survive.

Ok, enough about that…

Are you feeling ok? 😉

LOL Woody…

Yes, I'm fine! I used too talk about that kind of stuff more often in the past, but it bored most readers… so I stopped. But, sense Z… mentioned it, I thought I'd just share that little bit of top secret info with you guys.

🙂

Hi Red!

That's some great research. Keep up the good work.

There was a video circulating around in the 70's.

I saw it!

Video from a Mars lander, leaked out of Huntsville, Alabama

Lot's of stuff out there that most people won't believe… yet it's true.

VIX is showing higher high in 2 days, signals on the 15 minute chart. Monday down?

You gotta give these people credit. They run it down and then run it up at will.

Since the 60 minute chart is rolling up now, it could provide them the strength needed to get to that FP of 110.67 spy tomorrow. Maybe a gap up, to get out of the channel, and over resistances levels?

Jaywiz: Thought there was no way with today's candle it could close up on the high of the day or gap up to a new high tomorrow…….

As for the SPY fake print, stock charts has the high of the day for SPY at 110.4 or 110.512 which I don't get considering the SP was never positive.

It hit those levels in the pre-market session, but the market dropped prior to opening. The 8:30am data caused the sell off.

Some of the colorful comments by Well Armed (Anthony Allyn) annotated to his public charts: SPX to lose 50pts in an hour?Maybe…..Waterfall pattern to begin shortly—enjoy the show

Anthony Allyn called for a 47 point last opx (in June) on a Wednesday. It went up the next day, and he called for a 57 point drop on Friday… opx day!

Of course it went up, as there is NO way in Hell they are going to tank the market and payout all those put holders on the day of option expiration.

Needless to say, I don't see any 50 point drop coming tomorrow.

Hi Red, with goog being in deep red n nasty earnings, i can definitely see a 200 point drop tomorrow

The futures aren't moving right now, so I don't know if we get 200 points down or not? Maybe? But first they will likely gap up to squeeze out more bears and hit the FP of 110.67 spy.

After that, they should sell off the rest of the day. While I said earlier this week that I expected Friday to have the spy pinned at 108-109, that is still possible.

I just think it will be closer to 109, then 108… but again, I don't see it below 107 or 110, as I stated previously. Of course next week is another story, but tomorrow is opx… and we rarely move a lot on the last day options expire.

You were right on that call… we got our 200 point down day. Good job on that. I expected it to be down, but not so far. Mainly because it being opx, and you know how controlled and manipulated those days are.

P.S. I'm on the new post now…

Are there any big earnings afterhours/premarket? I know BAC is tmorrow morning. Only economic news out tomorrow is Mich Sentiment.

Google!!

Mich Sentiment tomorrow? My retail longs may not fare to well.

Here thet go.

S&P closes green

Is this unreal or what?