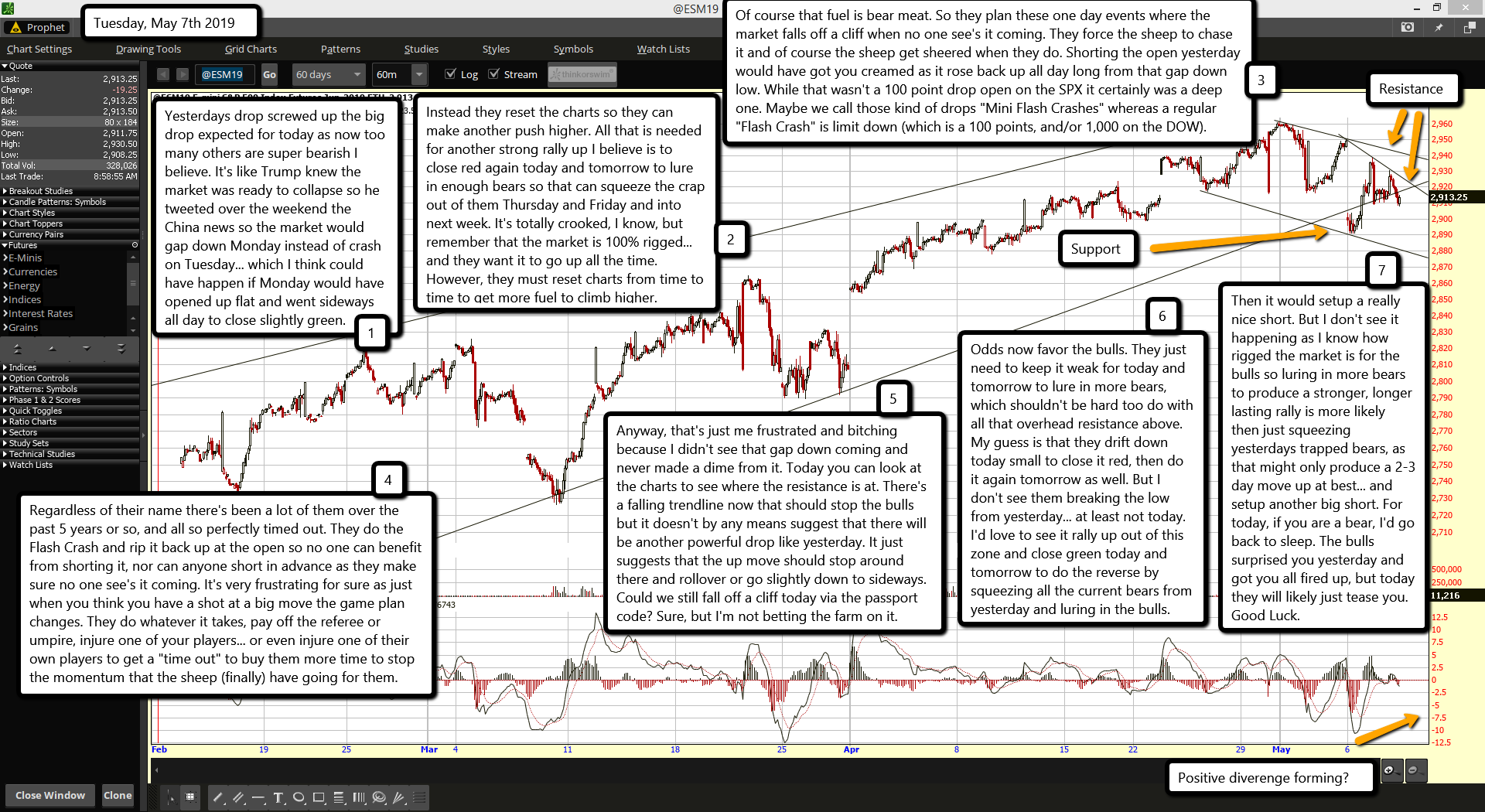

Yesterdays drop screwed up the big drop expected for today as now too many others are super bearish I believe. It's like Trump knew the market was ready to collapse so he tweeted over the weekend the China news so the market would gap down Monday instead of crash on Tuesday... which I think could have happen if Monday would have opened up flat and went sideways all day to close slightly green.

Instead they reset the charts so they can make another push higher. All that is needed for another strong rally up I believe is to close red again today and tomorrow to lure in enough bears so that can squeeze the crap out of them Thursday and Friday and into next week. It's totally crooked, I know, but remember that the market is 100% rigged... and they want it to go up all the time. However, they must reset charts from time to time to get more fuel to climb higher.

Of course that fuel is bear meat. So they plan these one day events where the market falls off a cliff when no one see's it coming. They force the sheep to chase it and of course the sheep get sheered when they do. Shorting the open yesterday would have got you creamed as it rose back up all day long from that gap down low. While that wasn't a 100 point drop open on the SPX it certainly was a deep one. Maybe we call those kind of drops "Mini Flash Crashes" whereas a regular "Flash Crash" is limit down (which is a 100 points, and/or 1,000 on the DOW).

Regardless of their name there's been a lot of them over the past 5 years or so, and all so perfectly timed out. They do the Flash Crash and rip it back up at the open so no one can benefit from shorting it, nor can anyone short in advance as they make sure no one see's it coming. It's very frustrating for sure as just when you think you have a shot at a big move the game plan changes. They do whatever it takes, pay off the referee or umpire, injure one of your players... or even injure one of their own players to get a "time out" to buy them more time to stop the momentum that the sheep (finally) have going for them.

Anyway, that's just me frustrated and bitching because I didn't see that gap down coming and never made a dime from it. Today you can look at the charts to see where the resistance is at. There's a falling trendline now that should stop the bulls but it doesn't by any means suggest that there will be another powerful drop like yesterday. It just suggests that the up move should stop around there and rollover or go slightly down to sideways. Could we still fall off a cliff today via the passport code? Sure, but I'm not betting the farm on it.

Odds now favor the bulls. They just need to keep it weak for today and tomorrow to lure in more bears, which shouldn't be hard too do with all that overhead resistance above. My guess is that they drift down today small to close it red, then do it again tomorrow as well. But I don't see them breaking the low from yesterday... at least not today. I'd love to see it rally up out of this zone and close green today and tomorrow to do the reverse by squeezing all the current bears from yesterday and luring in the bulls.

Then it would setup a really nice short. But I don't see it happening as I know how rigged the market is for the bulls so luring in more bears to produce a stronger, longer lasting rally is more likely then just squeezing yesterdays trapped bears, as that might only produce a 2-3 day move up at best... and setup another big short. For today, if you are a bear, I'd go back to sleep. The bulls surprised you yesterday and got you all fired up, but today they will likely just tease you. Good Luck.