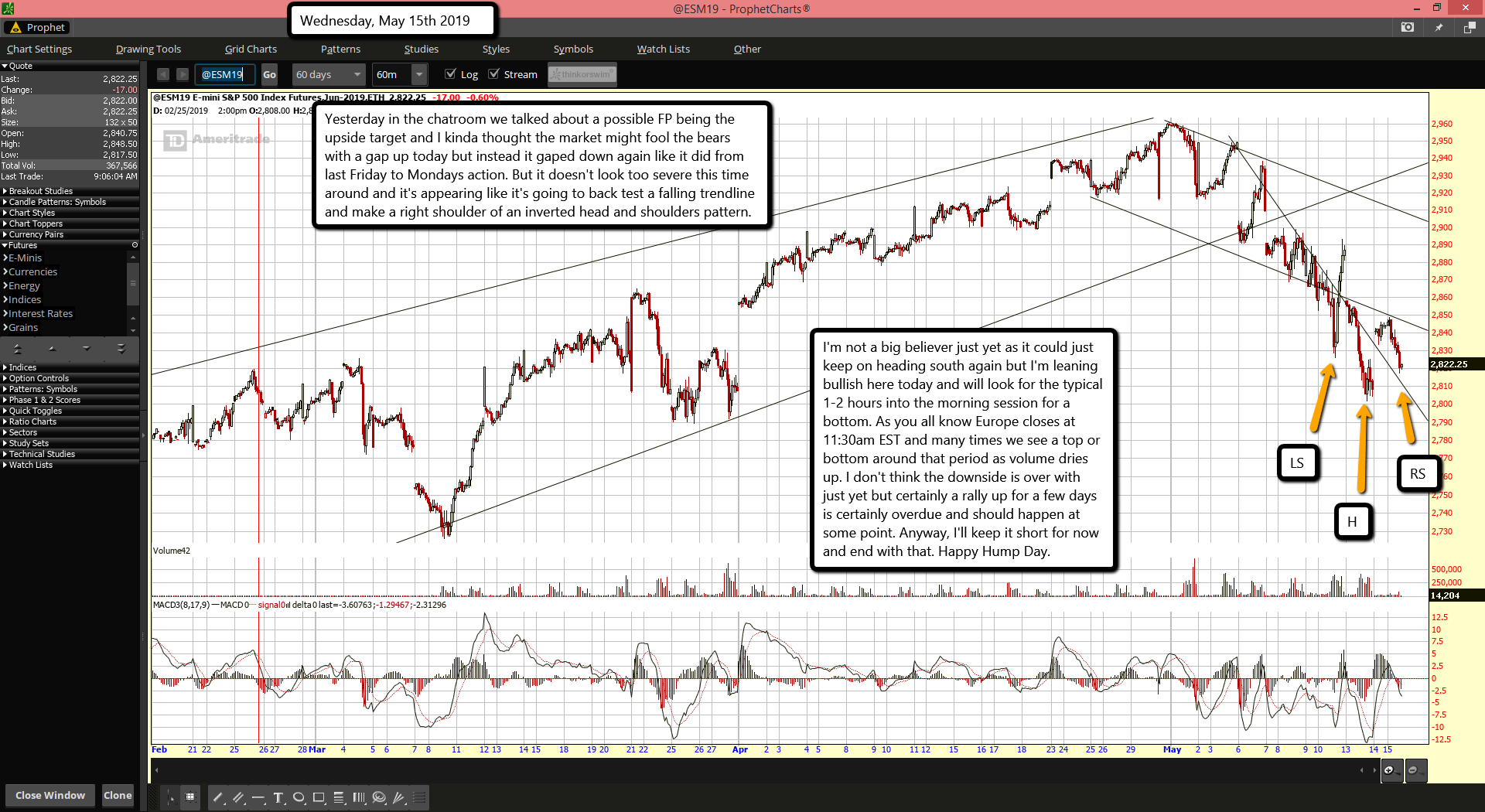

Yesterday in the chatroom we talked about a possible FP being the upside target and I kinda thought the market might fool the bears with a gap up today but instead it gaped down again like it did from last Friday to Mondays action. But it doesn't look too severe this time around and it's appearing like it's going to back test a falling trendline and make a right shoulder of an inverted head and shoulders pattern.

I'm not a big believer just yet as it could just keep on heading south again but I'm leaning bullish here today and will look for the typical 1-2 hours into the morning session for a bottom. As you all know Europe closes at 11:30am EST and many times we see a top or bottom around that period as volume dries up. I don't think the downside is over with just yet but certainly a rally up for a few days is certainly overdue and should happen at some point. Anyway, I'll keep it short for now and end with that. Happy Hump Day.