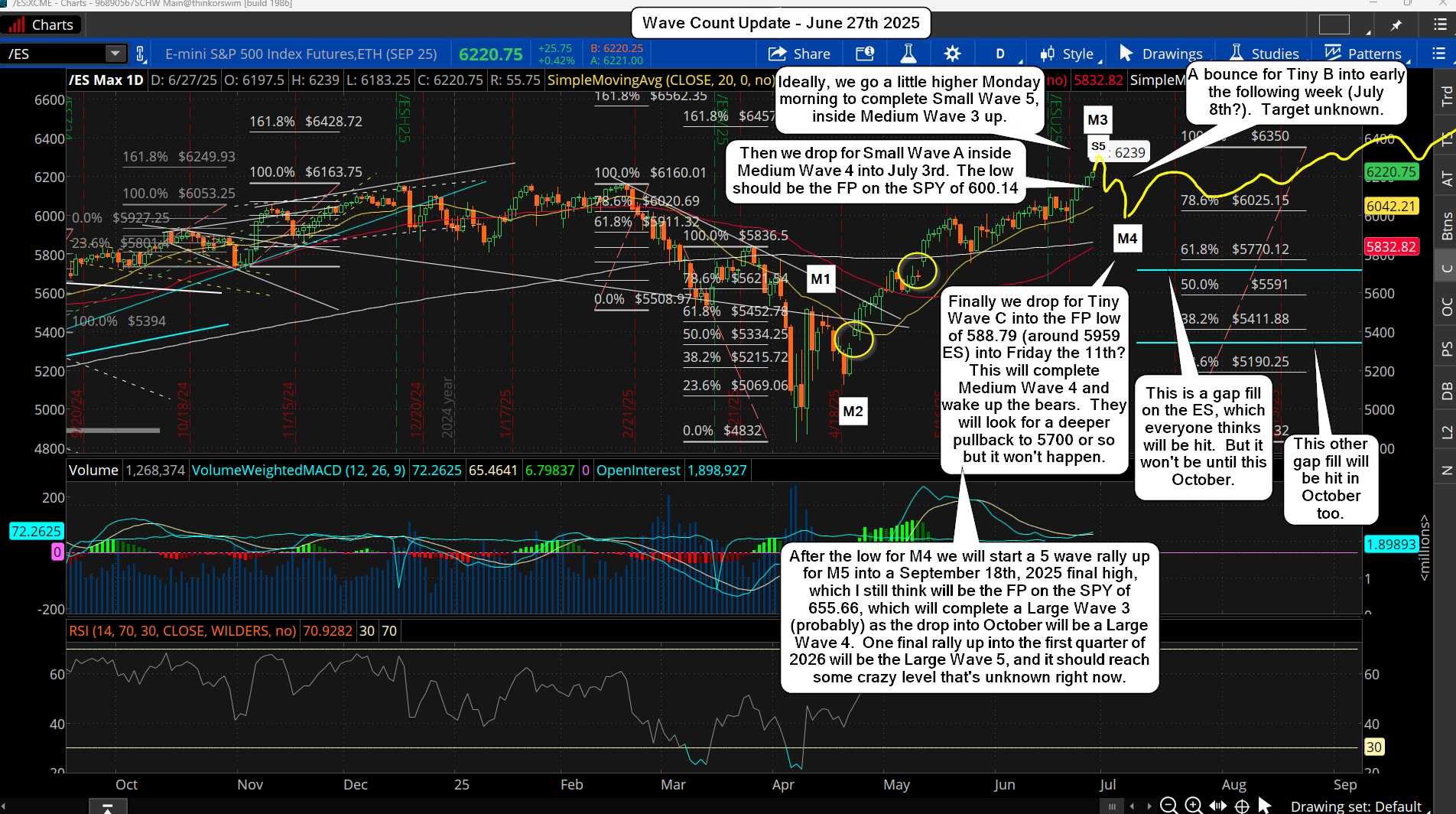

So over the weekend I had some time to think about what would screw the most traders. A lot of other sites are looking for roughly the 5700 zone for the coming pullback, which most agree is a wave 4 of some degree. It's a logical pullback area as it's to the 38.2% Fibonacci Retracement zone. But we have started the bullish period from both Seasonality and Cycles work... meaning I don't think we will get that deep.

The Medium Wave 2 pullback was about 50% of Medium Wave 1 up, but if the recent FP's are real "fake prints", and I think they are, we will only pullback to around the 23.6% zone. Ironically that's where the 588.79 FP on the SPY would be at, and if we do this into the 2nd week of July I think that's all the bears are going to see. After that I think we start a 5 wave advance for the final 5th wave up, and I still think it tops on September 18th, 2025 at 655.66 on the SPY. Below is a chart of it...

There are 2 levels below on the ES Futures that are "gap fills", and everyone see's them. Yes, it's rare to get them on the futures (common on the SPX cash), so they WILL be filled at some point... but when? I suspect they will not be filled until the big drop into October and for now we won't even get close to them. The nearest one is at 5715.25 from 5/9/25, and it's a little more then a 38.2% pullback (if we reach 6350 this week), but for all practical purposes we can just call it the 38.2% pullback zone.

