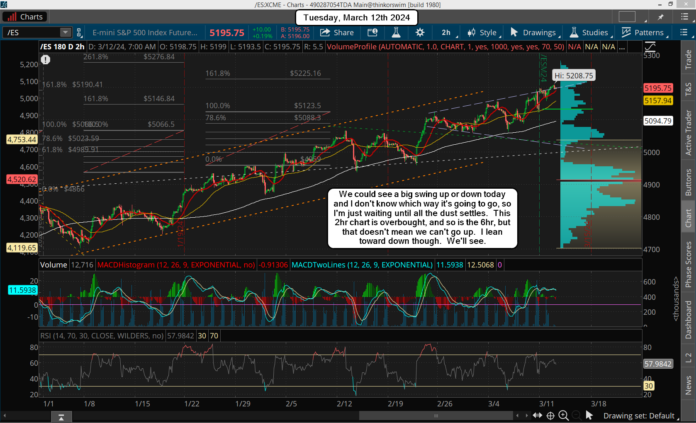

Yesterday first pulled back and then went up into the close to end slightly red but we have made another new higher high then the 5196 gap up high at the open Monday. It's really hard to get a good feel right now on where the market is going as there's nothing clear in the technicals.

Then of course we have the CPI this morning before the open and that's going to cause some wild swings both ways. I just sat on my hands yesterday and will again look for some better setup to get long. I could miss it, but I don't want to chase as that's how you lose money, so I'll be looking for one more pullback before we run up to the FET of 5334, which as I said yesterday, could happen after the CPI... and that would mean we should top there and drop into the March 22nd turn date to put in a low.

I prefer a pullback for Small Wave 4 but who knows if that wave count is right or not? The smaller degree ones are the toughest to figure out, but if we get a pullback then it should be S4, and might end next week before the FOMC?

It's possible that we hit my closer FET at 5225 from the CPI and then reverse back down afterwards... I mean after the wild swings subside of course. We did pullback some yesterday with a low of 5157 on the ES, but I just didn't feel comfortable taking a long there with the CPI the next day. I'm just patiently waiting to get a decent pullback to go long for that last rally up, or for that final FET of 5334 to get hit without me long where I'll short it. Nothing more to add, let's just see what happens and look for another setup.

On last thing, that low yesterday of 5157 came just shy of filling the gap on the ES from the roll from the March contract to the June, as on Friday it close at 5132 at the 4:59pm EST last tick. Not that it's required to close that gap I'd certain be interested in a long if we dropped that low to fill it. I'd still have to look at the technicals but it would be of big interest to me, that's for sure.

Have a blessed day.