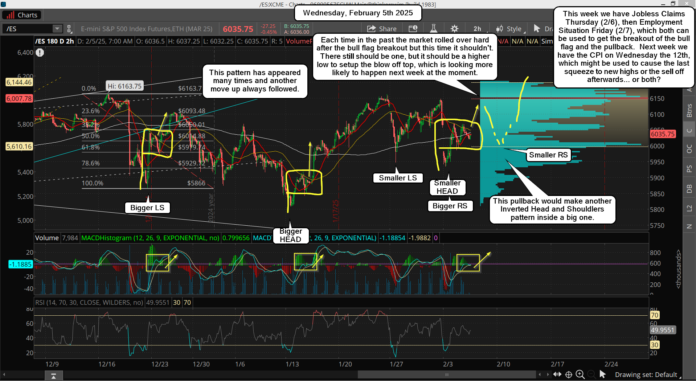

Yesterday was kind of a "pause day" as the market ran into overhead resistance and couldn't get through it. It pulled back some afterhours to reset some short term overbought charts, but the 2hr and 6hr still have room to run higher. The 2hr is probably going to get overbought on the next push higher, which I think will reach the 6100-6120 zone on the ES, and that's where we could see a pullback of say 100 points possibly?

It should NOT be the final high though as I still think we bust through the current triple top and hit the stops on the bears over it. Best guess is 80-100 points over the current all time high, and that might happen as early as this Friday but it could also drag out into early next week.

The market loves to trick the most traders so if we see a run to to the 6100-6120 today or tomorrow then I think we will see a pullback (maybe 100 points) into Friday to keep all the bears short. Then some positive news will come out over the weekend to gap it up Monday and squeeze those shorts up to the new all time high. This Thursday we have Jobless Claims, which could be blamed for the pullback into Friday, or (if we don't rally today to 6100-6120) could be used to get the market up to the quadruple top zone of 6100-6120.

Friday has the Employment Situation, which maybe it is used for the pullback? These events will be used some how to produce the turns in both directions, but I don't know which one does what. I'm just patiently waiting for the 6100-6120 rally to exit longs and re-enter on the pullback, but I will NOT short yet. The final target is roughly 6240-6250 on the ES, and only then will I become a bear.

Have a blessed day.