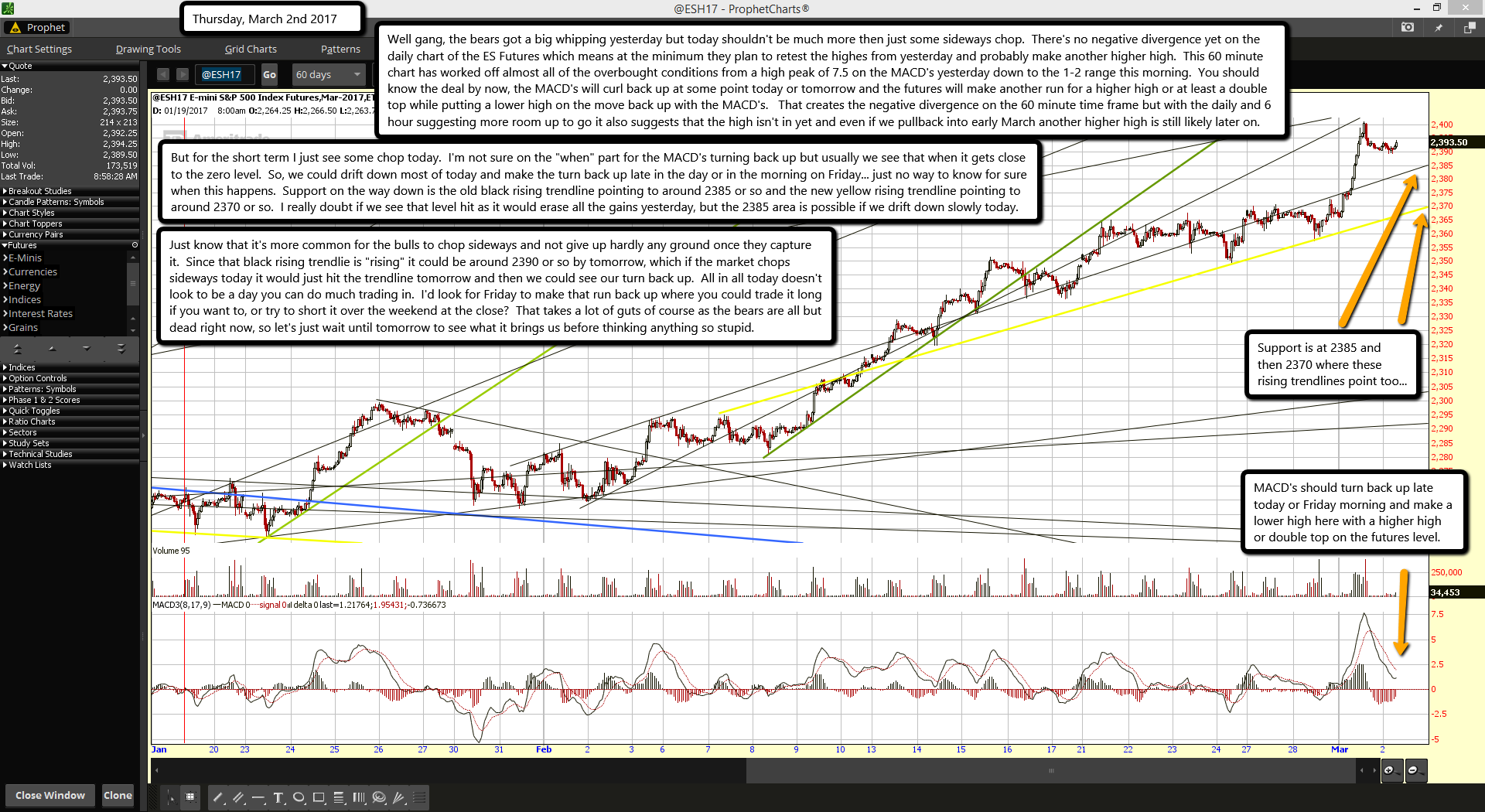

Well gang, the bears got a big whipping yesterday but today shouldn't be much more then just some sideways chop. There's no negative divergence yet on the daily chart of the ES Futures which means at the minimum they plan to retest the highes from yesterday and probably make another higher high. This 60 minute chart has worked off almost all of the overbought conditions from a high peak of 7.5 on the MACD's yesterday down to the 1-2 range this morning. You should know the deal by now, the MACD's will curl back up at some point today or tomorrow and the futures will make another run for a higher high or at least a double top while putting a lower high on the move back up with the MACD's. That creates the negative divergence on the 60 minute time frame but with the daily and 6 hour suggesting more room up to go it also suggests that the high isn't in yet and even if we pullback into early March another higher high is still likely later on.

But for the short term I just see some chop today. I'm not sure on the "when" part for the MACD's turning back up but usually we see that when it gets close to the zero level. So, we could drift down most of today and make the turn back up late in the day or in the morning on Friday... just no way to know for sure when this happens. Support on the way down is the old black rising trendline pointing to around 2385 or so and the new yellow rising trendline pointing to around 2370 or so. I really doubt if we see that level hit as it would erase all the gains yesterday, but the 2385 area is possible if we drift down slowly today.

Just know that it's more common for the bulls to chop sideways and not give up hardly any ground once they capture it. Since that black rising trendlie is "rising" it could be around 2390 or so by tomorrow, which if the market chops sideways today it would just hit the trendline tomorrow and then we could see our turn back up. All in all today doesn't look to be a day you can do much trading in. I'd look for Friday to make that run back up where you could trade it long if you want to, or try to short it over the weekend at the close? That takes a lot of guts of course as the bears are all but dead right now, so let's just wait until tomorrow to see what it brings us before thinking anything so stupid.