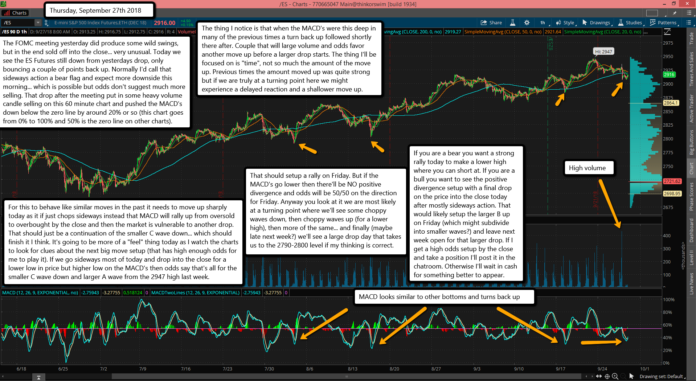

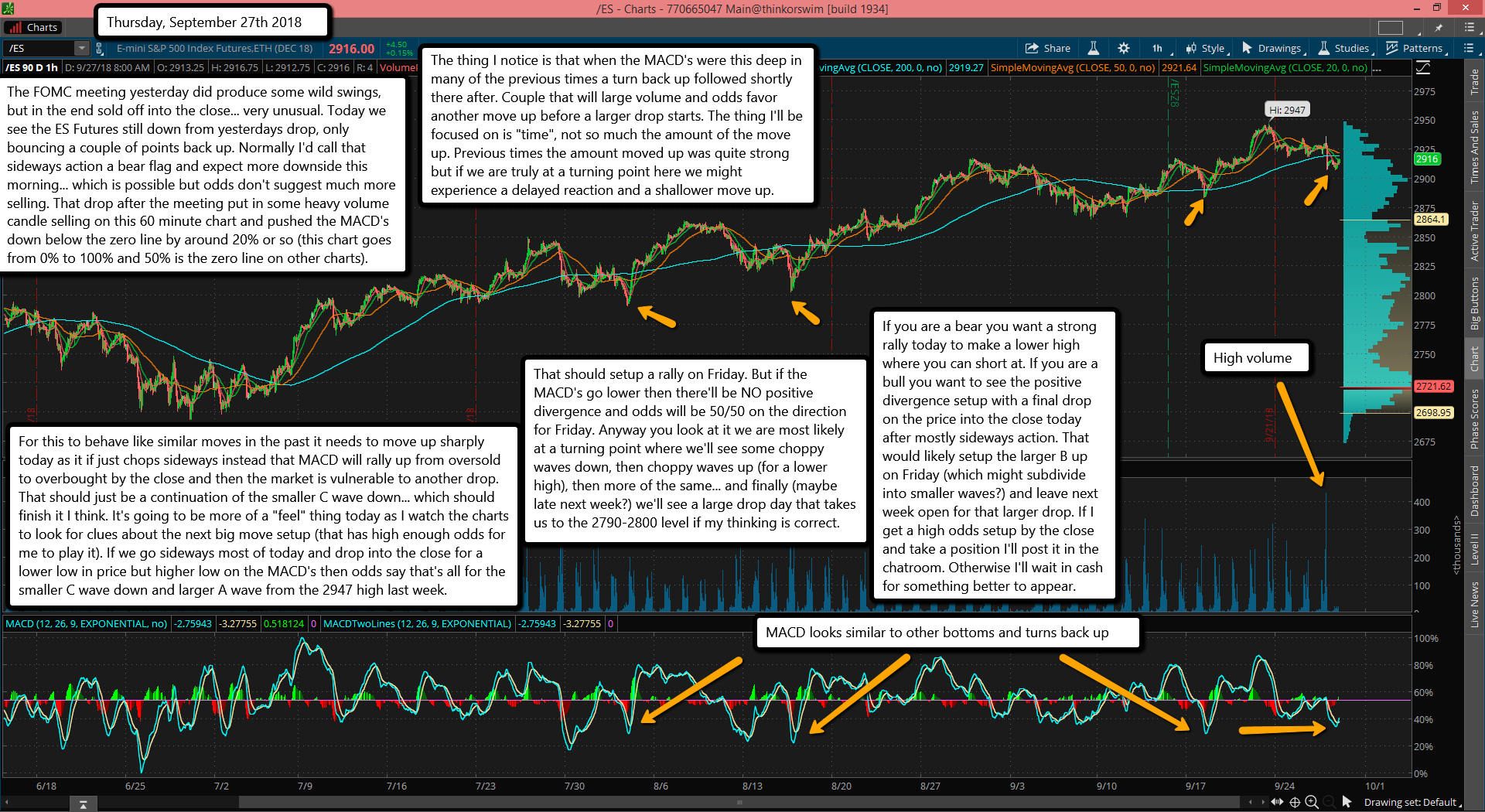

The FOMC meeting yesterday did produce some wild swings, but in the end sold off into the close... very unusual. Today we see the ES Futures still down from yesterdays drop, only bouncing a couple of points back up. Normally I'd call that sideways action a bear flag and expect more downside this morning... which is possible but odds don't suggest much more selling. That drop after the meeting put in some heavy volume candle selling on this 60 minute chart and pushed the MACD's down below the zero line by around 20% or so (this chart goes from 0% to 100% and 50% is the zero line on other charts).

The thing I notice is that when the MACD's were this deep in many of the previous times a turn back up followed shortly there after. Couple that will large volume and odds favor another move up before a larger drop starts. The thing I'll be focused on is "time", not so much the amount of the move up. Previous times the amount moved up was quite strong but if we are truly at a turning point here we might experience a delayed reaction and a shallower move up.

For this to behave like similar moves in the past it needs to move up sharply today as it if just chops sideways instead that MACD will rally up from oversold to overbought by the close and then the market is vulnerable to another drop. That should just be a continuation of the smaller C wave down... which should finish it I think. It's going to be more of a "feel" thing today as I watch the charts to look for clues about the next big move setup (that has high enough odds for me to play it). If we go sideways most of today and drop into the close for a lower low in price but higher low on the MACD's then odds say that's all for the smaller C wave down and larger A wave from the 2947 high last week.

That should setup a rally on Friday. But if the MACD's go lower then there'll be NO positive divergence and odds will be 50/50 on the direction for Friday. Anyway you look at it we are most likely at a turning point where we'll see some choppy waves down, then choppy waves up (for a lower high), then more of the same... and finally (maybe late next week?) we'll see a large drop day that takes us to the 2790-2800 level if my thinking is correct.

If you are a bear you want a strong rally today to make a lower high where you can short at. If you are a bull you want to see the positive divergence setup with a final drop on the price into the close today after mostly sideways action. That would likely setup the larger B up on Friday (which might subdivide into smaller waves?) and leave next week open for that larger drop. If I get a high odds setup by the close and take a position I'll post it in the chatroom. Otherwise I'll wait in cash for something better to appear.