This week the most important event is the FOMC meeting on Wednesday. There are different paths the market can take but with the new FP on the SPY of 551.49 last Friday we at least know the pullback low price. The big question though is "when"? I posted an additional chart on X Friday showing a possible Inverted Head and Shoulders pattern that might form. That chart is below...

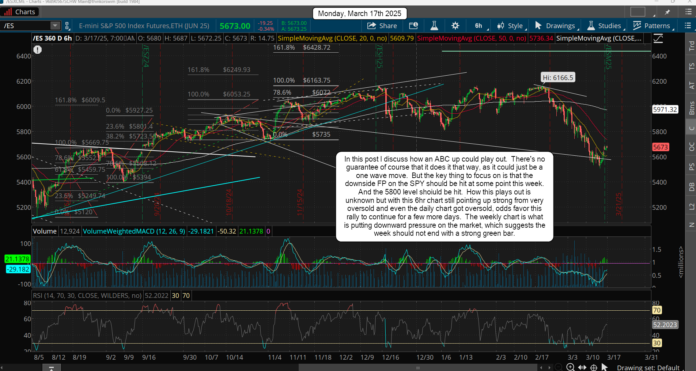

I think that is still very possible and likely to play out. Resistance overhead for today is around 5700 on the ES, and "if" we hit it today I think we can pullback into Tuesday (or early Wednesday) to hit the downside FP on the SPY and make the Right Shoulder. That's roughly around 5550 on the ES, and would be the perfect spot to suck in the last bear before a strong rally up to around 5800, and that probably will be from something the Fed says at the FOMC meeting.

It's possible I guess that we hit the target prior to the meeting but I lean toward it happening after the meeting, which is 2pm EST as usual. A one day squeeze into the close to 5800 to shake out the bears and lure in the bulls thinking the downside is over would be the perfect trick on both bulls and bears.

Then Thursday we rollover again and start the move down into next Monday or Tuesday for the low, which at minimum should be a double bottom but most likely we we take out the current low by some decent amount to hit the stops on the bulls trapped long. Meaning 5400 or even 5300 is possible (5440 and 5325 are support zones).

This is what I see for this week. As always the market loves to trick you, so my goal will just be to look for a hit of the downside FP on the SPY and if it happens before the FOMC I know there's a strong rally after it. Now if we rally to 5800 first then the downside FP would be the target for the expected pullback into the 24th/25th, but I don't lean that way. I just have to be open to whatever the market throws at me.

Have a blessed day.