The Grinch That Stole The Santa Rally?

The Bearish Wave Count...

I've been talking about a blow off top over the past many posts but I want to cover another scenario where the final high isn't until the spring or summer of next year. It's always wise to just let the market decide and have different plans of actions if the market doesn't do what you think it should.

Yes, I posted a chart Tuesday where we get a last squeeze up to a new higher high into the first week of January, but what if I'm wrong and Santa doesn't come this year? That chart was posted on X and here it is again below...

There's some issues with that chart when you look closer at the wave count. The waves just don't add up too me like they should in Elliottwave. Down moves usually have 3 waves, and subdivide into 5, 3, and 5 inside them.

FIRST: Notice that the decline from the high was 5 waves in total? They are clean looking waves too. Shouldn't that be an ABC pattern if it was finished? Yes, it should, but it's not and that worries me, which leads me to think it's NOT finished.

SECOND: The rally up from the low is looking very uneven for a 5 wave push with the wave 3 being the shorter move. And if we pullback small for a wave 4, and do a wave 5 blow off to say 6250+ to complete it all that last squeeze will make the wave 5 the largest wave.

Too me it looks more like we had a strong one wave move up from the low for an A wave, then did an ABC down for the B wave pullback, and then started a 5 wave rally for the C wave, which as of the close on Christmas Eve we completed wave 1, 2, and most (or all) of wave 3 inside that C wave up. Below is that chart...

If this wave count is correct we will NOT see a blow off top and will make a lower high, which might be today? All that is left is a wave 4 pullback and wave 5 up to complete the C wave, and that entire ABC up from the low is then just a B wave. Next will be a C down (with 5 waves inside it) into the first week of January. It should make a lower low as well.

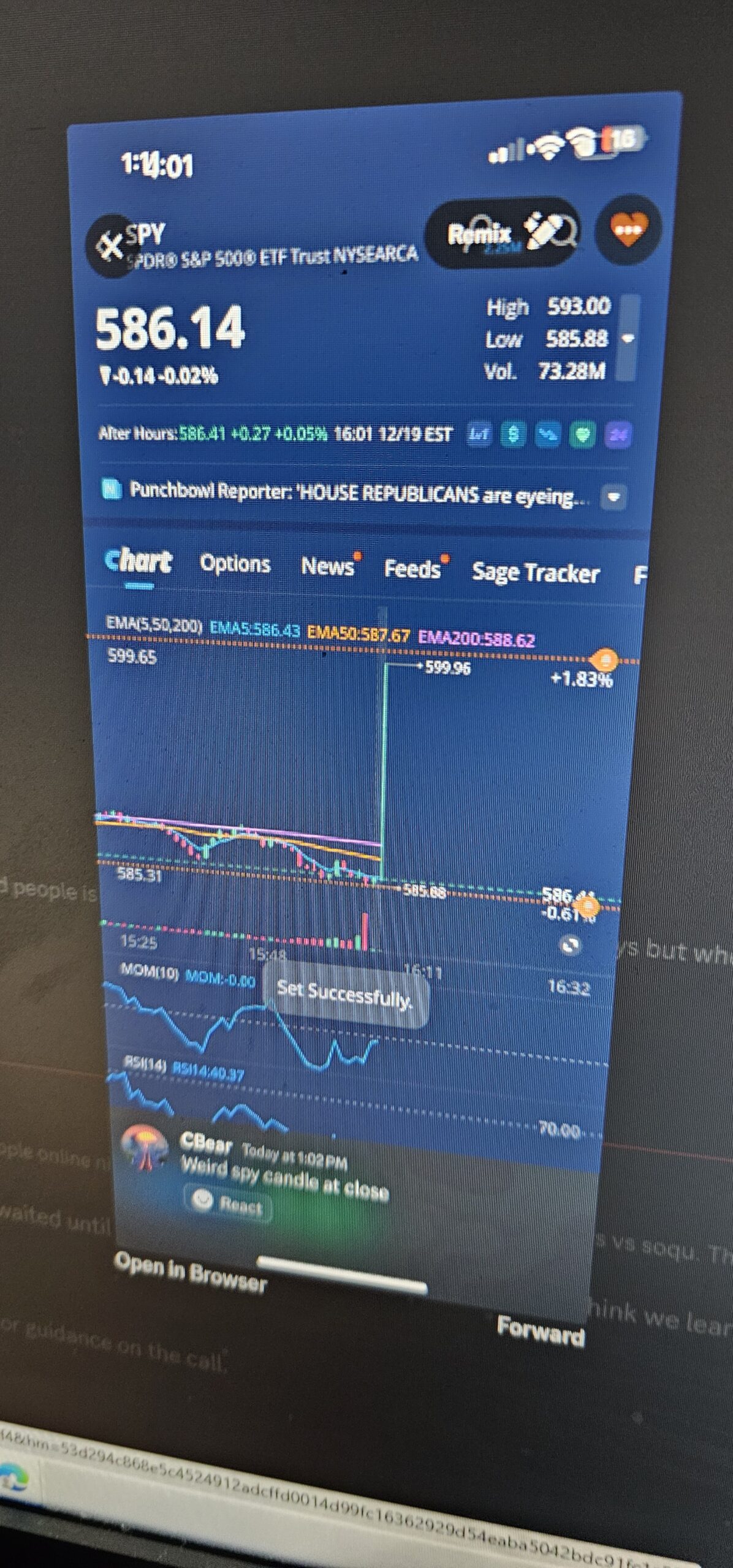

The technicals are getting short term overbought now, so they do favor a pullback of some degree into next week, and the wave count suggests it will be a C wave down. On top of that we hit and pierced on Tuesday an upside recent FP of 599.96 on the SPY, which is below...

That means that FP is complete as it did it's job. With it being fulfilled I have to be open to this bearish case with the market rolling over here very soon (today probably). I don't have any downside FP's except the 533.01 one but that's too deep I think as I only see about 5650-5700 as the target low.

Everyone is expecting the Santa rally here, even I have been sucked into thinking it's coming... but the wave count and the technicals just don't support it. I have to be open for another large drop here in the next week.

If this plays out the final high will be a lot higher as when you do a deeper pullback like what I think could happen it resets the upside target... meaning we could see 6500+ into this spring or summer as the final high. And strangely I have an upside FP on the SPY with a target that high. Plus we haven's yet seen the FP on NVDA of 160.22 hit yet either. My guess is that when we hit it we'll also be at 6500+ and that should happen until mid-2025.

In conclusion I think I'm wrong on the blow off, last squeeze top happening into early January and that instead the recent pullback, which I previously labeled as a wave 4, will subdivide into an ABC as it did NOT likely finish at the low on 12/20, and that we are about to start the C wave down for the wave 4, and it should complete into early January with a lower low.

Have a blessed day.