It's a big magnet for the market, and again, EVERYONE see's it. So will it be that obvious that the market is just going to pullback to that perfect level to allow the bears a nice profitable correction, and the bulls a great entry long? I've never seen it that easy, and the FP's do NOT suggest that will happen.

The second, and lower "gap fill" is at 5339.25 from 4/22/25, and I don't think many traders are expecting it to be reached during the coming correction, so we can just throw that out the window in my opinion as the odds are super low that we'll see it reached this month or next. That will be filled during the September to October decline.

And I wouldn't be surprised if that's not the low for that correction. If we reach around 6600 into September 18th a drop to 5300 is quite a big drop, so there's no reason that it MUST take out the 4832 low. I'm not saying that it won't, as anything is possible. But if we are going to have another massive blow off rally into the first quarter of 2026 to 7000, 8000, who knows... we probably will just make a higher low then the April 7th, 2025 bottom. We'll re-evaluate once we get into October but right now I don't think it gets taken out.

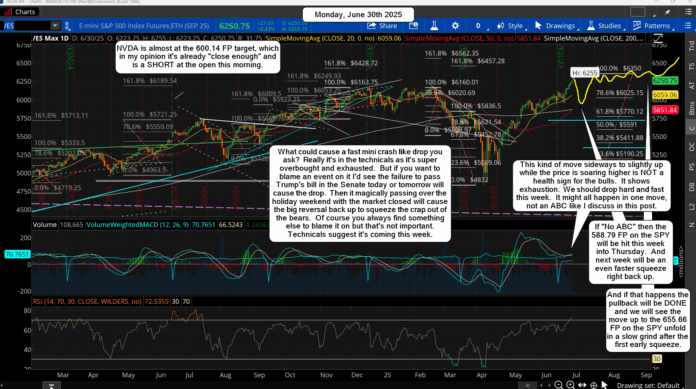

For today, I'd like to see the FP on NVDA hit (160.22) which will be a great short for it (expected drop into 140-145 in a few days) and a likely top for the rest of the market too, like 618+ on the SPY and 6250+ on the ES. If we get it, we should see a fast drop to the 600.14 FP on the SPY into this Thursday for Small Wave A inside Medium Wave 4. Then bounce for Small Wave B into around the 8th of July, followed by one more drop to the 588.79 FP on the SPY for the Small Wave C... and I think that ends by the 11th. That should wake up the bears and put in the low for Medium Wave 4 down.

The Alternative...

Everything would be the same here in this alternative scenario as far as the turn periods goes. We'd still pullback this week for an A wave, then do a quick bounce next Monday/Tuesday for a B wave. The difference here in this case is that the C wave down (which should still end by the 11th) will be a much deeper one. Basically one that feels like a mini flash crash or something. It could drop to fill the first gap on the ES, or even to the second and much lower gap.

I don't think that's going to happen but we should just be open to something crazy to get maximum fear back in the market, which will be used as rocket fuel to get the market to rally up to the final high of 655.66 on the SPY into September 18th. Maybe they just hit the first (higher gap fill) at 5715.25 pm the ES this time around and save the lower gap fill for the drop into October? Again, I don't think this is going to happen but I'll just let the market guide me.

Lastly...

We need to pay close attention to the expected B wave up from this Thursdays low for the A wave. If it rallies too high we could see the drop for the C down get pushed out in time for another week. It won't be easy to figure out and it will be based on what (and where) the A wave down does and goes too. I'm only looking for that 600.14 SPY level as that's a FP and will be support.

My worry is that the A down "might" wake up too many bears if it goes fast enough. That would then drag out the B up in "time", so I'd prefer this coming A down to be a slow and steady one. Then the B up I'd like to see a fast 1-2 day squeeze that almost makes a new high again. If that happens it will shake out any of the bears that go short this week.

But if it doesn't move up fast enough, and lingers down around the low 6000's, then I think that will be a bear trap. Meaning the market is just going to chop around for awhile to get more bears to load up looking for the C wave down. If that happens it can drag out into OPEX in July and make another new higher high to shake out those bears.

Meaning that we might see 6260-6300 on the ES this week, down to 6000 into this Thursday, and then chop with an upward bias to 6300-6350 into OPEX. Then we get that C wave down... which won't be a C wave if we make a higher high, but it will act as one and drop hard and fast to the 588.79 FP on the SPY the following 4-5 days.

Personally, I give it low odds that we'll see a long drawn out B wave up that could last into OPEX. There is high odds that the B wave will be fast and end next Monday/Tuesday and we see the C wave down into the end of next week.

Either way though, the bottom line here is that the only move I'm interested in trading is shorting the A wave down, skipping the B wave up, and waiting patiently to see if I can figure out where and when the B wave tops so I can short the C wave. Whether that is a short next Monday/Tuesday, or the week of OPEX is unknown right now... but again, odds favor next week.

Have an blessed day.