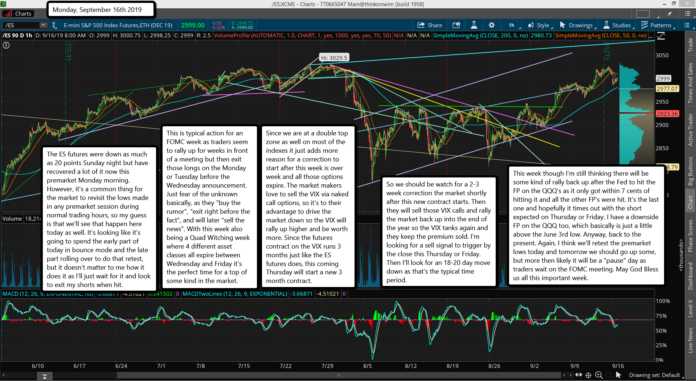

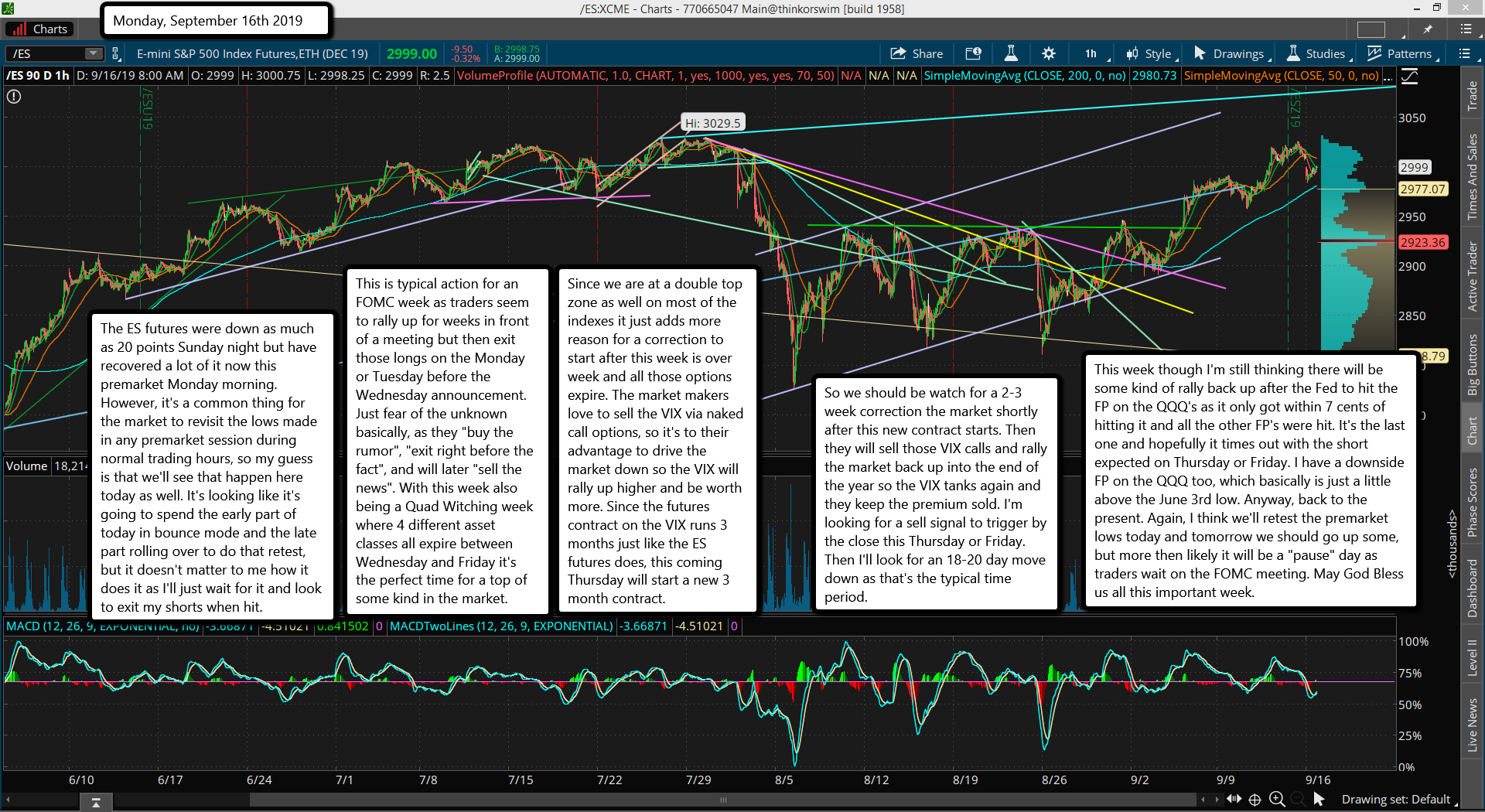

The ES futures were down as much as 20 points Sunday night but have recovered a lot of it now this premarket Monday morning. However, it's a common thing for the market to revisit the lows made in any premarket session during normal trading hours, so my guess is that we'll see that happen here today as well. It's looking like it's going to spend the early part of today in bounce mode and the late part rolling over to do that retest, but it doesn't matter to me how it does it as I'll just wait for it and look to exit my shorts when hit.

This is typical action for an FOMC week as traders seem to rally up for weeks in front of a meeting but then exit those longs on the Monday or Tuesday before the Wednesday announcement. Just fear of the unknown basically, as they "buy the rumor", "exit right before the fact", and will later "sell the news". With this week also being a Quad Witching week where 4 different asset classes all expire between Wednesday and Friday it's the perfect time for a top of some kind in the market.

Since we are at a double top zone as well on most of the indexes it just adds more reason for a correction to start after this week is over week and all those options expire. The market makers love to sell the VIX via naked call options, so it's to their advantage to drive the market down so the VIX will rally up higher and be worth more. Since the futures contract on the VIX runs 3 months just like the ES futures does, this coming Thursday will start a new 3 month contract.

So we should be watch for a 2-3 week correction the market shortly after this new contract starts. Then they will sell those VIX calls and rally the market back up into the end of the year so the VIX tanks again and they keep the premium sold. I'm looking for a sell signal to trigger by the close this Thursday or Friday. Then I'll look for an 18-20 day move down as that's the typical time period.

This week though I'm still thinking there will be some kind of rally back up after the Fed to hit the FP on the QQQ's as it only got within 7 cents of hitting it and all the other FP's were hit. It's the last one and hopefully it times out with the short expected on Thursday or Friday. I have a downside FP on the QQQ too, which basically is just a little above the June 3rd low. Anyway, back to the present. Again, I think we'll retest the premarket lows today and tomorrow we should go up some, but more then likely it will be a "pause" day as traders wait on the FOMC meeting. May God Bless us all this important week.