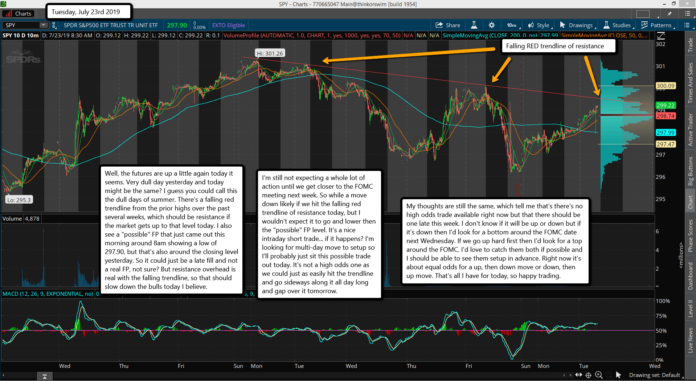

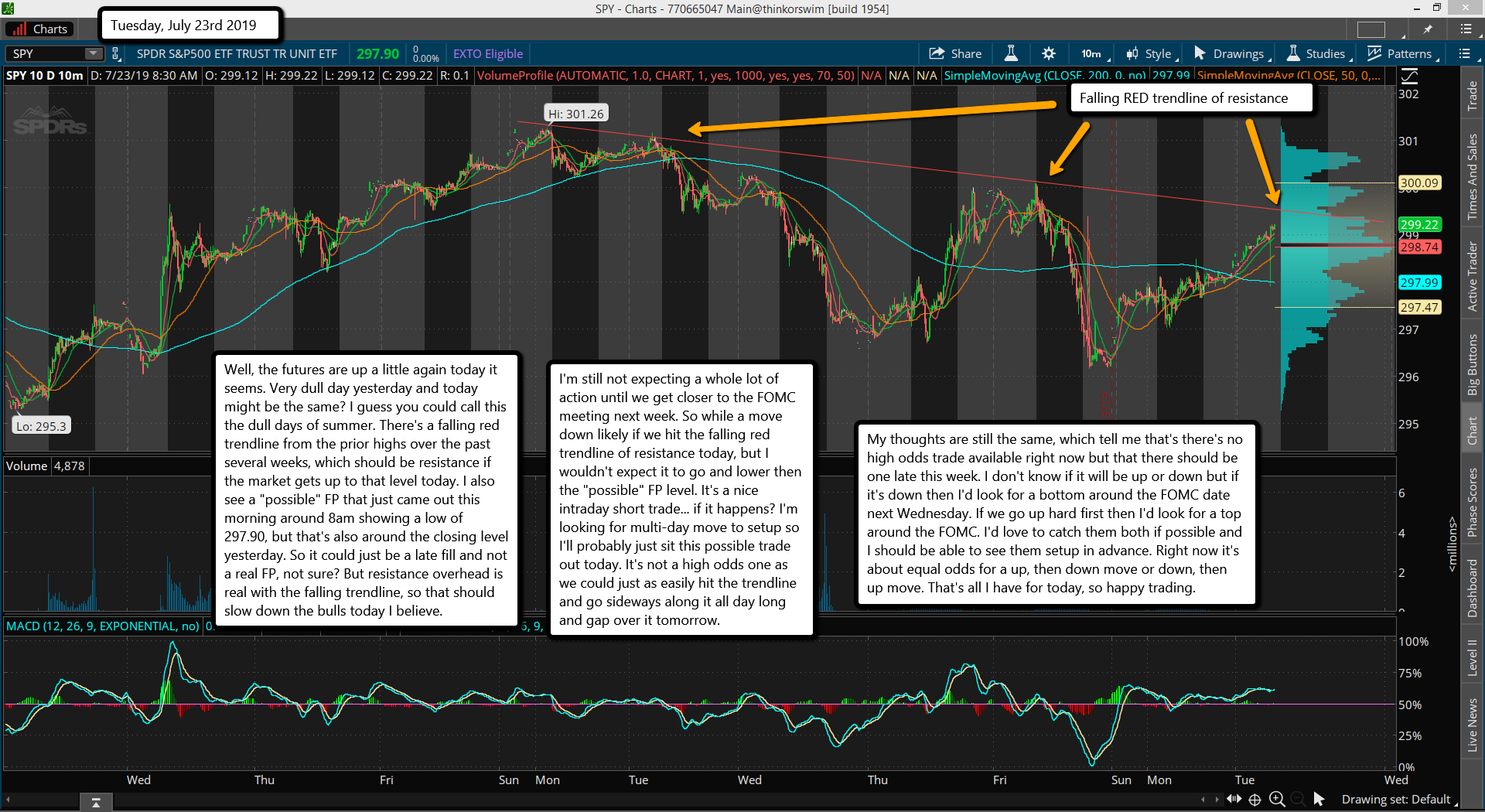

Well, the futures are up a little again today it seems. Very dull day yesterday and today might be the same? I guess you could call this the dull days of summer. There's a falling red trendline from the prior highs over the past several weeks, which should be resistance if the market gets up to that level today. I also see a "possible" FP that just came out this morning around 8am showing a low of 297.90, but that's also around the closing level yesterday. So it could just be a late fill and not a real FP, not sure? But resistance overhead is real with the falling trendline, so that should slow down the bulls today I believe.

I'm still not expecting a whole lot of action until we get closer to the FOMC meeting next week. So while a move down likely if we hit the falling red trendline of resistance today, but I wouldn't expect it to go and lower then the "possible" FP level. It's a nice intraday short trade... if it happens? I'm looking for multi-day move to setup so I'll probably just sit this possible trade out today. It's not a high odds one as we could just as easily hit the trendline and go sideways along it all day long and gap over it tomorrow.

My thoughts are still the same, which tell me that's there's no high odds trade available right now but that there should be one late this week. I don't know if it will be up or down but if it's down then I'd look for a bottom around the FOMC date next Wednesday. If we go up hard first then I'd look for a top around the FOMC. I'd love to catch them both if possible and I should be able to see them setup in advance. Right now it's about equal odds for a up, then down move or down, then up move. That's all I have for today, so happy trading.