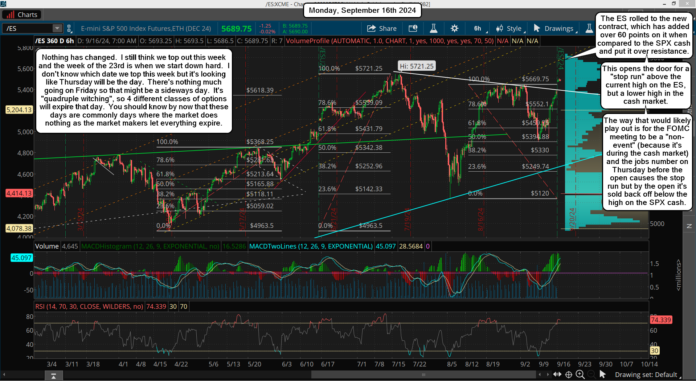

We are up against resistance from the falling white trendline and the horizontal prior highs around 5660-5670, so there's not much to do right now but wait until the FOMC this Wednesday and see where we are at. Too me, if we are still up in this range, meaning we don't pullback much, I have to think it's a sell the news event. If we pullback in front of it, to say 5550 or lower, then I'd look for some last rally into this Friday to attempt to make a new high again... but I really don't think we will get through it.

I feel like this market is setting up for a surprise crash like drop starting next week that no one will see coming. Others think we'll top out into mid-October but I just don't see it. I could be wrong but I think a big surprise is coming, and well before the November election. Not much more to add at this point as we wait on the FOMC.

Have a blessed day.

Mars is squaring the moon’s node soon which is when we can get these geopolitical events. There is a solar eclipse on October 2.

The full moon is today. The SP made a slightly higher high intraday. It’s also 99 weeks from the October 13,2022 lows. The markets like to do cycles involving 11multiples. Today is also 696 days from that low.

I think this puts denouement off until after the election which was a suspected time frame as geopolitical events explode. 10-24 is a key date though. We’ll have to see how things are transpiring as we approach that date. I expect wild swings ahead. We might now be entering the late July phase of the 2007 topping process.

Wild swings like the summers of 2011, 2015 also. The multi month chop fest seems to be their preferred modus operandi for denouement.

This could drag out in “time” for sure as tops take awhile to form and that 2011 and 2015 period is a perfect example. Possibly this drags out into the end of the month?