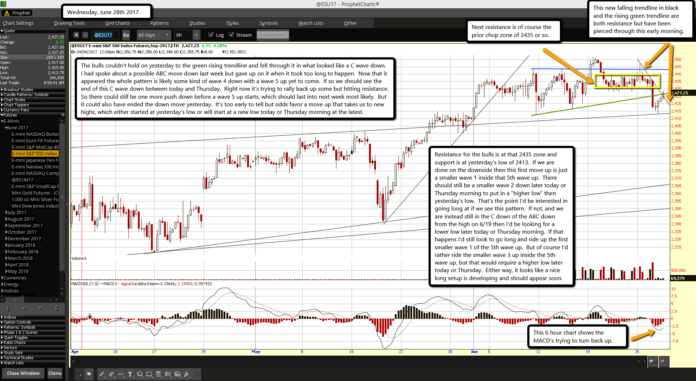

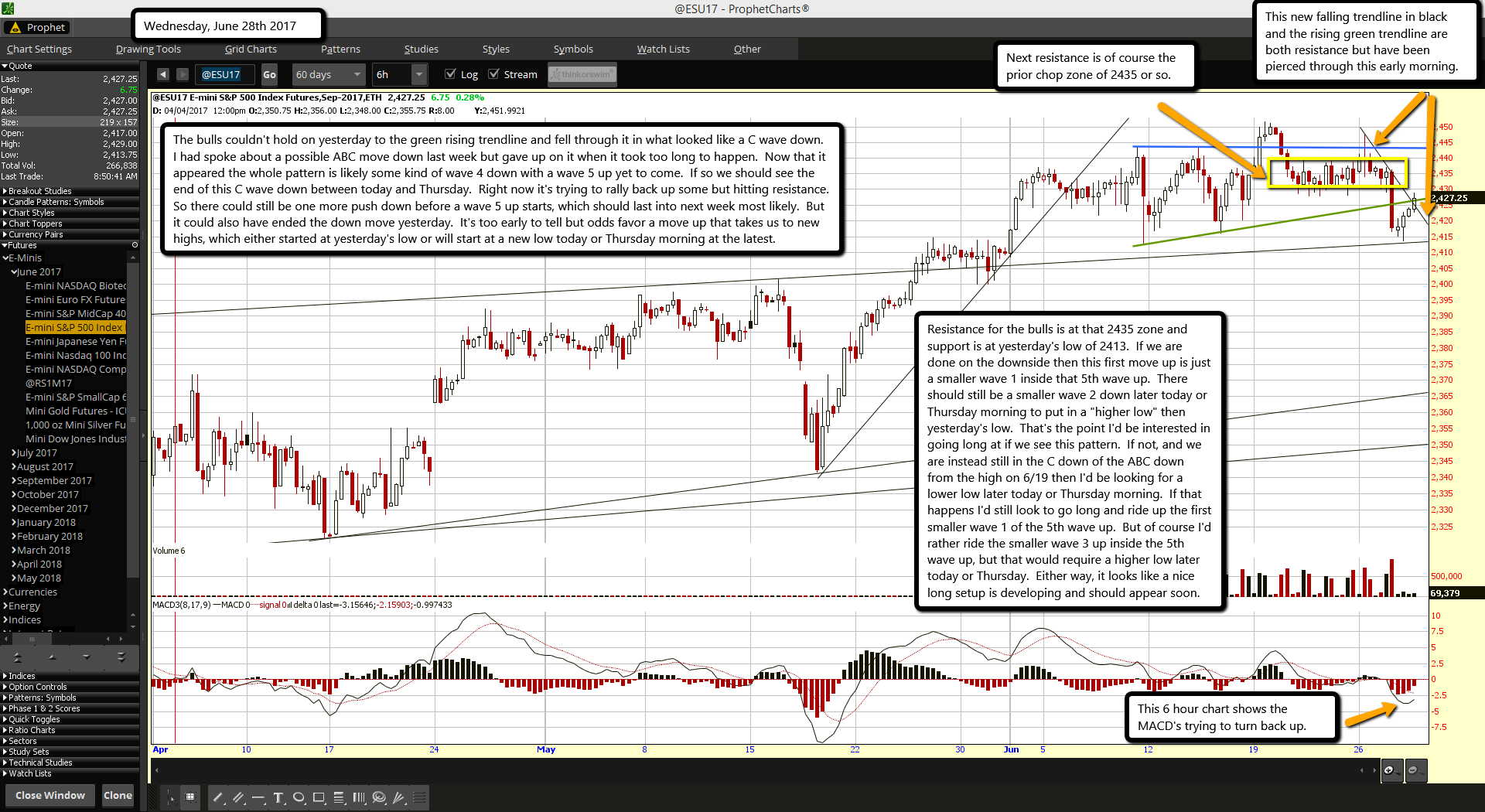

The bulls couldn't hold on yesterday to the green rising trendline and fell through it in what looked like a C wave down. I had spoke about a possible ABC move down last week but gave up on it when it took too long to happen. Now that it appeared the whole pattern is likely some kind of wave 4 down with a wave 5 up yet to come. If so we should see the end of this C wave down between today and Thursday. Right now it's trying to rally back up some but hitting resistance. So there could still be one more push down before a wave 5 up starts, which should last into next week most likely. But it could also have ended the down move yesterday. It's too early to tell but odds favor a move up that takes us to new highs, which either started at yesterday's low or will start at a new low today or Thursday morning at the latest.

Resistance for the bulls is at that 2435 zone and support is at yesterday's low of 2413. If we are done on the downside then this first move up is just a smaller wave 1 inside that 5th wave up. There should still be a smaller wave 2 down later today or Thursday morning to put in a "higher low" then yesterday's low. That's the point I'd be interested in going long at if we see this pattern. If not, and we are instead still in the C down of the ABC down from the high on 6/19 then I'd be looking for a lower low later today or Thursday morning. If that happens I'd still look to go long and ride up the first smaller wave 1 of the 5th wave up. But of course I'd rather ride the smaller wave 3 up inside the 5th wave up, but that would require a higher low later today or Thursday. Either way, it looks like a nice long setup is developing and should appear soon.