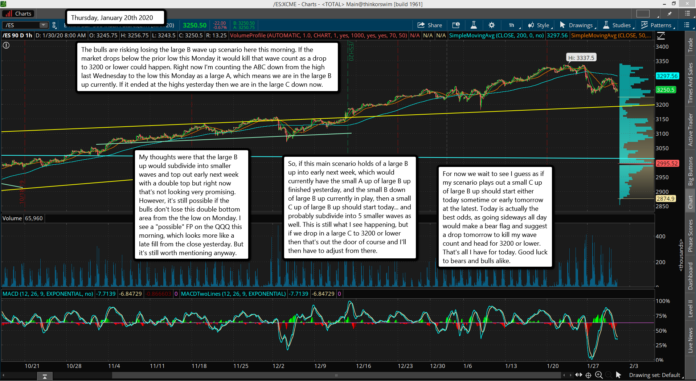

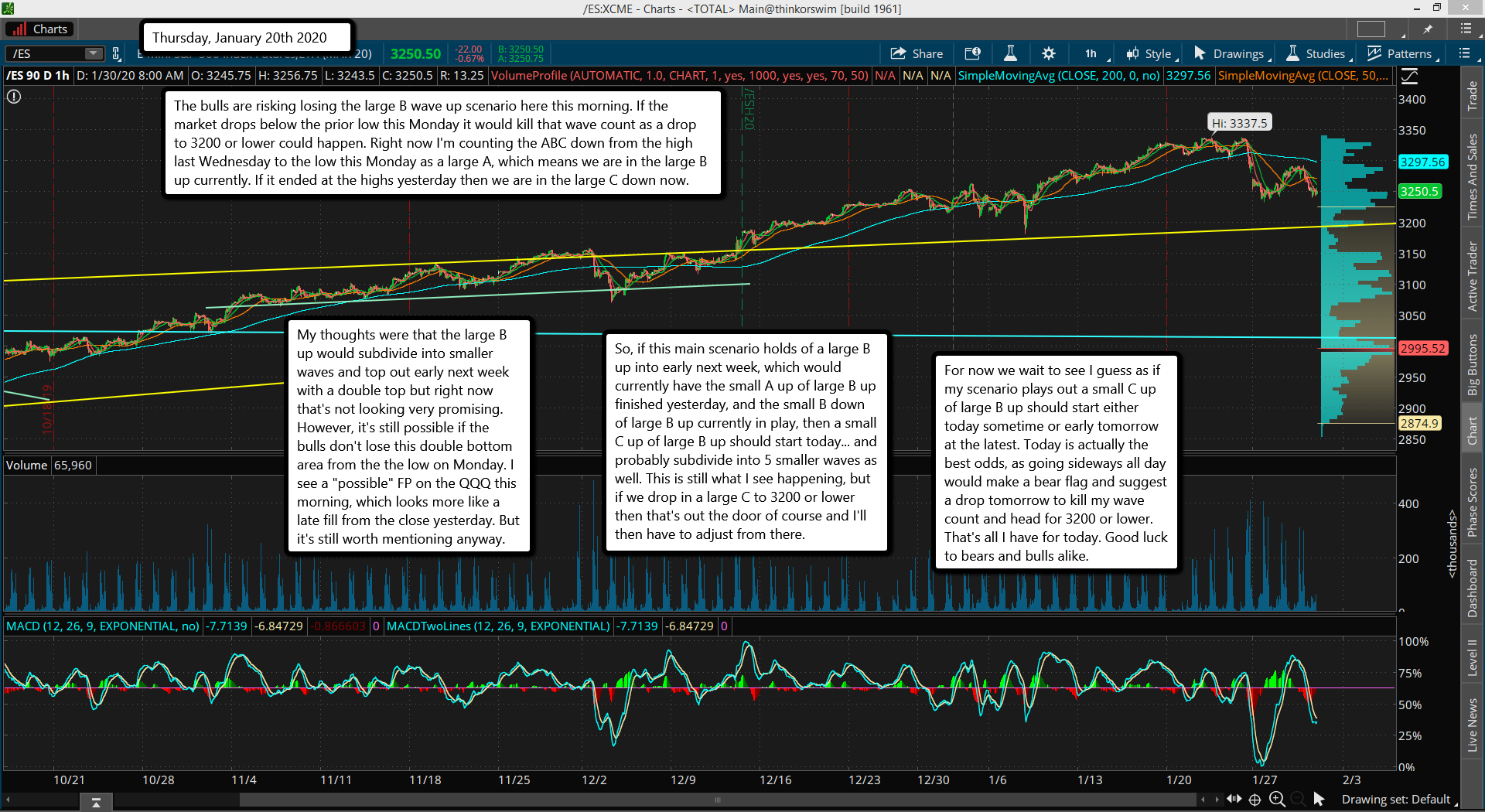

The bulls are risking losing the large B wave up scenario here this morning. If the market drops below the prior low this Monday it would kill that wave count as a drop to 3200 or lower could happen. Right now I'm counting the ABC down from the high last Wednesday to the low this Monday as a large A, which means we are in the large B up currently. If it ended at the highs yesterday then we are in the large C down now.

My thoughts were that the large B up would subdivide into smaller waves and top out early next week with a double top but right now that's not looking very promising. However, it's still possible if the bulls don't lose this double bottom area from the the low on Monday. I see a "possible" FP on the QQQ this morning, which looks more like a late fill from the close yesterday. But it's still worth mentioning anyway.

So, if this main scenario holds of a large B up into early next week, which would currently have the small A up of large B up finished yesterday, and the small B down of large B up currently in play, then a small C up of large B up should start today... and probably subdivide into 5 smaller waves as well. This is still what I see happening, but if we drop in a large C to 3200 or lower then that's out the door of course and I'll then have to adjust from there.

For now we wait to see I guess as if my scenario plays out a small C up of large B up should start either today sometime or early tomorrow at the latest. Today is actually the best odds, as going sideways all day would make a bear flag and suggest a drop tomorrow to kill my wave count and head for 3200 or lower. That's all I have for today. Good luck to bears and bulls alike.