I was looking at going long last Friday at the close when the market was drifting down slowly into 3:30 pm, and then BAM, out of no where it rips higher that final 30 minutes into the close. I missed it and wasn't going to chase it as I didn't know the reason for the move at the time and therefore didn't trust it. Of course it was related the G20 I'm sure now, so those people that bought it are sure happy this morning I'm sure. Very frustrating to have missed that move!

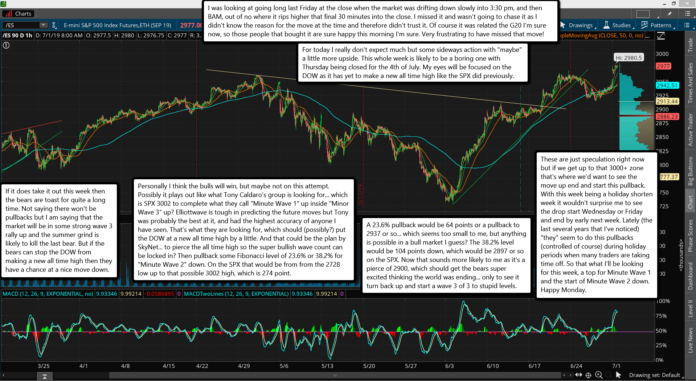

For today I really don't expect much but some sideways action with "maybe" a little more upside. This whole week is likely to be a boring one with Thursday being closed for the 4th of July. My eyes will be focused on the DOW as it has yet to make a new all time high like the SPX did previously.

If it does take it out this week then the bears are toast for quite a long time. Not saying there won't be pullbacks but I am saying that the market will be in some strong wave 3 rally up and the summer grind is likely to kill the last bear. But if the bears can stop the DOW from making a new all time high then they have a chance at a nice move down.

Personally I think the bulls will win, but maybe not on this attempt. Possibly it plays out like what Tony Caldaro's group is looking for... which is SPX 3002 to complete what they call "Minute Wave 1" up inside "Minor Wave 3" up? Elliottwave is tough in predicting the future moves but Tony was probably the best at it, and had the highest accuracy of anyone I have seen. That's what they are looking for, which should (possibly?) put the DOW at a new all time high by a little. And that could be the plan by SkyNet... to pierce the all time high so the super bullish wave count can be locked in? Then pullback some Fibonacci level of 23.6% or 38.2% for "Minute Wave 2" down. On the SPX that would be from from the 2728 low up to that possible 3002 high, which is 274 point.

A 23.6% pullback would be 64 points or a pullback to 2937 or so... which seems too small to me, but anything is possible in a bull market I guess? The 38.2% level would be 104 points down, which would be 2897 or so on the SPX. Now that sounds more likely to me as it's a pierce of 2900, which should get the bears super excited thinking the world was ending... only to see it turn back up and start a wave 3 of 3 to stupid levels.

These are just speculation right now but if we get up to that 3000+ zone that's where we'd want to see the move up end and start this pullback. With this week being a holiday shorten week it wouldn't surprise me to see the drop start Wednesday or Friday and end by early next week. Lately (the last several years that I've noticed) "they" seem to do this pullbacks (controlled of course) during holiday periods when many traders are taking time off. So that what I'll be looking for this week, a top for Minute Wave 1 and the start of Minute Wave 2 down. Happy Monday.