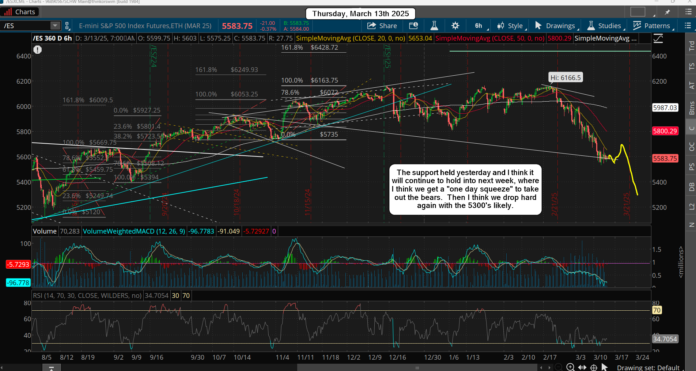

The market held support yesterday, so we have likely put in a temporary bottom. I think we are entering a period that is similar to 7/25/2024 to 7/31/2025, where that first low is equal to our current low. Now while I think it's similar nothing repeats exactly. However, the important thing that should repeat is that next week we should see a squeeze day up like 7/31/2025 did.

That should happen between next Tuesday to next Thursday. One of those days I'm looking for a squeeze up, which could hit the 200 day SMA, and that's around 5772 currently on the ES. That's the likely zone I believe, but the main thing to focus on is "time" and "the squeeze", as the next high should be between the 17th-19th next week. And we should have a big up day happen to shake out the bears.

Once it happens everyone should be calling for the low to be in and it's back to the bull market again. When this happens it's the last good short, which should feel like a crash as it's likely going to be a C wave, and similar to 7/31/2024 to 8/5/2024. As far as a target goes, I think we'll reach the 5300's, maybe pierce it? It should be finished by the end of next week or the Monday follow, so the 21st or 24th would be the target. Between now and then I'm personally just going to sit on my hands and wait for that one day squeeze, which again should be next week... and that's when I'll short the pig.

Have a blessed day.

Tomorrow’s lunar eclispe will be opposite 4 planets/ entities including explosive Rahu. A certain indicator isn’t oversold enough for anything mega but we could get minor mega.

From the January 24th high to the February 19th high is 17 trading days. 17 trading days from the 2-19 high is tomorrow. A Fib 34 total as well.

I think a crash is unlikely on Monday so we could have a big upday. The indices are far removed from their lower Bollinger Bands and would need to bounce back to them at the least. BTW, the first bounce in March 2020 came off the 100 week moving average.

It’s also been 4 weeks down and that’s usually good enough for a bottom or a bounce at a minimum.

Even if it doesn’t get down to the 100 week average tomorrow, the indices need to ride the lower BB rail lower so it need to bounce back to one.