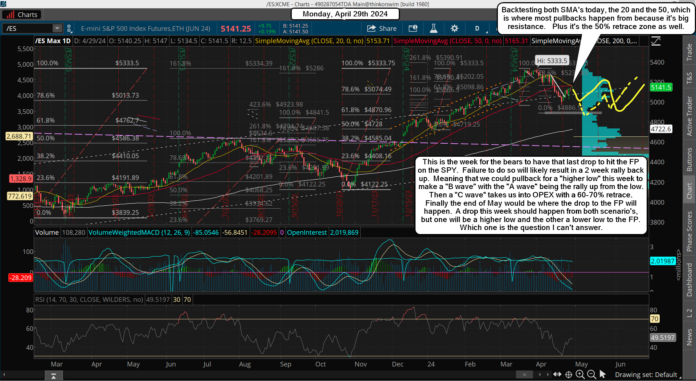

We got the rally to the 50% retracement that I was looking for on Friday by coming just 2 points shy of 5148, so that's a hit in my book. This week tells all for the bull or bear case I think as we are still in a bigger term bull market but the correction should not be over with just yet.

At least that's "if" the FP on the SPY of 483 is a real one and I think it is. In fact it was put out twice, once on March 1st for 483.07 and again on April 11th showing 483.62, so I have to think they are real and will be hit before the bull market resumes it's next big leg up. This week is when that FP should be hit as we have the FOMC meeting that can be used as an "event" to blame it on. We all know that the market loves to use "events" to trigger big moves, of which many are traps. I tend to think this one will be a trap as well.

I don't think we are going to rally up into the meeting but instead I think we pullback into it but save the hitting of the FP until right after the meeting. It will be a great way to scare the bulls out and trap the bears with a fast drop to the FP, which then bottoms and turns back up just as fast.

There won't be any bulls on board and bears will be shorting the crap out of it, which will be the fuel needed for a big squeeze to start from. I would not be shocked to see us pullback to around 5000 on the ES going into the meeting, and then flush down 100+ point to hit the FP (around 4880 on the ES roughly).

And then a full reversal back up to above 5000 by the close, with 5100+ possible by the end of the week. This is my dream scenario and one that would trick the most traders I think. The FP low would be the Head in a likely "Inverted Head and Shoulders" pattern that I still think will form. After the squeeze is finish, which could last for a week plus, there should be a pullback for a higher low to make the right shoulder as the left shoulder is the current low from 4/19 at 4963.50, and might take all of May to unfold.

The correction in December of last year to January formed a nice inverted head and shoulders, and I think this current correction can form another one. All just speculation at this point, but certainly possible. Now if a new FP comes out, which shows a lower low then the current 483 ones, then that right shoulder won't be accurate and we'll just drop to the new FP I guess. But right now I'm only looking for a higher low on that last pullback, and then the bull market to resume.

For the short term, pretty simple really, I'm looking for a pullback into the FOMC starting today, and that's even if we go a little higher first. It changes nothing as this rally up from the bottom is still just a bounce in a correction that isn't over with in my opinion, and won't be until the downside FP on the SPY is hit. If for any reason it is not hit this week then I don't think we'll see it hit until the last week of May.

Have a blessed day.