Looks like we have the breakout in play now and the market is gearing up to attempt to make a new all time high. I really don't think it's going to be as big of resistance as many may think because we are ending the bearish period and entering the bullish period now. Plus we've have several weeks of basing in a range from 5800-6000 or so, which means there should be plenty of energy for a strong move to gets through the high.

The 6250-6300 zone would be where the market could run out of steam as that's about a hundred points over the all time high and I'd say most of the shorts will be taken out by then, and they will flip to become bulls. We are not there yet of course, and we might grind sideways more after the current rally in play gets tired. But there's nothing bearish left now.

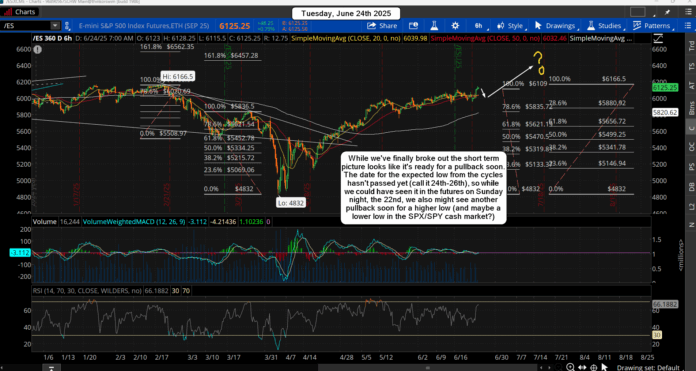

The weekly and daily charts have turned up from oversold on their MACD's and we are in a bullish period now, which can last into August. Sure, there should be a pullback at some point but we need to wait for the next "short term" bearish period to appear. For now though there's nothing to do on the bearish side. We are going up or sideways for awhile now.

Short term, we've probably run out of steam on this breakout and will top today and pullback small to base more into next week and beyond. There's a downside FP one the SPY this morning at 588.79 from 4:00 am, so we could see that hit in the next day or so. It would be a backtest of the Sunday futures low, but it would be a higher one then it was as 588.79 on the SPY should be around 6000-6020 (roughly) on the ES. The Sunday low was 5959, so the FP on the SPY will clearly put the ES well above it.

Have an blessed day.