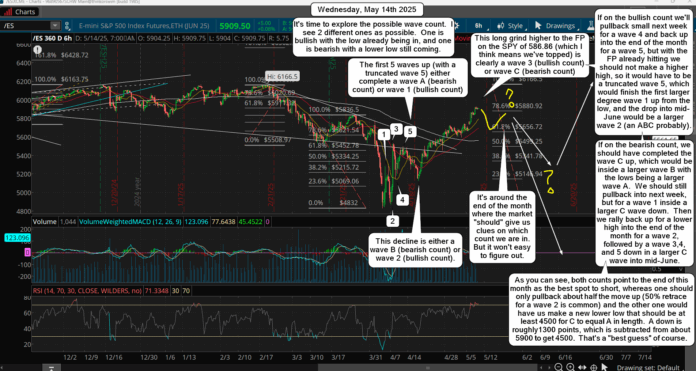

The FP on the SPY of 586.86 was successfully hit and pierced yesterday, so that should be it on the upside. But I don't think we are going to just fall off a cliff here as there's a lot of support below that will need to be hit, bounced from, hit again, bounce again, rinse and repeat. It means we could see the rest of May doing a lot of chop, and then in June we should start down steady to retest the lows.

Again, I don't know if we go through it hard, double bottom or just make a higher low? I just have to give it more time to let the first series of waves unfold and get a better feel for what could happen. Short term, we should pullback in the coming few days to retest the week long support in the 5650-5700 zone. This might drag into next week, and then we go back up again for a lower high the following week. I don't see any good setup for a short now as we need to allow the market to get the series of wave 1's down and 2's up until support get much weaker and we get a wave 3 of 3 setup form.

This could take a couple of weeks. Yesterday is kind of like the 3/25 high, that pulled back and went back up into the 4/2 lower high, which then setup the big drop that was a wave 3 of some degree. I think we are going to do something similar but it should take 2 weeks this time around, whereas back then it was only about 1 week. Basically, the last week of this month is where we should see that bounce high like the 4/2 high. Nothing more to add as we just have to be patient to allow the pattern to setup.

Have an blessed day.