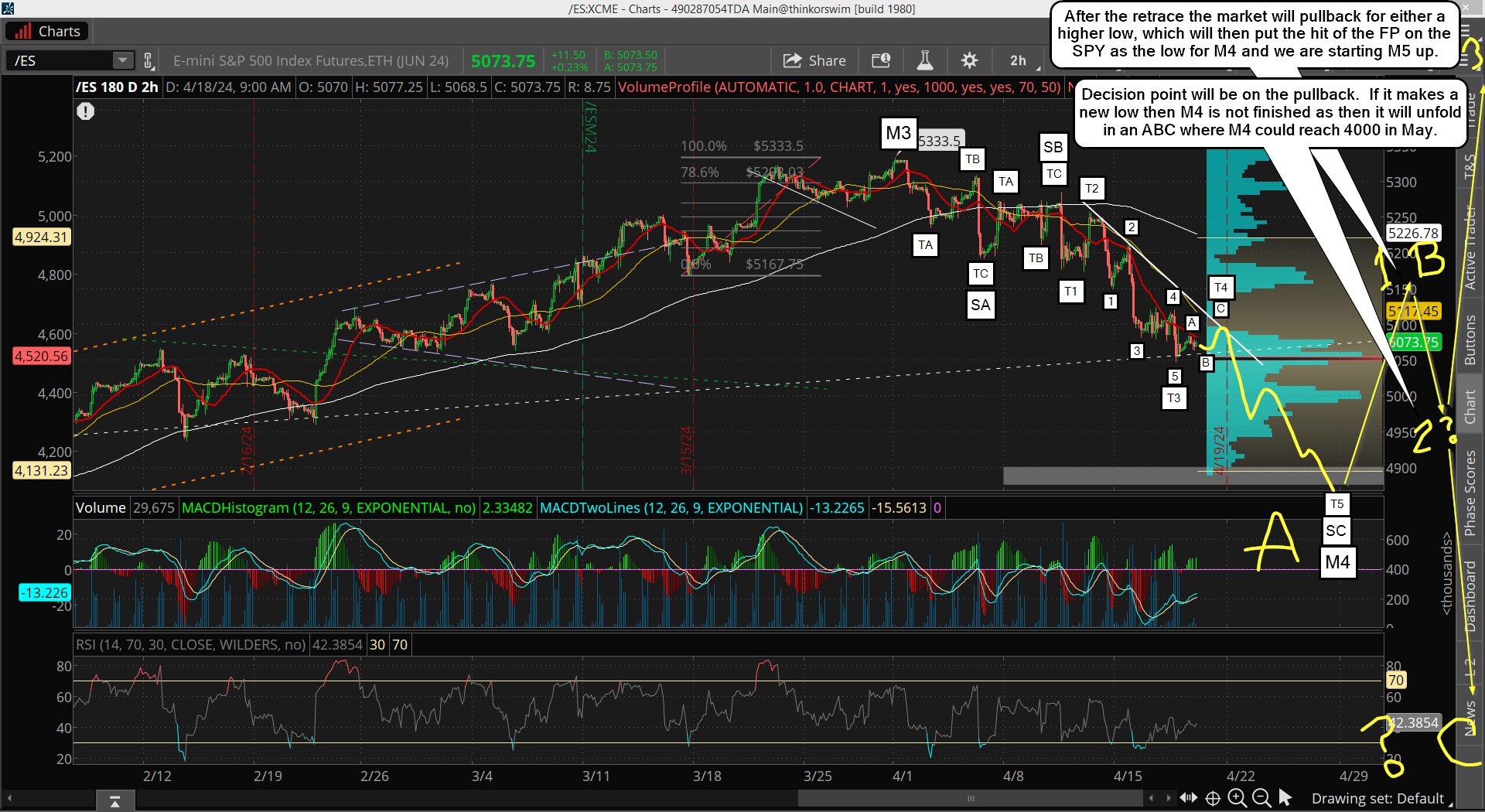

A nothing day yesterday as the chop continued. This 5050 area on the ES is critical support for the bulls, which is why it's been such a battleground. To me it's just delaying the move down to the FP, which is coming one way or the other. At this point it's looking like it will be next week, which is fine with me. Possibly next Monday or Tuesday as we are only about 150 points or so away from it.

On the ES it should be around 4880-4890 and on the SPX around 4850 or so. That could hit even today, but with it being OPEX I have to think they will hold it up to pin it at wherever max pain is for options. That's all I have for now. Here's yesterday wave count I posted in the chatroom.

Keep in mind that if we hit the FP today that means they plan on gaping it up on Monday to do the 50% retrace with everyone trapped short over the weekend expecting a crash. It won't happen. Once the FP is hit the market will reverse. With two FP's in the 483 zone on the SPY that's double conformation that it's real and that we will turn back up from it.

I would fully expect a gap up Monday (big one) and a squeeze all week. I guess it could be over with by Wednesday but it should last the whole week I think. I'll just be looking for a 50% move up (probably a hair more as it rarely stops right at 50), which is where I'll exit the long I plan on taking at the FP... if hit today. I'm still short and will exit it when the FP is hit, whether that's today or Monday. But I get the feeling we will hit it today to get all the bears to stay short over the weekend.

I've been down this road many times thinking a crash would happen the following Monday, and it never did. And now I have two FP's around the same area as well, so I know that once they are hit this market will squeeze back up the next day. It's the perfect trap to do it over a weekend, so I promise you I will be exiting my short at the FP today and going long.

Have a great weekend.

Monday has the worst astrology seen in a while with the Sun squaring Pluto along with all the other stuff.

It was a strange day with breadth so strong and markets down. We never got a bounce back to the 50 day average and now the indices are getting oversold.

The Dow and $nya led the way down and have been consolidating the last few days. My expectation was for the market to bottom on Friday next week. Since the SP500 hasn’t hit the 100 day average yet (Dow has), I’ll stick with that.

Maybe we get a stong bounce to the 50 day and a final washout drop into Friday. I still haven’t seen any moving average crossovers of certain indicators that wpuld indicate an imminent bottom.

I’m still looking for the FP on the SPY of 483 to get hit. Once it does I’m exiting my shorts and going long for a 50% retrace.

I’m extending the low to the end of the month now. Maybe the SP500 bounces off the 100 day average back to the 50 day average. The Nasdaq is already below its 100 day average.

The 13 day simple average had been providing resistance so that should cap any rally for now. The 20 day ema would be the next layer of resistance. The market is stretched from both now.

The market is going to have to survive the first 2 days of the next week. The full moon is going to be opposed to all those entities conjoined in Aries as well as the Sun squared to Pluto in Aquarius.

I did a check of the Tulip Bubble astro in Feb 1637 and the Sun was square Pluto in the same signs but the Sun and Pluto were reversed.