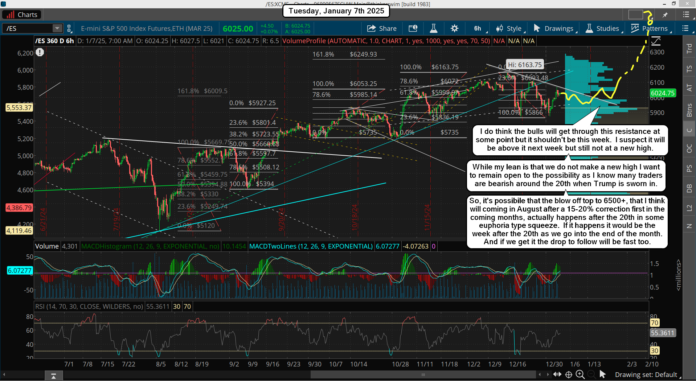

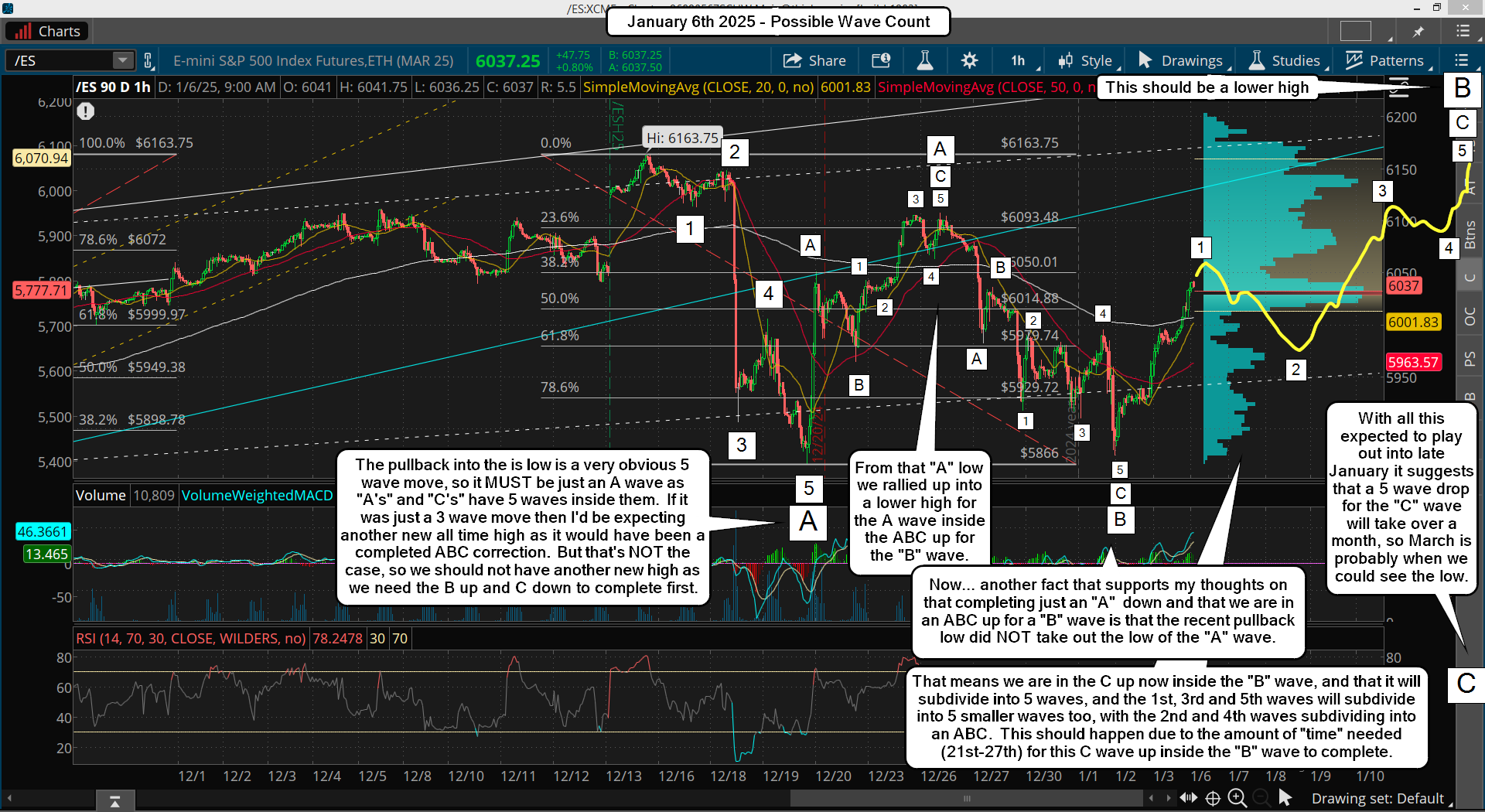

So far, so good for resistance holding. We've had a clean 5 wave rally up from the low last week and we have likely seen the top for now. We should spend some time (the rest of the week) pulling back some and going back up for a lower high... basically chop. I posted a chart on Twitter yesterday showing what I think the wave count is, and below is that chart again.

The Small Wave 1 up inside Medium Wave C, inside Large Wave B (just labels for this chart ONLY and NOT correct on bigger time frame charts), likely ended at the 6068 ES high and we are in the ABC down for the Small Wave 2 now. It can (and should) subdivide into even smaller waves, Tiny Waves, which would be a 5,3,5 pattern if it wants to divide that much.

Sometimes the wave A or C will just be one big wave when it's one that is of a smaller degree, and this would be Tiny Waves, so the 5,3,5 waves inside the ABC would be Extra Tiny Waves, and many times those waves just end up being a one wave move. Regardless of how it plays out on the really small time frame the end result should be a move down into late this week for a higher low then last week.

Clearly the low I was looking for around the 6th came early with the bottom being put in one 1/2/25 at 5874 on the ES. I'm just looking for a lot of "back and fill" this week, which might carry into early next week, before Small Wave C up takes us up to challenge the current all time high around the 20th. Again, I suspect that the inauguration will NOT be a "sell the news" event and that there will be one last move up a few days after it to hit the stops on the bears trying to short it. Then we should drop hard into February.

Have a blessed day.