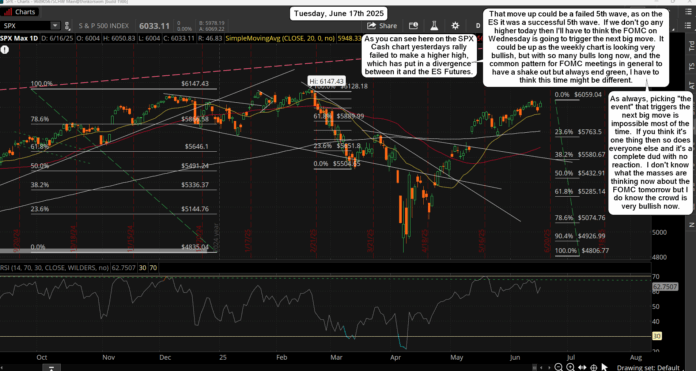

The SPX Cash failed to make a higher high then last Wednesday, so the rally up yesterday might have been a wave C inside a wave 2, which could be finished now? Hard to say for sure but the roll yesterday from the June ES Futures contract to the September one created about a 60 point difference between it and the SPX Cash.

So, we now have a divergence between the 2 of them with the cash making a lower high and the futures making a higher high. I've see "the roll" be used many times in the past to do a stop run on the bulls or bears before a nice turn in the market and I think that's what we had yesterday.

It's frustrating to see for sure but that's how they take out the bears right before a big move down. This market is now going to go into the FOMC with a high it seems, and if that high was yesterday we could see some smaller degree wave 1's down and 2's up setup in front of the meeting. And that means we might see a nasty wave 3 of 3 of 3 (or something) happen afterwards. This week is still suppose too be the week where we start a nice pullback for a larger degree wave 2 down, and the target is still the 5500-5600 range.

The next turn area is around the 26th, so it's looking likely that we will extend into next week since this topping process has extended longer in time. Needless to say trying to catch the top of this move is not easy. I thought we would have already topped by now and would be going into the FOMC for a low, but now it's looking like a high is more likely.

Even if it's already topped and we pullback small into the meeting that's still considered going into it at a high as you have to look at the entire rally up from the April low. I've layered into 2 short positions over the last 2 weeks, and I still think they will pay off nicely as when the drops starts I don't think we'll get much bouncing until the bottom. I thought it would be a nice ABC down but with time running out for the drop it will likely be faster and not give the bears any chance to short a B wave bounce, nor any chance for the bulls to exit. It's more likely to be a one wave decline now, which again, should end next week sometime.

Have an blessed day.