Friday held up as expected and closed green on the day. Nothing has changed with my thoughts from the posts last week. I still expect a pullback this week with the target areas around 5700 or so on the ES, and then we rally up into the election, and probably past it as I don't think we are going to repeat election night in 2016.

This time will be different. We know that the results of it could be drug out for many days afterwards as the deep state have to figure out a way to create enough votes to cheat and put Kammie in as the next puppet. I don't think it's going to happen though as I think God will intervene and Trump will win, but "when" they actually announce it and said it's final is unknown? Maybe it's just a few days after the election or maybe it's a week or so afterwards?

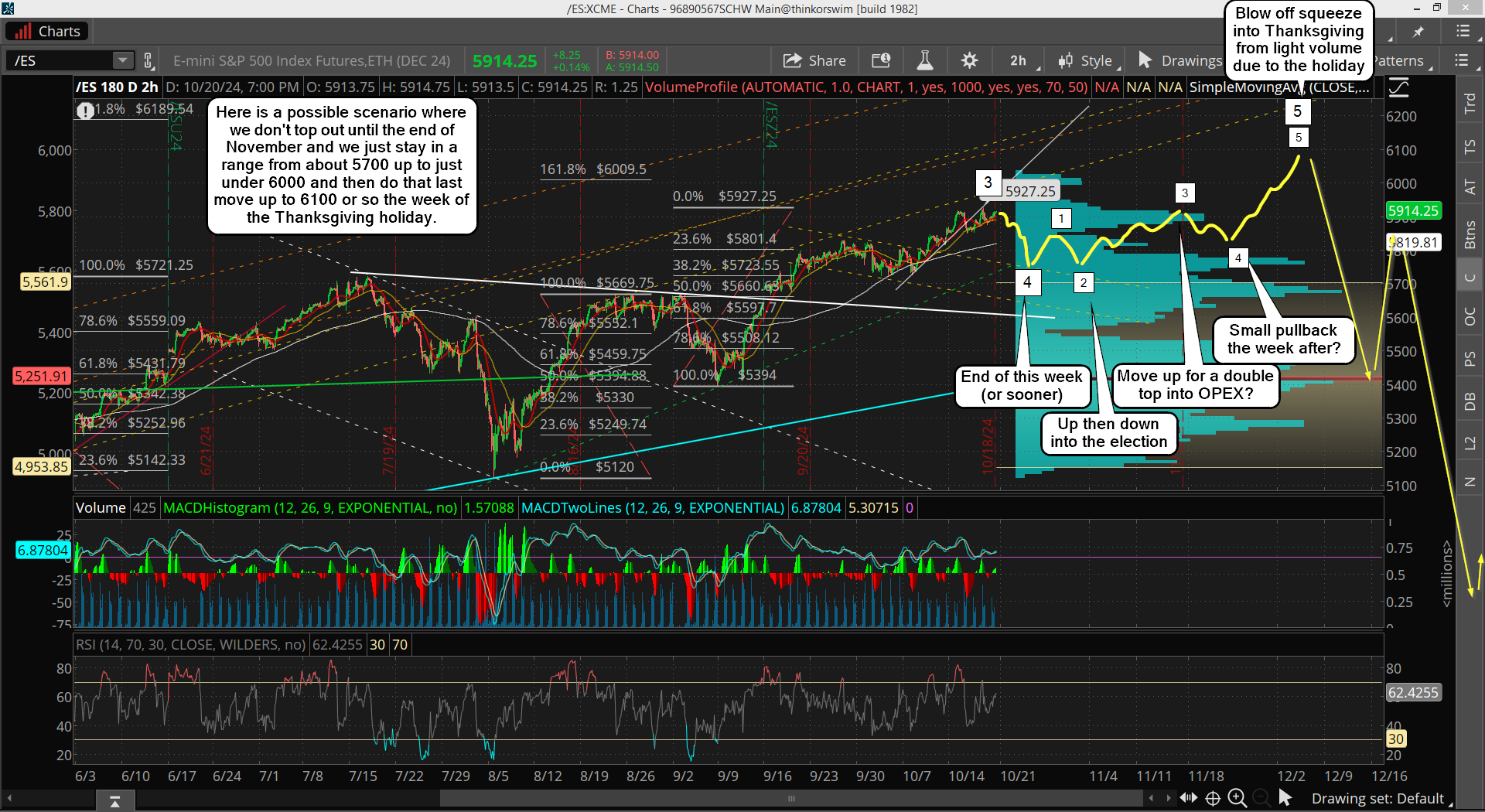

Regardless, the upside target is still the same to me, which is the preferred FET of 6082.46 on the ES, but it could reach the 6189.54 target if it's a really big squeeze. I think that's less likely as I don't think there is enough time left to get it up there before the election, or even after it with some last gasp squeeze from a Trump win. That's only a 100 point difference so we can just call it "that zone" is where the market should top out at.

However, I don't think we are going to just fall off a cliff the day after the results, but instead we will likely have some wild swings up and down for a few weeks as bulls see a Trump wins as a reason to buy the pullbacks while the bears short them looking for the correction to start because the election is over with.

That fighting could last for a few weeks and look similar to the up's and down in September and October of 2018 before the plunge into a Christmas low. I suspect we are going to get some kind of repeat of that, but exact of course. The downside target I still think we reach is the 483 fake print on the SPY and from 6100 on the ES that's only about a 20% correction, which the 2018 one was just under 22%, so they could be close in that area.

My point here is to "expect the un-expected" and a surprise drop in December will fool the masses... especially if we repeat the first drop back then, which was 12% that was followed by a strong rally with everyone thinking the low was in. But it wasn't and we could see that same thing happen this time around too.

Possible Scenario...

And if nothing much happens after the election we could see the market put in the high going into the end of November, which would fool everyone thinking whatever wild swings we had after the election was all there was, and that it's off to the races again in the bull market. But instead we get a surprise large drop in December like 2018 to catch everyone on the wrong side. I think this is very possible, so keep an open mind here as the coming drop won't be easy to trade.

Have a blessed day.