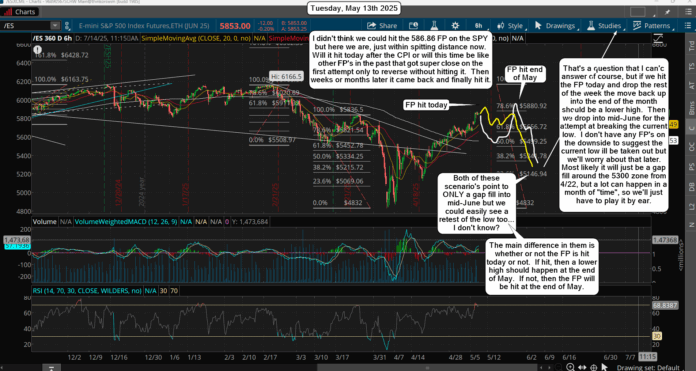

The market just grinned sideways yesterday after a gap up at the open. It got really close to the FP of 586.86 through out the day but never hit it. After hours it got even closer. It's looking like it might hit it today, and with the CPI out before the open that would be an easy move up to hit from the current closing price from yesterday.

But, if for any strange reason, it does not hit it and it goes down instead, then it's the ol' FP trick again that it's done in the past many times. It will get close to a FP (up or down) on the first attempt and fall shy of hitting it. Then it will go the other direct for awhile (weeks, months?) and come back later to hit it. While I don't think it will do that this time around (because it's so close) I can't rule it out.

Many traders these days see these fake prints just like I do and they wait for them to be hit to take a position. So the market just might trick them and head south without hitting them. If this happens you can just sit back and wait for the end of this month for the FP to get hit on the expected move back up, which then will be followed by a large drop into mid-June, which should take out the current low but that's unknown of course.

The two FP's of 483.07 and 483.62 from last year were hit on that decline (and pierced) so those FP's are fulfilled, so there's no clues on the downside of where the market might go to? I don't know if it's going to be a higher low or lower low but the "time window" for it is mid-June. We'll have to just see where the market is at when we get there I guess. For now those my lean is that we hit (and pierce) the 586.86 FP (in regular hours) and then rollover for the A wave (or wave 1) of the next leg down. It should be over with by the end of this week and then we do the B wave up (or wave 2) into the end of May. I still think about a 50% retracement is possible but it's going to take some bad news to cause it at this point it seems.

Have an blessed day.