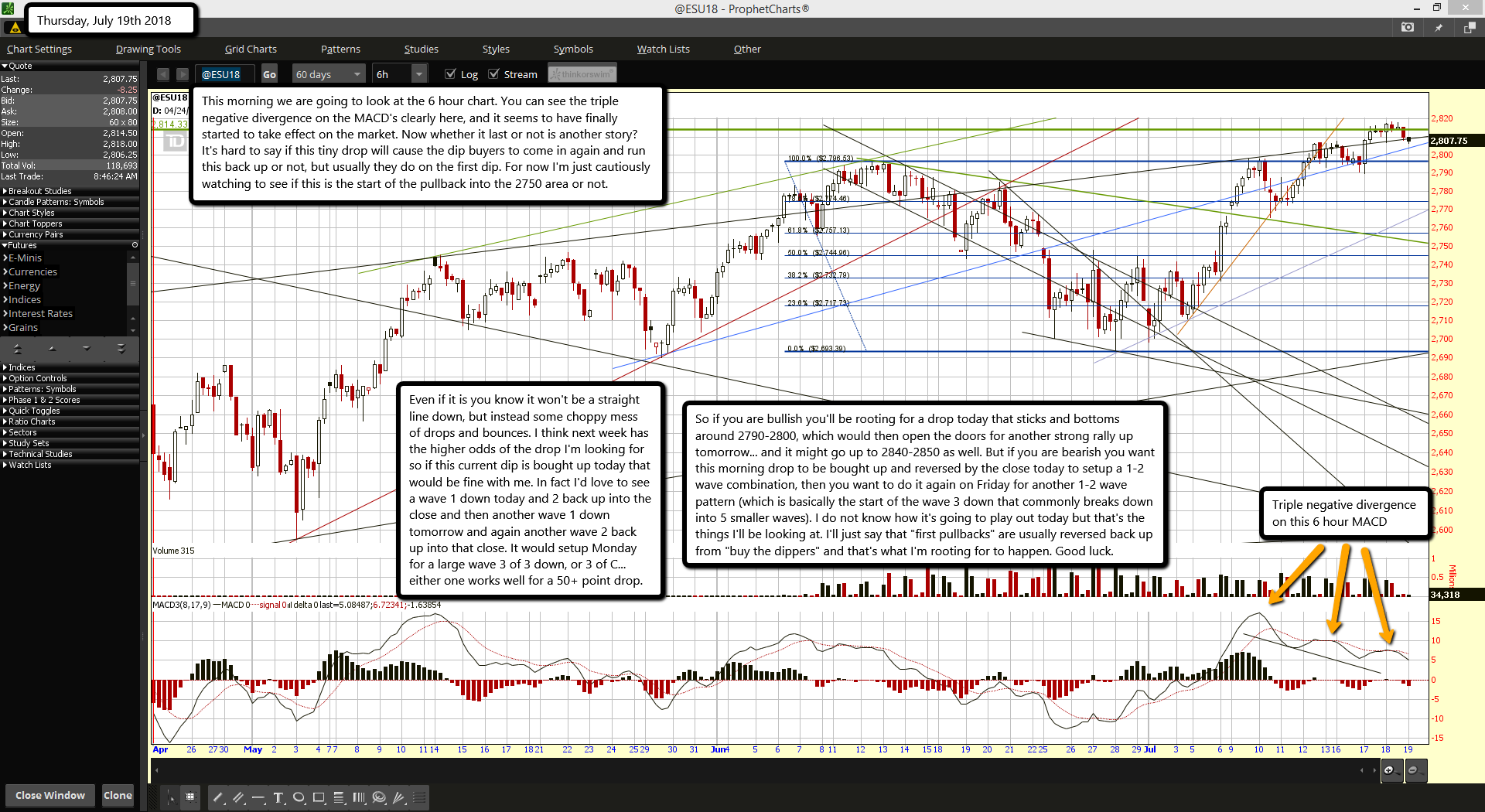

This morning we are going to look at the 6 hour chart. You can see the triple negative divergence on the MACD's clearly here, and it seems to have finally started to take effect on the market. Now whether it last or not is another story? It's hard to say if this tiny drop will cause the dip buyers to come in again and run this back up or not, but usually they do on the first dip. For now I'm just cautiously watching to see if this is the start of the pullback into the 2750 area or not.

Even if it is you know it won't be a straight line down, but instead some choppy mess of drops and bounces. I think next week has the higher odds of the drop I'm looking for so if this current dip is bought up today that would be fine with me. In fact I'd love to see a wave 1 down today and 2 back up into the close and then another wave 1 down tomorrow and again another wave 2 back up into that close. It would setup Monday for a large wave 3 of 3 down, or 3 of C... either one works well for a 50+ point drop.

So if you are bullish you'll be rooting for a drop today that sticks and bottoms around 2790-2800, which would then open the doors for another strong rally up tomorrow... and it might go up to 2840-2850 as well. But if you are bearish you want this morning drop to be bought up and reversed by the close today to setup a 1-2 wave combination, then you want to do it again on Friday for another 1-2 wave pattern (which is basically the start of the wave 3 down that commonly breaks down into 5 smaller waves). I do not know how it's going to play out today but that's the things I'll be looking at. I'll just say that "first pullbacks" are usually reversed back up from "buy the dippers" and that's what I'm rooting for to happen. Good luck.