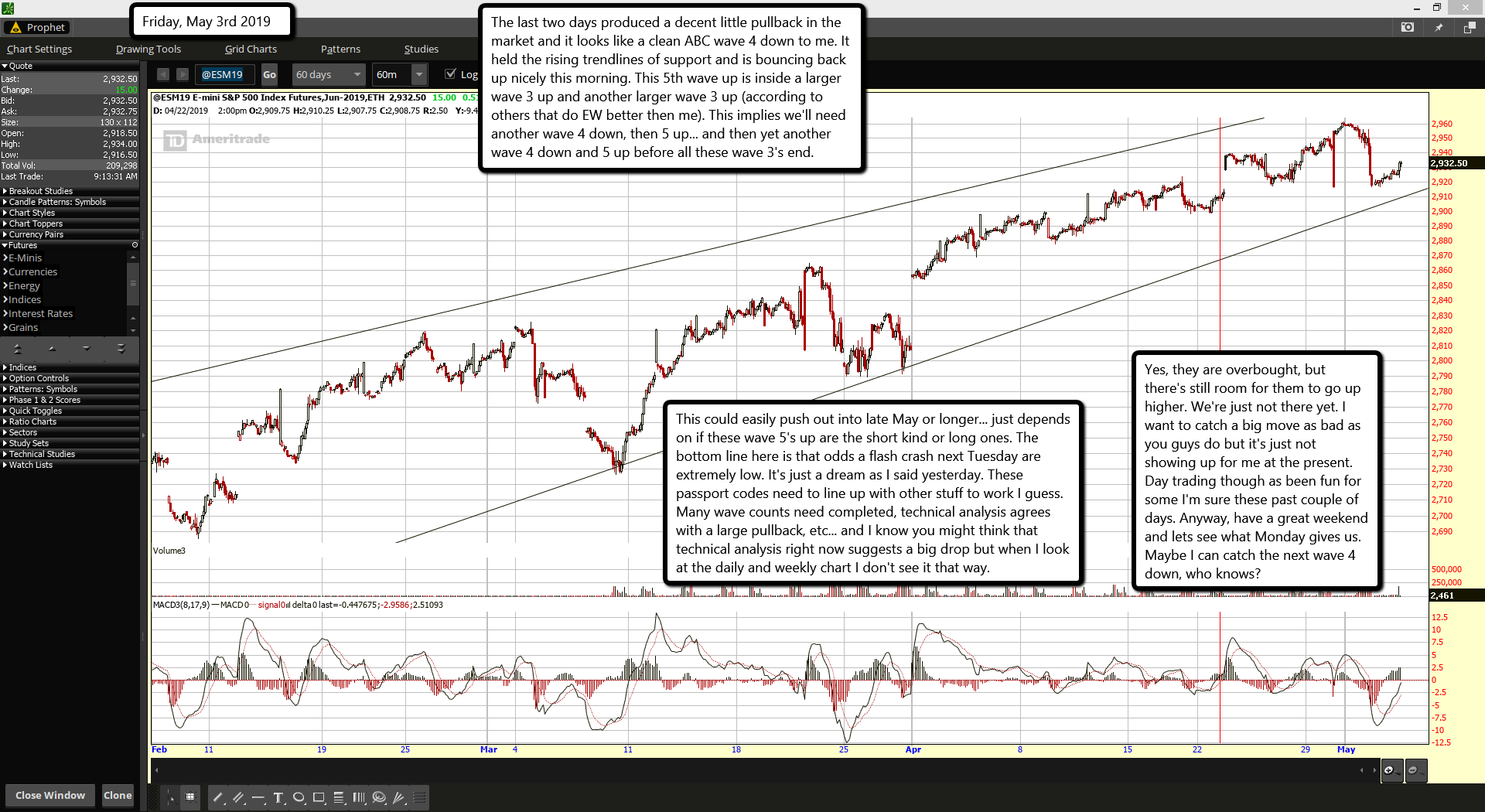

The last two days produced a decent little pullback in the market and it looks like a clean ABC wave 4 down to me. It held the rising trendlines of support and is bouncing back up nicely this morning. This 5th wave up is inside a larger wave 3 up and another larger wave 3 up (according to others that do EW better then me). This implies we'll need another wave 4 down, then 5 up... and then yet another wave 4 down and 5 up before all these wave 3's end.

This could easily push out into late May or longer... just depends on if these wave 5's up are the short kind or long ones. The bottom line here is that odds a flash crash next Tuesday are extremely low. It's just a dream as I said yesterday. These passport codes need to line up with other stuff to work I guess. Many wave counts need completed, technical analysis agrees with a large pullback, etc... and I know you might think that technical analysis right now suggests a big drop but when I look at the daily and weekly chart I don't see it that way.

Yes, they are overbought, but there's still room for them to go up higher. We're just not there yet. I want to catch a big move as bad as you guys do but it's just not showing up for me at the present. Day trading though as been fun for some I'm sure these past couple of days. Anyway, have a great weekend and lets see what Monday gives us. Maybe I can catch the next wave 4 down, who knows?