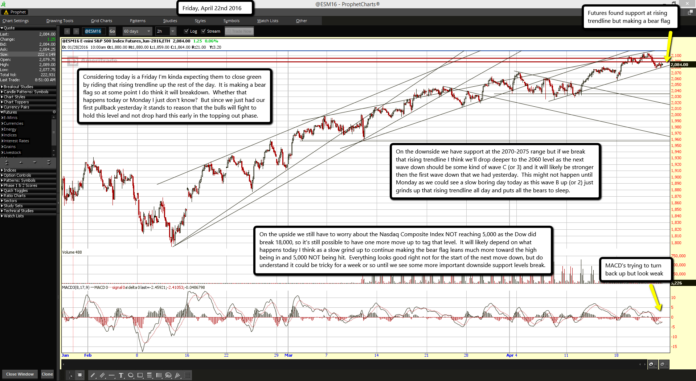

Futures found support at rising trendline but making a bear flag

MACD's trying to turn back up but look weak

Considering today is a Friday I'm kinda expecting them to close green by riding that rising trendline up the rest of the day. It is making a bear flag so at some point I do think it will breakdown. Whether that happens today or Monday I just don't know? But since we just had our first pullback yesterday it stands to reason that the bulls will fight to hold this level and not drop hard this early in the topping out phase.

On the downside we have support at the 2070-2075 range but if we break that rising trendline I think we'll drop deeper to the 2060 level as the next wave down should be some kind of wave C (or 3) and it will likely be stronger then the first wave down that we had yesterday. This might not happen until Monday as we could see a slow boring day today as this wave B up (or 2) just grinds up that rising trendline all day and puts all the bears to sleep.

On the upside we still have to worry about the Nasdaq Composite Index NOT reaching 5,000 as the Dow did break 18,000, so it's still possible to have one more move up to tag that level. It will likely depend on what happens today I think as a slow grind up to continue making the bear flag leans much more toward the high being in and 5,000 NOT being hit. Everything looks good right not for the start of the next move down, but do understand it could be tricky for a week or so until we see some more important downside support levels break.